***

***

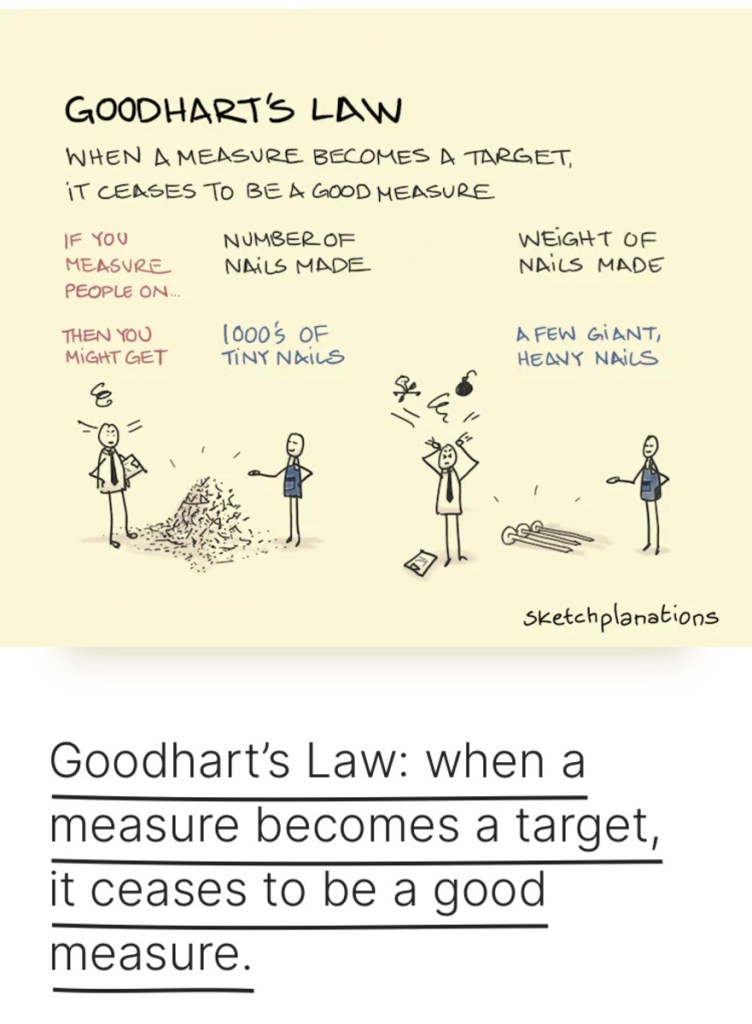

A paradox is a logically self-contradictory statement or a statement that runs contrary to one’s expectation. It is a statement that, despite apparently valid reasoning from true or apparently true premises, leads to a seemingly self-contradictory or a logically unacceptable conclusion. A paradox usually involves contradictory-yet-interrelated elements that exist simultaneously and persist over time. They result in “persistent contradiction between interdependent elements” leading to a lasting “unity of opposites”.

MORAVEC’S ARTIFICIAL INTELLIGENCE HEALTHCARE PARADOX

Classic Definition: Artificial intelligence (AI) refers to computer systems capable of performing complex tasks that historically only a human could do, such as reasoning, making decisions, or solving problems. The term “AI” describes a wide range of technologies that power many of the services and goods we use every day – from apps that recommend TV shows to chat-bots that provide customer support in real time.

Modern Circumstance: The role of artificial intelligence in health care is becoming an increasingly topical and controversial discussion. There remains uncertainty about what is achievable regarding ongoing medical artificial intelligence research. Although there are some people who believe that artificial intelligence will be used, at best, as a tool to assist clinicians in their day-to-day activities, there are others who believe that job automation and replacement is a looming threat.

***

Paradox Example: Moravec’s paradox is a phenomenon observed by robotics researcher Hans Moravec, in which tasks that are easy for humans to perform (eg, motor or social skills) are difficult for machines to replicate, whereas tasks that are difficult for humans (eg, performing mathematical calculations or large-scale data analysis) are relatively easy for machines to accomplish.

***

***

For example, a computer-aided diagnostic system might be able to analyze large volumes of images quickly and accurately but might struggle to recognize clinical context or technical limitations that a human radiologist would easily identify.

Similarly, a machine learning algorithm might be able to predict a patient’s risk of a specific condition on the basis of their medical history and laboratory results but might not be able to account for the nuances of the patient’s individual case or consider the effect of social and environmental factors that a human physician would consider.

In surgery, there has been great progress in the field of robotics in health care when robotic elements are controlled by humans, but artificial intelligence-driven robotic technology has been much slower to develop.Thus far, research into clinical artificial intelligence has focused on improving diagnosis and predictive medicine.

Assessment

Moravec’s paradox also highlights the importance of maintaining a human element in the health-care system, and the need for collaboration between humans and technology to achieve the best possible outcomes.

Conclusion

In the field of medicine, it is becoming indisputable that artificial intelligence will have a role in population health analysis, predictive medicine, and personalized care.

However, for now, the job of doctors seems safe from automation.

Cite: Shuaib A: The increasing role of artificial intelligence in health care: will robots replace doctors in the future? Int J Gen Med. 2020; 13: 891-896

COMMENTS APPRECIATED

Like and Subscribe

***

***

***

Filed under: Ask a Doctor, Glossary Terms, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, iMBA, Inc., Information Technology, Marcinko Associates, mental health | Tagged: AI, artificial intelligence, david marcinko, Hans Moravec, health, healthcare, mental health, Morovec's paradox, paradox, Technology | Leave a comment »