Micro-Credentials on the Rise

KNOWLEDGE RICHES IN NICHES

DR. DAVID EDWARD MARCINKO MBA CMP™

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

Do you ever wish you could acquire specific information for your career activities without having to complete a university Master’s Degree or finish our entire Certified Medical Planner™ professional designation program? Well, Micro-Certifications from the Institute of Medical Business Advisors, Inc., might be the answer. Read on to learn how our three Micro-Certifications offer new opportunities for professional growth in the medical practice, business management, health economics and financial planning, investing and advisory space for physicians, nurses and healthcare professionals.

Micro-Certification Basics

Stock-Brokers, Financial Advisors, Investment Advisors, Accountants, Consultants, Financial Analyists and Financial Planners need to enhance their knowledge skills to better serve the changing and challenging healthcare professional ecosystem. But, it can be difficult to learn and demonstrate mastery of these new skills to employers, clients, physicians or medical prospects. This makes professional advancement difficult. That’s where Micro-Certification and Micro-Credentialing enters the online educational space. It is the process of earning a Micro-Certification, which is like a mini-degree or mini-credential, in a very specific topical area.

Micro-Certification Requirements

Once you’ve completed all of the requirements for our Micro-Certification, you will be awarded proof that you’ve earned it. This might take the form of a paper or digital certificate, which may be a hard document or electronic image, transcript, file, or other official evidence that you’ve completed the necessary work.

Uses of Micro-Certifications

Micro-Certifications may be used to demonstrate to physicians prospective medical clients that you’ve mastered a certain knowledge set. Because of this, Micro-Certifications are useful for those financial service professionals seeking medical clients, employment or career advancement opportunities.

Examples of iMBA, Inc., Micro-Certifications

Here are the three most popular Micro-Certification course from the Institute of Medical Business Advisors, Inc:

- 1. Health Insurance and Managed Care: To keep up with the ever-changing field of health care physician advice, you must learn new medical practice business models in order to attract and assist physicians and nurse clients. By bringing together the most up-to-date business and medical prctice models [Medicare, Medicaid, PP-ACA, POSs, EPOs, HMOs, PPOs, IPA’s, PPMCs, Accountable Care Organizations, Concierge Medicine, Value Based Care, Physician Pay-for-Performance Initiatives, Hospitalists, Retail and Whole-Sale Medicine, Health Savings Accounts and Medical Unions, etc], this iMBA Inc., Mini-Certification offers a wealth of essential information that will help you understand the ever-changing practices in the next generation of health insurance and managed medical care.

- 2. Health Economics and Finance: Medical economics, finance, managerial and cost accounting is an integral component of the health care industrial complex. It is broad-based and covers many other industries: insurance, mathematics and statistics, public and population health, provider recruitment and retention, health policy, forecasting, aging and long-term care, and Venture Capital are all commingled arenas. It is essential knowledge that all financial services professionals seeking to serve in the healthcare advisory niche space should possess.

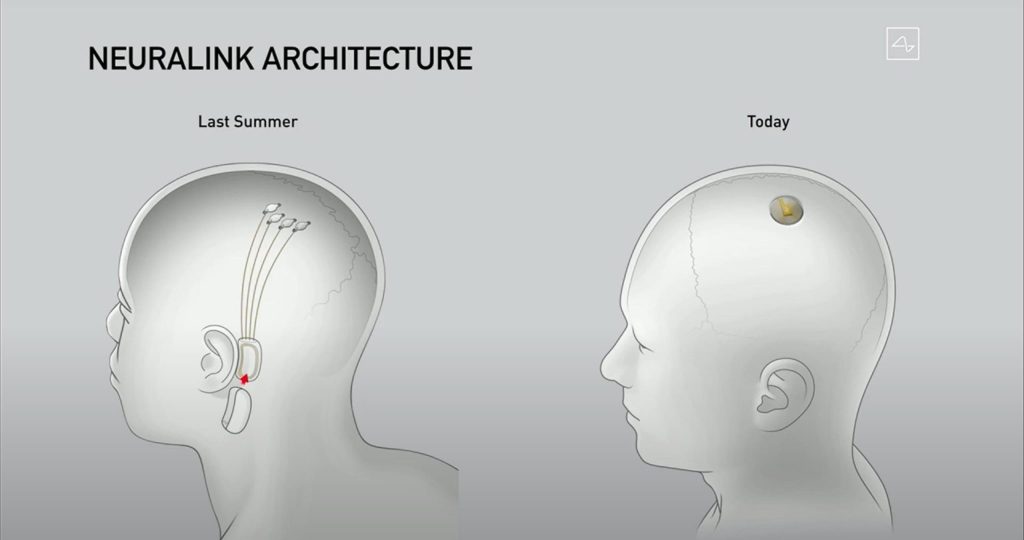

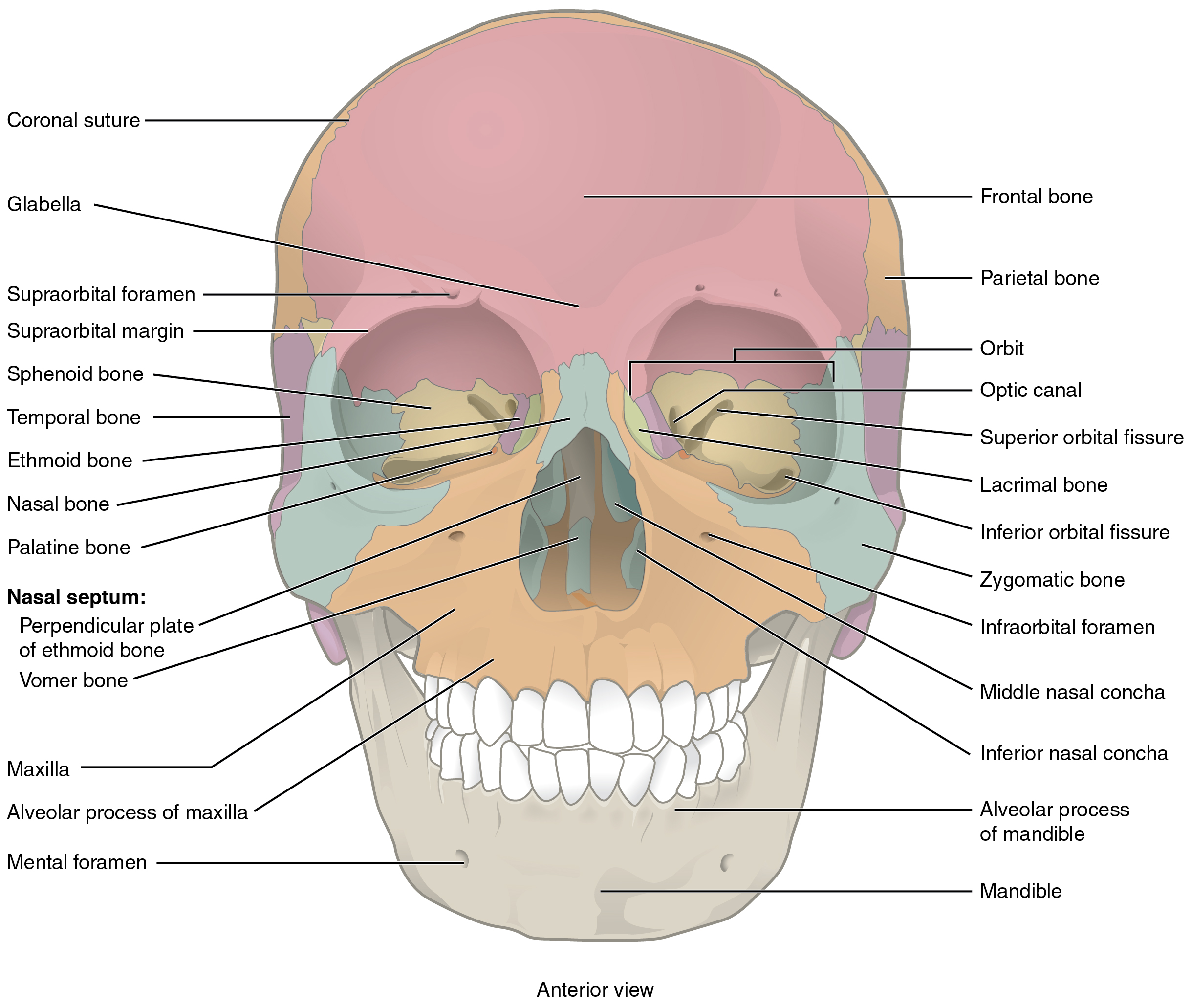

- 3. Health Information Technology and Security: There is a myth that all physician focused financial advisors understand Health Information Technology [HIT]. In truth, it is often economically misused or financially misunderstood. Moreover, an emerging national HIT architecture often puts the financial advisor or financial planner in a position of maximum uncertainty and minimum productivity regarding issues like: Electronic Medical Records [EMRs] or Electronic Health Records [EHRs], mobile health, tele-health or tele-medicine, Artificial Intelligence [AI], benefits managers and human resource professionals.

Other Topics include: economics, finance, investing, marketing, advertising, sales, start-ups, business plan creation, financial planning and entrepreneurship, etc.

How to Start Learning and Earning Recognition for Your Knowledge

Now that you’re familiar with Micro-Credentialing, you might consider earning a Micro-Certification with us. We offer 3 official Micro-Certificates by completing a one month online course, with a live instructor consisting of twelve asynchronous lessons/online classes [3/wk X 4/weeks = 12 classes]. The earned official completion certificate can be used to demonstrate mastery of a specific skill set and shared with current or future employers, current clients or medical niche financial advisory prospects.

Mini-Certification Tuition, Books and Related Fees

The tuition for each Mini-Certification live online course is $1,250 with the purchase of one required dictionary handbook. Other additional guides, white-papers, videos, files and e-content are all supplied without charge. Alternative courses may be developed in the future subject to demand and may change without notice.

***

Contact: For more information, or to speak with an academic representative, please contact Ann Miller RN MHA CMP™ at: MarcinkoAdvisors@msn.com [24/7] -OR- 770-448-0769[9:00 – 5:00 EST].

***

Filed under: "Advisors Only", "Ask-an-Advisor", Career Development, CMP Program, Experts Invited, Financial Planning, Glossary Terms, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, iMBA, iMBA, Inc., Information Technology, Investing, Op-Editorials | Tagged: accountants, certifications, certified medical planner, CMP, financial advisors, financial planners, Investing, investment advisors, Marcinko, micro, micro-certifications, micro-credentials | Leave a comment »