Or, NOT!

By Rick Kahler CFP®

How do you spot the investment opportunity that will become the next Apple, Facebook, or Microsoft? Certainly they are out there. Someone is going to discover them and be set for life, so why shouldn’t it be you?

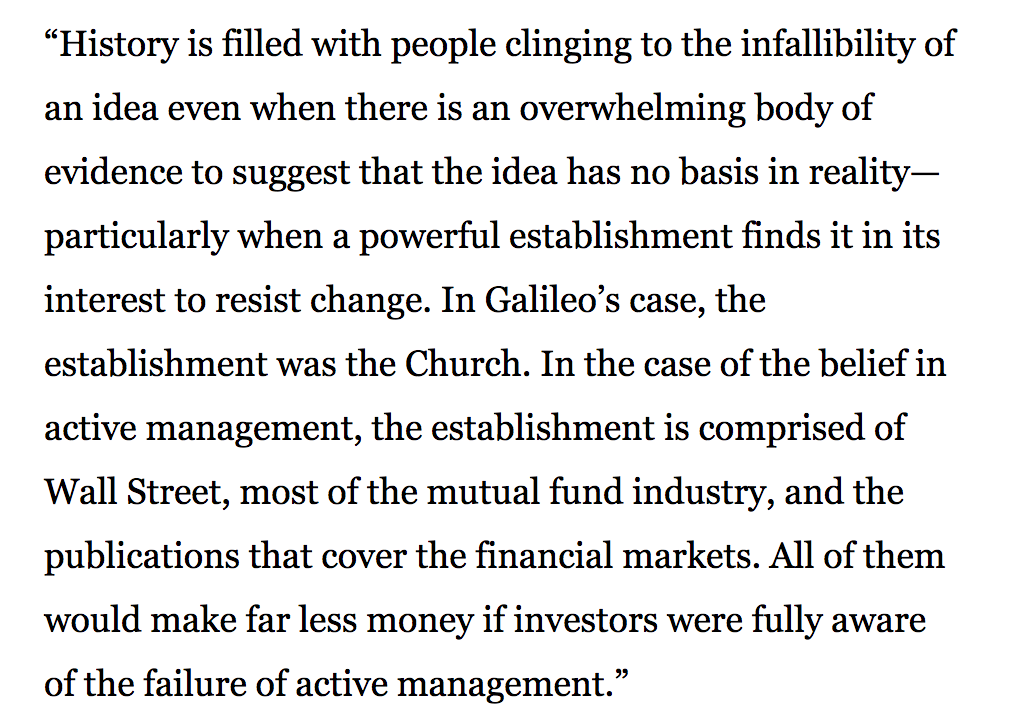

Here’s why it shouldn’t

As with all Registered Investment Advisors, the amount of money I manage for clients is publicly disclosed information that anyone with an Internet connection can find.

Because of that, I am seen as the gatekeeper of a source of funding for every under funded business opportunity that is sure to become the next Apple. I get to see a lot of proposals. Many have promise at first glance. But the promise usually fades the more I dig into the proposal, ask questions, and do the math.

After hours and hours of investigation, every few years I see that one proposal that looks really good. One that calls to me to invest, that really has the promise of being a winner. When all the stars and the planets align, I know I now have a 90% chance of not making a dime on the venture.

That’s why I have learned to save my time and my money when I am approached with “the next big thing.” I just don’t have time to investigate every project and cull hundreds of opportunities down to the one that has a 10% chance of succeeding. I see it as looking for the proverbial needle in the haystack. Certainly, there’s a needle in there somewhere. But examining every piece of hay in order to find it has a significant monetary cost.

To succeed, I would need a lot of time, even more money, and exponentially more intuition and intellect. Not to mention a fair amount of luck. The probability that I will go bankrupt before I ever find the needle is staggering.

Most of the “next big things” are discovered by driven entrepreneurs who bank everything they have on an idea and find the financing to shoestring it together. It usually isn’t the armchair investor who cashes in.

My experience

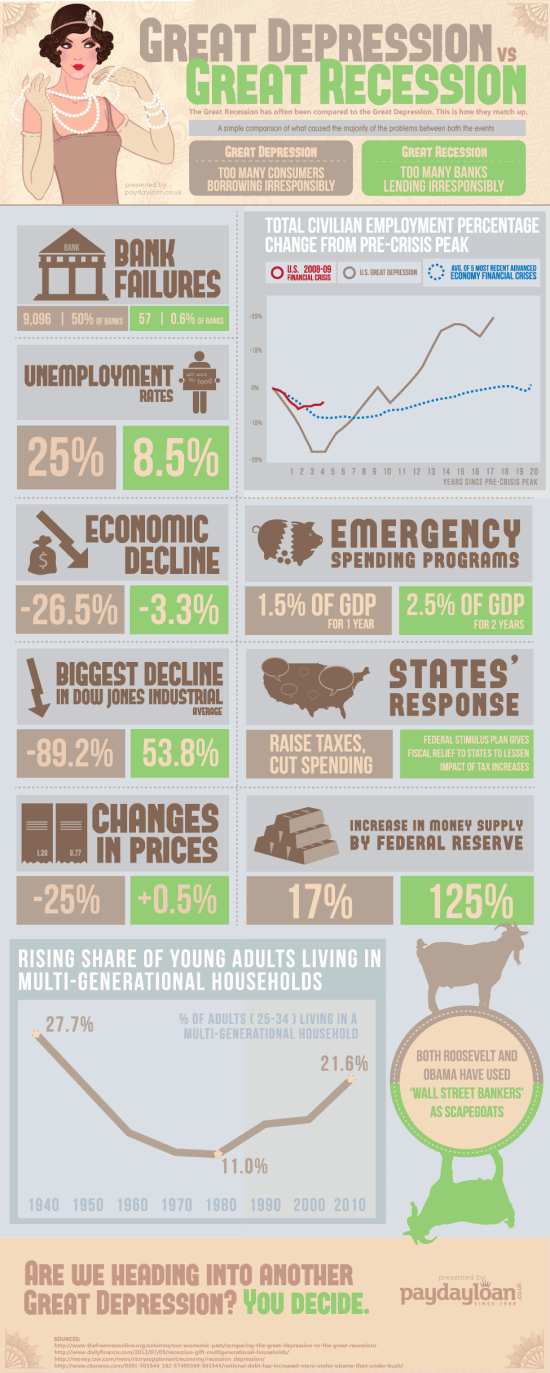

Over my 40 years of real estate and investment experience, I have seen people lose millions investing in lumber mills, emu farms, highly leveraged real estate, futures contracts, day trading, restaurants, multi-level-marketing companies, rare earth minerals, Iraqi currency, and the newest ones—marijuana farms and crypto-currencies.

As a result, for my money and the money of my clients, I’ll play the odds for success by saying “no” to every opportunity that comes across my desk. I don’t take the time to investigate them. I don’t read the offering circulars. I don’t attend presentations. The answer is “no” to the great odds of losing my money and “yes” to the staggering odds of keeping money growing conservatively for me and for my clients.

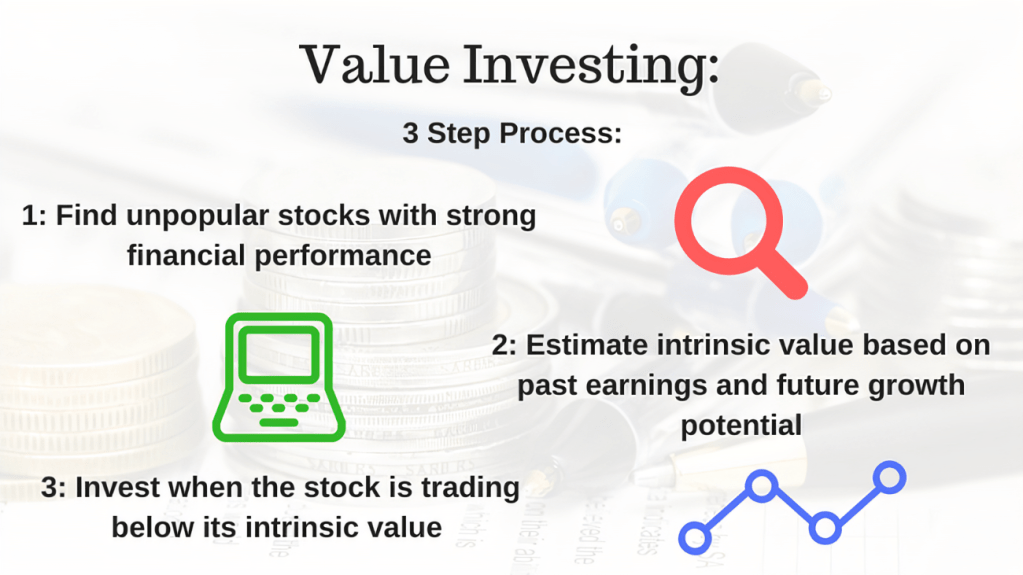

What do I say “yes” to? I say yes to investing in mutual funds that own or loan money to 12,000 successful companies around the globe and thousands of real estate properties. I say yes to well-diversified portfolios. I say yes to proven investment strategies with 25-year track records. I say yes to having enough cash reserves to fund two to five years of retirement income.

Boring

I know, it’s not very sexy, is it? In fact, the way I invest my money and the money of those who have entrusted their investments to me is downright boring.

***

https://www.crcpress.com/Comprehensive-Financial-Planning-Strategies-for-Doctors-and-Advisors-Best/Marcinko-Hetico/p/book/9781482240283

***

Assessment

So here is my hot tip when it comes to finding investment opportunities to secure your future: forget about the “next big thing.” Instead, stay with the “next boring thing.” The odds are overwhelming that this will make you a long-term winner.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements.

Book Marcinko: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

Subscribe: MEDICAL EXECUTIVE POST for curated news, essays, opinions and analysis from the public health, economics, finance, marketing, IT, business and policy management ecosystem.

***

***

Filed under: Experts Invited, Investing, Op-Editorials | Tagged: Next Big [Investment] Thing?, Rick Kahler CFP® | 1 Comment »