The Big Picture View

By Suevon Lee ProPublica, Sept. 14, 2012, 2:26 p.m.

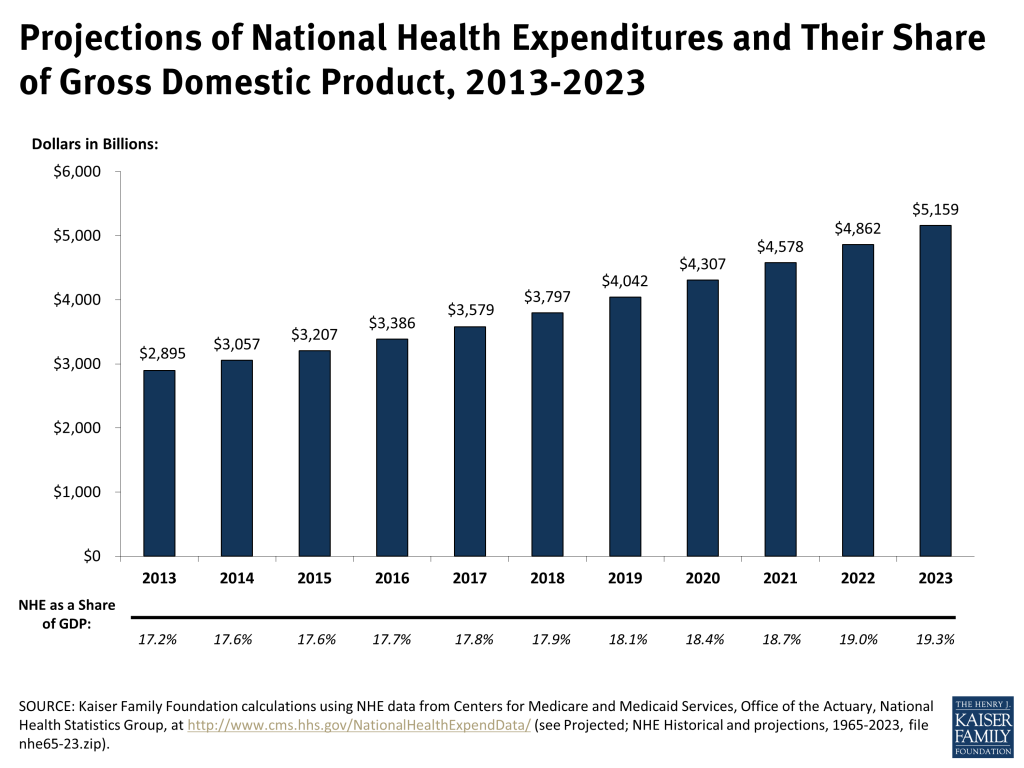

Medicare and Medicaid, which provide medical coverage for seniors, the poor and the disabled, together [1]make up nearly a quarter [1] of all federal spending. With total Medicare spending projected to cost [2] $7.7 trillion over the next 10 years, there is consensus that changes are in order. But what those changes should entail has, of course, been one of the hot-button issues [3] of the campaign.

With the candidates slinging charges [4], we thought we’d lay out the facts. Here’s a rundown of where the two candidates stand on Medicare and Medicaid:

THE CANDIDATES ON MEDICARE

Big Picture

Earlier this year, the Medicare Board of Trustees estimated [5] that the Medicare hospital trust fund would remain fully funded only until 2024. Medicare would not go bankrupt or disappear, but it wouldn’t have enough money to cover all hospital costs.

Under traditional government-run Medicare, seniors 65 and over and people with disabilities are given health insurance for a fixed set of benefits, in what’s known as fee-for-service [6] coverage. Medicare also offers a subset of private health plans known as Medicare Advantage, in which roughly one-quarter [7] of Medicare beneficiaries are currently enrolled. Obama retains this structure.

The Obama administration has also made moves that it says would keep Medicare afloat. It says the Affordable Care Act would extend solvency [8] by eight years, mainly by imposing tighter spending controls on Medicare payments to private insurers and hospitals.

In contrast, Rep. Paul Ryan, Mitt Romney’s running mate, has proposed a more fundamental overhaul of Medicare, which he says [9] is on an “unsustainable path.” On his campaign website [10], Romney says that Ryan’s proposals “almost precisely mirrors” his ideas on Medicare. But he’s been fuzzy on other aspects of the plan.

A Romney-Ryan administration would replace a defined benefits system with a defined contribution system [11] in which seniors are given federal vouchers to purchase health insurance in a newly created private marketplace known as Medicare Exchange. In this marketplace, private health plans, along with traditional Medicare, would compete for enrollees’ business. These changes wouldn’t start until 2023, meaning current beneficiaries aren’t affected – just those under 55.

Under the Romney-Ryan, the vouchers would be valued [12] at the second-cheapest private plan or traditional Medicare, whichever costs less. Seniors who opt for a more expensive plan would pay the difference. If they choose a cheaper plan, they keep the savings.

Who’s Covered

In the current system, people 65 and over are eligible for Medicare, which Obama has said he would keep [13] for now.

Romney has proposed [14]raising the eligibility age for Medicare beneficiaries from 65 to 67 in 2022, then increasing it by a month each year after that. In the long run, he would index [15] eligibility levels to “longevity.” Ryan’s budget plan proposes [16] raising Medicare eligibility age by two months a year starting in 2023, until it reaches 67 by 2034.

Many others looking to keep Medicare solvent have also proposed [17]raising the age of eligibility.

The Congressional Budget Office estimates [18]that raising the minimum age from 65 to 67 would reduce annual federal spending by 5 percent.But it would also result in higher premiums and out-of-pocket costs for seniors who would lose access to Medicare.

Obama’s health care law also adds [19] some benefits for seniors, such as annual wellness visits without co-pays, preventive services like free cancer screenings and prescription drug savings.

Proposed Savings

The Affordable Care Act is projected to reduce Medicare spending by $716 billion over the next 10 years. These reductions, as detailed [20] by Washington Post’s Wonkblog, will come mostly from reducing payments to hospitals, nursing homes and private health care providers.

While Ryan criticized [21] such spending cuts in his speech at the Republican National Convention, his own budget proposed [22] keeping these reductions.

“The ACA grows the trust fund by giving more general revenue to the Treasury, which then gives the trust fund bonds. But it then uses the money from those bonds to expand coverage for low- and middle-income people,” explains [23] Dylan Matthews on Washington Post’s Wonkblog.

Romney hasn’t really come up with a solid answer: he previously said he would restore [24] the $716 billion savings that the health care law imposes. Per this New York Times story [24], the American Institutes for Research calculates this would increase premiums and co-payments for Medicare beneficiaries by $342 a year on average over the next 10 years.

For more on where the candidates stand on the $716 billion, the private health policy Commonwealth Fund offers this helpful explanation [25].

Caps on Spending

Both Obama and Ryan have set an identical target rate [26] that would cap Medicare spending at one-half a percentage point above the nation’s gross domestic product.

But they have different ideas on mechanisms to achieve it.

The Affordable Care Act establishes a 15-member Independent Payment Advisory Board [27] that, starting in 2015, would make binding recommendations to reduce spending rates. As Jonathan Cohn points out [28] in the New Republic, the commission is prohibited from making any changes that would affect beneficiaries.

Ryan has proposed hard caps on spending and derided [29]this panel of appointed members as “unelected, unaccountable bureaucrats.” When laying out his plan in a 2011 memo [30], Ryan wrote that to control spending, “Congress would be required to intervene and could implement policies that change provider reimbursements, program overhead, and means-tested premiums.”

Romney hasn’t stated [31] clear proposals for imposing a cap on spending.

THE CANDIDATES ON MEDICAID

Big Picture

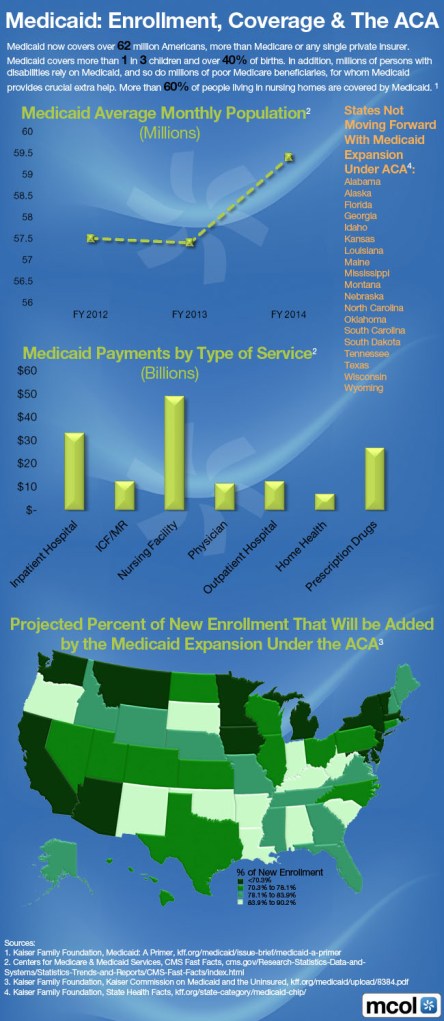

Though, it’s far less discussed [32] on the campaign trail, Medicaid actually covers more people than Medicare. The joint federal-state insurance program for the poor, the disabled, and elderly individuals in long-term nursing home care currently covers about 60 million Americans. The Affordable Care Act hasexpanded [33] Medicaid coverage further. Beginning 2014, Medicaid will include [34]people under 65 with income below 133 percent of the federal poverty level (roughly $15,000 for an individual, $30,000 for a family of four). This was estimated [35] to cover an additional 17 million Americans as eligible beneficiaries.

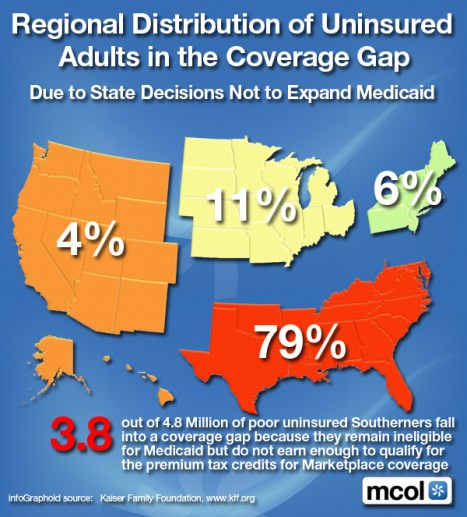

In June, however, the U.S. Supreme Court ruled [36] that states could opt out of the Medicaid expansion. A ProPublica analysis estimated [37] that the 26 states that challenged the health care law, and thus may possibly opt out, would account for up to 8.5 million of those new beneficiaries.

Romney and Ryan would overhaul this current system by turning Medicaid into a system of block grants [38]: the federal government would issue lump sum payments to the states, who would determine eligibility criteria and benefits for enrollees. These grants would begin in 2013.

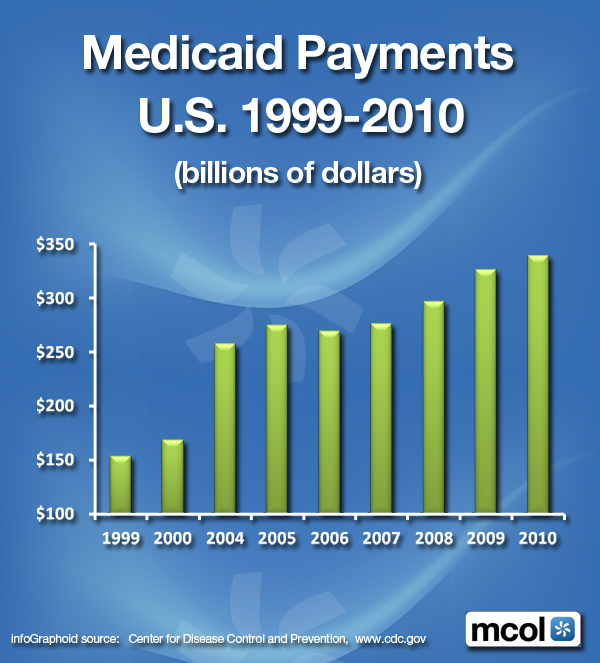

Effects on spending

The Congressional Budget Office estimates [39] that Medicaid expansion under the new health care law would cost an additional $642 billion over the next 10 years.

Under the Ryan plan, federal Medicaid grants would be adjusted only for inflation, but not health care costs, which grow at a much higher rate. The CBO estimates [40] Ryan’s plan would save the federal government $800 billion over the next 10 years. Another study conducted by Bloomberg News shows that the block-grants could decrease Medicaid funding by as much as $1.26 trillion [41] over the next nine years.

Actual Impact

The New York Times points out [42] that more than half of Medicaid spending goes toward the elderly and disabled. An Urban Institute analysis estimates [43] the Ryan plan would result in 14 million to 27 million fewer people receiving Medicaid coverage by 2021.

Assessment

Though rarely mentioned by any of the candidates, Medicaid costs are soaring to cover the elderly who require long-term nursing care. As the Times’ details [44] how, states saddled by high Medicaid costs have begun turning to private managed care plans to blunt the cost.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: Health Law & Policy | Tagged: ACA, Affordable Care Act., Dylan Matthews, Medicaid, medicare, obama, Paul Ryan, Presidential Candidates Stand on Medicare and Medicaid, ProPublica, romney, Suevon Lee | 7 Comments »