SPONSOR: http://www.MarcinkoAssociates.com

By Dr. David Edward Marcinko; MBA MEd

***

***

Gold has long been regarded as a cornerstone of wealth preservation, and its role within modern investment portfolios continues to attract scholarly attention. As both a tangible asset and a financial instrument, gold embodies characteristics that distinguish it from equities, fixed income securities, and other commodities. Its historical resilience, inflation-hedging capacity, and diversification benefits render it a subject of considerable importance in portfolio construction and risk management.

Historical and Monetary Significance

Gold’s enduring appeal is rooted in its function as a monetary standard and store of value. For centuries, gold underpinned global currency systems, most notably through the gold standard, which provided stability in international trade and monetary policy. Although fiat currencies have supplanted gold in official circulation, its symbolic and practical role as a measure of wealth persists. This historical continuity reinforces investor confidence in gold as a reliable repository of value during periods of economic uncertainty.

Inflation Hedge and Safe-Haven Asset

A substantial body of empirical research demonstrates that gold serves as a hedge against inflation and currency depreciation. When consumer prices rise and fiat currencies weaken, gold tends to appreciate, thereby preserving purchasing power. Moreover, gold’s status as a safe-haven asset is particularly evident during geopolitical crises, financial market turbulence, and systemic shocks. In such contexts, investors reallocate capital toward gold, seeking protection from volatility in traditional asset classes. This defensive quality underscores gold’s utility in stabilizing portfolios during adverse conditions.

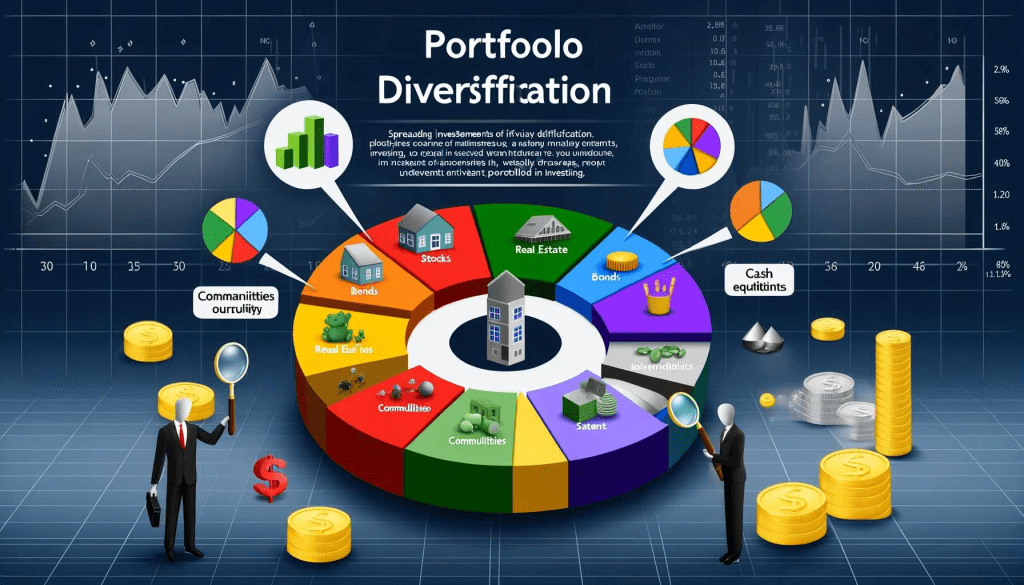

Diversification and Risk Management

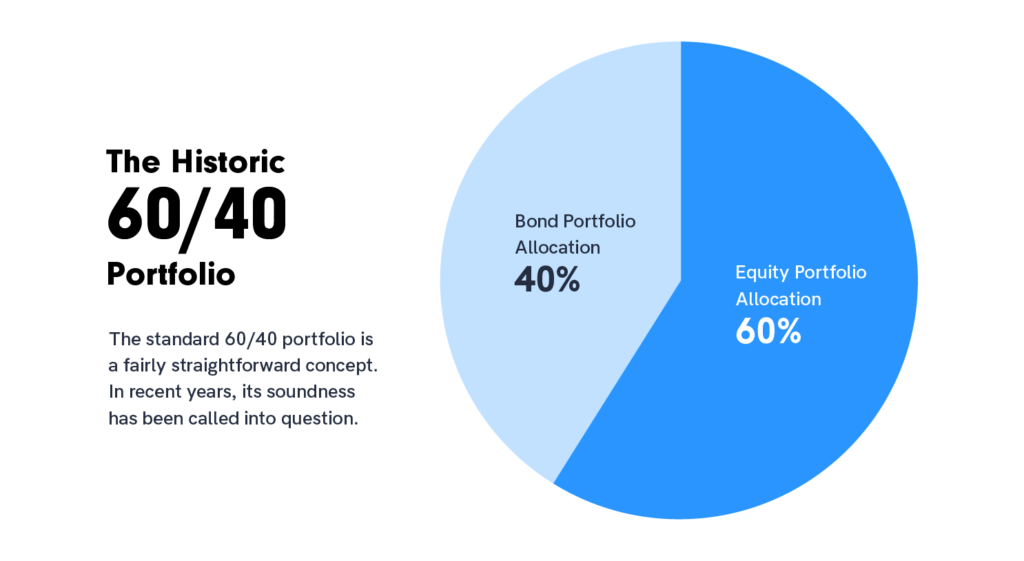

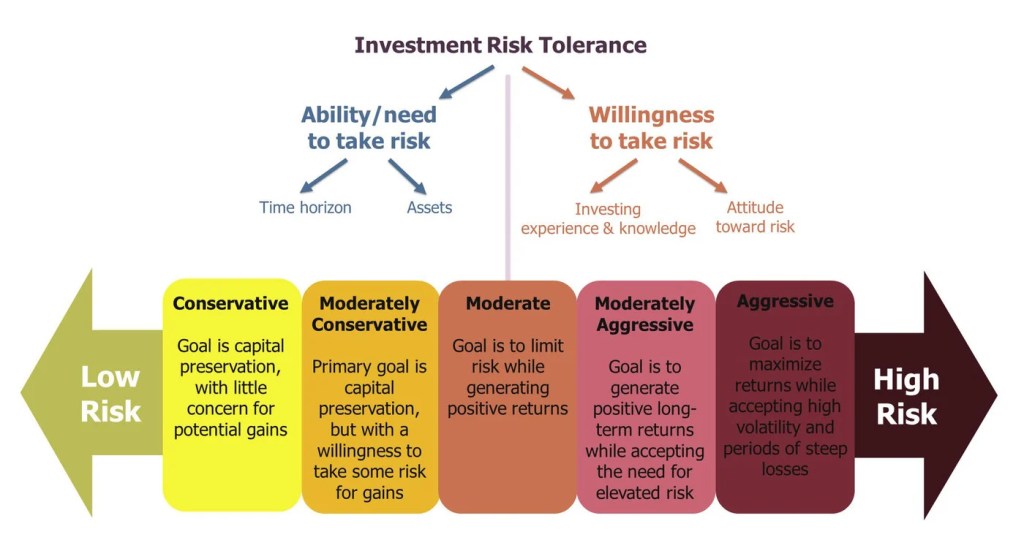

From the perspective of modern portfolio theory, gold offers diversification benefits due to its low correlation with equities and bonds. Incorporating gold into a portfolio reduces overall variance and enhances risk-adjusted returns. Studies suggest that even modest allocations—typically ranging from 5 to 10 percent—can improve portfolio resilience by mitigating downside risk. This non-correlation is especially valuable in environments characterized by heightened uncertainty, where traditional diversification strategies may prove insufficient.

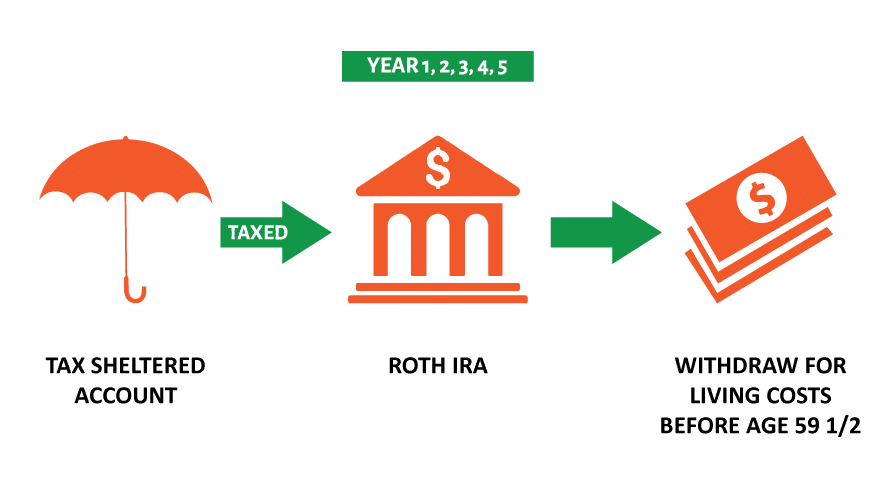

Investment Vehicles and Accessibility

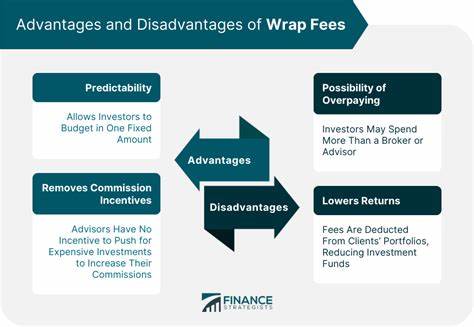

Gold’s versatility as an investment is reflected in the variety of instruments available to investors. Physical bullion, in the form of coins and bars, provides tangible ownership but entails storage and insurance costs. Exchange-traded funds (ETFs) offer liquidity and ease of access, while mining equities provide leveraged exposure to gold prices, albeit with operational risks. Futures contracts and derivatives enable sophisticated strategies, though they demand expertise and tolerance for volatility. The breadth of these vehicles ensures that gold remains accessible across diverse investor profiles.

Limitations and Critical Considerations

Despite its strengths, gold is not without limitations. Unlike equities or bonds, gold does not generate income, such as dividends or interest. This absence of yield can constrain long-term portfolio growth, particularly in low-inflation environments. Furthermore, gold prices are subject to volatility, influenced by investor sentiment, central bank policies, and global demand dynamics. Overexposure to gold may therefore hinder portfolio performance, underscoring the necessity of balanced allocation.

Conclusion

Gold’s dual identity as a historical store of value and a contemporary financial instrument secures its relevance in portfolio construction. Its inflation-hedging capacity, safe-haven qualities, and diversification benefits justify its inclusion as a strategic asset. Nevertheless, prudent management is essential, given its lack of yield and susceptibility to volatility. Within a scholarly framework of portfolio theory, gold emerges not as a panacea but as a complementary asset, enhancing resilience and stability in the face of evolving economic landscapes.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Alternative Investments, finance, Funding Basics, Glossary Terms, Health Law & Policy, Investing, Marcinko Associates, Portfolio Management, Risk Management | Tagged: diversification, economy, ETFs, finance, gold, gold bars, gold coins, gold standard, inflation hedge, Investing, Marcinko, money, personal-finance, Risk Management, store of wealth, Wealth | Leave a comment »