By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

New stock market indices are frequently created to track emerging sectors, regional markets, or particular investment strategies. However, some of the recent and notable stock market indices introduced in recent years focus on new trends or themes such as technology, sustainability, and ESG (Environmental, Social, and Governance) factors. Here are a few noteworthy examples:

1. S&P 500 ESG Index (2021)

One of the newer and increasingly popular indices is the S&P 500 ESG Index, launched in 2021. This index tracks the performance of the companies within the S&P 500 that meet certain environmental, social, and governance (ESG) criteria. The S&P 500 ESG Index aims to provide a more sustainable and socially responsible alternative to the traditional S&P 500 index. It excludes companies involved in industries like tobacco, firearms, or fossil fuels, reflecting the growing interest in socially responsible investing.

2. Nasdaq-100 ESG Index (2021)

Another significant ESG-focused index is the Nasdaq-100 ESG Index, also introduced in 2021. This index tracks the Nasdaq-100, which is typically made up of the 100 largest non-financial companies listed on the Nasdaq stock exchange, but it filters those companies to include only those with strong ESG scores. Given the rapid growth of ESG investing, indices like this one are becoming increasingly important for socially-conscious investors.

3. Global X Metaverse ETF Index (2022)

The Global X Metaverse ETF Index, introduced in 2022, is another example of a new market index targeting a specific, emerging sector. This index focuses on companies involved in the development of the metaverse, which encompasses technologies like virtual reality (VR), augmented reality (AR), and other digital experiences. As the concept of the metaverse gains popularity, this index is designed to provide investors with exposure to companies working within this new virtual space.

4. FTSE All-World High Dividend Yield ESG Index (2022)

This is an example of a more niche index, combining high-dividend yield investing with ESG factors. Introduced by FTSE Russell in 2022, this index is designed for investors looking for companies with high dividend yields while also considering sustainability and ethical investment criteria. It is part of a broader trend where investors seek to combine solid financial returns with socially responsible practices.

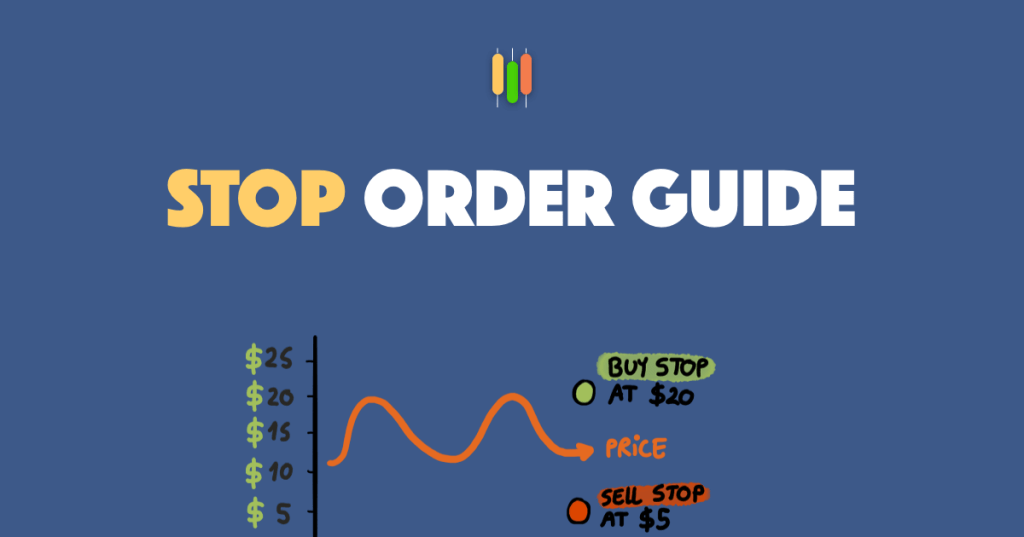

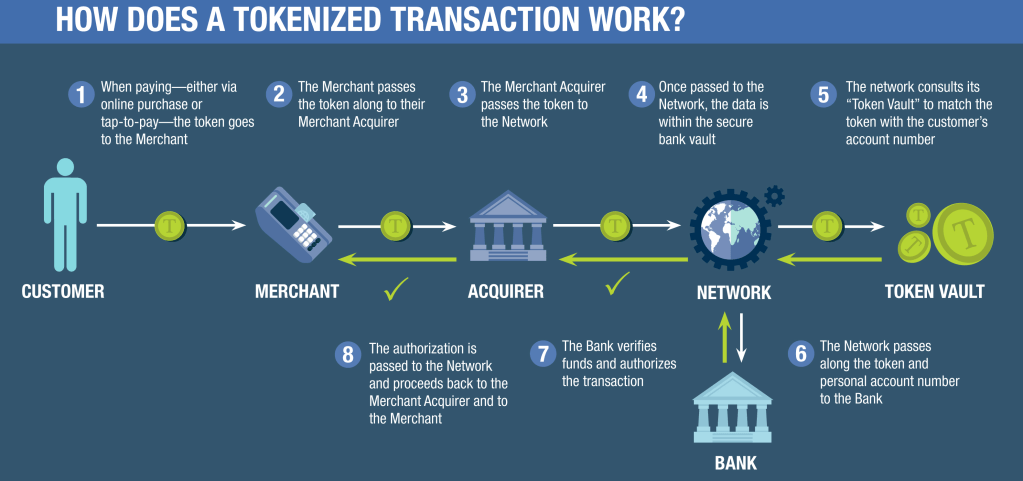

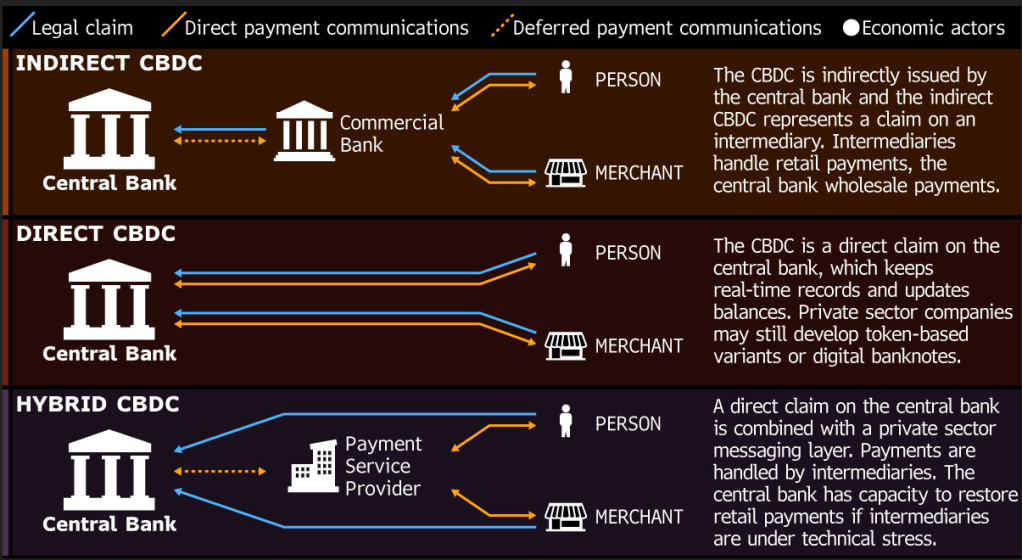

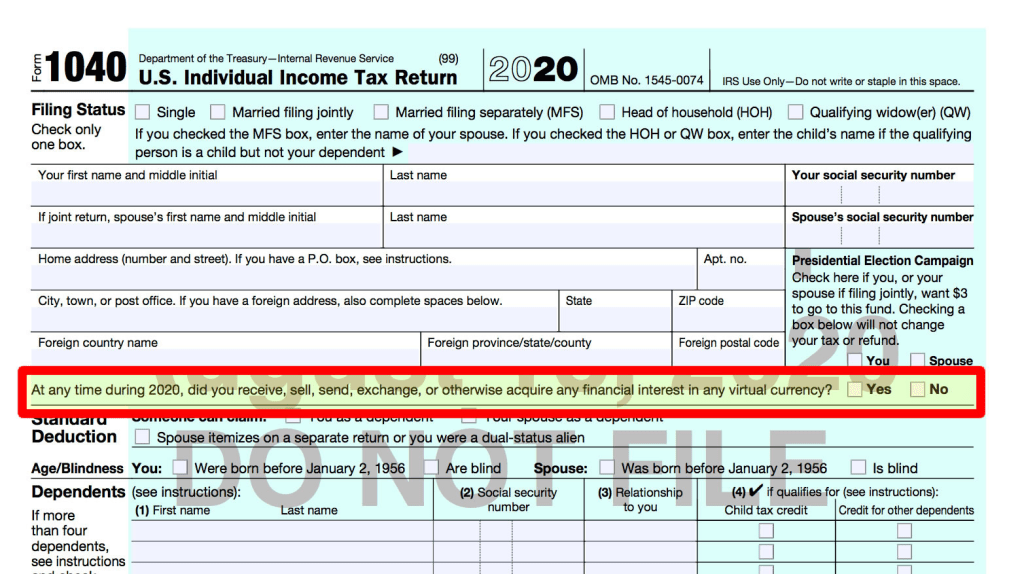

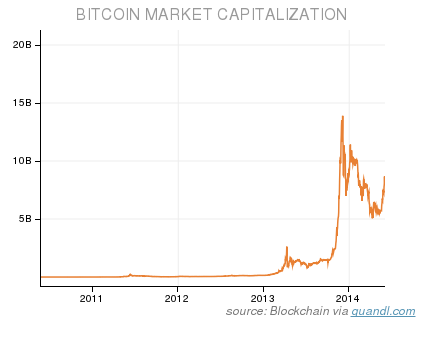

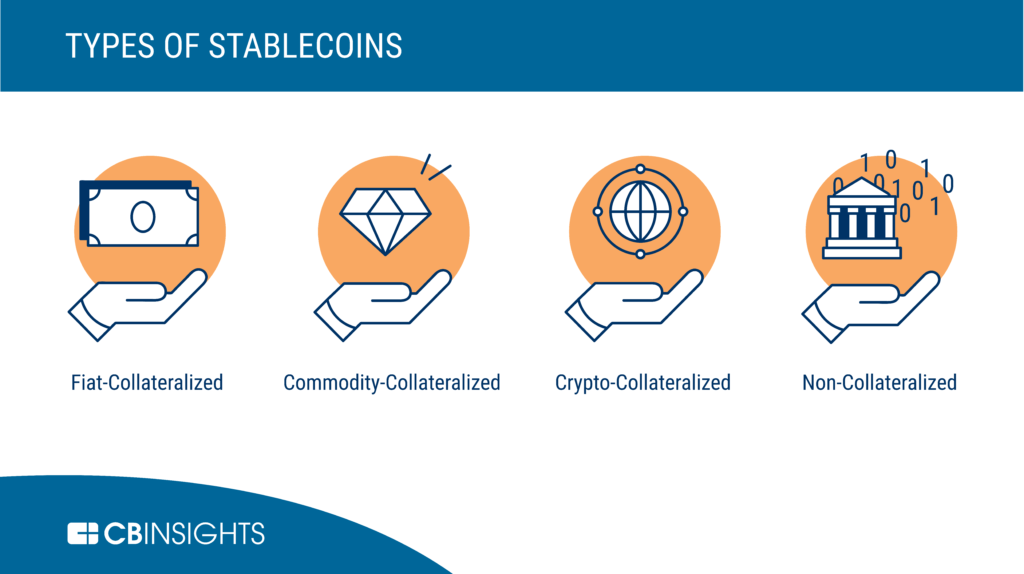

5. Bitcoin and Digital Assets Indices

As cryptocurrency continues to grow in prominence, more indices focused on digital assets and cryptocurrency have emerged. For instance, the S&P Bitcoin Index and the Nasdaq Crypto Index were created to provide benchmarks for the growing market of cryptocurrencies and blockchain technology companies. These indices help investors track the performance of digital currencies and crypto-related stocks or funds.

Why Are New Indices Created?

New stock market indices are created for several reasons:

- Emerging Market Trends: As new sectors like the metaverse, AI, and ESG investing become more relevant, indices are developed to capture the performance of these new areas.

- Investor Demand: As investors look for more targeted strategies, whether for ethical investing or to gain exposure to emerging technologies, indices are created to meet those demands.

- Financial Innovation: As financial products like ETFs (Exchange-Traded Funds) gain popularity, they require benchmarks or indices to track performance.

Conclusion

While the S&P 500 ESG Index and Nasdaq-100 ESG Index are among the newest mainstream indices focusing on socially responsible investing, there are also many other niche indices targeting rapidly growing sectors like the metaverse, cryptocurrencies, and digital assets. These indices reflect the evolving nature of global markets and the increasing interest in themes such as sustainability and technological innovation. With such rapid change in the financial landscape, it’s likely that even more specialized indices will continue to emerge in the coming years.

COMMENTS APPRECIATED

Like, Refer and Subscribe

***

***

Filed under: "Advisors Only", "Ask-an-Advisor", economics, finance, Investing, Marcinko Associates, Portfolio Management | Tagged: Bitcoin, bitcon, cryptocurrency, digital assets index, Global X Metaverse ETF Index, Investing, Marcinko, NASDAQ, NASDAQ-100 ESG, S&P 500 | Leave a comment »

![DR. DAVID EDWARD MARCINKO FACFAS MBA CFP MBBS [Hon] [Executive Summary] - PDF Free Download](https://educationdocbox.com/docs-images/75/71938560/images/8-1.jpg)