Dr. David Edward Marcinko, MBA MEd

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

Risk management has become an essential component of modern medical practice, shaping how physicians deliver care, communicate with patients, and navigate an increasingly complex healthcare environment. While medicine has always involved uncertainty, today’s physicians face heightened scrutiny, evolving regulations, and rising patient expectations. Effective risk management is not merely about avoiding lawsuits; it is about fostering safer clinical environments, strengthening trust, and supporting high‑quality care. When approached proactively, it becomes a framework that protects both patients and practitioners.

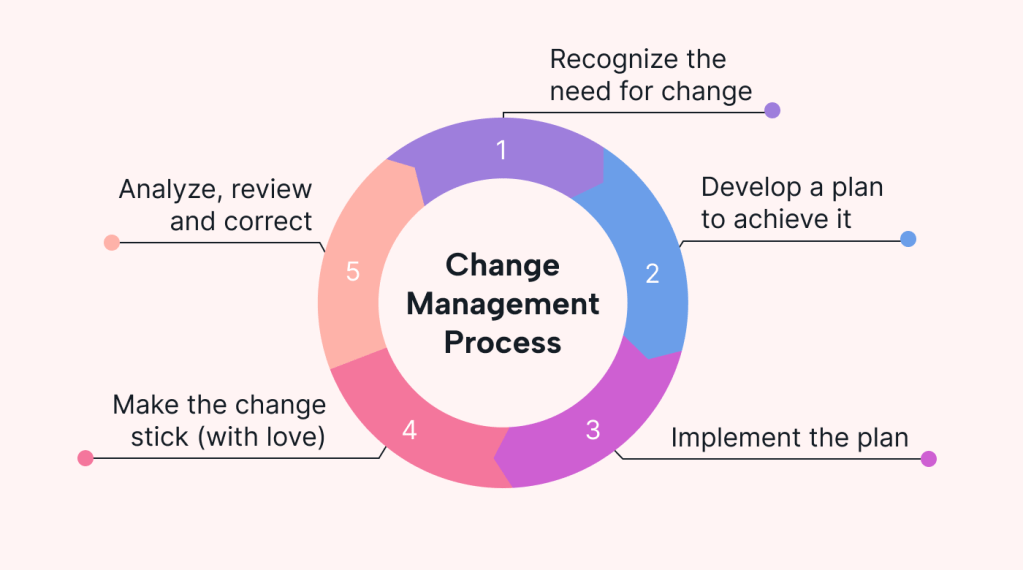

At its core, risk management begins with recognizing the areas where errors, misunderstandings, or system failures are most likely to occur. Clinical decision‑making is an obvious focal point. Physicians must constantly balance diagnostic possibilities, weigh treatment options, and consider potential complications. Even with strong clinical judgment, risks arise when information is incomplete, when symptoms are ambiguous, or when time pressures limit thorough evaluation. To mitigate these challenges, physicians increasingly rely on structured clinical protocols, decision‑support tools, and multidisciplinary collaboration. These strategies help reduce variability in care and ensure that critical steps are not overlooked.

Communication is another central pillar of risk management. Many malpractice claims stem not from clinical mistakes but from breakdowns in communication—unclear explanations, unmet expectations, or perceived dismissiveness. Physicians who take the time to listen carefully, explain diagnoses and treatment plans in accessible language, and invite questions create a foundation of trust that can prevent conflict later. Informed consent is a particularly important aspect of this process. When patients fully understand the benefits, risks, and alternatives of a proposed intervention, they are better equipped to make decisions and less likely to feel blindsided if complications arise. Clear documentation of these conversations further strengthens the physician’s position and ensures continuity of care.

Documentation itself is a powerful risk‑management tool. Accurate, timely, and thorough medical records serve multiple purposes: they guide clinical decision‑making, support communication among care teams, and provide a factual account of events if questions arise later. Physicians who document not only what they did but why they made certain decisions create a transparent narrative that reflects thoughtful, patient‑centered care. Conversely, incomplete or inconsistent records can create vulnerabilities, even when the care provided was appropriate.

***

***

Another important dimension of risk management involves staying current with medical knowledge and regulatory requirements. Medicine evolves rapidly, and outdated practices can expose physicians to unnecessary risk. Continuing education, peer review, and participation in quality‑improvement initiatives help physicians maintain competence and identify areas for improvement. Regulatory compliance—whether related to privacy laws, prescribing rules, or reporting obligations—is equally critical. Violations, even unintentional ones, can lead to legal consequences and damage professional credibility.

Systems‑based risk management has also gained prominence. Many errors arise not from individual negligence but from flawed processes or communication gaps within healthcare organizations. Physicians who engage in system‑level improvements—such as refining hand off procedures, participating in morbidity and mortality reviews, or advocating for safer workflows—contribute to a culture of safety that benefits everyone. This collaborative approach recognizes that risk management is not solely the responsibility of individual clinicians but a shared commitment across the healthcare team.

Emotional intelligence plays a surprisingly influential role as well. When adverse events occur, patients and families often look to the physician for honesty, empathy, and reassurance. A compassionate response can de‑escalate tension and preserve the therapeutic relationship, even in difficult circumstances. Many institutions now encourage physicians to participate in disclosure training, which helps them navigate these conversations with clarity and sensitivity. Addressing the emotional impact on physicians themselves is equally important; burnout, fatigue, and stress can impair judgment and increase the likelihood of errors. Supporting physician well‑being is therefore an indirect but vital component of risk management.

Ultimately, effective risk management is not about practicing defensively or avoiding complex cases. It is about creating an environment where safety, transparency, and continuous improvement are woven into everyday practice. Physicians who embrace these principles are better equipped to navigate uncertainty, maintain strong patient relationships, and deliver care that aligns with both ethical and professional standards. In a healthcare landscape that continues to evolve, risk management remains a dynamic and indispensable part of responsible medical practice.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

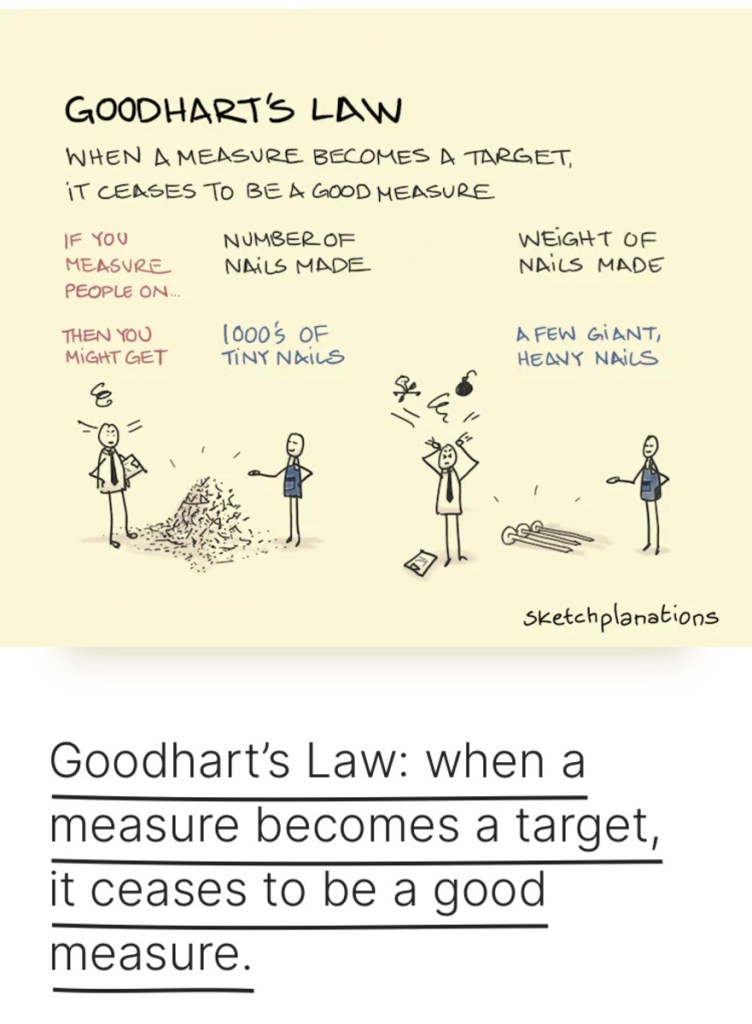

Filed under: "Ask-an-Advisor", Career Development, Experts Invited, Glossary Terms, iMBA, Inc., Investing, Marcinko Associates, Risk Management | Tagged: AI, artificial intelligence, david marcinko, DDS, DMD, DO, EI, EQ, health, healthcare, physisians, Risk Management, Technology | Leave a comment »