On Financial Fiduciary Accountability

[By Dr. David E. Marcinko MBA MEd CMP™]

[By Ann Miller; RN, MHA]

Currently, there is a growing dilemma in the financial sales and services industry. It goes something like this:

- What is a financial fiduciary?

- Who is a financial fiduciary?

- How can I tell if my financial advisor is a fiduciary?

Now, in as much as this controversy affects laymen and physician-investors alike, we went right to the source for up-to-date information regarding this often contentious topic, for an email interview and Q-A session, with Ben Aikin.

About Bennett Aikin AIF® and fi360.com

Bennett [Ben] Aikin is the Communications Coordinator for fi360.com. He oversees all communications for fi360. His responsibilities include messaging, brand management, copyrights and trademarks, and publications. Mr. Aikin received his BA in English from Virginia Tech in 2003 and is currently an MS candidate in Journalism from Ohio University.

Q. Medical Executive Post

You have been very helpful and gracious to us. So, let’s get right to it, Ben. In the view of many; attorneys, doctors, CPAs and the clergy are fiduciaries; most all others who retain this title seem poseurs; sans documentation otherwise.

A. Mr. Aikin

You are correct. Attorneys, doctors and clergy are the prototype fiduciaries. They have a clear duty to put the best interests of their clients, patients, congregation, etc., above their own. [The duty of a CPA isn’t as clear to me, although I believe you are correct]. Furthermore, this is one of the first topics we address in our AIF training programs, and what we call the difference between a profession and an industry. The three professions you name have three common characteristics that elevate them from an industry to a profession:

- Recognized body of knowledge

- Society depends upon practitioners to provide trustworthy advice

- Code of conduct that places the clients’ best interests first

Q. Medical Executive Post

It seems that Certified Financial Planner®, Chartered Financial Analysts, Registered Investment Advisors and their representatives, Registered Representative [stock-brokers] and AIF® holders, etc, are not really financial fiduciaries, either by legal statute or organizational charter. Are we correct, or not? Of course, we are not talking ethics or morality here. That’s for the theologians to discuss.

A. Mr. Aikin

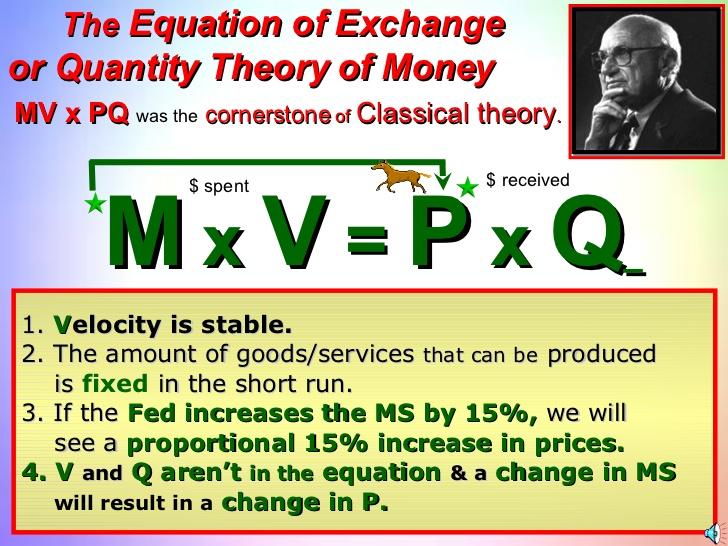

One of the reasons for the “alphabet soup”, as you put it in one of your white papers [books, dictionaries and posts] on financial designations, is that while there is a large body of knowledge, there is no one recognized body of knowledge that one must acquire to enter the financial services industry. The different designations serve to provide a distinguisher for how much and what parts of that body of knowledge you do possess. However, being a fiduciary is exclusively a matter of function.

In other words, regardless of what designations are held, there are five things that will make one a fiduciary in a given relationship:

- You are “named” in plan or trust documents; the appointment can be by “name” or by “title,” such as CFO or Head of Human Resources

- You are serving as a trustee; often times this applies to directed trustees as well

- Your function or role equates to a professional providing comprehensive and continuous investment advice

- You have discretion to buy or sell investable assets

- You are a corporate officer or director who has authority to appoint other fiduciaries

So, if you are a fiduciary according to one of these definitions, you can be held accountable for a breach in fiduciary duty, regardless of any expertise you do, or do not have. This underscores the critical nature of understanding the fiduciary standard and delegating certain duties to qualified “professionals” who can fulfill the parts of the process that a non-qualified fiduciary cannot.

Q. Medical Executive Post

How about some of the specific designations mentioned on our site, and elsewhere. I believe that you may be familiar with the well-known financial planner, Ed Morrow, who often opines that there are more than 98 of these “designations”? In fact, he is the founder of the Registered Financial Consultants [RFC] designation. And, he wrote a Foreword for one of our e-books; back-in-the-day. His son, an attorney, also wrote as a tax expert for us, as well. So, what gives?

A. Mr. Aikin

As for the specific designations you list above, and elsewhere, they each signify something different that may, or may not, lend itself to being a fiduciary: For example:

• CFP®: The act of financial planning does very much imply fiduciary responsibility. And, the recently updated CFP® rules of conduct does now include a fiduciary mandate:

• 1.4 A certificant shall at all times place the interest of the client ahead of his or her own. When the certificant provides financial planning or material elements of the financial planning process, the certificant owes to the client the duty of care of a fiduciary as defined by CFP Board. [from http://www.cfp.net/Downloads/2008Standards.pdf]

• CFA: Very dependent on what work the individual is doing. Their code of ethics does have a provision to place the interests of clients above their own and their Standards of Practice handbook makes clear that when they are working in a fiduciary capacity that they understand and abide by the legally mandated fiduciary standard.

• FA [Financial Advisor]: This is a generic term that you may find being used by a non-fiduciary, such as a broker, or a fiduciary, such as an RIA.

• RIA: Are fiduciaries. Registered Investment Advisors are registered with the SEC and have obligations under the Investment Advisers Act of 1940 to provide services that meet a fiduciary standard of care.

• RR: Registered Reps, or stock-brokers, are not fiduciaries if they are doing what they are supposed to be doing. If they give investment advice that crosses the line into “comprehensive and continuous investment advice” (see above), their function would make them a fiduciary and they would be subject to meeting a fiduciary standard in that advice (even though they may not be properly registered to give advice as an RIA).

• AIF designees: Have received training on a process that meets, and in some places exceeds, the fiduciary standard of care. We do not require an AIF® to always function as a fiduciary. For example, we allow registered reps to gain and use the AIF® designation. In many cases, AIF designees are acting as fiduciaries, and the designation is an indicator that they have the full understanding of what that really means in terms of the level of service they provide. We do expect our designees to clearly disclose whether they accept fiduciary responsibility for their services or not and advocate such disclosure for all financial service representatives.

Q. Medical Executive Post

Your website, http://www.fi360.com, seems to suggest, for example, that banks/bankers are fiduciaries. We have found this not to be the case, of course, as they work for the best interests of the bank and stockholders. What definitional understanding are we missing?

A. Mr. Aikin

Banks cannot generally be considered fiduciaries. Again, it is a matter of function. A bank may be a named trustee, in which case a fiduciary standard would generally apply. Banks that sell products are doing so according to their governing regulations and are “prudent experts” under ERISA, but not necessarily held to a fiduciary standard in any broader sense.

Q. Medical Executive Post

And so, how do we rectify the [seemingly intentional] industry obfuscation on this topic. We mean, our readers, subscribers, book and dictionary purchasers, clients and colleagues are all confused on this topic. The recent financial meltdown only stresses the importance of understanding same.

For example, everyone in the industry seems to say they are the “f” word. But, our outreach efforts to contact traditional “financial services” industry pundits, CFP® practitioners and other certification organizations are continually met with resounding silence; or worse yet; they offer an abundance of parsed words and obfuscation but no confirming paperwork, or deep subject-matter knowledge as you have kindly done. We get the impression that some FAs honesty do-not have a clue; while others are intentionally vague.

A. Mr. Aikin

All of the evidence you cite is correct. But that does not mean it is impossible to find an investment advisor who will manage to a fiduciary standard of care and acknowledge the same. The best way to rectify confusion as it pertains to choosing appropriate investment professionals is to get fiduciary status acknowledged in writing and go over with them all of the necessary steps in a fiduciary process to ensure they are being fulfilled. There also are great resources out there for understanding the fiduciary process and for choosing professionals, such as the Department of Labor, the SEC, FINRA, the AICPA’s Personal Financial Planning division, the Financial Planning Association, and, of course, Fiduciary360.

We realize the confusion this must cause to those coming from the health care arena, where MD/DO clearly defines the individual in question; as do other degrees [optometrist, clinical psychologist, podiatrist, etc] and medical designations [fellow, board certification, etc.]. But, unfortunately, it is the state of the financial services industry as it stands now.

Q. Medical Executive Post

It is as confusing for the medical community, as it is for the lay community. And, after some research, we believe retail financial services industry participants are also confused. So, what is the bottom line?

A. Mr. Aikin

The bottom line is that lay, physician and all clients have a right to expect and demand a fiduciary standard of care in the managing of investments. And, there are qualified professionals out there who are providing those services. Again, the best way to ensure you are getting it is to have fiduciary status acknowledged in writing, and go over the necessary steps in a fiduciary process with them to ensure it is being fulfilled.

Q. Medical Executive Post

The “parole-evidence” rule, of contract law, applies, right? In dealing with medical liability situations, the medics and malpractice attorneys have a rule: “if it wasn’t written down, it didn’t happen.”

A. Mr. Aikin

An engagement contract accepting fiduciary status should trump a subsequent attempt to claim the fiduciary standard didn’t apply. But, to reiterate an earlier point, if someone acts in one of the five functional fiduciary roles, they are a fiduciary whether they choose to acknowledge it or not. I have attached a sample acknowledgement of fiduciary status letter with copies of our handbook, which details the fiduciary process we instruct in our programs, and our SAFE, which is basically a checklist that a fiduciary should be able to answer “Yes” to every question to ensure the entire fiduciary process is being covered.

Q. Medical Executive Post

It is curious that you mention checklists. We have a post arguing that very theme for doctors and hospitals as they pursue their medial error reduction, and quality improvement, endeavors. And, we applaud your integrity, and wish only for clarification on this simple fiduciary query?

A. Mr. Aikin

Simple definition: A fiduciary is someone who is managing the assets of another person and stands in a special relationship of trust, confidence, and/or legal responsibility.

Q. Medical Executive Post

Who is a financial fiduciary and what, if any, financial designation indicates same?

A. Mr. Aikin

Functional definition: See above for the five items that make you a fiduciary.

Financial designations that unequivocally indicate fiduciary duty: Short answer is none, only function can determine who is a fiduciary.

Q. Medical Executive Post

Please repeat that?

A. Mr. Aikin

Financial designations that indicate fiduciary duty: none. It is the function that determines who is a fiduciary. Now, having said that, the CFP® certification comes close by demanding their certificants who are engaged in financial planning do so to a fiduciary standard. Similarly, other designations may certify the holder’s ability to perform a role that would be held to a fiduciary standard of care. The point is that you are owed a fiduciary standard of care when you engage a professional to fill that role or they functionally become one. And, if you engage a professional to fill a non-fiduciary role, they will not be held to a fiduciary standard simply because they have a particular designation. One of the purposes the designations serve is to inform you what roles the designation holder is capable of fulfilling.

It is also worth keeping in mind that just being a fiduciary doesn’t equate to a full knowledge of the fiduciary standard. The AIF® designation indicates having been fully trained on the standard.

Q. Medical Executive Post

Yes, your website mentions something about fiduciaries that are not aware of same! How can this be? Since our business model mimics a medical model, isn’t that like saying “the doctor doesn’t know he is doctor?” Very specious, with all due respect!

A. Mr. Aikin

I think it is first important to note that this statement is referring not just to investment professionals. Part of the audience fi360 serves is investment stewards, the non-professionals who, due to facts and circumstances, still owe a fiduciary duty to another. Examples of this include investment committee members, trustees to a foundation, small business owners who start 401k plans, etc. This is a group of non-sophisticated investors who may not be aware of the full array of responsibilities they have.

However, even on the professional side I believe the statement isn’t as absurd as it sounds. This is basically a protection from both ignorant and unscrupulous professionals. Imagine a registered representative who, either through ignorance or design, begins offering comprehensive and continuous investment advice. Though they may deny or be unaware of the fact, they have opened themselves up to fiduciary liability.

Q. Medical Executive Post

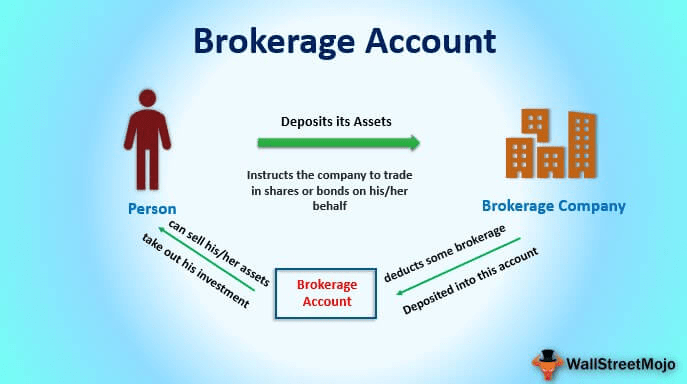

Please clarify the use of arbitration clauses in brokerage account contracts for us. Do these disclaim fiduciary responsibility? If so, does the client even know same?

A. Mr. Aikin

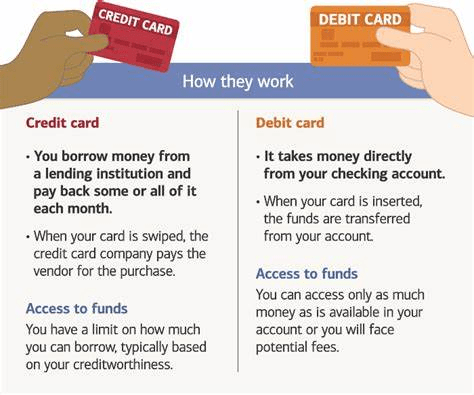

By definition, an engagement with a broker is a non-fiduciary relationship. So, unless other services beyond the scope of a typical brokerage account contract are specified, fiduciary responsibility is inherently not applicable. Unfortunately, I do imagine there are clients who don’t understand this. Furthermore, AIF® designees are not prohibited from signing such an agreement and there are some important points to understand the reasoning.

First, by definition, if you are entering into such an agreement, you are entering into a non-fiduciary relationship. So, any fiduciary requirement wouldn’t apply in this scenario.

Second, if this same question were applied into a scenario of a fiduciary relationship, such as with an RIA, this would be a method of dispute resolution, not a practice method. So, in the event of dispute, the advisor and investor would be free to agree to the method of resolution of their choosing. In this scenario, however, typically the method would not be discussed until the dispute itself arose.

Finally, it is important to know that AIF/AIFA designees are not required to be a fiduciary. It is symbolic of the individuals training, knowledge and ongoing development in fiduciary processes, but does not mean they will always be acting as a fiduciary.

Q. Medical Executive Post

Don’t the vast majority of arbitration hearings find in favor of the FA; as the arbitrators are insiders, often paid by the very same industry itself?

A. Mr. Aikin

Actual percentages are reported here: http://www.finra.org/ArbitrationMediation/AboutFINRADR/Statistics/index.htm However, brokerage arbitration agreements are a dispute resolution method for disputes that arise within the context of the securities brokerage industry and are not the only means of resolving differences for all types of financial advisors. Investment advisers, for example, are subject to respond to disputes in a variety of forums including state and federal courts. Clients should look at their brokerage or advisory agreement to see what they have agreed to. If you wanted to go into further depth on this question, we would recommend contacting Brian Hamburger, who is a lawyer with experience in this area and an AIFA designee. Bio page: http://www.hamburgerlaw.com/attorneys/BSH.htm.

Q. Medical Executive Post

What about our related Certified Medical Planner® designation, and online educational program for financial advisors and medical management consultants? Is it a good idea – reasonable – for the sponsor to demand fiduciary accountability of these charter-holders? Cleary, this would not only be a strategic competitive advantage, but advance the CMP™ mission to put medical colleagues first and champion their cause www.CertifiedMedicalPlanner.org above all else.

A. Mr. Aikin

I think it is a good idea for any plan sponsor to demand fiduciary status be acknowledged from anyone engaged to provide comprehensive and continuous investment advice. I also think it is a good idea to be proactive in verifying that the fiduciary process is being followed.

Q. Medical Executive Post

Is there anything else that we should know about this topic?

A. Mr. Aikin

Yes, a further note about fi360’s standards. I wrote generically about the fiduciary standard, because there is one that is defined by multiple sources of regulation, legislation and case law. The process defined in our handbooks, we call a Fiduciary Standard of Excellence, because it covers that minimum standard and also best practice standards that go above and beyond. All of our Practices, which comprise that standard, are legally substantiated in our Legal Memoranda handbook, which was written by Fred Reish’s law firm, who is considered a leading ERISA attorney.

Additional resources:

Q. Medical Executive Post

Thank you so much for your knowledge and willingness to frankly share it with the Medical-Executive-Post.

Assessment

All are invited to continue the conversation with Mr. Aikin, asynchronously online, or thru this contact information:

fi360.com

438 Division Street

Sewickley, PA 15143

412-741-8140 Phone

866-390-5080 Toll-free phone

412-741-8142 Fax

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

ADVISORS: www.CertifiedMedicalPlanner.org

BLOG: www.MedicalExecutivePost.com

8

8

Filed under: "Advisors Only", "Doctors Only", Book Reviews, Career Development, Ethics, Financial Planning, Insurance Matters, Interviews, Investing, Media Mentions and PR, Monthly Reports, Op-Editorials, Portfolio Management, Professional Liability, Quality Initiatives, Research & Development, Sponsors, Touring with Marcinko | Tagged: AIF, ann miller, bennett aikin, Bob Veres, certified medical planner, CFA, CFP, CMP, CPA, david marcinko, Fi360, fiduciary, financial fiduciary, Fred Reish, hope hetico, iMBA, Inc., insurance agents, Marcinko, RR | Leave a comment »