“Physicians who don’t understand modern risk management, insurance, business, and asset protection principles are sitting ducks waiting to be taken advantage of by unscrupulous insurance agents and financial advisors; and even their own prospective employers or partners. This comprehensive volume from Dr. David Marcinko and his co-authors will go a long way toward educating physicians on these critical subjects that were never taught in medical school or residency training.”

—Dr. James M. Dahle, MD, FACEP, Editor of The White Coat Investor, Salt Lake City, Utah, USA

“With time at a premium, and so much vital information packed into one well organized resource, this comprehensive textbook should be on the desk of everyone serving in the healthcare ecosystem. The time you spend reading this frank and compelling book will be richly rewarded.”

—Dr. J. Wesley Boyd, MD, PhD, MA, Harvard Medical School, Boston, Massachusetts, USA

“Physicians have more complex liability challenges to overcome in their lifetime, and less time to do it, than other professionals. Combined with a focus on practicing their discipline, many sadly fail to plan for their own future. They need trustworthy advice on how to effectively protect themselves, their family, and their practice from the many overt and covert risks that could potentially disrupt years of hard work.

Fortunately, this advice is contained within Risk Management, Liability Insurance, and Asset Protection Strategies for Doctors and Advisors: Best Practices from Leading Consultants and Certified Medical Planners™. Written by Dr. David Edward Marcinko, Nurse Hope Rachel Hetico, and their team of risk managers, accountants, insurance agents, attorneys, and physicians, it is uniquely positioned as an integration of applied, academic, and peer-reviewed strategies and research, with case studies from top consultants and Certified Medical Planners™. It contains the latest principles of risk management and asset protection strategies for the specific challenges of modern physicians. My belief is that any doctor who reads and applies even just a portion of this collective wisdom will be fiscally rewarded. The Institute of Medical Business Advisors has produced another outstanding reference for physicians that provide peace of mind inthis unique marketplace! In my opinion, it is a mandatory read for all medical professionals.”

—David K. Luke, MS-PFP, MIM, CMP™, Net Worth Advisory Group, Inc., Sandy, Utah, USA

“This book is a well-constructed, comprehensive, and experiential view of risk management throughout the entire medical practice life-cycle. It is organized in an accessible, high-yield style that is familiar to doctors. Each chapter has case models, examples, insider tips, and useful pearls. I was pleased to see multi-degreed physicians sharing their professional experiences in a textbook on something other than clinical medicine. I can’t decide if this book is right on – over the top – or just plain prescient. Now, after a re-read, I conclude it is all of the above; and much more.”

—Dr. Peter P. Sidoriak, Pottsville, Pennsylvania, USA

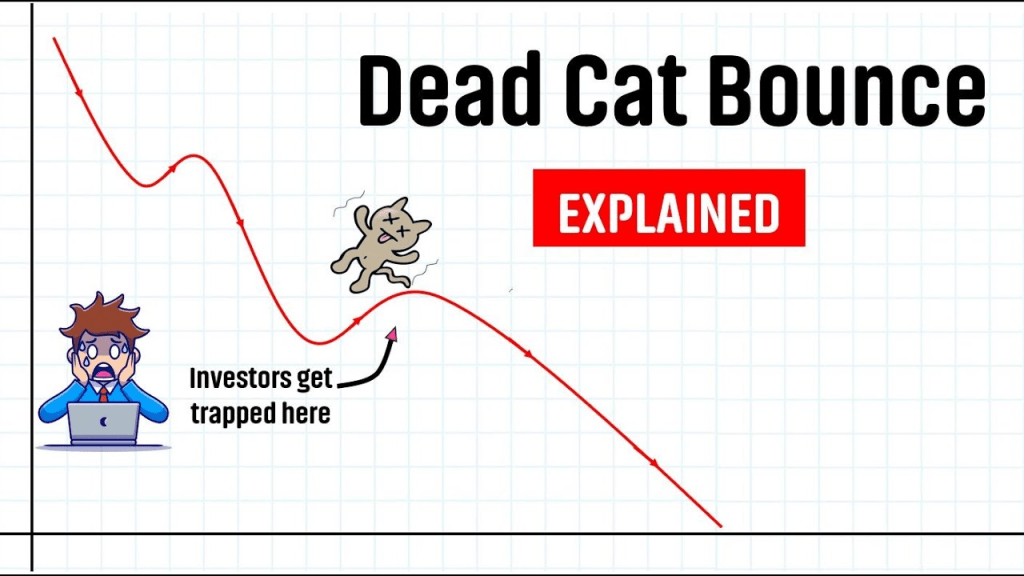

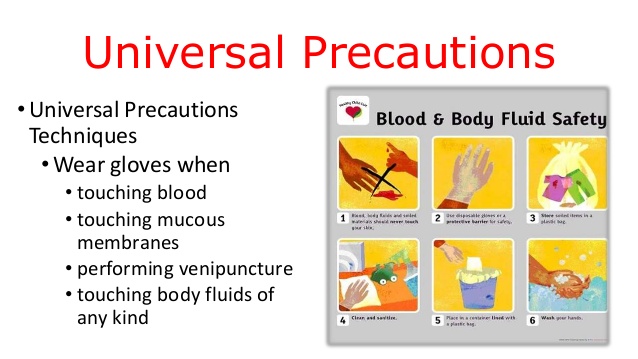

“When a practicing physician thinks about the risk exposure resulting from providing patient care, medical malpractice risk immediately comes to mind. But, malpractice and liability risk are barely the tip of the iceberg, and likely not even the biggest risk in the daily practice of medicine. There are risks from having medical records to keep private, risks related to proper billing and collections, risks from patients tripping on your office steps, risks from medical board actions, risk arising from divorce, and the list goes on and on. These liabilities put a doctor’s hard earned assets and career in a very vulnerable position. This new book from Dr. David Marcinko and Prof. Hope Hetico shows doctors the multiple types of risk they face and provides examples of steps to take to minimize them. It is written clearly and to the point, and is a valuable reference for any well-managed practice. Every doctor who wants to take preventive action against the risks coming at them… from all sides needs to read this book.”

—Richard Berning, MD, FACC, New Haven, Connecticut, USA

“This is an excellent companion book to Dr. Marcinko’s Comprehensive Financial Planning Strategies For Doctors and Advisors: Best Practices from Leading Consultants and Certified Medical Planners™. It is all inclusive, yet easy to read, with current citations, references, and much frightening information. I highly recommend this text. It is a fine educational and risk management tool for all doctors and medical professionals.”—Dr. David B. Lumsden, MD, MS, MA, Orthopedic Surgeon, Baltimore, Maryland, USA

“This comprehensive text book provides an in-depth presentation of the cyber security and real risk management, asset protection, and insurance issues facing all medical professions today. It is far beyond the mere medical malpractice concerns I faced when originally entering practice decades ago.”

—Dr. Barbara s. Schlefman, DPM, MS, Family Foot Care, PA, Tucker, Georgia, USA

“Am I over-insured and thus wasting money? Am I under-insured and thus at risk for a liability or other disaster? I never really had the means of answering these questions; until now.”

—Dr. Lloyd M. Krieger, MD, MBA, Rodeo Drive Plastic Surgery, Beverly Hills, California, USA

“I read and use this book and several others from Dr. David Edward Marcinko and his team of advisors.”

—Dr. John Kelley, DO, Orthopedic Surgeon, Tucker, Georgia, USA

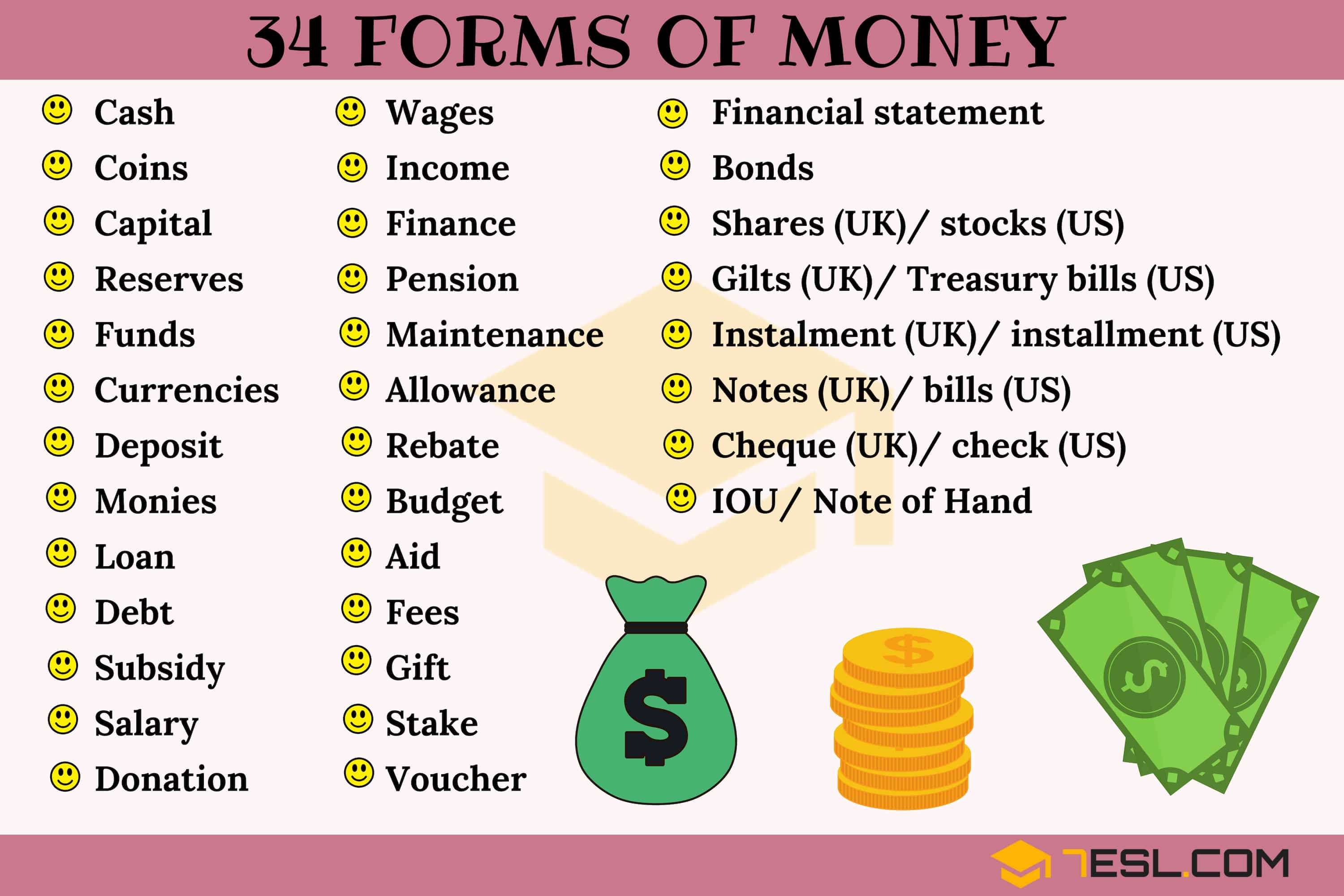

“An important step in the risk management, insurance planning, and asset protection process is the assessment of needs. One can create a strong foundation for success only after all needs have been analyzed so that a plan can be constructed and then implemented. This book does an excellent job of recognizing those needs and addressing strategies to reduce them.“

—Shikha Mittra, MBA, CFP®, CRPS®, CMFC®, AIF®, President – Retire Smart Consulting LLC, Princeton, New Jersey, USA

“The Certified Medical Planner™ professional designation and education program was created by the Institute of Medical Business Advisors Inc., and Dr. David Edward Marcinko and his team (who wrote this book). It is intended for financial advisors who aim specifically to serve physicians and the medical community. Content focuses not only on the insurance and professional liability issues relevant to physicians, but also provides an understanding of the risky business of medical practice so advisors can help work more successfully with their doctor-clients.” —Michael E. Kitces, MSFS, MTAX, CFP®, CLU, ChFC, RHU, REBC, CASL Reston, Virginia, USA

“I have read this text and used consulting services from the Institute of Medical Business of Advisors, Inc. on several occasions.”

—Dr. Marsha Lee, DO, Radiologists, Norcross, Georgia, USA

“The medical education system is grueling and designed to produce excellence in medical knowledge and patient care. What it doesn’t prepare us for are the slings and arrows that come our way once we actually start practicing medicine. Successfully avoiding these land mines can make all the difference in the world when it comes to having a fulfilling practice. Given the importance of risk management and mitigation, you would think these subjects would be front and center in both medical school and residency – ‘they aren’t.’ Thankfully, the brain trust over at iMBA Inc. has compiled this comprehensive guide designed to help you navigate these mine fields so that you can focus on what really matters – patient care.”

—Dennis Bethel, MD, Emergency Medicine Physician

![DR. DAVID EDWARD MARCINKO FACFAS MBA CFP MBBS [Hon] [Executive Summary] - PDF Free Download](https://educationdocbox.com/docs-images/75/71938560/images/8-1.jpg)

/u-s-debt-ceiling-why-it-matters-past-crises-9ee4f4a3337c4203997fb191a9858b8c.gif)

:strip_icc():format(webp)/what-is-the-rule-of-55-2894280-v1-fa6b42c5a8f647e8aa5776a550c121a5-1fc39bd85b914af9b2682601f2cefdf6.png)