Selection Criteria Critical for Physicians

By Dr. David Edward Marcinko; MBA, CMP™

[Publisher-in-Chief and former certified financial planner ]

]

Recently in the Atlanta area, two high-profile financial advisors and portfolio investment managers have been charged with client embezzlement, malfeasance, and more!

The first was Kirk Wright, a Harvard-educated fund manager who was convicted last week in a fraud scheme that bilked investors out of tens of millions of dollars. He later hanged himself, according to the Fulton County Georgia medical examiner’s office. A federal jury convicted Wright last week on all 47 counts of mail fraud, securities fraud and money laundering stemming from a scam run through his firm, International Management Associates. High-profile clients included sports-stars, celebrities and several well-known local physicians.

The second, Frederick J. Barton, received a Securities and Exchange Commission (SEC) civil action letter on June 3rd, 2008. Barton, formerly a registered representative of a national, registered broker-dealer and two entities he controlled: TwinSpan Capital Management, LLC (TwinSpan), an investment adviser formerly registered with the Commission, and Barton Asset Management, LLC (Barton Asset Management). The Commission alleges that, between 1999 and 2007, Barton, acting individually or through TwinSpan or Barton Asset Management, engaged in three separate securities frauds-including one involving a patient suffering from Alzheimer’s disease-and through his misconduct obtained over $3 million in ill-gotten gains. The Commission further alleges that he then spent his ill-gotten gains, among other things, to send his children to an exclusive private school, fund his own investment portfolio, and service his credit card debts.

Manager Selection

So, how can the medical professional reduce the potential for similar behavior from his/her portfolio manager?

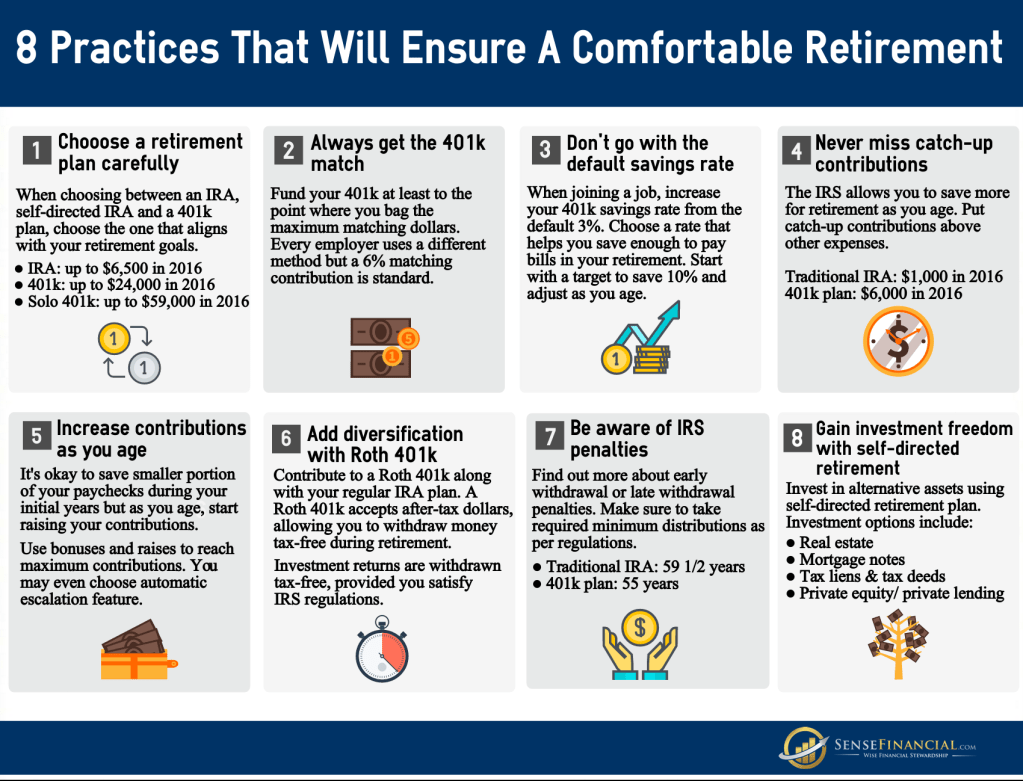

The first way is to skip the middle-man and “do-it-yourself.” But, doctors are sometimes hard-pressed to following this directive because of time constraints, knowledge paucity, fear/greed and/or disinterest; among other reasons.

The second way, of course, is to outsource the task by hiring a financial advisor. But, how do you find a financial advisor (easy), and more importantly, how do you discern a good fit (personally and professionally)? Still, there is no guarantee of honesty or capability.

But, your odds can be improved with insider knowledge of the financial services industry; a common-theme of the ME-P. And so, the following checklist may be a good place to start the selection, or triage process.

SAMPLE: Engagement Letter

Mr. Joseph H. Sample

Vice President

Medical Capital Management of Nevada, LLC

Dear [Mr. Name]:

Thank you for agreeing to meet with us on [date, time] in our office. We are in the process of interviewing several portfolio investment managers.

So that we may obtain consistent information in our evaluation, we would appreciate the coverage of specific areas during your presentation. We are particularly interested in information regarding your approach to investment management in the following areas:

Investment philosophy and approach

• Describe your management style and any changes you have made over the past decade.

• Describe your investment decision-making process.

• Do you make the decisions or do you rely on others, and if so, who?

• Describe your sources of research.

• What contact, if any, do you have with the management of companies in which you invest?

• Briefly describe the sell disciplines employed by you and your firm.

• Describe whether/how you use top-down or bottom-up approaches to investment selection.

• Are you value or growth orientated; hedged or not; domestic or international?

Track record

• Please supply performance data by 5, 10 and 15-year intervals.

• Please supply performance records compared to benchmarks you feel appropriate.

• If balanced management, please provide performance data by asset class.

• Provide MPT or APT statistics such as beta, alpha, standard deviations, etc.

• What are your cash holdings; fully invested or selectively invested at various times?

• Turnover history and number of securities, industries and sectors; are guidelines in place?

• Typical portfolio percentage of largest ten positions.

Firm/advisor background

Please provide us with information regarding your background, including general information about the organization. In particular, please cover:

• The stability of ownership, managers, analysts or others directly involved in management.

• Who makes the investment decisions and how the firm dictates policy to managers?

• A description of expenses, including management fees, commissions, and other expenses.

• A detailed description of the growth of money under management over the past ten years.

• Please discuss the flexibility in design and management of a client’s portfolio by managers.

• If your firm is multidisciplined, what are your areas of expertise?

• Who is the custodian of securities? Does the firm have insurance?

Manager background

Please provide the resume(s) of the manager(s) as well as information about the manager’s style and consistency. Additional items of interest include:

• The manager’s record with other firms, if employed less than ten years.

• How the manager does research, including use of analysts and outside research?

• Regarding the decision process, what steps does the manager actually take?

• Manager’s ownership status in the firm?

• History of asset growth under the specific manager.

• Examples of past successes and failures on investment decisions.

Statistics

Please provide the following statistical information:

• Price/earnings ratios compared to market

• Price/book ratios compared to market

• Average earnings growth data

• Average market cap of companies in portfolio

• Average dividend yield information

• Average maturity and/or duration of fixed-income portfolios (and how this is managed)

• Average credit rating of fixed-income portfolios

• Where short-term funds are invested

Communication

• How often do you provide portfolio and performance reports?

• How do you compare performance to the market? What benchmarks do you use?

• Who will meet with us (and how often)?

• Who is the primary and secondary contact?

• Does the firm provide investment newsletters or promotional literature, with sample?

• Is the portfolio manager(s) available to meet or discuss issues with the client or advisor?

Compliance

• Are you a fiduciary? Will you sign-off as same?

• Are you a stoke-broker or registered representative?

• What securities licenses do you hold?

• Are you independent?

• Who is your broker-dealer?

• Who is your custodian and clearinghouse?

• Are you a RIA or RIA representative?

• May we please see you ADV Parts I, II, III

• May we review a sample investment policy statement?

• May we see your CRD report?

• Must we sign an arbitration clause?

• What educational degrees have earned?

• What financial/securities designation do you hold?

• What peer-reviewed or non-peered reviewed material have you published, and where?

• What medical specificity do you possess?

• Do you hold the AIF® and/or AIFA® designations, and adhere to its code-of-ethics?

• Are you a [CMP] Certified Medical Planner™?

• Are you a [CFP] Certified Financial Planner™ with health economics knowledge?

• How do/can you demonstrate you specific knowledge on the heath care space?

Thank you.

Dr. Michael B. Sample; MD/DO

Managing Partner – Medical Associates of Nevada, PC

Assessment

Some financial advisors, insurance agents, portfolio and wealth managers speak of “prospecting”, “hunting” or “screening” clients. In fact, potential doctor-clients are often, not-so-charmingly called, “prospects”.

Don’t you think it’s about time that the “tables-are-turned” by informed medical professionals, as the “hunted-becomes-the-hunter”, by the informed physician? Triage well, and always remember; caveat emptor and vendor emptor!

What other criteria should be included in this engagement letter, or personal interview itself? What has been your experience with portfolio manager selection? How do you select same, and what has been your success rate? Why don’t you do-it-yourself? Please comment and opine.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: Financial Planning, Investing, Op-Editorials, Portfolio Management, Retirement and Benefits, Uncategorized | 1 Comment »

By Dr. David E. Marcinko MBA

By Dr. David E. Marcinko MBA