A SPECIAL ME-P REPORT

###

Asset Protection Planning for Qualified and Non-Qualified Retirement Plans, IRAs, 403(b)s, Education IRAs (Coverdell ESAs), 529 Plans, UTMA Accounts, Health/Medical Savings Accounts (MSA/HSAs), Qualified and Non-Qualified Annuities, Long-Term Care Insurance, Disability Insurance and Group, Individual and Business Life Insurance [Ohio Focus]

By Edwin P. Morrow III; JD LLM MBA CFP® RFC®

By Edwin P. Morrow III; JD LLM MBA CFP® RFC®

[©2007-12-14. All rights reserved. USA]

EDITOR’S NOTE:

Hi Ann,

A couple years ago you posted an earlier version of the attached Asset Protection Outline. I updated it to include quite a bit more discussion of different protection levels for various kinds of accounts, and included more discussion of states other than Ohio, including a 50 state chart with IRA/403b protections.

So please delete the old one and replace with this one which contains more topics, including some substantial discussion of issues regarding current class action litigation jeopardizing asset protection for Schwab and Merrill Lynch IRAs.

Regards

Ed

###

The Importance of Asset Protection as Part of Financial and Estate Planning for Doctor’s and Medical Professionals

Asset Protection has become a ubiquitous buzz-word in the legal and financial community. It often means different things to different people. It may encompass anything from buying umbrella liability insurance to funding offshore trusts.

What is most likely to wipe out a client’s entire net worth? An investment scam, investment losses, a lawsuit, divorce or long-term health care expenses? “Asset Protection” may be construed to address all of these scenarios, but this outline will cover risk from non-spousal creditors as opposed to risk from bad investments, divorce, medical bills or excessive spending. Prudent business practice and limited liability entity use (LP, LLP, LLC, Corporation, etc) is the first line of defense against such risks. Similarly, good liability insurance and umbrella insurance coverage is paramount.

However, there is a palpable fear among many of frivolous lawsuits and rogue juries [especially among physicians and medical professionals]. Damages may exceed coverage limits. Moreover, insurance policies often have large gaps in coverage (e.g. intentional torts, “gross” negligence, asbestos or mold claims, sexual harassment).

As many doctors in Ohio know all too well, malpractice insurance companies can fail, too. Just as we advise clients regarding legal ways to legitimately avoid income and estate taxes or qualify for benefits, so we advise how to protect family assets from creditors. Ask your clients, “What level of asset protection do you want for yourself?

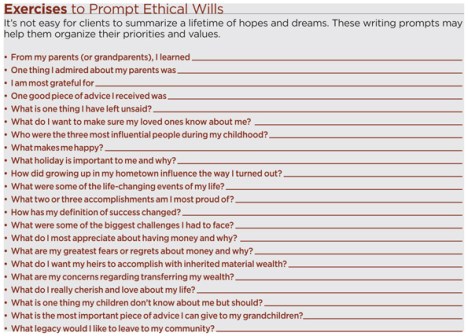

For the inheritance you leave to your family?” Do any clients answer “none” or “low”? Trusts that are mere beneficiary designation form or POD/TOD substitutes are going out of style in favor of “beneficiary-controlled trusts”, “inheritance trusts” and the like.

Table of Contents

While effort is made to ensure the material is accurate, this material is not intended as legal advice and no one may rely on it as such. Sections II(d), II(i), V, VI and XI were updated Feb 2012, but much of the material and citations have not been verified since 2010. Permission to reprint and share with fellow bar members is granted, but please contact author for updates if more than a year old.

T.O.C. [Page Number]

I. Importance of Asset Protection 2

II. State and Federal Protections Outside ERISA or Bankruptcy 4

a. Non-ERISA Qualified Plans: SEP, SIMPLE IRAs 5

b. Traditional and Roth IRAs, “Deemed IRAs” 7

c. Life Insurance 9

d. Long-Term Care, Accident/Disability Insurance 13

e. Non-Qualified Annuities 13

f. Education IRAs (now Coverdell ESAs) 16

g. 529 Plans 17

h. Miscellaneous State and Federal Benefits 18

i. HSAs, MSAs, FSAs, HRAs 18

III. Federal ERISA Protection Outside Bankruptcy 20

IV. Federal Bankruptcy Scheme of Creditor Protection 26

V. Non-Qualified Deferred Comp – Defying Easy Categorization 30

VI. Breaking the Plan – How Owners Can Lose Protection 32

(incl Prohibited Transactions and Schwab/Merrill Lynch IRA problems) 35

VII. Post-Mortem – Protections for a Decedent’s Estate 51

VIII. Post-Mortem – State Law Protections for Beneficiaries 52

IX. Post-Mortem – Bankruptcy Protections for Beneficiaries 54

X. Dangers and Advantages of Inheriting Through Trusts 56

XI. Piercing UTMA/UGMA and Other Third Party Created Trusts 59

XII. Exceptions for Spouses, Ex-Spouses and Dependents 61

XIII. Exceptions when the Federal Government (IRS) is Creditor 62

XIV. Fraudulent Transfer (UFTA) and Other Exceptions 68

XV. Disclaimer Issues – Why Ohio is Unique 69

XVI. Medicaid/Government Benefit Issues 71

XVII. Liability for Advisors 72

XVIII. Conflicts of Law – Multistate Issues 73

XIX. Conclusions 75

Appendices

A. Ohio exemptions – R.C. §2329.66 (excerpt), §3911.10, §3923.19 78

B. Bankruptcy exemptions – 11 U.S.C. § 522 excerpts 80

C. Florida IRA exemption – Fla Stat. § 222.21 (note-may be outdated) 85

D. Sal LaMendola’s Inherited IRA Win/Loss Case Chart 86

E. Multistate Statutory Debtor Exemption Chart 88

###

Assessment

This outline will discuss the sometimes substantial difference in legal treatment and protection for various investment vehicles and retirement accounts, with some further discussion of important issues to consider when trusts receive such assets.

Beware of general observations like: “retirement plans, insurance, IRAs and annuities are protected assets” – that may often be true, but Murphy’s law will make your client the exception to the general rules. The better part of this outline is pointing out those exceptions.

2012 WHITE PAPER LINK:

Creditor Protection for IRAs Annuities Insurance Nov 19 2010 WC CLE Feb 2012 update

***

2014 WHITE PAPER LINK UPDATE:

Optimal Basis Increase Trust Aug 2014

***

ABOUT THE AUTHOR:

Mr. Edwin P. Morrow III, a friend of the Medical Executive-Post, is a Wealth Specialist and Manager, Wealth Strategies Communications Ohio State Bar Association Certified Specialist, Estate Planning, Probate and Trust Law Key Private Bank Wealth Advisory Services. 10 W. Second St., 27th Floor Dayton, OH 45402. He is an ME-P “thought leader”.

Constructive criticism or other comments welcome.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: Estate Planning, Experts Invited, Financial Planning, Health Insurance, Insurance Matters, Portfolio Management, Risk Management | Tagged: 403(b) plans, 529 plans, Annuities and Insurance, anuities, asset protection, Creditor Protection Working White-Paper for IRAs, disability insurance, Education IRAs, Edwin P. Morrow III JD, Estate Planning, Financial Planning, HSA, insurance planning, IRAs, LTCI, MSA, Non-Qualified Retirement Plans, Qualified Retirement Plans, Risk Management, UTMA, Wealth Specialist | 5 Comments »