Financial Experts Share Tips on Obtaining Loans to Start or Expand a Medical Practice

By Michael Gibbons

Editor: ADVANCE Newsmagazines

Maybe you’re a young dermatologist or plastic surgeon who dreams of starting your own practice. Or maybe you’re an established professional but want to expand your palette of anti-aging services. Either way, you’ve probably made an unpleasant discovery: Banks are leery about lending today. Global recessions with seemingly no end in sight tend to give loan officers sticky fingers.

Dermatologists and Plastic Surgeons

We have it on good authority that dermatologists and plastic surgeons as a group are less affected by this problem than physicians in some other branches of medicine. Still, there’s no better time than now to absorb some sound advice on how to approach banks for loans—whether you’re a fresh-faced newcomer to the fresh-face business or a wrinkled veteran at eliminating wrinkles.

Start Small

There’s no soft-soaping it: Starting a healthy aging practice is much harder than expanding an existing practice, even in the flushest of times.

“For young dermatologists starting out, I recommend you start small,” advises Jerome Potozkin, MD, who offers facial rejuvenation, liposuction, body contouring and dermatological care through his practice in Walnut Creek, CA. “You can always expand. Keep your overhead low. Know what your credit score is and do everything you can to improve it. Pay your bills on time.”

Lasers aren’t cheap. Besides the initial acquisition costs, a service contract can cost $7,000 to $12,000 a year, according to Dr. Potozkin. “Don’t feel you have to buy every new laser under the sun,” he says. “In fact, renting rather than purchasing is an option many companies offer. When your volume is low you can rent and schedule laser days—although the pitfall there is you don’t have lasers available whenever patients come in.”

Also, young dermatologists “will probably have an easier time getting a loan if they go to a relatively underserved area, as opposed to an area that has a large number of dermatologists per capita,” says Dr. Potozkin, who began practicing 10 years ago. “There are two schools of thought on this: Go where you want to live to start a practice or go to where there’s a need and be instantly successful. I chose the former. It took me longer to get started but I’m very happy where I am.”

Patience, Prudence and Passion

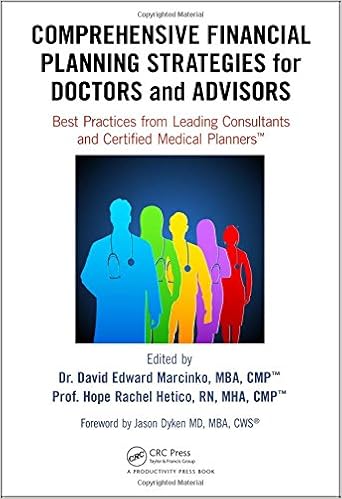

Be patient, prudent, passionate—and start with a spare office and as little debt as possible, advises Dr. David E. Marcinko MBA, a financial advisor and Certified Medical Planner™. Marcinko, a health economist, is CEO of the Institute of Medical Business Advisors Inc., a national physician and medical practice consulting firm based in Norcross, GA www.MedicalBusinessAdvisors.com

“Patients are looking for passion from you, not lavish trappings,” Dr. Marcinko says. “When a banker or a loan officer sees $175,000 or more of debt they are loath to give a loan—and it’s hard to blame them. Purchase a home after you become a private practitioner. You need to be as close to debt-free as you can be.

Exit Strategy

“Another thing bankers want to know is, ‘If we give you a loan and you start a practice and it fails, how will we be paid back?’ They want an exit strategy.”

The good news is dermatology “remains a very lucrative specialty, and in most parts of the country they are in a shortage position, particularly with the aging population,” says Sandra McGraw, JD, MBA, principal and CEO of the Health Care Group, a financial and legal consulting firm based in Plymouth Meeting, PA., that advises the American Academy of Dermatology, among other groups.

“I would start with a realistic business plan for why you think this practice can succeed, in the specific location,” McGraw says. “How many patients do you expect to see? How will they know you are there and available? Remember that banks lend to all kinds of people, so keep your numbers realistic. Overestimating expenses is as bad as underestimating them. Then determine how you want the money—usually a fixed loan for a period of time and then a line of credit as you get your practice going and sometimes need the cash flow.”

Expanding a Practice

Established dermatologists should have an easier time getting loans to expand their practices. They have, one hopes, a track record of success and assets to put up as collateral.

Mid-career physicians “have cash flow, physician assets and equity to some degree in a house and personal assets,” Dr. Marcinko observes. “Banks can attach loans to personal assets and savings accounts. Ninety-nine percent of times you must sign a personal asset guarantee. Mid-lifers have assets young ones don’t, so mid-lifers aren’t quite the risk. They have businesses that have value and cash flow. Banks like cash flow.”

However, even veterans must do some homework before approaching a bank. “You still want to establish why you want the money and how the expansion will increase your income,” McGraw says.

Another tip: If the bank has loans out with reputable vendors, you might ask the loan officer to recommend them to you as potential contractors. “Sometimes keeping it local and supporting others with loans at the bank can be helpful,” she says.

Assessment

Dr. Marcinko adds, “Bankers today want you to come in with a well-reasoned, well-thought-out and well-written business plan. Give bankers a 30-second elevator speech on why you are different. It’s really important to ask yourself, ‘What can I offer the community as a doctor in my specialty that nobody else can?’ If you bill yourself as the first dermatologist to do laser surgery, that’s a perceived advantage. You purchased the equipment and learned to use it. But anyone can do that. If you can come up with something that nobody else has or can do, that’s how you’re successful in anything.”

Link: Dr. Marcinko Interview

Link: https://medicalexecutivepost.com/wp-content/uploads/2009/08/dr-marcinko-interview.pdf

Conclusion

And so, your thoughts and comments on this Medical Executive-Post are appreciated. Tell us what you think. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, be sure to subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

Sponsors Welcomed

And, credible sponsors and like-minded advertisers are always welcomed.

Link: https://healthcarefinancials.wordpress.com/2007/11/11/advertise

Filed under: "Doctors Only", Book Reviews, Career Development, CMP Program, Experts Invited, iMBA, Inc., Interviews, Managed Care, Practice Management, Practice Worth, Recommended Books, Research & Development | Tagged: ADVANCE Newsmagazines, bankers, business plan, certified medical planner, CMP, credit, credit crunch, david marcinko, dermatologists, Health Care Group, Jerome Potozkin, loans, MD, Michael Gibbons, plastic surgeons, Sandra McGraw, www.certifiedmedicalplanner.com, www.medicalbusinessadvisors.com | 2 Comments »

:max_bytes(150000):strip_icc():format(webp)/the-50-30-20-rule-of-thumb-453922-final-5b61ec23c9e77c007be919e1-5ecfc51b09864e289b0ee3fa0d52422f.png)