Do You Have “What it Takes”?

By Professor David E. Marcinko MBBS DPM MBA MEd CMP®

Institute of Medical Business Advisors, Inc.

www.CertifiedMedicalPlanner.org

My History

More than 20 years ago I crafted a comprehensive holistic financial plan for a young doctor colleague who was born in 1959. In fact, he was not even a medical student at the time; so “canned off-the-shelf plans”, computer generated software or generic spread sheets were not a viable creation option. It was all a granular, detailed, specific and cognitive work-product. Today, he is a board-certified internist.

So, in 2023, it is right and just to take a look back and see how well, or poorly, we’ve fared.

Now, I appreciate more than most how financial planning is a “process”; and not an isolated event. Yet, all sorts of “advisors” and “consultants” create and charge hefty fees for same, and on-going monitoring, every day.

The ME-P Challenge

Nevertheless, I challenge all you mid-career or senior financial planners /advisors to this competition; regardless of degree, certification or designation.

“Show me your financial plan” – AND – “I’ll show you my financial plan”

Here Comes the Judge

Then, our community of ME-P readers, subscribers, visitors and “judges” will decide the winner.

The contest is open to any financial advisor, planner, consultant, wealth manager, CFP®, CFA, insurance agent, CPA or CLU, ChFC, or stock-broker, etc., who is not afraid of transparency in his or her work product and purported expertise.

*** [Creating and Evaluating a physician focused financial plan]

[Creating and Evaluating a physician focused financial plan]

***

Assessment

So, just send in a copy of any “blinded” physician-focused financial plan that is about 21 years old. We will post for all to see and review …. warts and all … including my own; three part mega-plan!

The winner will receive bragging rights, academic swagger, and expert promotion to our entire ME-P ecosystem and network of medical, business, law and graduate school communities; as well as physicians, nurses, healthcare executives and allied health care professionals.

An informed sought-after and lucrative sector – indeed!

IOW: Free publicity and positive “new-wave” PR – PRICELESS!

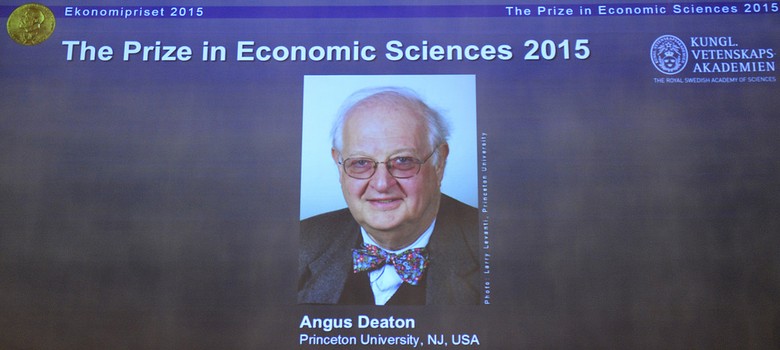

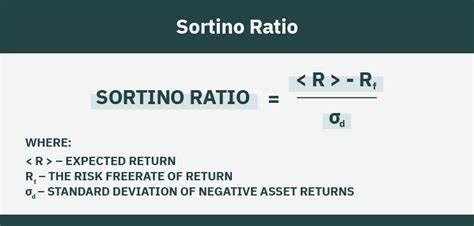

Of course, as an educator and professor of health economics and finance, we are pleased to present you with the deep medical business knowledge and detailed financial,managerial and accounting techniques used, with some real-life “tips and pearls” developed over the last two decades of R&D, right here:

MORE: Comprehensive Financial Planning Strategies for Doctors …[Best Practices from Leading Consultants and Certified Medical Planners™]

MORE: Risk Management Liability Insurance, and Asset Protection Strategies for Doctors and Advisors [Best Practices from Leading Consultants and Certified Medical Planners™]

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

***

8

8

***

PART 1: My Sample Financial Plan I [Data gathering, goals and objectives]

PART 2: My Sample Financial Plan II [Data Analytics, Creation and Crafting]

PART 3: Request here: MarcinkoAdvisors@msn.com [Stress Testing and Completion]

***

Filed under: "Advisors Only", "Ask-an-Advisor", "Doctors Only", CMP Program, Experts Invited, Financial Planning, Funding Basics, Glossary Terms, Health Economics, iMBA, Inc., Insurance Matters, Investing, Touring with Marcinko | Tagged: CMP, financial plan, financial plan challenge, Financial Planning, Marcinko | Leave a comment »