By Staff Reporters

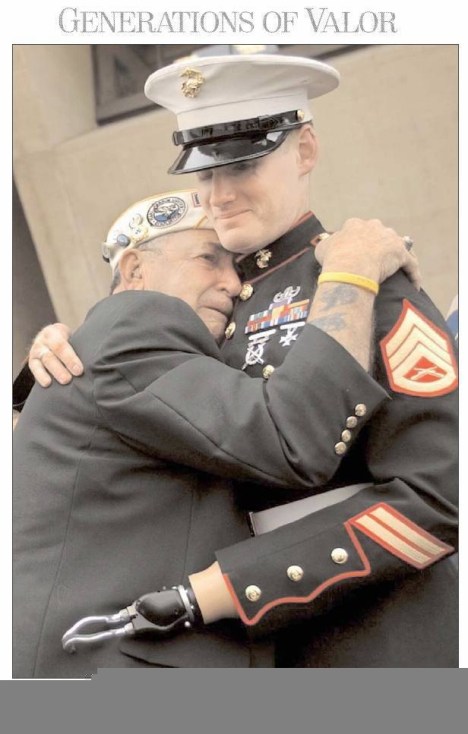

Today is Veterans Day, when Americans honor all who have served our country in the armed forces. It’s celebrated on November 11th each year because on that morning in 1918 (at the 11th hour of the 11th day of the 11th month), the Allied nations and Germany signed an armistice that ended the fighting in World War I.

***

SPONSOR: MarcinkoAssociates.com

***

Moody’s credit rating agency downgraded its outlook on the US government from ‘stable’ to ‘negative’, citing the risks to the nation’s fiscal strength and the political polarization in Congress. The agency has maintained the US’s current top-grade AAA rating, but has raised the possibility that it may be cut in the future. While the move does not automatically mean it will downgrade America’s creditworthiness, it increases the chances. Even the prospect of a US downgrade could hurt Americans’ investment portfolios, make it even more expensive for them to borrow money, and make it more costly for the government to pay off its debts.

These effects would likely be even more painful if Moody’s does eventually downgrade the US debt. The nation’s diminished fiscal strength, undone by extreme partisanship in Washington, was a key driver of the action, according to a statement from Moody’s.

***

***

YET: Here is where the major benchmarks ended on Friday:

- The S&P 500 Index was up 67.89 points (1.6%) at 4,415.24, up 1.3% for the week; the Dow Jones Industrial Average was up 391.16 points (1.2%) at 34,283.10, up 0.7% for the week; the NASDAQ Composite was up 276.66 points (2.1%) at 13,798.11, up 2.4% for the week.

- The 10-year Treasury note yield was down about 1 basis point at 4.622%.

- CBOE’s Volatility Index (VIX) was down 0.11 at 14.20.

Nearly every market sector gained Friday, with semiconductors and other tech shares leading the pack. The Philadelphia Semiconductor Index (SOX) jumped more than 4% to its highest level in more than two months. Consumer discretionary and energy companies were also strong, the latter thanks to a nearly-2% gain in crude oil futures.

But small-caps continued to lag their bigger counterparts, with the Russell 2000 Index (RUT) rising 1.1% Friday, though it was still down 3.1% for the week.

CITE: https://www.r2library.com/Resource

***

***

COMMENTS APPRECIATED

Thank You

***

Filed under: Alternative Investments, Experts Invited, Financial Planning, Funding Basics, Glossary Terms, Investing, Touring with Marcinko | Tagged: banks, DJIAm, energy, gold, inflation, Marcinko, markets, Moody's, NASDAQ, oil, Russell Index 2000, RUT, S&P 500, SOX, us credit, US Debt, Veterans Day, VIX | Leave a comment »