Third Edition of Classic Text Now Available

[Transformational Health 2.0 Skills for Savvy Doctors]

By Ann Miller RN MHA [Executive-Director]

For the first time anywhere, we offer our loyal ME-P readers and subscribers an exclusive first look at the new book: The “Business of Medical Practice” from the Institute of Medical Business Advisors Inc, in Atlanta, GA www.MedicalBusinessAdvisors.com

Synopsis

Now in its 3rd edition, the book explores a variety of issues and seeks to answer these questions:

- Does Health 2.0 enhance or detract from traditional medical care delivery, and can private practice business models survive?

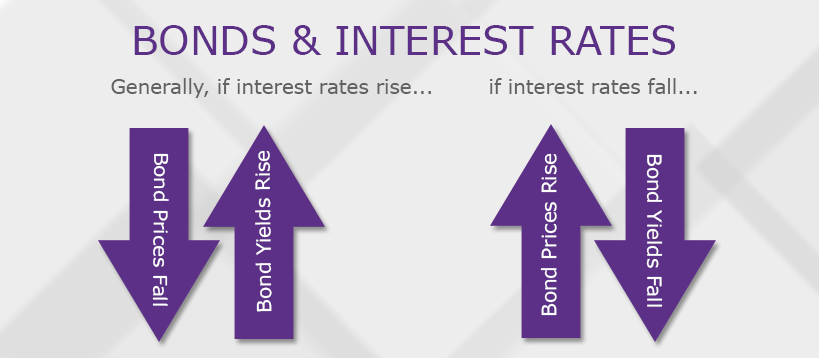

- How does transparent business information and reimbursement data impact the modern competitive healthcare scene?

- How are medical practices, clinics, and physicians evolving as a result of rapid health- and non-health-related technology change?

- Does transparent quality information affect the private practice ecosystem?

A Tool for all Stakeholders

Answering these questions and more, this newly updated and revised edition is an essential tool for doctors, nurses, and healthcare administrators; management and business consultants; accountants; and medical, dental, business, and healthcare administration graduate, doctoral students and virtually all stakeholders of the healthcare industrial complex.

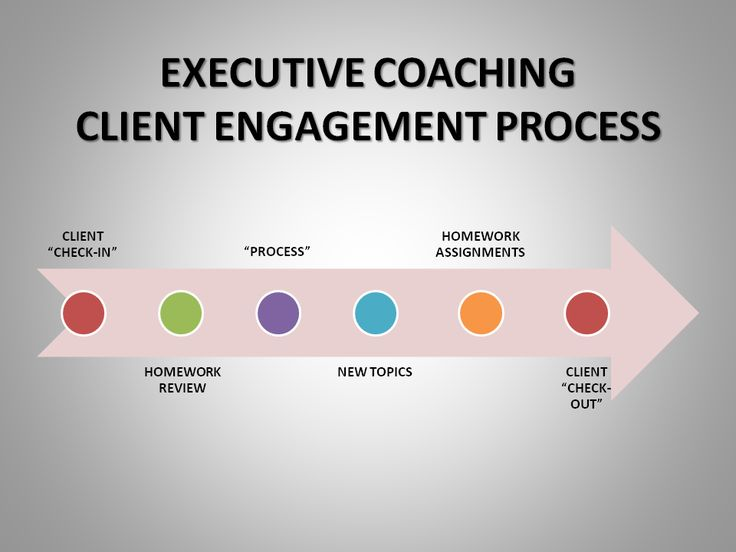

Management and Operational Strategies for Private Practice

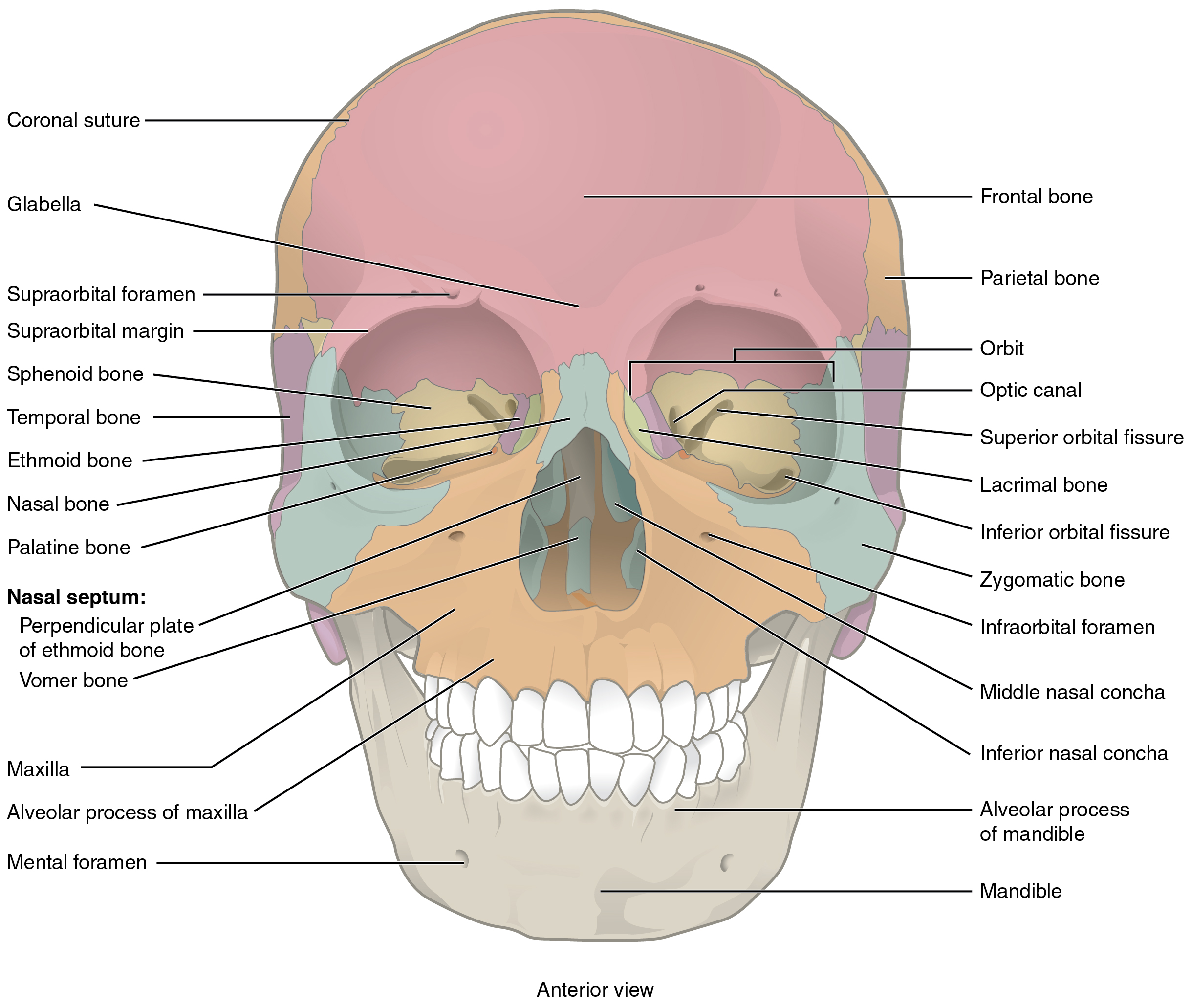

Written in plain language using nontechnical jargon, the text presents a progressive discussion of management and operation strategies. It incorporates prose, news reports, and regulatory and academic perspectives with Health 2.0 examples, and blog and internet links, as well as charts, tables, diagrams, and Web site references, resulting in an all-encompassing resource. It integrates various medical practice business disciplines-from finance and economics to marketing to the strategic management sciences-to improve patient outcomes and achieve best practices in the healthcare administration field. With contributions by a world-class team of expert authors, the third edition covers brand-new information, including:

- The impact of Web 2.0 technologies on the healthcare industry

- Internal office controls for preventing fraud and abuse

- Physician compensation with pay-for-performance trend analysis

- Healthcare marketing, advertising, CRM, and public relations

- eMRs, mobile IT systems, medical devices, and cloud computing

- and much more!

Front Matter: Front Matter BoMP – 3

Assessment

Please send any question/and or comments directly to us at: MarcinkoAdvisors@msn.com

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Book Reviews, Breaking News, Experts Invited, Health Economics, Information Technology, Managed Care, Practice Management, Practice Worth, Quality Initiatives, Recommended Books | Tagged: business appraisals, Business Medical Practice, Marcinko, medical clinics | 1 Comment »