This essay is going to be long.

I blame inflation, be it transitory or not, for inflating its length.

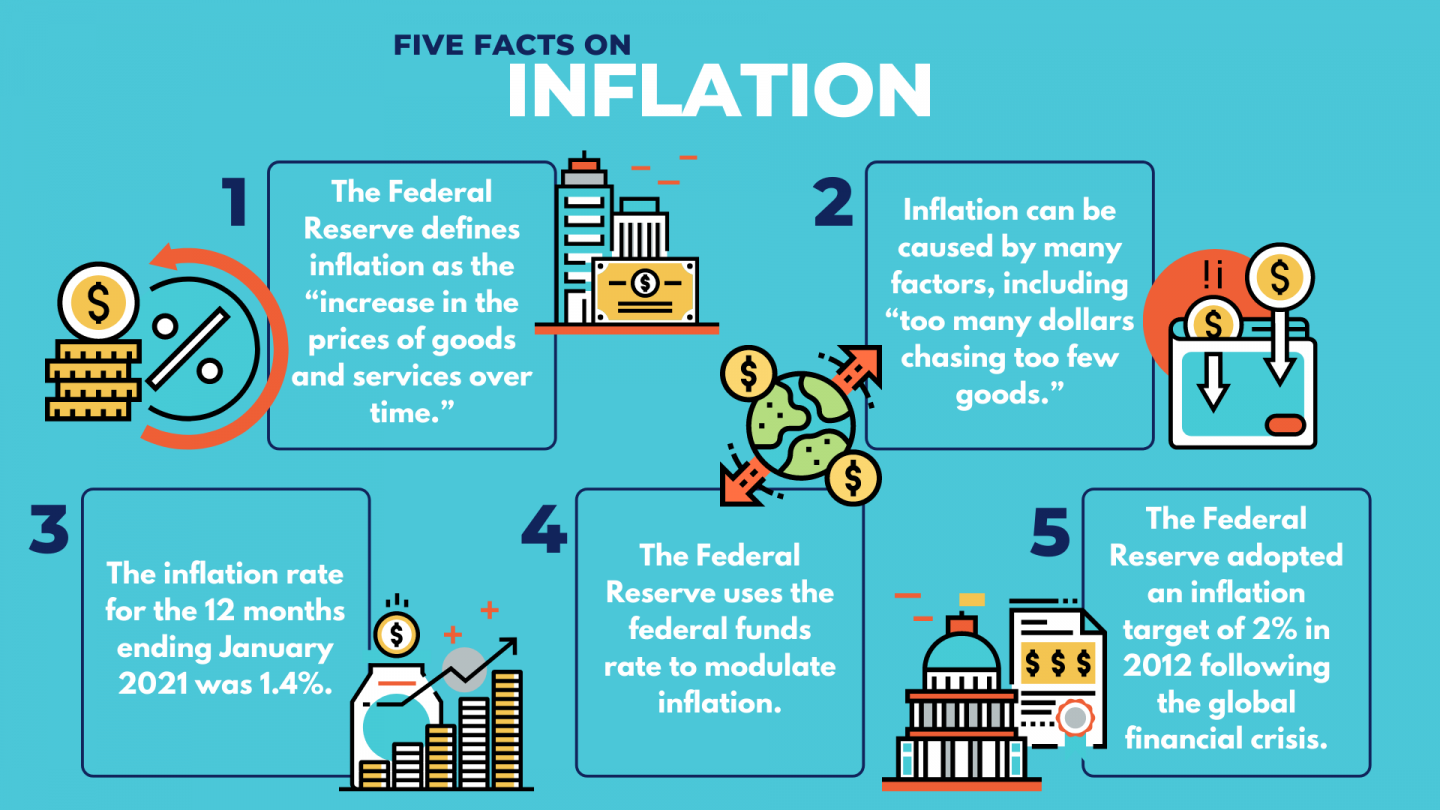

The number one question I am asked by clients, friends, readers, and random strangers is, are we going to have inflation?

I think about inflation on three timelines: short, medium, and long-term.

The pandemic disrupted a well-tuned but perhaps overly optimized global economy and time-shifted the production and consumption of various goods. For instance, in the early days of the pandemic automakers cut their orders for semiconductors. As orders for new cars have come rolling back, it is taking time for semiconductor manufacturers, who, like the rest of the economy, run with little slack and inventory, to produce enough chips to keep up with demand. A $20 device the size of a quarter that goes into a $40,000 car may have caused a significant decline in the production of cars and thus higher prices for new and used cars. (Or, as I explained to my mother-in-law, all the microchips that used to go into cars went into a new COVID vaccine, so now Bill Gates can track our whereabouts.)

Here is another example. The increase in new home construction and spike in remodeling drove demand for lumber while social distancing at sawmills reduced lumber production – lumber prices spiked 300%. Costlier lumber added $36,000 to the construction cost of a house, and the median price of a new house in the US is now about $350,000.

The semiconductor shortage will get resolved by 2022, car production will come back to normal, and supply and demand in the car market will return to the pre-pandemic equilibrium. High prices in commodities are cured by high prices. High lumber prices will incentivize lumber mills to run triple shifts. Increased supply will meet demand, and lumber prices will settle at the pre-pandemic level in a relatively short period of time. That is the beauty of capitalism!

Most high prices caused by the time-shift in demand and supply fall into the short-term basket, but not all. It takes a considerable amount of time to increase production of industrial commodities that are deep in the ground – oil, for instance. Low oil prices preceding the pandemic were already coiling the spring under oil prices, and COVID coiled it further. It will take a few years and increased production for high oil prices to cure high oil prices. Oil prices may also stay high because of the weaker dollar, but we’ll come back to that.

Federal Reserve officials have told us repeatedly they are not worried about inflation; they believe it is transitory, for the reasons I described above. We are a bit less dismissive of inflation, and the two factors that worry us the most in the longer term are labor costs and interest rates.

Let’s start with labor costs

During a garden-variety recession, companies discover that their productive capacity exceeds demand. To reduce current and future output they lay off workers and cut capital spending on equipment and inventory. The social safety net (unemployment benefits) kicks in, but not enough to fully offset the loss of consumer income; thus demand for goods is further reduced, worsening the economic slowdown. Through millions of selfish transactions (microeconomics), the supply of goods and services readjusts to a new (lower) demand level. At some point this readjustment goes too far, demand outstrips supply, and the economy starts growing again.

This pandemic was not a garden-variety recession

The government manually turned the switch of the economy to the “off” position. Economic output collapsed. The government sent checks to anyone with a checking account, even to those who still had jobs, putting trillions of dollars into consumer pockets. Though output of the economy was reduced, demand was not. It mostly shifted between different sectors within the economy (home improvement was substituted for travel spending). Unlike in a garden-variety recession, despite the decline in economic activity (we produced fewer widgets), our consumption has remained virtually unchanged. Today we have too much money chasing too few goods– that is what inflation is. This will get resolved, too, as our economic activity comes back to normal.

But …

Today, though the CDC says it is safe to be inside or outside without masks, the government is still paying people not to work. Companies have plenty of jobs open, but they cannot fill them. Many people have to make a tough choice between watching TV while receiving a paycheck from big-hearted Uncle Sam and working. Zero judgement here on my part – if I was not in love with what I do and had to choose between stacking boxes in Amazon’s warehouse or watching Amazon Prime while collecting a paycheck from a kind uncle, I’d be watching Sopranos for the third time.

To entice people to put down the TV remote and get off the couch, employers are raising wages. For instance, Amazon has already increased minimum pay from $15 to $17 per hour. Bank of America announced that they’ll be raising the minimum wage in their branches from $20 to $25 over the next few years. The Biden administration may not need to waste political capital passing a Federal minimum wage increase; the distorted labor market did it for them.

These higher wages don’t just impact new employees, they help existing employees get a pay boost, too. Labor is by far the biggest expense item in the economy. This expense matters exponentially more from the perspective of the total economy than lumber prices do. We are going to start seeing higher labor costs gradually make their way into higher prices for the goods and services around us, from the cost of tomatoes in the grocery store to the cost of haircuts.

Only investors and economists look at higher wages as a bad thing. These increases will boost the (nominal) earnings of workers; however, higher prices of everything around us will negate (at least) some of the purchasing power.

Wages, unlike timber prices, rarely decline. It is hard to tell someone “I now value you less.” Employers usually just tell you they need less of your valuable time (they cut your hours) or they don’t need you at all (they lay you off and replace you with a machine or cheap overseas labor). It seems that we are likely going to see a one-time reset to higher wages across lower-paying jobs. However, once the government stops paying people not to work, the labor market should normalize; and inflation caused by labor disbalance should come back to normal, though increased higher wages will stick around.

There is another trend that may prove to be inflationary in the long-term: de-globalization. Even before the pandemic the US set plans to bring manufacturing of semiconductors, an industry deemed strategic to its national interests, to its shores. Taiwan Semiconductor and Samsung are going to be spending tens of billions of dollars on factories in Arizona.

The pandemic exposed the weaknesses inherent in just-in-time manufacturing but also in over reliance on the kindness of other countries to manufacture basic necessities such as masks or chemicals that are used to make pharmaceuticals. Companies will likely carry more inventory going forward, at least for a while. But more importantly more manufacturing will likely come back to the US. This will bring jobs and a lot of automation, but also higher wages and thus higher costs.

If globalization was deflationary, de-globalization is inflationary

We are not drawing straight-line conclusions, just yet. A lot of manufacturing may just move away from China to other low-cost countries that we consider friendlier to the US; India and Mexico come to mind.

And then we have the elephant in the economy – interest rates, the price of money. It’s the most important variable in determining asset prices in the short term and especially in the long term. The government intervention in the economy came at a significant cost, which we have not felt yet: a much bigger government debt pile. This pile will be there long after we have forgotten how to spell social distancing.

The US government’s debt increased by $5 trillion to $28 trillion in 2020 – more than a 20% increase in one year! At the same time the laws of economics went into hibernation: The more we borrow the less we pay for our debt, because ultra-low interest rates dropped our interest payments from $570 billion in 2019 to $520 billion in 2020.

That is what we’ve learned over the last decade and especially in 2020: The more we borrow the lower interest we pay. I should ask for my money back for all the economics classes I took in undergraduate and graduate school.

This broken link between higher borrowing and near-zero interest rates is very dangerous. It tells our government that how much you borrow doesn’t matter; you can spend (after you borrow) as much as your Republican or Democratic heart desires.

However, by looking superficially at the numbers I cited above we may learn the wrong lesson. If we dig a bit deeper, we learn a very different lesson: Foreigners don’t want our (not so) fine debt. It seems that foreign investors have wised up: They were not the incremental buyer of our new debt – most of the debt the US issued in 2020 was bought by Uncle Fed. Try explaining to your kids that our government issued debt and then bought it itself. Good luck.

Let me make this point clear: Neither the Federal Reserve, nor I, nor a well-spoken guest on your business TV knows where interest rates are going to be (the total global bond market is bigger even than the mighty Fed, and it may not be able to control over interest rates in the long run). But the impact of what higher interest rates will do the economy increases with every trillion we borrow. There is no end in sight for this borrowing and spending spree (by the time you read this, the administration will have announced another trillion in spending).

Let me provide you some context about our financial situation

The US gross domestic product (GDP) – the revenue of the economy – is about $22 trillion, and in 2019 our tax receipts were about $3.5 trillion. Historically, the-10 year Treasury has yielded about 2% more than inflation. Consumer prices (inflation) went up 4.2% in April. Today the 10-year Treasury pays 1.6%; thus the World Reserve Currency debt has a negative 2.6% real interest rate (1.6% – 4.2%).

These negative real (after inflation) interest rates are unlikely to persist while we are issuing trillions of dollars of debt. But let’s assume that half of the increase is temporary and that 2% inflation is here to stay. Let’s imagine the unimaginable. Our interest rate goes up to the historical norm to cover the loss of purchasing power caused by inflation. Thus it goes to 4% (2 percentage points above 2% “normal” inflation). In this scenario our federal interest payments will be over $1.2 trillion (I am using vaguely right math here). A third of our tax revenue will have to go to pay for interest expense. Something has to give. It is not going to be education or defense, which are about $230 billion and $730 billion, respectively. You don’t want to be known as a politician who cut education; this doesn’t play well in the opponent’s TV ads. The world is less safe today than at any time since the end of the Cold War, so our defense spending is not going down (this is why we own a lot of defense stocks).

The government that borrows in its own currency and owns a printing press will not default on its debt, at least not in the traditional sense. It defaults a little bit every year through inflation by printing more and more money. Unfortunately, the average maturity of our debt is about five years, so it would not take long for higher interest expense to show up in budget deficits.

Money printing will bring higher inflation and thus even higher interest rates

If things were not confusing enough, higher interest rates are also deflationary

We’ve observed significant inflation in asset prices over the last decade; however, until this pandemic we had seen nothing yet. Median home prices are up 17% in one year. The wild, speculative animal spirits reached a new high during the pandemic. Flush with cash (thanks to kind Uncle Sam), bored due to social distancing, and borrowing on the margin (margin debt is hitting a 20-year high), consumers rushed into the stock market, turning this respectable institution (okay, wishful thinking on my part) into a giant casino.

It is becoming more difficult to find undervalued assets. I am a value investor, and believe me, I’ve looked (we are finding some, but the pickings are spare). The stock market is very expensive. Its expensiveness is setting 100-year records. Except, bonds are even more expensive than stocks – they have negative real (after inflation) yields.

But stocks, bonds, and homes were not enough – too slow, too little octane for restless investors and speculators. Enter cryptocurrencies (note: plural). Cryptocurrencies make Pets.com of the 1999 era look like a conservative investment (at least it had a cute sock commercial). There are hundreds if not thousands of crypto “currencies,” with dozens created every week. (I use the word currency loosely here. Just because someone gives bits and bytes a name, and you can buy these bits and bytes, doesn’t automatically make what you’re buying a currency.)

“The definition of a bubble is when people are making money all out of proportion to their intelligence or work ethic.”

By Mike Burry MD

[The Big Short]

I keep reading articles about millennials borrowing money from their relatives and pouring their life savings into cryptocurrencies with weird names, and then suddenly turning into millionaires after a celebrity CEO tweets about the thing he bought. Much ink is spilled to celebrate these gamblers, praising them for their ingenious insight, thus creating ever more FOMO (fear of missing out) and spreading the bad behavior.

Unfortunately, at some point they will be writing about destitute millennials who lost all of their and their friends’ life savings, but this is down the road. Part of me wants to call this a crypto craziness a bubble, but then I think, Why that’s disrespectful to the word bubble, because something has to be worth something to be overpriced. At least tulips were worth something and had a social utility. (I’ll come back to this topic later in the letter).

But ….

When interest rates are zero or negative, stocks of sci-fi-novel companies that are going to colonize and build five-star hotels on Mars are priced as if El Al (the Israeli airline) has regular flights to the Red Planet every day of the week except on Friday (it doesn’t fly on Shabbos). Rising interest rates are good defusers of mass delusions and rich imaginations.

In the real economy, higher interest rates will reduce the affordability of financed assets. They will increase the cost of capital for businesses, which will be making fewer capital investments. No more 2% car loans or 3% business loans. Most importantly, higher rates will impact the housing market.

Up to this point, declining interest rates increased the affordability of housing, though in a perverse way: The same house with white picket fences (and a dog) is selling for 17% more in 2021 than a year before, but due to lower interest rates the mortgage payments have remained the same. Consumers are paying more for the same asset, but interest rates have made it affordable.

At higher interest rates housing prices will not be making new highs but revisiting past lows. Declining housing prices reduce consumers’ willingness to improve their depreciating dwellings (fewer trips to Home Depot). Many homeowners will be upside down in their homes, mortgage defaults will go up… well, we’ve seen this movie before in the not-so-distant past. Higher interest rates will expose a lot of weaknesses that have been built up in the economy. We’ll be finding fault lines in unexpected places – low interest has covered up a lot of financial sins.

And then there is the US dollar, the world’s reserve currency. Power corrupts, but the unchallenged and unconstrained the power of being the world’s reserve currency corrupts absolutely. It seems that our multitrillion-dollar budget deficits will not suddenly stop in 2021. With every trillion dollars we borrow, we chip away at our reserve currency status (I’ve written about this topic in great detail, and things have only gotten worse since). And as I mentioned above, we’ve already seen signs that foreigners are not willing to support our debt addiction.

A question comes to mind.

Am I yelling fire where there is not even any smoke?

Higher interest rates is anything but a consensus view today. Anyone who called for higher rates during the last 20 years is either in hiding or has lost his voice, or both. However, before you dismiss the possibility of higher rates as an unlikely plot for a sci-fi novel, think about this.

In the fifty years preceding 2008, housing prices never declined nationwide. This became an unquestioned assumption by the Federal Reserve and all financial players. Trillions of dollars of mortgage securities were priced as if “Housing shall never decline nationwide” was the Eleventh Commandment, delivered at Temple Sinai to Goldman Sachs. Or, if you were not a religious type, it was a mathematical axiom or an immutable law of physics. The Great Financial Crisis showed us that confusing the lack of recent observations of a phenomenon for an axiom may have grave consequences.

Today everyone (consumers, corporations, and especially governments) behaves as if interest rates can only decline, but what if… I know it’s unimaginable, but what if ballooning government debt leads to higher interest rates? And higher interest rates lead to even more runaway money printing and inflation?

This will bring a weaker dollar

A weaker US dollar will only increase inflation, as import prices for goods will go up in dollar terms. This will create an additional tailwind for commodity prices.

If your head isn’t spinning from reading this, I promise mine is from having written it.

To sum up: A lot of the inflation caused by supply chain disruption that we see today is temporary. But some of it, particularly in industrial commodities, will linger longer, for at least a few years. Wages will be inflationary in the short-term and will reset prices higher, but once the government stops paying people not to work, wage growth should slow down. Finally, in the long term a true inflationary risk comes from growing government borrowing and budget deficits, which will bring higher interest rates and a weaker dollar with them, which will only make inflation worse and will also deflate away a lot of assets.

–THE END–

UPDATE: https://www.msn.com/en-us/news/us/how-us-inflation-rate-is-impacting-americans-wallets-before-the-holiday-season/vi-AAROG5J

CURRENT: https://www.msn.com/en-us/money/markets/us-treasury-yields-tick-lower-on-fears-omicron-will-dent-recovery/ar-AARYSKy?li=BBnbfcL

Your thoughts are appreciated.

THANK YOU

*** |

in order to calculate income, with p representing the permanent component, and t representing the transitory component.

in order to calculate income, with p representing the permanent component, and t representing the transitory component.