On Valentine’s Day Diversification

By Rick Kahler MS CFP® ChFC CCIM

www.KahlerFinancial.com

The stock markets crashed yesterday after the new CPI report and update.

The stock markets crashed yesterday after the new CPI report and update.

Nevertheless, with displays of Valentine candy in every store, February is the perfect time to talk about chocolate. A creative financial planner might even steal Forrest Gump’s analogy and say, “Diversification is like a box of chocolates.”

Except that it isn’t.

True, a box of chocolates might have a lot of variety. Cream centers. Caramels. Nougats. Nuts. Dark chocolate. Milk chocolate. Truffles. Yet it’s all still chocolate.

Retirement Savings

Buying that box would be like investing your retirement savings in a variety of US stocks. Even if you had a dozen different companies, they would all be the same basic category of investment, or asset class.

For example, suppose you gave your true love a slightly more diversified Valentine gift made up of chocolates, Girl Scout cookies, baklava, and apple pie. That would compare to investing in different types of stocks like US, international, or emerging markets. But, everything would still be dessert.

Wiser Physician-Investors

You would be a wiser doctor-investor if you took your true love out for dinner and had a meat course, a salad, vegetables, bread, dessert, and wine. Now you’d start to see real diversification.

In addition to US, international, and emerging market stocks (all dessert), you might have some other asset classes like US and international bonds (meat), real estate (bread), cash (salad), commodities (veggies), and absolute return strategies (wine).

***

***

Long Term Growth Generator

This kind of asset class diversification is the best investment strategy for long-term growth. My preference is eight or nine different classes. For many clients, I recommend a mix of US and international stocks and bonds, real estate investment trusts, a commodities index fund, market neutral funds like merger arbitrage and managed futures, junk bonds, and Treasury Inflation Protected Securities (TIPS).

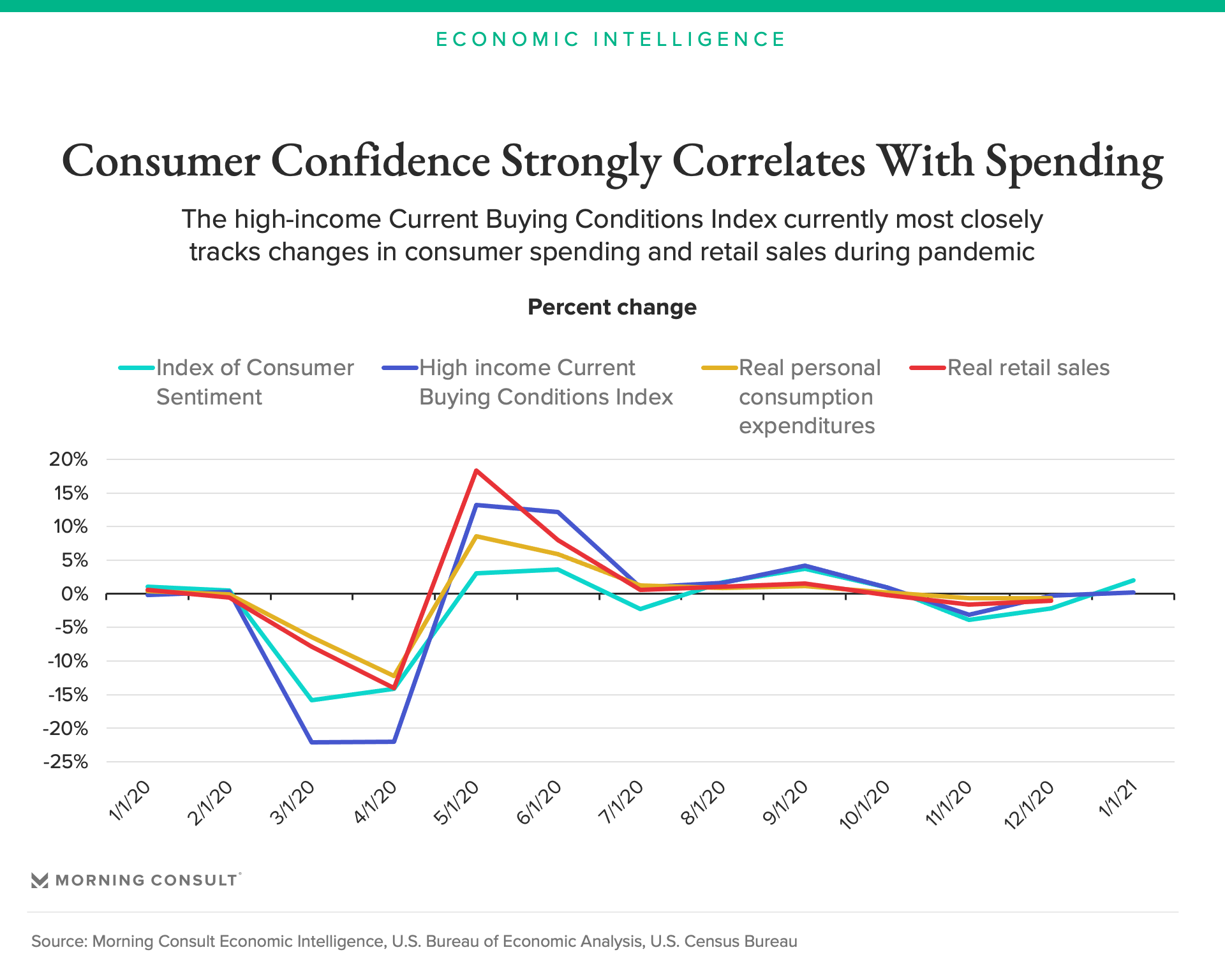

Market Fluctuations

Fluctuations in the market will tend to affect the various securities within a given asset class in the same way. Most US stocks, for example, would generally move up or down at the same times. So, owning shares of several different stocks wouldn’t protect you against changes in the market. When a portfolio is well-diversified, the volatility is reduced even during times when the markets are moving strongly up or down.

When I talk about investing in a variety of asset classes, I don’t mean owning stocks, real estate, gold, or other assets directly. For individual investors, mutual funds are a much better choice. Occasionally, someone will ask me, “But why should I have everything in mutual funds? That isn’t diversified, is it?”

Mutual Funds

Mutual funds are not an asset class. A mutual fund isn’t like a type of food; it’s like the plate you put the food on. A single plate might hold one food item or servings from several different food groups. More specifically, mutual funds are pools of money invested by managers. One fund might invest in real estate investment trusts (REITS). Another might have international stocks chosen for their high returns. Still others invest in a diversified mix of asset classes. The mutual fund is just the container that holds the investments.

[Courtesy GE Healthcare]

[Courtesy GE Healthcare]

Annuities

Annuities and IRAs aren’t asset classes, either, but are also examples of different types of containers that hold investments. If you use your IRA to purchase an annuity, all you’re doing is stacking one plate on top of another. It doesn’t give you another asset class, it just costs you more for the second plate.

Assessment

Having a box of chocolates for dinner might seem more appealing in the short term than eating a balanced meal. Investing in the “get-rich-now” flavor of the month might seem tempting, too. Yet in the long run, asset class diversification is the best way to make sure you have a healthy investment diet.

***

February 14th, 2024

***

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

***

* 8

* 8

Filed under: "Ask-an-Advisor", Experts Invited, Financial Advisor Listings, Financial Planning, Investing, Portfolio Management | Tagged: annuities, asset allocation, diversification, ETFs, heart, Mutual Funds, REITS, Rick Kahler CFP®, Valentine Day | 4 Comments »