Dr. David Edward Marcinko; MBA MEd CMP

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

An Examination of Its Causes and Consequences

The breakup of the Medical Act represents one of the most significant turning points in the evolution of modern healthcare governance. For decades, the Act served as a foundational framework that regulated medical practice, established professional standards, and defined the relationship between the state, medical institutions, and practitioners. Its dissolution did not occur suddenly; rather, it emerged from a complex interplay of political pressures, professional disputes, and shifting societal expectations. Understanding the breakup requires examining both the structural weaknesses within the Act itself and the broader forces that made its continuation untenable.

At its core, the Medical Act was designed to centralize authority over medical licensing and professional conduct. When it was first introduced, this centralization was seen as a necessary step toward ensuring uniform standards and protecting the public from unqualified practitioners. Over time, however, the rigidity of the Act became a source of tension. Medical knowledge expanded rapidly, new specialties emerged, and healthcare delivery became increasingly complex. Yet the Act remained anchored in assumptions that no longer reflected the realities of modern medicine. Many practitioners argued that the Act constrained innovation, limited professional autonomy, and failed to adapt to new models of care.

One of the major catalysts for the breakup was the growing dissatisfaction among medical professionals who felt that the Act imposed excessive bureaucratic oversight. Licensing procedures, disciplinary mechanisms, and continuing education requirements were often criticized as outdated or overly punitive. Younger practitioners, in particular, viewed the Act as an obstacle to entering the profession, citing long delays, inconsistent evaluation standards, and a lack of transparency. These frustrations fueled calls for reform, but attempts to revise the Act repeatedly stalled due to political disagreements and resistance from established institutions that benefited from the status quo.

Another factor contributing to the breakup was the increasing involvement of non‑physician healthcare providers in delivering essential services. Nurses, physician assistants, pharmacists, and other allied health professionals sought expanded scopes of practice to meet rising patient demand. However, the Medical Act was built around a physician‑centric model that did not easily accommodate these shifts. As collaborative care models became more common, the Act’s limitations became more apparent. Conflicts emerged over authority, responsibility, and professional boundaries, creating friction within the healthcare system. The inability of the Act to adapt to these new dynamics weakened its legitimacy and fueled arguments for its dissolution.

Public expectations also played a significant role. Patients became more informed, more vocal, and more demanding of accountability. They expected transparency in medical decision‑making, greater access to care, and more equitable treatment across communities. Yet the Medical Act was often criticized for protecting professional interests rather than prioritizing patient welfare. High‑profile cases involving malpractice, discrimination, or regulatory failures eroded public trust. Advocacy groups argued that the Act lacked sufficient mechanisms for patient representation and that its disciplinary processes were opaque and slow. As public pressure mounted, political leaders found it increasingly difficult to defend the existing framework.

***

***

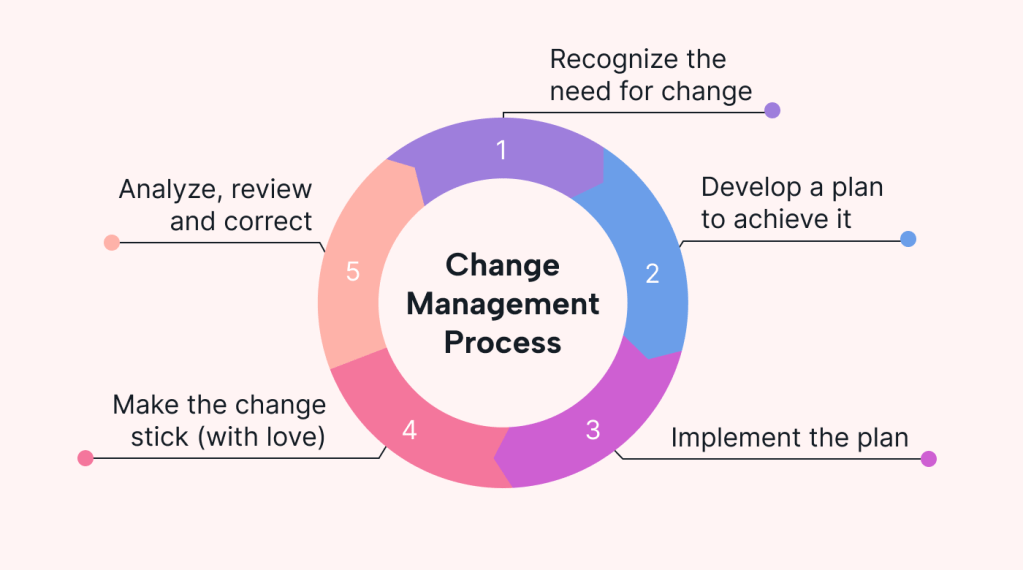

The breakup of the Medical Act was ultimately driven by a convergence of these pressures. When reform efforts repeatedly failed, stakeholders began to explore alternative regulatory models. Some advocated for decentralization, arguing that regional or specialty‑specific bodies could respond more effectively to local needs. Others pushed for a more integrated system that would regulate all healthcare professionals under a unified framework, promoting collaboration and reducing duplication. The eventual dissolution of the Act opened the door to these new possibilities, though not without controversy.

The consequences of the breakup have been far‑reaching. On one hand, it created opportunities for modernization. New regulatory structures have been more flexible, more responsive to emerging trends, and more inclusive of diverse healthcare professions. Licensing processes have been streamlined, interdisciplinary collaboration has improved, and patient advocacy has gained a stronger voice in governance. Many practitioners feel that the new system better reflects the realities of contemporary healthcare and supports innovation rather than hindering it.

On the other hand, the transition has not been without challenges. The breakup initially created uncertainty, as practitioners and institutions navigated shifting rules and responsibilities. Some critics argue that decentralization has led to inconsistencies in standards, making it harder to ensure uniform quality of care. Others worry that the new system may lack the strong oversight mechanisms that once protected the public. Balancing flexibility with accountability remains an ongoing struggle, and debates continue over how best to regulate a rapidly evolving healthcare landscape.

In many ways, the breakup of the Medical Act symbolizes a broader transformation in society’s understanding of healthcare. It reflects a shift away from rigid, hierarchical models toward more dynamic, collaborative, and patient‑centered approaches. While the dissolution of such a longstanding framework inevitably brought disruption, it also created space for innovation and reform. The legacy of the Medical Act lives on in the structures that replaced it, shaped by the lessons learned from its strengths and its shortcomings.

Ultimately, the breakup was not merely a legal or administrative event; it was a reflection of changing values, expectations, and realities. As healthcare continues to evolve, the story of the Medical Act serves as a reminder that regulatory systems must remain adaptable, transparent, and responsive to the needs of both practitioners and the public.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: Ask a Doctor, Ethics, Glossary Terms, Health Economics, Health Insurance, Health Law & Policy, Marcinko Associates | Tagged: AI, CMP, david marcinko, health, healthcare, medicine, Technology, The Breakup of the Medical Act | Leave a comment »