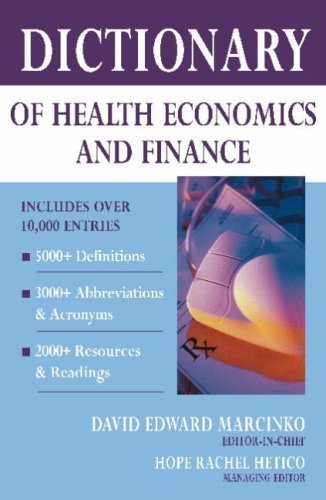

By Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.MarcinkoAssociates.com

***

***

The Firm Foundation Theory of investing is one of the most influential approaches to stock valuation. It rests on the belief that every financial asset possesses an intrinsic value that can be objectively determined through careful analysis of its fundamentals. This theory contrasts sharply with more speculative approaches, such as the “Castle-in-the-Air” theory, which emphasizes crowd psychology and market sentiment.

At its core, the Firm Foundation Theory was popularized by economist John Burr Williams in his 1938 book The Theory of Investment Value. Williams argued that the intrinsic value of a stock is equal to the present value of all future dividends the company is expected to pay. In other words, the worth of a stock is not determined by short-term price movements or investor enthusiasm, but by the long-term cash flows it generates. This principle has become a cornerstone of fundamental analysis, influencing investors such as Warren Buffett, who is often cited as a practitioner of this approach.

The theory assumes that while market prices may fluctuate due to speculation, fear, or irrational exuberance, they will eventually regress toward intrinsic value. This creates opportunities for disciplined investors: when a stock trades below its intrinsic value, it represents a buying opportunity; when it trades above, it may be time to sell. Thus, the Firm Foundation Theory provides a rational framework for identifying mispriced securities and making long-term investment decisions.

***

***

One of the strengths of this theory is its emphasis on objective analysis. By focusing on dividends, earnings, and growth potential, it encourages investors to ground their decisions in measurable financial data rather than emotional impulses. This approach aligns with the broader philosophy of value investing, which seeks to purchase securities at a discount to their true worth. It also offers a counterbalance to speculative bubbles, reminding investors that prices untethered from fundamentals are unsustainable in the long run.

However, the Firm Foundation Theory is not without challenges. Forecasting future dividends and earnings is inherently uncertain. Companies may change their payout policies, face unexpected competition, or encounter macroeconomic shocks that alter their growth trajectory. Additionally, the theory assumes that markets will eventually correct mispricings, but in reality, irrational exuberance or pessimism can persist for extended periods. Critics argue that this makes the theory more idealistic than practical in certain contexts.

Despite these limitations, the Firm Foundation Theory remains a vital tool in the investor’s toolkit. It underpins many valuation models used today, including discounted cash flow (DCF) analysis, which extends Williams’s dividend-based approach to include broader measures of cash generation. By insisting that stocks have a calculable intrinsic value, the theory provides a disciplined lens through which investors can evaluate opportunities and avoid being swayed by market noise.

In conclusion, the Firm Foundation Theory offers a rational, fundamentals-driven perspective on investing. While it requires careful forecasting and is vulnerable to uncertainty, its emphasis on intrinsic value continues to guide prudent investors. By reminding us that stocks are ultimately worth the cash they return to shareholders, the theory stands as a bulwark against speculation and a foundation for long-term wealth building.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Subscribe and Refer

***

***

Filed under: iMBA, Inc. | Tagged: bonds, CASH, david marcinko, dividends, finance, firm foundation theory, intrinsic value, Investing, investment, john burr williams, stock market, stocks | Leave a comment »