And … their Financial Advisors

[An Appendix Styled Special ME-P Report]

Anju D. Jessani, MBA, APM

Accredited Professional Mediator & Arbitrator

Divorce with Dignity

223 Bloomfield Street, Suite #104

Hoboken, New Jersey 07030

201-217-1090 (voice)

201-217-1220 (fax)

www.MedicalBusinessAdvisors.com

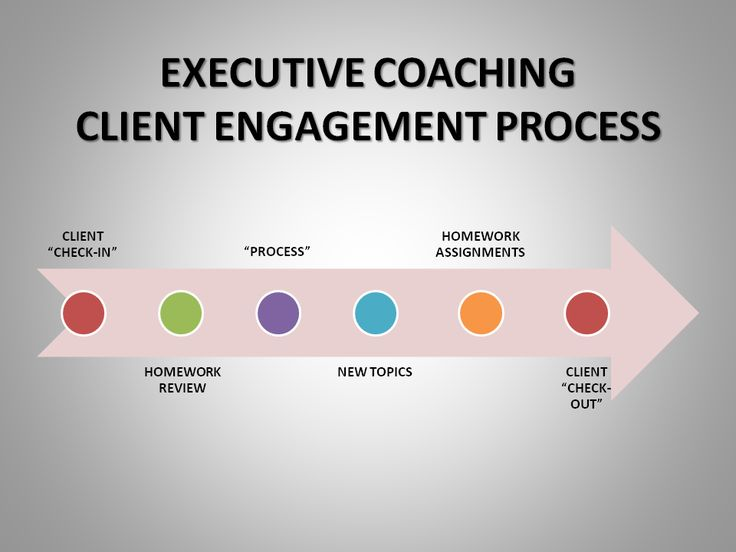

As opposed to therapy with is often open-ended, mediation should be approached in a structured manner so as to minimize mediation fees, maximize the productivity of sessions by keeping clients focused, and expedite a fair resolution before the conflict is allowed to escalate. The reality of divorce is that most clients have similar issues they need to address such as the house, the pension, and college education for the children. Nevertheless, the process should also be flexible to properly address the uniqueness of each clients’ situation such as different religious requirements, or the needs of a gifted child.

In this ME-P, I describe an approach to the divorce mediation process with the caveat that each mediator has their own style, hat there are many right approaches to this process, and the process can take more or less sessions and time than described below depending on the complexity of the issues, the availability of documentation and third-party appraisals, and preparedness of the parties, and the parties readiness to proceed. I have found that on average, I meet with client from three to eight 90 minute sessions over a two-three month time frame. However, I have had clients who literally take years to work through the issues, and also clients who have completed the mediation process over two weekends.

My objective is to provide information that demystifies what happens behind closed doors during the divorce mediation process. Although I have outlined an approach that assumes the couple has children, I use the same approach in a more contracted fashion, for couples without children.

The mediator helps the separating couple address the custody and parenting time issues, distribution of assets and liabilities, child and spousal support amounts, insurance, income tax and other decisions needed to restructure their family into two units.

The mediator’s role is to help the couple explore options and their consequences, and bring knowledge and experience that provides a context for decision-making. Mediation is guided by the concept of self-determination – decision-making authority in the mediation process rests with the parties. When necessary, the mediator will refer the couple to experts for services such as appraisals.

At the end of the mediation process, the mediator prepares a Memorandum of Understanding that summarizes the agreements reached. Although attorneys generally do not participate in the mediation sessions, the two spouses are advised to have their attorneys review the memorandum. They may also use the services of an attorney or attorneys to prepare their separation or divorce agreement, based on the decisions in the memorandum.

The success rate for divorce mediation, which I define as the parties coming to agreement, is higher than in other civil mediation cases. Additionally, the success rate for couples voluntarily seeking divorce mediation is significantly higher than for court-mandated mediation. From my experience, 90% of separating clients who voluntarily come to mediation, complete the process.

Scheduling The First Mediation Session

A client may phone or e-mail to either learn more about mediation or to make an appointment. In his book The Fundamentals of Family Mediation, John Haynes, the Founding President of the Academy of Family Mediators, states that “the mediator is presented with a classic dilemma: how to provide sufficient information so she can make can intelligent decision about the suitability of mediation while at the same time not developing a relationship with the client.”1

During this initial inquiry, the mediator will try and ascertain the following:

- How the prospect received their name.

- The names of the parties and their attorneys.

- Where the parties are in the divorce process with their attorneys.

- Whether there are any domestic violence issues that would preclude the couple form mediating.

- The length of the marriage and the ages of the children, if any.

The mediator will provide the following information during the conversation:

- Description of the mediation process and the role of the mediator.

- The role of mediator versus role of the attorney in the divorce process.

- Typical number of sessions, fee structure, and available times for the first session.

- Information on my background, training and experience.

Mediation Session #1

The first session serves as an introduction and overview of the mediation process. The agenda for the first session will usually encompass the following:

- Description of mediation, the mediator’s role, number of sessions and fees.

- Parties’ objectives for today and for the mediation process.

- Review the mediation agreement (not to be signed that day).

- Grounds for filing for divorce/separation, and a summary of the legal process of divorce.

- Issues that must be addressed today.

- Description of issues to be addressed in the mediation process.

- Develop list of documents for clients to bring in for the next session.

This session is usually highly emotionally charged. There may be great anxiety about the session, anger between the parties, and apprehension about the mediator and the mediation process. A number of things help to put the clients at ease during this session. Mediators may remind clients that the purpose of the first session is to provide them with information, and that they are under no pressure to make any decision until they are comfortable.

The most helpful information obtained during this session is each of the party’s objectives for the mediation. What mediators hear most frequently is that the parties don’t want to spend unnecessary money, don’t have the intestinal fortitude for a court battle, want to keep their conflict private, and want to remain friendly with each other for the sake of the children.

The mediation agreement includes the following:

- The parties have entered mediation voluntarily, and it is understood that they may discontinue the mediation process at any time.

- They have not waived the right to consult with and/or retain their own attorney.

- The mediation process is confidential with the exception of information regarding abuse, neglect, abandonment, or exploitation of a child.

- Neither the mediator nor his/her records shall be subject to subpoena.

- Good faith disclosure requires full disclosure of information and production of documents; if documents requested are not provided, the mediator reserves the right to terminate the mediation.

- If the services of other experts are required such as appraisers, the parties will retain neutral experts and will pay their fees directly to them.

- The hourly fee for the mediation and the payment schedule (usually pay-as-you go).

- That the Memorandum of Understanding (MOU) is not a legal document; their attorney(s) will include information from the MOU in the Property Settlement Agreement/Divorce Agreement.

- That the parties are urged to consult with attorneys prior to signing the Property Settlement Agreement/ Divorce Agreement.

The mediator may provide legal information, but should not provide legal advice. They may cover the grounds for filing for divorce for their state, who may file for divorce, any residence requirements, as well as a time-line of the legal process.

Towards the end of the first session, the mediator will provide a list of documents needed for the next session. If either party has a defined benefit pension plan, the mediator will provide forms so that they can request a valuation of the pensions. If there is a business or professional practice, the mediator will suggest that the parties need a business valuation by a neutral business appraiser, and may provide a list of professionals they recommend. Other documents that are usually requested include:

- The children’s school schedules with holidays.

- Pay stubs.

- Last year’s W-2 Forms for each party (summarizing annual earnings).

- Most recent federal tax return.

- Copies of all bank, brokerage, and 401(k)/403(b) statements.

- Most recent mortgage statement showing outstanding loan balances

- A summary of all insurance policies and coverage.

- A market assessment of real estate if property values are in dispute.

- A list of household items to be divided, if the parties cannot agree among themselves how to divide these items.

- A credit report for each party.

With the exception of business appraisals which can be very time consuming, it usually takes two or three weeks for clients to collect the other requested documentation and deal with getting a market assessment on the house. Therefore, scheduling the second session for three weeks later makes sense. The time lapse is also helpful in allowing client to process what happened in mediation and their emotional issues regarding their impending separation and divorce.

Mediation Session #2

The focus of this session is on developing the parenting plan and on data collection. The agenda for the second session will usually encompass the following:

- Sign the mediation agreement.

- Develop the parenting plan and address related issues.

- Meet with each party alone (caucus).

- Collect requested documentation.

- Provide budget worksheets for completion by the next session.

Many states require parents in divorce proceeding to file parenting plans, with the hope that the parties will be encouraged to fulfill their parenting responsibilities through their agreements rather than rely on judiciary intervention. The parenting plan typically encompasses non-financial parenting issues, including:

- The type of custody chosen and reasons for selecting it (usually either sole custody to one parent with parenting time to the other, joint legal custody with one parent having primary residential care, or joint physical custody).

- A specific schedule for parenting time for each party including weeknights, weekends, vacations, religious holidays, school vacations, birthdays, and special occasions, and including procedures for transferring the child.

- Access to various records including educational and medical records.

- Provisions or restrictions on domestic or international travel.

- The impact if there is a contemplated change of residence by a parent; and

- Participation in making decisions regarding the child included decisions about religious upbringing, health care and education.During this session, the mediator may meet with each party alone (caucus) for approximately ten minutes with the idea of providing equal time to each participant. Different mediators have different views on whether the caucus is confidential; they should share this information, so you can proceed accordingly. Most clients appreciate the time in caucus, as it allows them to share the emotional details of their personal situation without worrying about their spouse’s reactions.

- If the case appears appropriate for spousal support because of a large difference in the parties incomes, or if one party is a supported spouse, budgeting is a necessity. However, even for clients who have similar incomes, preparing a budget can help reduce the level of anxiety about separating. The mediator may provide budget work sheets for clients to complete outlining current and projected expenses. As time is needed to go through the documents provided by clients, for them to collect budget information, and for the return of the business appraisal, it is good to schedule the next session at least two weeks out.

- In some other states, child support is based on a number of factors including the number of overnights each parent has with the child/children. By first developing the parenting plan, the mediator has an essential building block to assist the clients in structuring their financial settlement.

Mediation Session #3

The focus of this session is on data analysis for child support and distribution of assets and liabilities. The agenda for the third session will usually encompass the following:

- Review child support based on child support guidelines.

- Discuss other financial issues related to the children.

- Review inventory of assets and liabilities.

- Decide how to divide assets and liabilities.

- Collect budgeting information.

By the third session, most clients feel comfortable with mediation process and the routine of going through the agenda. This session will be pivotal, and requires that clients be ready to make key financial decisions. However, because the clients have provided the necessary documentation that has allowed the mediator to conduct data analysis, they will now be in a position to make decisions based on information.

Each state has its own child support guidelines and formulas, and many of the courts will require proof that parties have been provided with information regarding what child support would be by the state’s child support guidelines. Therefore the mediator should be able to perform these calculations. Clients may choose to adjust the child support — that is also something the mediator should work through with clients. Additionally, if spousal support is also warranted, child support may be revised upward or downward depending on the amount of spousal support agreed to in Session Four.

There are frequent and recurring child expenses that must also addressed during this session including:

- Work-related childcare.

· Child’s share of health insurance premiums.

- Out-of-pocket health care expenses of the child such as for orthodontia.

· Other extraordinary, but forcasted expenses such at SAT preparation classes.

Some child-related costs cannot be anticipated at the time of the divorce such as fees for summer camps or karate lessons. Parents often choose to share these costs, or pay them in percentage to their incomes. The mediator may also bring up the following issues:

- Frequency and/or events that should trigger a child support modification.

- Age of emancipation for the children as related to the child support obligation.

- Any religious rights of passage and how they will be funded such as Bar Mitzvahs.

- The parties’ desires regarding the child’s college education and costs.

The first area discussed with respect to assets and liabilities is personal property. If the parties can decide how to divide their personal property on their own such as furniture, stereo equipment, television, computer equipment, antiques, photographs, the mediator will usually stay out of that process. If they cannot, the mediator may suggest they make an inventory of household items, place a fire sale price next to each item, and then take turns picking which items they desire. If one person ends up with significantly less, they can ask for reimbursement from the other party.

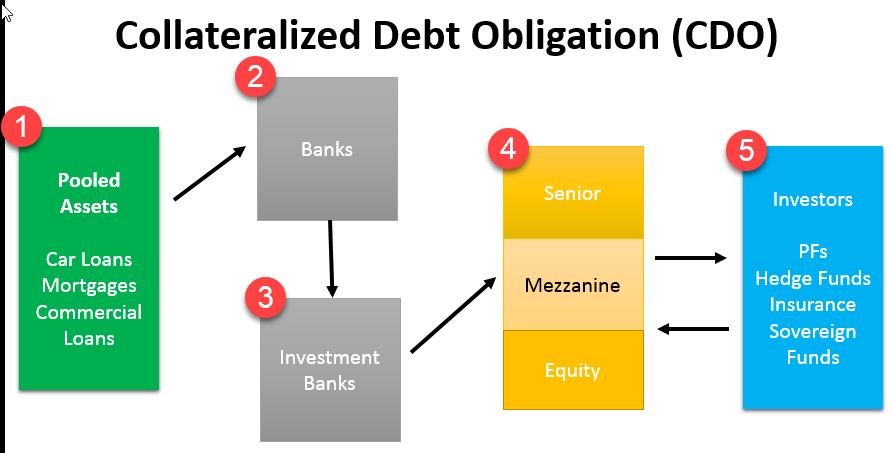

The parties have provided documentation including copies of bank statements, business valuations, brokerage statements, and pensions statements. Once all the information has been collected, one methodology for dividing assets and liabilities it to prepare a three column spreadsheet program such as Excel. The total estate would be in Column One. Columns Two would be reserved for assets and liabilities the wife is receiving, and Column Three would be reserved for assets and liabilities for husband is receiving. As an example, if the parties have a car worth $10,000 with a $5,000 loan, a house worth $250,000 with a $125,000 mortgage, and a bank account with $130,000, the total value of their entire estate as indicated in Column One would be $260,000. If the parties decide the wife is keeping the car, the car loan, the house and the mortgage, those values go in Column One, it is clear that she is getting 50% of the total assets. Please note that this is a simple illustration and does not adjust for potential taxes, sales commissions and closing costs that may or not be considered in the mediation process.

During the mediation session, the mediator may go through numerous alternatives on how they could divide up the marital assets and liabilities, and may look for ways to balance the division through vehicles such as Qualified Domestic Relations Orders that allow the transfer of part of a pension of deferred savings plan to the other party.

As time is needed to analyze budget information provided by the clients, it is wise to schedule the next session for two weeks later.

Mediation Session #4

The focus of this session is on budgets, spousal support and other outstanding. The agenda for the fourth session will usually encompass the following:

- Review parties current and forecasted budgets.

- Discuss what is needed if there are shortfalls including spousal support.

- Review other outstanding issues including incomes taxes, religious issues, cost of the divorce, etc.

- Provide agenda for next session.

As with the balance sheet, the mediator will take data provided by the clients and create a spreadsheet with the parties’ marital budget, and the projected budgets for each of the parties after the separation and divorce. There are many issues that influence the ease or difficulty of this task. It is usually easier if the parties are already living in separate residences, and if both parties are employed and working at their full earning capacity. It is harder if the parties are self-employed, and also if they have a lot of cash expenditures that are hard to track. The parties’ capacity for record keeping will influence the accuracy of the budget. For most clients the goal is to capture the 20% of expenses that account for 80% of their budget.

During the session, the mediator will review the current and forecasted budgets with the clients, and try and help them jog their memories for expenditures and well as income sources we may have missed. The budgets either provide reassurance that both parties will be self-sustaining and relatively comfortable, or help identify shortfalls. The budgeting exercise provides for a more rational discussion regarding spousal support be it some type of interim support, support for a number of years, or in longer-term marriages, permanent alimony. Because establishing both the amount and the term of spousal support is highly subjective, it is advisable that that clients see advise from counsel, and even get a second opinion, if they are not comfortable

Outstanding issues usually addressed in this session include:

- Income taxes including exemptions for the children, and filing status during the separation.

- Religious issues such as possibly religious annulments for Catholic clients, and Gets for Jewish clients.

- Whether the wife plans to change her name following the divorce.

- Social Security issues, including a process for equalizing social security benefits for long-term marriages.

- How the parties plan to pay the legal costs and fees for the divorce.

Once the mediator has gathered the remaining information so that he/she will be in a position to write a draft version of the Memorandum of Understanding. As I now need time to draft this document, the next session will be scheduled for at least for two weeks later.

Mediation Session #5

The focus of the fifth, and usually the last session is on reviewing the Draft Memorandum of Understanding and amending/correcting it.

The Draft MOU summarizes everything the parties have agreed to in the mediation process. The MOU is not intended as a legal document and will remain unsigned by the parties. It serves the purpose of putting in writing the goals, intentions and attitudes of the couple. The mediator will each client with a drafts copy of the MOU, and then should go through it in as great detail as is needed, to ensure that the document reflects the intentions of the clients. The Final MOU will be mailed to clients shortly after the session.

Generally, the text of the MOU does not come as a surprise to client. However, seeing the document itself can be upsetting to some clients, as it reminds them that they are moving along in the process. If any of the issues appear to be creating conflict, the mediator may caucus with the parties to try and bring it to closure. If it appears that the clients could benefit from another mediation session, the mediator will suggest it. However, this is the exception rather than the rule.

If clients have not secured legal counsel, most mediators will supply a list of mediation friendly attorneys, and will encourage their clients to make contact with a few attorneys so that they can inquire about fees, availability and approach.

Frequently, mediators will suggest that clients also review the MOU with their accountant, tax accountant, and financial planner. This review often helps identify or confirm strategies that may be mutually advantageous. As an example, there may be a tax benefit to waiting until the next-year for the divorce to be finalized. In that situation, the parties can instruct their attorneys accordingly.

The last part of this session will be spent answering questions and addressing concerns. Most clients are comfortable with the MOU, but apprehensive about moving forward. They should be assured that the hardest part of the process is done – the decision making. Their attorneys will review the MOU and help them implement the agreement. For some clients, there is a sadness in moving on. The mediator will assure them that if any conflicts arise during the filing process, during the divorce, or after the divorce, they are free to come back to mediation to address those issues.

[THE END]

Note 1 John M. Haynes, The Fundamental of Mediation, 31 (State University of New York Press, 1994).

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

***

***

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Comprehensive Financial Planning Strategies for Doctors and Advisors: Best Practices from Leading Consultants

Filed under: Risk Management | Tagged: Anju D. Jessani, divorce, divorce mediation, doctor's divorce | Leave a comment »