Asymmetric Information and the Death of ABS CDOs

By Daniel O. Beltran, Larry Cordell and Charles P. Thomas

***

***

ABSTRACT

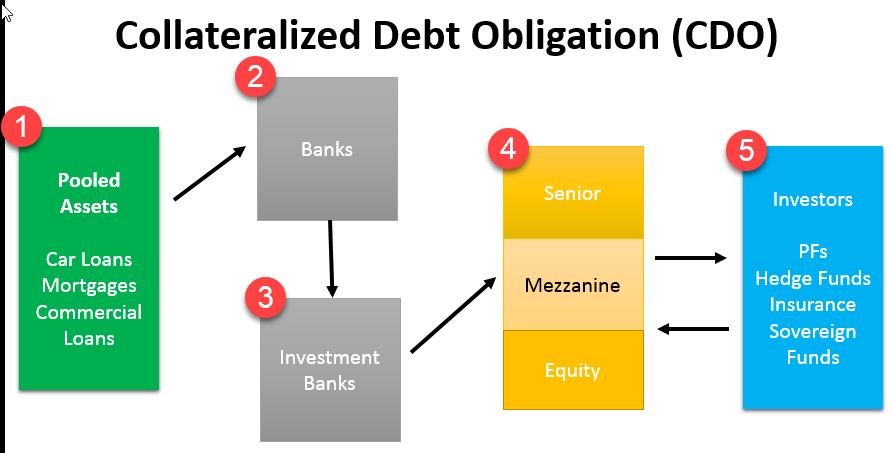

An asset-backed security (ABS) is a type of investment that is backed by a pool of debt, such as auto loans or home equity loans. A collateralized debt obligation (CDO) is a version of an ABS that may include mortgages as well as other types of assets. In either case, the owner of such a product makes money, directly or indirectly, from the repayment of principal and interest by the pool of consumers whose loans have been packaged to create that security.

***

A key feature of the 2007 financial crisis is that for some classes of securities trade has practically ceased. And where trade has occurred, it appears that market prices are well below their intrinsic values. This seems especially true for those securities where the payoff streams are particularly complex, for example, structured finance ABS CDOs.

One explanation for this is that information about these securities’ intrinsic values since the crisis has been asymmetric, with current holders having better information than potential buyers. We first characterize the information asymmetries that were present in the structured finance ABS CDO market. Because many of the CDO dealers had partially or fully integrated the pipeline from mortgage originations through CDO issuance, they had informational advantages over potential buyers that could well have disrupted trading in CDOs as the crisis took hold in August of 2007.

Using a “workhorse” model for pricing securities under asymmetric information and a novel dataset for the intrinsic values of ABS CDOs, we show how the resulting adverse selection problem could explain why the bulk of these securities either trade at significant discounts to their intrinsic values or do not trade at all.

READ: https://www.federalreserve.gov/pubs/ifdp/2013/1075/ifdp1075.htm

***

***

COMMENTS APPRECIATED

Thank You

***

Filed under: "Ask-an-Advisor", Alternative Investments, Experts Invited, Investing | Tagged: ABS, asset back security, CDO, CDOs, Charles P. Thomas, collateralized debt obligation, collateralized mortgage obligations, Daniel O. Beltran, Larry Cordell |

Leave a comment