Competitive HIT Issues Emerging by Default

[By Dr. David Edward Marcinko; MBA CMP™]

Publisher-in-Chief

Health entities of the Physician Practice Management Corporation [PPMC] era might be termed the originators of corporate medicine despite contentious legal policies and prohibitions. Since then, there have been other modifications to the business model, as those PPMCs left for dead by the year 1999 made a modest comeback thru 2003-04.

They did so by evolving from first generation multi-specialty national concerns, to second generation regional single specialty groups, to third generation regional concerns, and finally to fourth generation Internet enabled service companies, providing both business-to-business [B2B] solutions to affiliated medical practices, as well as business-to-consumer [B2C] health solutions to plan members.

Prior machinations were ambulatory surgery centers [ASCs] and out-patient treatment centers [OPTCs], while the newer twists are specialty owned hospitals.

Social Transformation of Medicine

And so, I believe that Paul Starr, author of the Pulitzer-prize-winning book “The Social Transformation of American Medicine” who first predicted healthcare corporatization was more correct, than not.

But, his vision was early in the evolutionary game. And, while corporate medicine seems inevitable in 2008 and beyond, the marketplace is still struggling for the correct business mode. It needs something that bridges the gap between medical professionalism and ROI.

The Balancing Act

In-other-words, a better balancing act is needed. Slowly, like capitalism itself, the pendulum will swing back and forth between paucity and excess, until a point is reached where all concerned are moderately satisfied, ethical, and marginally profitable; while delivering quality medical care that is more needed by the citizenry-many [i.e., more pediatricians, internists, primary care doctors, OB-GYNs, nurse-practitioners, PAs, etc]; than the vital-few [neuro-surgeons, pediatric endocrinologists, super specialists, etc].

Maybe this “missing balance link” is the retail medical clinic model.

Retail Clinics

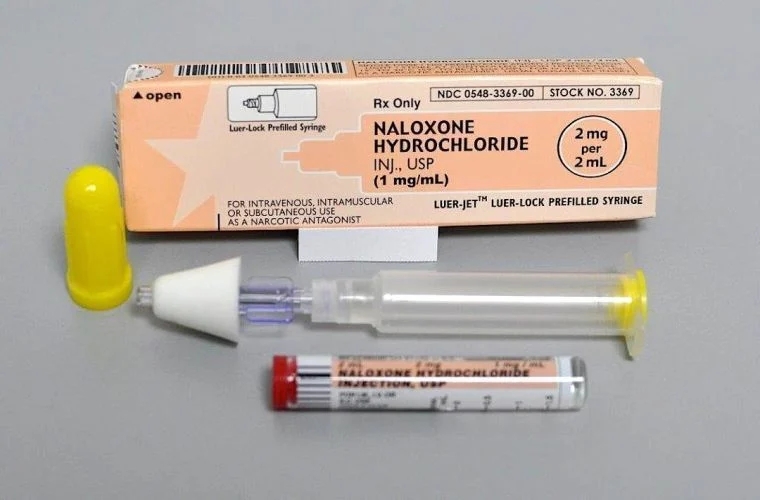

As most doctors, payers, patients and consumers are aware, the retail quick-service medical care concept has found a familiar place in national chains such as Target, Wal-Mart and CVS, where pharmacies and patients already exist, and space is inexpensive and abundant.

These clinics are typically staffed by nurse practitioners and offer a limited menu of walk-in medical services with insurance co-payments between $10 and $30. And, unlike some physician practices, private pay patients are welcomed with fees ranging from $55 to $85 cash in many parts of the country! Prescription drugs are nearby at robust generic discounts, or even for free in some cases. Office hours are extended, and convenience reigns.

HIT Issues by Default?

Ironically, as one positive side-effect of this innovative next-gen corporate practice model, may be the goading of late adopting, tight-fisted and/or refusing MD-niks to enter into the modern health-information-technology [HIT] age.

Thus, one way to get margin compressed private medical practices up and running with electronic medical records [EMRs] may be these same retail clinics.

***

***

Projected Growth of the Retail Industry

Today, more than 800 retail clinics are open for business, and analysts predict that 85 percent of the U.S. population will have a clinic within five miles of home in five years. And, the number of retail health clinics is expected to multiply in 2009; as recently reported by the Washington Times.

Illustration

Now, ponder the current state of affairs where a retail clinic [say Walgreen’s, etc] treats a vacationing patient for $65; who then receives the medical-record instantly on a flash-drive or securely uploaded to some virtual storage facility?

Just how will that patient’s premium priced private practitioner back-home explain his/her lack of EMR technology, and ages-old anchor to the hand-written paper-based medical records of yore?

Can you say Dossia.org, HealthVault.com, etc?

Competitive Assessment

The ideological leap from technical buffoonery – to clinical distrust – will not be great in the minds of the modern, intelligent, educated and insightful patients that we all crave.

Assessment

Of course, one wonders how long will it take for EMRs to become a strategic competitive advantage for early adopting physicians. Will late adopters even survive as EMTs become main-stream?

Channel Surfing the ME-P

Have you visited our other topic channels? Established to facilitate idea exchange and link our community together, the value of these topics is dependent upon your input. Please take a minute to visit. And, to prevent that annoying spam, we ask that you register. It is fast, free and secure.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: Information Technology | Tagged: CVs, Paul Starr, retail medical clinics | 3 Comments »