Br. David Edward Marcinko MBA MEd

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

DEFINED

A multiple‑choice test is one of the most widely used assessment formats in education, professional certification, and psychological measurement. Its defining feature is simple: each question presents a prompt and a set of possible answers, from which the test‑taker must select the correct or best option. Although the structure appears straightforward, the multiple‑choice test is a sophisticated tool shaped by decades of research on learning, cognition, and measurement. Understanding what a multiple‑choice test is requires looking beyond its surface format and examining its purpose, design, strengths, limitations, and the ways it influences how people learn and demonstrate knowledge.

The Structure and Purpose of Multiple‑Choice Tests

At its core, a multiple‑choice test is designed to measure knowledge, skills, or reasoning in a standardized and efficient way. Each question—often called an “item”—contains two main parts: the stem and the alternatives. The stem presents the problem, scenario, or question. The alternatives include one correct answer, known as the key, and several incorrect answers, known as distractors. The test‑taker’s task is to identify the key among the distractors.

This structure serves a clear purpose: to evaluate whether someone can recognize accurate information or apply knowledge to a specific situation. Because the answer choices are predetermined, scoring can be objective and consistent. This makes multiple‑choice tests particularly useful in large‑scale settings such as school exams, professional licensing tests, and standardized assessments. They allow thousands—or even millions—of people to be evaluated using the same criteria, with results that can be compared fairly across individuals and groups.

Designing Effective Multiple‑Choice Questions

Although the format seems simple, writing high‑quality multiple‑choice questions is a demanding process. A good item must be clear, unambiguous, and aligned with the skill or concept being assessed. The stem should present a meaningful problem rather than a trivial fact, and the distractors must be plausible enough to challenge someone who has not fully mastered the material.

The best multiple‑choice questions do more than test memorization. They can assess higher‑order thinking by asking test‑takers to analyze scenarios, apply principles, evaluate evidence, or solve problems. For example, a question in a biology exam might present a real‑world situation and ask which explanation best fits the observed data. In this way, multiple‑choice tests can measure complex reasoning when they are carefully constructed.

Another important aspect of design is fairness. A well‑designed test avoids cultural bias, overly tricky wording, or clues that unintentionally reveal the answer. The goal is to measure knowledge or skill—not reading speed, test‑taking tricks, or familiarity with a particular cultural reference. Achieving this level of fairness requires careful review, pilot testing, and revision.

***

***

Strengths of Multiple‑Choice Tests

One of the major strengths of multiple‑choice tests is efficiency. They allow instructors and institutions to assess a large amount of content in a relatively short time. Because scoring is objective, results can be processed quickly and consistently, reducing the potential for human error or subjective judgment.

Another advantage is reliability. When items are well‑designed, multiple‑choice tests can produce stable and repeatable results. This reliability is crucial in high‑stakes settings such as medical licensing exams or university admissions, where decisions must be based on trustworthy measures.

Multiple‑choice tests also offer diagnostic value. Patterns of correct and incorrect responses can reveal which concepts students understand and which require further instruction. For teachers, this information can guide lesson planning and targeted support. For learners, it can highlight strengths and weaknesses, helping them focus their study efforts more effectively.

Finally, multiple‑choice tests can assess a wide range of cognitive skills. While they are often associated with factual recall, they can also measure comprehension, application, analysis, and even aspects of critical thinking. The key is thoughtful item design that challenges students to use knowledge rather than simply recognize it.

Limitations and Criticisms

Despite their strengths, multiple‑choice tests are not without limitations. One common criticism is that they encourage guessing. Because the correct answer is always present, a test‑taker might select it by chance rather than through understanding. While this effect can be reduced by including more distractors or using statistical scoring methods, it cannot be eliminated entirely.

Another limitation is that multiple‑choice tests may oversimplify complex skills. Some abilities—such as writing, creativity, collaboration, or open‑ended problem solving—cannot be captured well through fixed response options. For example, evaluating a student’s ability to construct a persuasive argument or design an experiment requires formats that allow for extended responses.

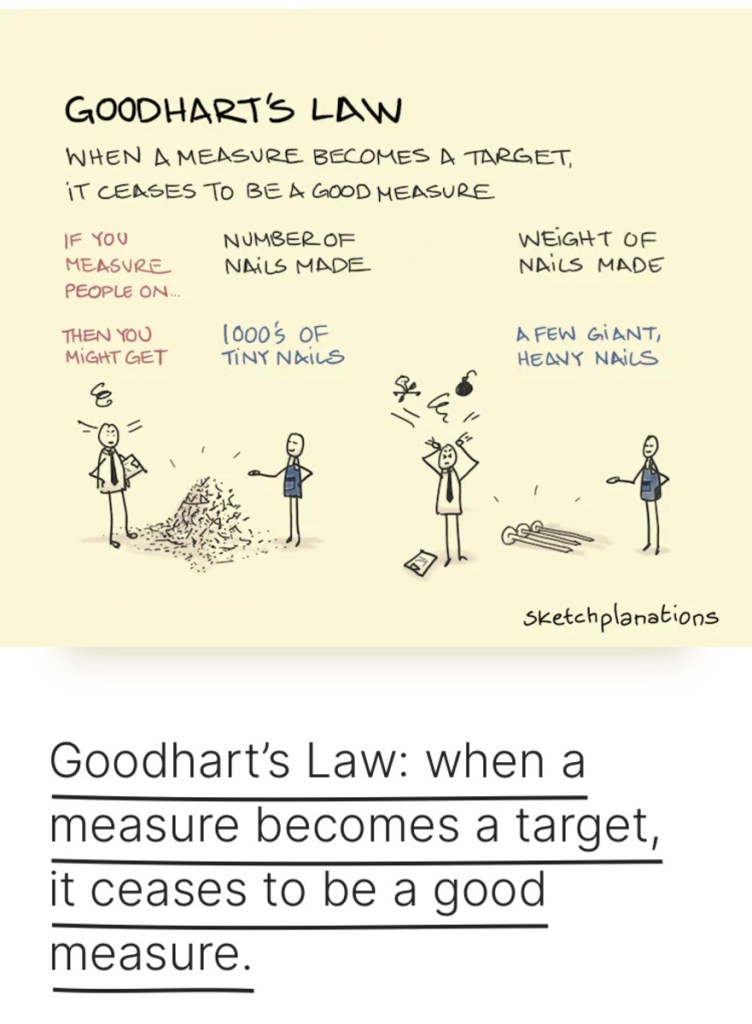

Multiple‑choice tests can also create a narrow focus on test preparation. When students know they will be assessed through this format, they may prioritize memorizing isolated facts rather than developing deeper understanding. This phenomenon, sometimes called “teaching to the test,” can limit the richness of learning experiences.

Additionally, poorly written items can introduce bias or confusion. Ambiguous wording, irrelevant details, or distractors that are obviously incorrect can distort results. In such cases, the test may measure test‑taking ability more than actual knowledge.

The Role of Multiple‑Choice Tests in Learning

Multiple‑choice tests influence not only how knowledge is measured but also how it is learned. When used thoughtfully, they can reinforce learning by encouraging retrieval practice—the act of recalling information from memory. Research shows that retrieval strengthens memory and improves long‑term retention. Taking a multiple‑choice test can therefore help students learn, not just demonstrate what they know.

However, the impact depends on how the tests are integrated into instruction. Frequent low‑stakes quizzes can support learning by providing regular opportunities for practice and feedback. In contrast, high‑stakes exams that determine grades or advancement may create anxiety and narrow students’ focus to short‑term performance.

Multiple‑choice tests can also support metacognition. When students review their results, they gain insight into what they understand and where they need improvement. This self‑awareness is a key component of effective learning.

Why Multiple‑Choice Tests Persist

Despite ongoing debates about their limitations, multiple‑choice tests remain a central part of modern assessment. Their persistence is not simply a matter of convenience. They offer a combination of efficiency, reliability, and scalability that few other formats can match. In large educational systems, they provide a practical way to evaluate learning across diverse populations.

Moreover, advances in test design have expanded what multiple‑choice tests can measure. Computer‑based testing allows for adaptive assessments that adjust difficulty based on performance, providing a more precise measure of ability. Scenario‑based items can simulate real‑world decision‑making, making the test more authentic and meaningful.

Conclusion

A multiple‑choice test is far more than a set of questions with predetermined answers. It is a carefully designed tool for measuring knowledge, reasoning, and understanding. Its structure allows for efficient, objective, and reliable assessment, making it invaluable in educational and professional contexts. At the same time, its limitations remind us that no single format can capture the full range of human abilities.

When used thoughtfully, multiple‑choice tests can support learning, provide meaningful feedback, and help institutions make informed decisions. Understanding what they are—and what they are not—allows educators and learners to use them more effectively. Ultimately, the multiple‑choice test endures because it strikes a balance between practicality and precision, offering a structured way to evaluate what people know in an increasingly complex world.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: Ask a Doctor, Career Development, CMP Program, Glossary Terms, Marcinko Associates | Tagged: answers, CMP, david marcinko, distractors, education, Ethics, fail, learning, meta cognition, multiple choice test, pass, philosophy, questions, test, What is a Multiple-Choice Test? | Leave a comment »