Financial Advisor’s are Not Doctors!

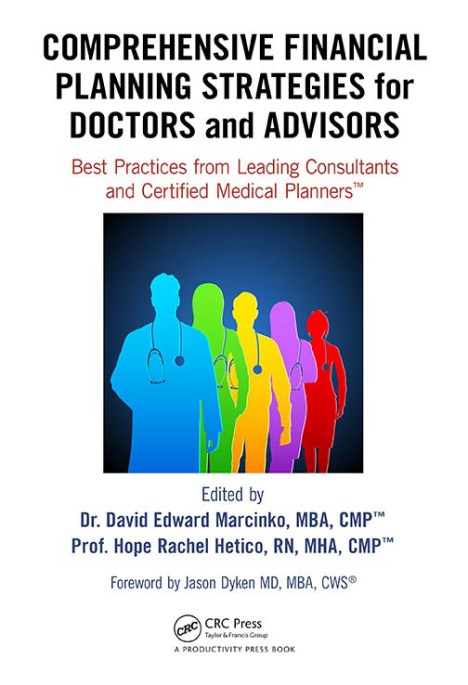

Dr. David E. Marcinko FACFAS MBA MEd CMP™ MBBS

THRIVE-BECOME A CMP™ Physician Focused Fiduciary

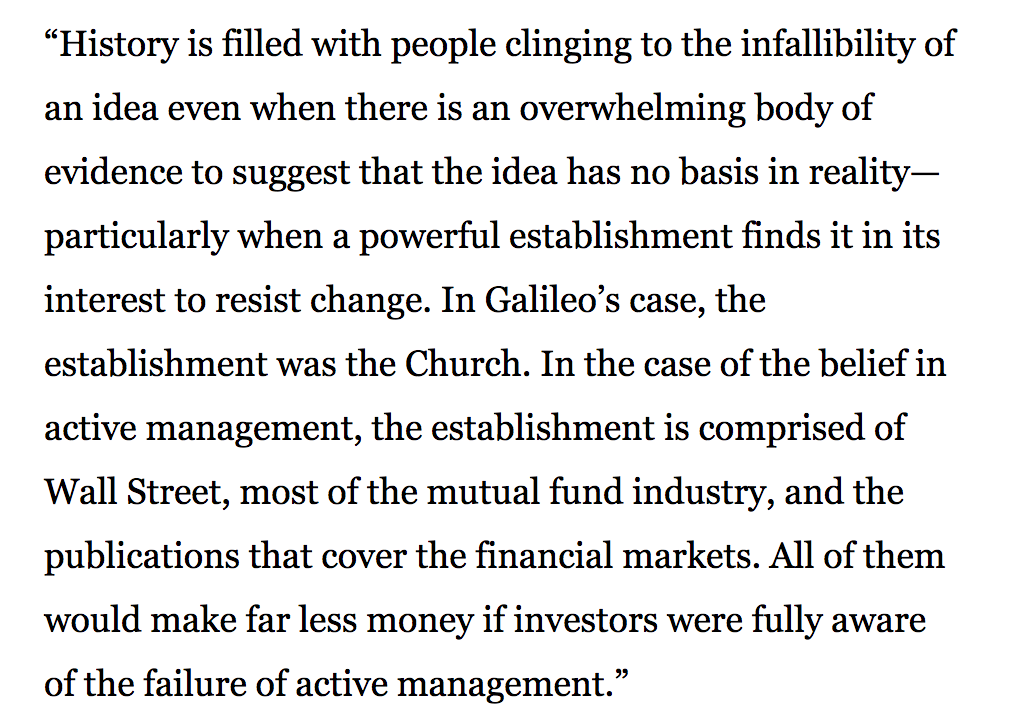

Financial advisors don’t ascribe to the Hippocratic Oath. People don’t go to work on “Wall Street” for the same reasons other people become firemen and teachers. There are no essays where they attempt to come up with a new way to say, “I just want to help people.”

Financial Advisor’s are Not Doctors

Some financial advisors and insurance agents like to compare themselves to CPAs, attorneys and physicians who spend years in training and pass difficult tests to get advanced degrees and certifications. We call these steps: barriers-to-entry. Most agents, financial product representatives and advisors, if they took a test at all, take one that requires little training and even less experience. There are few BTEs in the financial services industry.

For example, most insurance agent licensing tests are thirty minutes in length. The Series #7 exam for stock brokers is about 2 hours; and the formerly exalted CFP® test is about only about six [and now recently abbreviated]. All are multiple-choice [guess] and computerized. An aptitude for psychometric savvy is often as important as real knowledge; and the most rigorous of these examinations can best be compared to a college freshman biology or chemistry test in difficulty.

Yet, financial product salesman, advisors and stock-brokers still use lines such as; “You wouldn’t let just anyone operate on you, would you?” or “I’m like your family physician for your finances. I might send you to a specialist for a few things, but I’m the one coordinating it all.” These lines are designed to make us feel good about trusting them with our hard-earned dollars and, more importantly, to think of personal finance and investing as something that “only a professional can do.”

Unfortunately, believing those lines can cost you hundreds of thousands of dollars and years of retirement.

***

***

Suitability Rule

A National Association of Securities Dealers [NASD] / Financial Industry Regulatory Authority [FINRA] guideline that require stock-brokers, financial product salesman and brokerages to have reasonable grounds for believing a recommendation fits the investment needs of a client. This is a low standard of care for commissioned transactions without relationships; and for those “financial advisors” not interested in engaging clients with advice on a continuous and ongoing basis. It is governed by rules in as much as a Series #7 licensee is a Registered Representative [RR] of a broker-dealer. S/he represents best-interests of the firm; not the client.

And, a year or so ago there we two pieces of legislation for independent broker-dealers-Rule 2111 on suitability guidelines and Rule 408(b)2 on ERISA. These required a change in processes and procedures, as well as mindset change.

Note: ERISA = The Employee Retirement Income Security Act of 1974 (ERISA) codified in part a federal law that established minimum standards for pension plans in private industry and provides for extensive rules on the federal income tax effects of transactions associated with employee benefit plans. ERISA was enacted to protect the interests of employee benefit plan participants and their beneficiaries by:

- Requiring the disclosure of financial and other information concerning the plan to beneficiaries;

- Establishing standards of conduct for plan fiduciaries ;

- Providing for appropriate remedies and access to the federal courts.

ERISA is sometimes used to refer to the full body of laws regulating employee benefit plans, which are found mainly in the Internal Revenue Code and ERISA itself. Responsibility for the interpretation and enforcement of ERISA is divided among the Department Labor, Treasury, IRS and the Pension Benefit Guarantee Corporation.

Yet, there is still room for commissioned based FAs. For example, some smaller physician clients might have limited funds [say under $100,000-$250,000], but still need some counsel, insight or advice.

Or, they may need some investing start up service from time to time; rather than ongoing advice on an annual basis. Thus, for new doctors, a commission based financial advisor may make some sense.

Prudent Man Rule

This is a federal and state regulation requiring trustees, financial advisors and portfolio managers to make decisions in the manner of a prudent man – that is – with intelligence and discretion. The prudent man rule requires care in the selection of investments but does not limit investment alternatives. This standard of care is a bit higher than mere suitability for one who wants to broaden and deepen client relationships.

***

***

Prudent Investor Rule

The Uniform Prudent Investor Act (UPIA), adopted in 1992 by the American Law Institute’s Third Restatement of the Law of Trusts, reflects a modern portfolio theory [MPT] and total investment return approach to the exercise of fiduciary investment discretion. This approach allows fiduciary advisors to utilize modern portfolio theory to guide investment decisions and requires risk versus return analysis. Therefore, a fiduciary’s performance is measured on the performance of the entire portfolio, rather than individual investments

Fiduciary Rule

The legal duty of a fiduciary is to act in the best interests of the client or beneficiary. A fiduciary is governed by regulations and is expected to judge wisely and objectively. This is true for Investment Advisors [IAs] and RIAs; but not necessarily stock-brokers, commission salesmen, agents or even most financial advisors. Doctors, lawyers, and the clergy are prototypical fiduciaries.

***

***

More formally, a financial advisor who is a fiduciary is legally bound and authorized to put the client’s interests above his or her own at all times. The Investment Advisors Act of 1940 and the laws of most states contain anti-fraud provisions that require financial advisors to act as fiduciaries in working with their clients. However, following the 2008 financial crisis, there has been substantial debate regarding the fiduciary standard and to which advisors it should apply. In July of 2010, The Dodd-Frank Wall Street Reform and Consumer Protection Act mandated increased consumer protection measures (including enhanced disclosures) and authorized the SEC to extend the fiduciary duty to include brokers rather than only advisors, as prescribed in the 1940 Act. However, as of 2014, the SEC has yet to extend a meaningful fiduciary duty to all brokers and advisors, regardless of their designation.

The Fiduciary Oath: fiduciaryoath_individual

Assessment

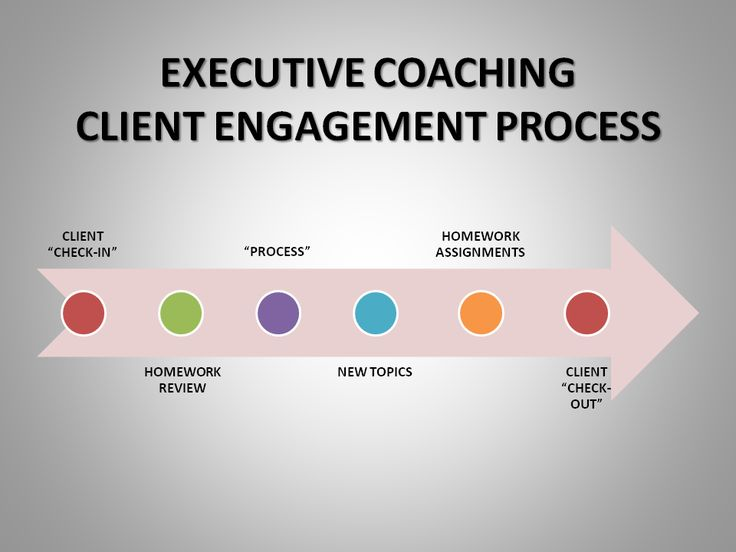

Ultimately, physician focused and holistic “financial lifestyle planning” is about helping some very smart people change their behavior for the better. But, one can’t help doctors choose which opportunities to take advantage of along the way unless there is a sound base of technical knowledge to apply the best skills, tools, and techniques to achieve goals in the first place.

Most of the harms inflicted on consumers by “financial advisors” or “financial planners” occur not due to malice or greed but ignorance; as a result, better consumer protections require not only a fiduciary standard for advice, but a higher standard for competency.

The CFP® practitioner fiduciary should be the minimum standard for financial planning for retail consumers, but there is room for post CFP® studies, certifications and designations; especially those that support real medical niches and deep healthcare specialization like the Certified Medical Planner™ course of study [Michael E. Kitces; MSFS, MTax, CLU, CFP®, personal communication].

Being a financial planner entails Life-Long-Learning [LLL]. One should not be allowed to hold themselves out as an advisor, consultant, or planner unless they are held to a fiduciary standard, period. Corollary – there’s nothing wrong with a suitability standard, but those in sales should be required to hold themselves out as a salesperson, not an advisor.

The real distinction is between advisors and salespeople. And, fiduciary standards can accommodate both fee and commission compensation mechanisms. However; there must be clear standards and a process to which advisors can be held accountable to affirm that a recommendation met the fiduciary obligation despite the compensation involved.

Ultimately, being a fiduciary is about process, not compensation.

More: Deception in the Financial Service Industry

Full Disclosure:

As a medical practitioner, Dr. Marcinko is a fiduciary at all times. He earned Series #7 (general securities), Series #63 (uniform securities state law), and Series #65 (investment advisory) licenses from the National Association of Securities Dealers (NASD-FINRA), and the Securities Exchange Commission [SEC] with a life, health, disability, variable annuity, and property-casualty license from the State of Georgia.

Dr.Marcinko was a licensee of the CERTIFIED FINANCIAL PLANNER™ Board of Standards (Denver) for a decade; now reformed, and holds the Certified Medical Planner™ designation (CMP™). He is CEO of iMBA Inc and the Founding President of: http://www.CertifiedMedicalPlanner.org

More: Enter the CMPs

***

[PHYSICIAN FOCUSED FINANCIAL PLANNING AND RISK MANAGEMENT COMPANION TEXTBOOK SET]

[Dr. Cappiello PhD MBA] *** [Foreword Dr. Krieger MD MBA]

[Two Newest Books by Marcinko annd the iMBA, Inc Team]

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

***

[PRIVATE MEDICAL PRACTICE BUSINESS MANAGEMENT TEXTBOOK – 3rd. Edition]

[Foreword Dr. Hashem MD PhD] *** [Foreword Dr. Silva MD MBA]

***

Filed under: Book Reviews, Career Development, CMP Program, Financial Planning, Health Economics, Health Insurance, Healthcare Finance, iMBA, Inc., Op-Editorials, Portfolio Management, Practice Management, Professional Liability, Recommended Books, Research & Development, Risk Management, Touring with Marcinko | Tagged: Dr. David E. Marcinko, fiduciary accountability, financial planing MDs, Prudent Investor Act, prudent man rule, suitability rule, Uniform Prudent Investors Act, Wall Street | 3 Comments »