By Staff Reporters

***

***

Practical applications in financial services

Among practical applications provided by the Metaverse, its ability to create virtual environments for people to connect may severely impact the financial industry. The employment of VR and AR during COVID-19 and remote work conditions enabled greater collaboration in teleconferencing where professionals used annotating, chatting and screen-sharing features, allowing them to work efficiently while not in the same physical space.

VR and AR can also be used by financiers in individual capacities, particularly with data visualization, aiding them in analyzing financial risks, providing more precise services to customers. This raises the bar on their expectations, stimulating competition and innovation in the market.

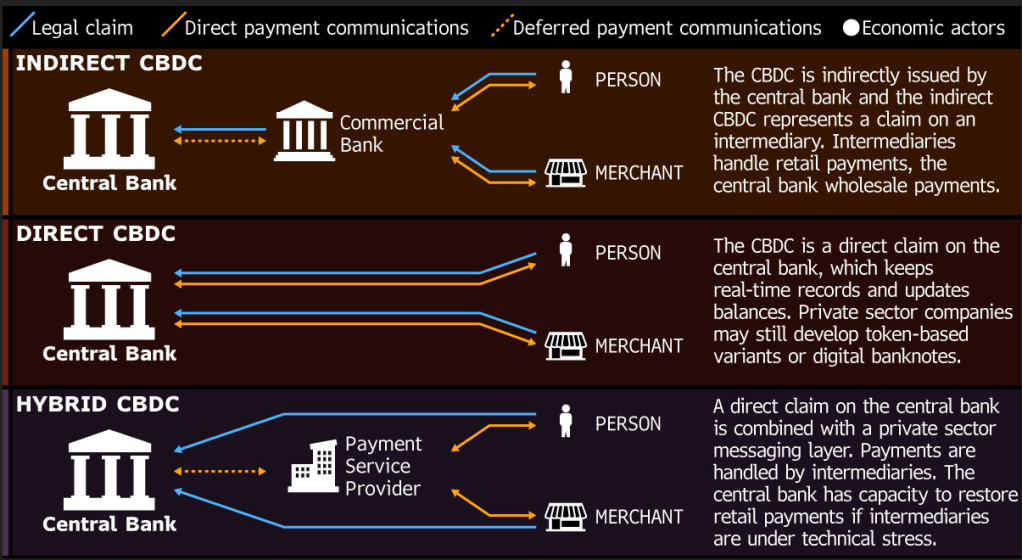

Moreover, virtual environments can be used in consumer-oriented manners. The creation of digital shopping environments in the Metaverse acts as a hub for companies to reach a wider range of consumers without geographical constraints, allowing for greater exposure. Such virtual shopping hubs can employ digital payment means so that transactions take place entirely within the realm of the Metaverse.

Through digital means, financial advisors can provision for greater convenience, signifying a shift in the industry, and broadening the scope of the services clients can be provided with, such as AR being used to simulate different financial scenarios so that customers can visualize them with ease. With the progression of the Metaverse in finance and banking, the next developments could see the creation of fully-digital bank branches, diminishing or perhaps eliminating the need for physical ones. Such client centric developments can either build upon existing consumer experiences or create entirely new ones.

A main attractive feature of using VR or AR is the ability to superimpose a wider range of information digitally, which mobile devices or computer screens would not accommodate. Thereby, complementing existing mobile banking apparatus, such as apps that showcase customers’ account balances or direct them to the nearest bank branches using AR.

CITE: https://www.r2library.com/Resource/Title/082610254

***

Why are Banks Entering the Metaverse?

Some people are concerned about whether there is anything for banks to benefit from entering the metaverse. There are a host of new opportunities for banks in the metaverse. So, tet’s look at the most important ones

Firstly, they are working with the idea that being the early adopters by entering the field before others will give them an advantage over latecomers in the future. That is why they are investing in potentially strategic locations in the metaverse.

Secondly, some digital banks imagine that the metaverse has the potential for the banking industry to reinvent transactions for a three-dimensional (3D) world. That is why they are experimenting with it. The primary objective has been to learn new ways of meeting the needs of their customers who are crazy about trending technologies. With metaverse, it could be possible to enable customers to pay bills, check balances, and transfer money using VR or AR channels.

Thirdly, as the younger generations are becoming more attracted to crypto-friendly banks, NFT marketplaces, and other blockchain-based platforms, digital banks are looking for unconventional ways to improve their brand image. So, a smart marketing strategy is to create the presence of their brands in the metaverse and win the hearts of their customers through their show of modernity.

Fourthly, the metaverse can offer new ways for banks to engage with their customers. A customer could stay at home and interact with an avatar concerning any business they have with their bank. This technology can be used to deliver personalized financial advice, product recommendations, and even financial planning.

Finally, entering the metaverse is a way for digital banks to pool highly talented employees. It makes them attractive to professionals such as data scientists, developers, and other IT experts who have been working in this developing field and are looking for job opportunities that can bring out the best in them. For example, the metaverse has the potential for use in on-boarding remote workers and training employees on safety and other aspects of their jobs using simulated environments.

***

ORDER: https://www.amazon.com/Dictionary-Health-Information-Technology-Security/dp/0826149952/ref=sr_1_5?ie=UTF8&s=books&qid=1254413315&sr=1-5

***

ORDER: https://www.routledge.com/Comprehensive-Financial-Planning-Strategies-for-Doctors-and-Advisors-Best/Marcinko-Hetico/p/book/9781482240283

***

COMMENTS APPRECIATED

Thank You

***

Filed under: "Ask-an-Advisor", Accounting, Alternative Investments, Information Technology, Investing, Taxation | Tagged: banking, Banking and the Financial Services Industry, financial services industry, Meta, metaverse, METAVERSE: In Banking and the Financial Services Industry | 1 Comment »