SPONSOR: http://www.CertifiedMedicalPlanner.org

Dr. David Edward Marcinko; MBA MEd

***

***

Artificial intelligence has emerged as a transformative force across multiple domains, and the financial sector is no exception. Within the stock market, the integration of AI-driven tools has redefined how investors, analysts, and institutions approach decision-making. Microsoft Copilot, as an advanced AI companion, exemplifies this shift by offering a multifaceted platform that enhances data interpretation, risk management, and strategic planning. Its role in the stock market can be understood through several dimensions: information synthesis, analytical augmentation, behavioral regulation, and democratization of access.

Information Synthesis

The stock market is characterized by an overwhelming flow of information, ranging from corporate earnings reports and macroeconomic indicators to geopolitical developments and investor sentiment. Traditionally, investors have relied on manual research, financial news outlets, and analyst commentary to remain informed. Copilot introduces a paradigm shift by synthesizing this information in real time. It can process vast datasets, extract salient points, and present them in a structured format that reduces cognitive overload. This capacity for rapid synthesis ensures that investors are not only informed but also able to act with timeliness, a critical factor in markets where seconds can determine profitability.

Analytical Augmentation

Beyond information gathering, Copilot contributes to the analytical dimension of investing. Financial analysis often requires the comparison of companies, industries, and macroeconomic trends. Copilot’s ability to contextualize data allows investors to move beyond surface-level metrics and engage with deeper insights. For instance, when evaluating a technology firm, Copilot can highlight competitive positioning, regulatory challenges, and innovation trajectories. This analytical augmentation supports more comprehensive investment theses, enabling investors to balance quantitative indicators with qualitative considerations. In this sense, Copilot functions not merely as a data provider but as an intellectual partner in the construction of financial strategies.

Behavioral Regulation

One of the most persistent challenges in the stock market is the influence of human emotion on decision-making. Fear, greed, and overconfidence often lead to irrational trading behaviors that undermine long-term success. Copilot mitigates these tendencies by offering objective, balanced perspectives. By presenting counterarguments, highlighting risks, and encouraging critical reflection, it acts as a stabilizing force against impulsive actions. This behavioral regulation is particularly valuable in volatile markets, where emotional reactions can exacerbate losses. Copilot thus contributes to the cultivation of disciplined investment practices, aligning investor behavior with rational analysis rather than psychological bias.

***

***

Democratization of Access

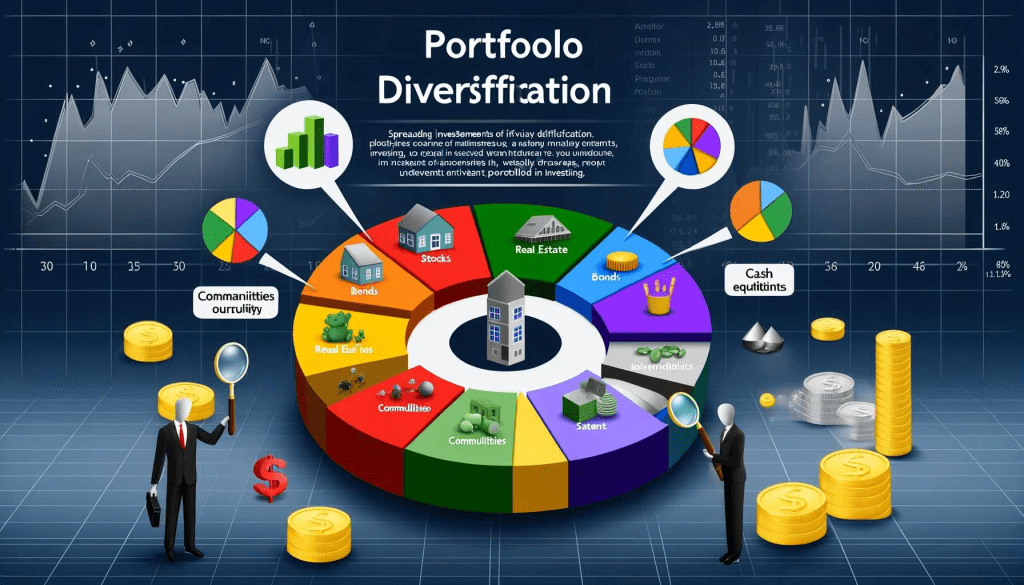

Historically, sophisticated financial analysis has been the domain of institutional investors with access to specialized resources. Copilot challenges this exclusivity by making advanced insights accessible to a broader audience. Novice investors can engage with complex concepts such as portfolio diversification, valuation ratios, or market cycles through Copilot’s clear explanations.

This democratization of access lowers barriers to entry, fostering greater participation in financial markets. In doing so, Copilot not only empowers individual investors but also contributes to the broader goal of financial literacy and inclusion.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: iMBA, Inc. | Tagged: david marcinko | Leave a comment »