How to evaluate the academic performance of individual scientists

[By Dr. David Edward Marcinko MBA]

The “h-index” was introduced in 2005 as a metric for estimating “the importance, significance and broad impact of a scientist’s cumulative contributions.” It takes into account both the number of an individual’s publications and their impact on peers, as indicated by citation counts.

The “h-index” was introduced in 2005 as a metric for estimating “the importance, significance and broad impact of a scientist’s cumulative contributions.” It takes into account both the number of an individual’s publications and their impact on peers, as indicated by citation counts.

Origination

Its creator, Jorge Hirsch (UC-San Diego) asserts that a “successful scientist” will have an h-index of 20 after 20 years; an “outstanding scientist” will have an index of 40 after 20 years; and a “truly unique individual” will have an index of 60 after 20 years or 90 after 30 years. You can read more about it in Nature and PhysicsWeb.

Web of Science

Curious to know your own h-index? You can easily determine it using Web of Science. Select “Science Citation Index Expanded.” Click “General Search” category and search for your name as author (e.g., SMITH J*). Use “Refine Your Results” by Institution to differentiate yourself from other scientists with the same initial(s). (This is an important step, otherwise your publications will be intermingled with unrelated papers and your h-index will be inaccurate.) Click on “Citation Report” in the box on the right side. Your h-index will be calculated automatically.

An alternative method is to sort your citations by “Times Cited”, using sort box on the right side. Scan down the list until the number of the paper exceeds the number of citations to that paper. For example, your h-index is 20 if your 21st paper has been cited 20 or fewer times, but your 20th paper has been cited 20 or more times.

Critique

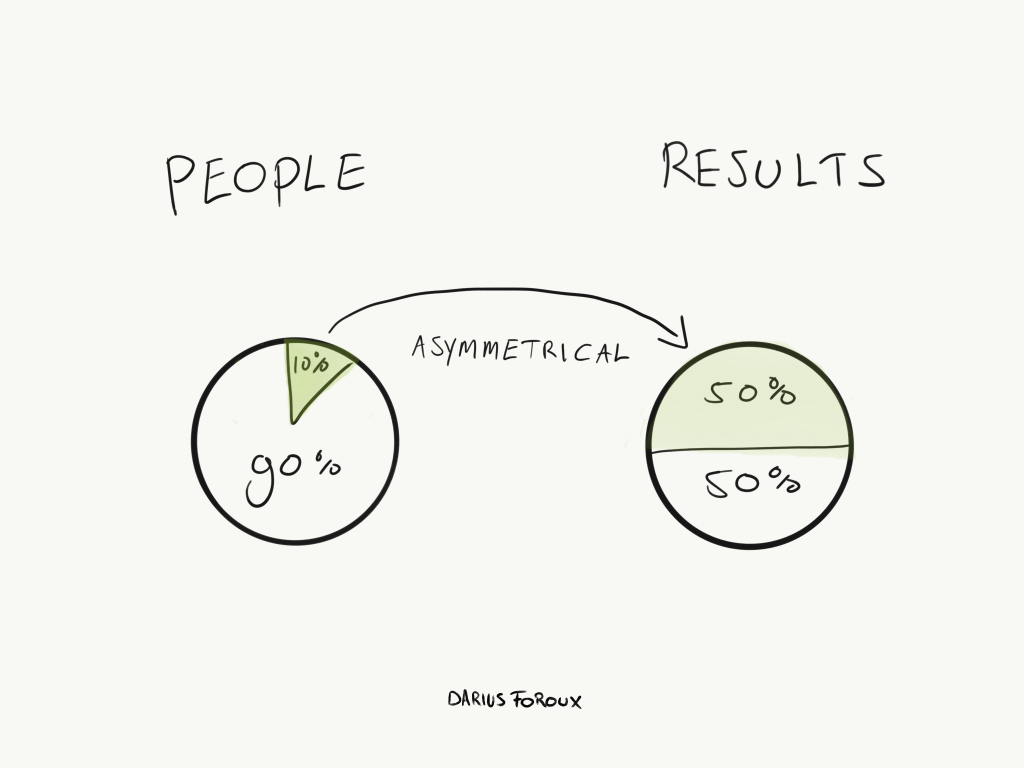

Although effective and simple, the h-index suffers from some drawbacks that limit its use in accurately and fairly comparing the scientific output of different researchers. These drawbacks include information loss and low resolution: the former refers to the fact that in addition to h2 citations for papers in the h-core, excess citations are completely ignored, whereas the latter means that it is common for a group of researchers to have an identical h-index.

***

Comprehensive Financial Planning Strategies for Doctors and Advisors: Best Practices from Leading Consultants

***

Fixing the Bias

To solve these problems, Chun-Ting Zhang proposed the “e-index“, where e2 represents the ignored excess citations, in addition to the h2 citations for h-core papers. Citation information can be completely depicted by using the h-index together with the e-index, which are independent of each other. Some other h-type indices, such as a and R, are h-dependent, have information redundancy with h, and therefore, when used together with h, mask the real differences in excess citations of different researchers.

Link: http://www.plosone.org/article/info%3Adoi%2F10.1371%2Fjournal.pone.0005429

Assessment

Google Scholar is another useful source of citation data. A.-W. Harzing’s Publish or Perish software is a free application for Windows, Mac OS, and GNU/Linux that uses Google Scholar to compute citation counts, h-indexes, journal impact factors, and many other citation metrics.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: Career Development, iMBA, Inc. | Tagged: Chun-Ting Zhang, David Edward Marcinko, e-Index, Jorge Hirsch, PhysicsWeb, Publication "H-Index", Web of Science | 2 Comments »