By Staff Reporters

***

The final hour of trading on a Friday when stock index futures, stock index options, and stock options all expire. This happens on the third Friday in March, June, September, and December. See Quadruple Witching Hour.

CITE: https://www.r2library.com/Resource/Title/0826102549

According to TheStreet, Inc –

Triple witching sounds like something from a horror movie, but it’s actually a financial term. Options and derivatives traders know this phenomenon well because it’s the day when three different types of contracts expire. It happens only once a quarter and can cause wild swings in volatility, as large institutional traders roll over futures contracts to free up cash. Doing so creates a ton of increased volume—sometimes 50% higher than average, especially in the last trading hour of the day—but individual investors needn’t feel spooked. In fact, some might even view this volatility as a profit-making opportunity.

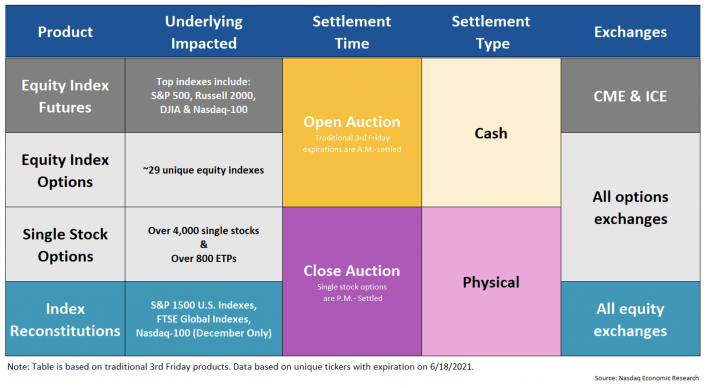

Which 3 Types of Derivative Contracts Expire on Triple Witching Day?

- Stock Options: These are contracts taken out on the direction of a stock price at a future date. Unlike stocks, they’re not an investment in a company; rather, they’re the right to buy or sell shares of a company at a later time frame. Calls let you buy stock shares at a set price, known as the strike price, on or before the expiration date. Puts give you the right to sell shares.

- Index Options: These are futures contracts on a stock index, such as the S&P 500. These options are settled in cash.

- Index Futures: These are futures contracts on equity indexes. These contracts are also settled in cash.

A futures contract is also referred to as an “anticipated hedge” because it’s used to lock in prices on future buy or sell transactions. These hedges are a way to protect a portfolio from market setbacks without selling long-term holdings.

It’s worth noting that a few times a year, single stock futures also expire on witching day, adding a fourth asset to the trading cauldron, and that’s why some investors refer to this date as “quadruple witching,” although the terms are interchangeable.

When Is Triple Witching? Triple Witching Calendar 2022

In modern trading, triple witching happens on the third Friday of March, June, September, and December (the last month of each quarter).

Upcoming Triple Witching Dates

- Friday, March 18, 2022

- Friday, June 17, 2022

- Friday, September 16, 2022

- Friday, December 16, 2022

What Is the Witching Hour?

In the U.S. stock market, the last hour of the trading day, before the closing bell, sees the most trading activity, so the witching hour is from 3–4 pm EST. In folklore, the “witching hour” actually happens in the dead of night, from 3–4 am. It was known as a time when spirits reached the height of their powers. During the Middle Ages, the Catholic Church even banned people from venturing outside during this time, so as not to get caught in the chaos.

Today, such ideas aren’t taken any more seriously than mere superstition, but triple witching can cause chaos among investors, if they are not aware of what is happening.

***

***

What Happens During Triple Witching?

As you might imagine, a lot of trading activity happens in the market when stock options, index options, and index futures contracts all expire. We’re talking a lot of money here: during Triple Witching in September 2021, for example, around $3.4 trillion of equity options expired.

So, what exactly is going on? Should they keep their hedges on? Should they speculate? Should they roll, or close out, their contracts, and if so, by how much? This is what generates the increased trading activity, and the large trades, especially from offsetting trades, can cause temporary price distortions.

At the same instant that the derivatives contracts expire, the anticipatory hedges that traders have placed become unnecessary, and so traders also seek to close these hedges, and the offsetting trades result in increased volume. These large volume increases can in turn cause price swing (i.e., volatility) in the underlying assets.

How Does Triple Witching Affect the Stock Market?

Triple witching itself doesn’t move the stock market; it just creates increased volume. In the same way, the expiration of the options and futures contracts don’t necessarily result in volatility—that’s caused by the actions that traders take based on the temporary price fluctuations of their underlying assets which can be moved due to the increased volume.

When this happens, arbitrageurs try to take advantage, often making trades that are completed in mere seconds. An arbitrageur is a trader who looks for price inefficiencies in a security and then seeks to make a profit by buying and selling it simultaneously. This practice involves much risk.

Is Triple Witching Bullish or Bearish?

Historically speaking, triple witching is not always an “up” day, and it’s not always a “down” day for the markets. It does not signify a trend. Typically, it neither moves the market significantly higher nor lower; it simply adds a temporary increase in volume and liquidity.

However, it’s important to note that market volumes also tend to be higher on index re-balancing day as well as during and after broader macroeconomic news events, and so, when taken in tandem with triple witching, these events can cause big moves in the market.

Examples of Triple Witching Volatility in Light of News Events

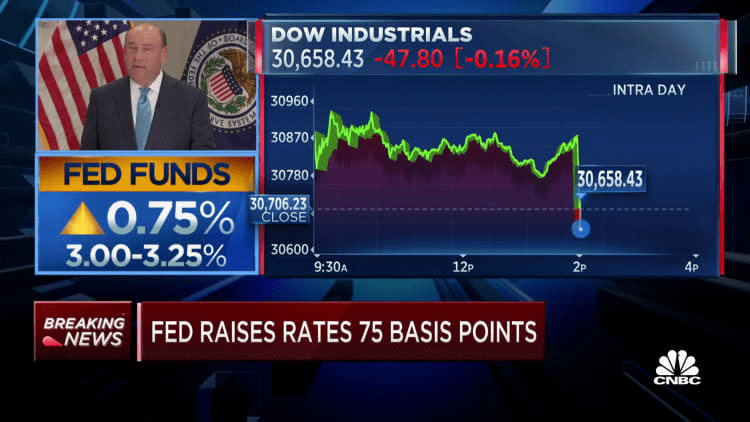

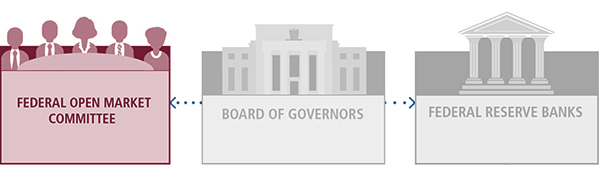

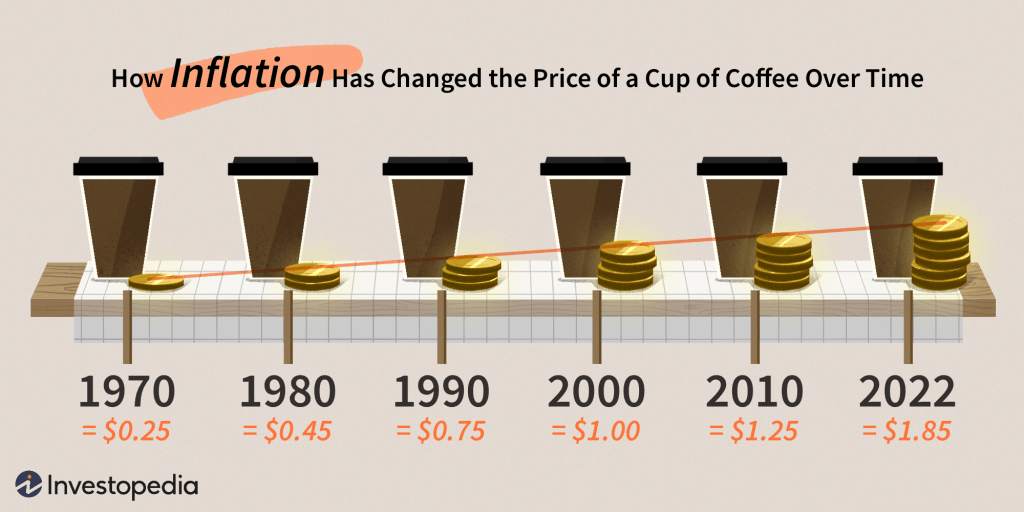

On June 18, 2021, a record number—$818 billion—of stock options expired, which led to nearly $3 trillion in “open interest,” or open contracts. On this day, the Federal Reserve also announced that it might raise interest rates in 2023 due to inflationary pressures. These news events resulted in increased volatility, and the S&P 500 lost 1.3% while the Dow Jones Industrial Average dropped 1.6%.

On September 17th, 2021, one week ahead of the Federal Reserve’s meeting, market volatility was growing based on mounting concerns about the COVID-19 Delta variant impacting the economy as well as the Federal Reserve’s announcement that it would begin to unwind its monetary stimulus. These news events, taken along with the S&P 500’s quarterly index rebalancing, which also happened that day, caused the S&P 500 to lose 1%.

Is There Such a Thing as “Quadruple” Witching?

Single Stock Futures are the fourth type of derivative contract which can expire on triple witching day. This can cause the phenomenon to be called “quadruple witching,” although one term can replace the other. Single stock futures are futures contracts placed on individual stocks, with one contract controlling 100 shares being typical. They are a hedging tool that was previously banned from trading in the United States. The Commodity Futures Modernization Act lifted the ban in 2000, and single stock futures were traded on the One Chicago Exchange from November, 2002 until September, 2020, although currently they are only available on overseas financial markets.

MORE: https://www.tradestation.com/insights/2022/02/03/quadruple-witching-dates-2022-trading/

***

How Did Triple Witching Affect 1987’s “Black Monday?”

On October 19th, 1987, the Dow Jones Industrial Average lost 22.6% in a single trading session. The day became known as “Black Monday,” but triple witching events, which took place the Friday before, on October 16, 1987, had caused the selloff of options and futures contracts to rapidly accelerate, resulting in stocks tanking in pre-day trading. The massive sell orders were left unchecked by any kinds of systematic stop gaps, and so financial markets roiled globally throughout the day. This stock market crash was the greatest one-day decline to occur since the Great Depression in 1929.

Taking lessons from the event, regulators moved the options expiration from the morning to the afternoon and put “circuit breakers” into place that would let the exchanges temporarily halt trading in the event of another massive sell off.

How Can Investors Prepare for Triple Witching Days?

The triple witching takeaway is that investors should be aware of what happens on these days and understand that there is a lot more volume in the markets. There could be some drastic price swings, but investors shouldn’t be carried away by any short-term emotions (which, really, is great advice any day in the markets).

COMMENTS APPRECIATED

Thank You

Subscribe to the Medical Executive-Post

***

https://www.amazon.com/Comprehensive-Financial-Planning-Strategies-Advisors/dp/1482240289/ref=sr_1_1?ie=UTF8&qid=1418580820&sr=8-1&keywords=david+marcinko

***

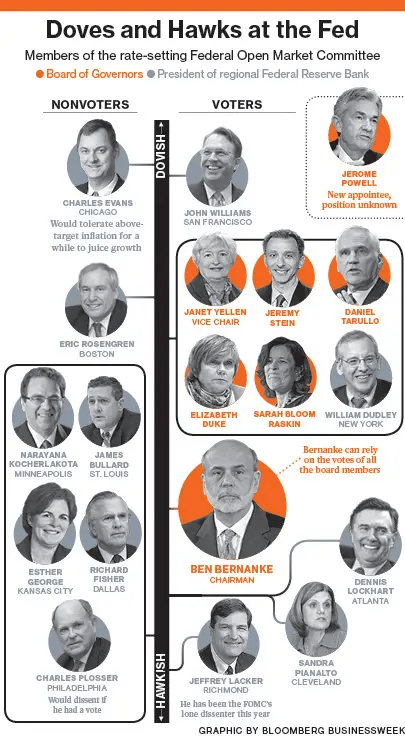

Filed under: "Ask-an-Advisor", Glossary Terms, Investing | Tagged: FOMC, index futures, index options, quadruple witching, stock options, triple witching | Leave a comment »