AND … RISK MANAGEMENT TOOL?

BY DR. DAVID EDWARD MARCINKIO MBA CMP®

SPONSOR: http://www.CertifiedMedicalPlanner.org

To start, let us all recall the Canadian physician Sir William Osler MD, one of the founders of Johns Hopkins Hospital in my hometown of Baltimore Maryland, and where I played stickball in the parking lot as a kid. He left a sizeable body of wisdom that has guided many physicians in the practice of medicine. So, allow me to share with you some of that accumulated wisdom and the quotes that have served me well over the years.

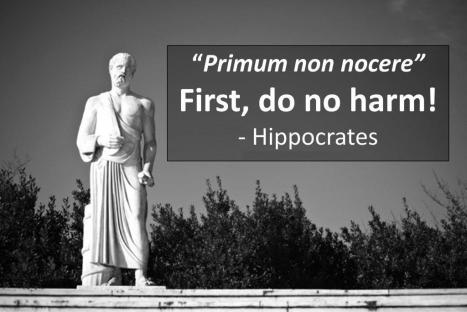

From Dr. Osler, I learned the art of putting myself in the patient’s shoes. “The motto of each of you as you undertake the examination and treatment of a case should be ‘put yourself in his place.’ Realize, so far as you can, the mental state of the patient, enter into his feelings.” Osler further stresses that we should “scan gently (the patient’s) faults” and offer the “kindly word, the cheerful greeting, the sympathetic look.”1

“In some of us, the ceaseless panorama of suffering tends to dull that fine edge of sympathy with which we started,” writes Osler in his famous essay “Aequanimitas.”2 “Against this benumbing influence, we physicians and nurses, the immediate agents of the Trust, have but one enduring corrective — the practice towards patients of the Golden Rule of Humanity as announced by Confucius: ‘What you do not like when done to yourself, do not do to others.’”

Medicine can be both art and science as many physicians have discovered. As Osler tells us, “Errors in judgment must occur in the practice of an art which consists largely of balancing probabilities.”2 Osler notes that “Medicine is a science of uncertainty and an art of probability” and also weighs in with the idea that “The practice of medicine is an art, based on science.”3,4

Osler emphasized that excellence in medicine is not an inheritance and is more fully realized with the seasoning of experience. “The art of the practice of medicine is to be learned only by experience,” says Osler. “Learn to see, learn to hear, learn to feel, learn to smell, and know that by practice alone can you become expert.”5

Finally, some timeless wisdom on patient care came from Osler in an address to St. Mary’s Hospital Medical School in London in 1907: “Gain the confidence of a patient and inspire him with hope, and the battle is half won.”6

***

***

Osler has also imparted plenty of advice on the business of medicine. In “Aequanimitas,” Osler says there are only two types of doctors: “those who practice with their brains, and those who practice with their tongues.”7

In a valedictory address to medical school graduates at McGill University, Osler suggested treating money as a side consideration in a medical career.8 “You have of course entered the profession of medicine with a view of obtaining a livelihood; but in dealing with your patients let this always be a secondary consideration.”

“You are in this profession as a calling, not as a business: as a calling which exacts from you at every turn self-sacrifice, devotion, love and tenderness to your fellow man,” explains Osler in the address to St. Mary’s Hospital Medical School.6 “Once you get down to a purely business level, your influence is gone and the true light of your life is dimmed. You must work in the missionary spirit, with a breadth of charity that raises you far above the petty jealousies of life.”

It is not easy for doctors to combine a passion for patient care, a knowledge of science and the maintenance of business, according to Osler in the British Medical Journal.9 “In the three great professions, the lawyer has to consider only his head and pocket, the parson the head and heart, while with us the head, heart, and pocket are all engaged.”

While some aspects of practice may fall short or be devoid of appropriate financial remuneration, the giving of one’s time, expertise and experience in improving patient outcomes and the quality of their lives may be the greatest gift. “The ‘good debts’ of practice, as I prefer to call them … amount to a generous sum by the end of each year,” says Osler.9

And so, as you practice medicine and reflect on your career, always remember the words and wisdom of Dr. William Osler, and keep patient welfare as your first priority.

References

1. Penfield W. Neurology in Canada and the Osler centennial. Can Med Assoc J. 1949; 61(1): 69-73

2. Osler W. Aequanimitas. Chapter 9, P. Blakiston’s Son and Co., Philadelphia, 1925, p. 159

3. Bean WB. William Osler: Aphorisms, CC Thomas, Springfield, IL, p. 129.

4. Osler W. Aequanimitas. Chapter 3, P. Blakiston’s Son and Co., Philadelphia, 1925, p. 34

5. Thayer WS. Osler the teacher. In: Osler and Other Papers. Johns Hopkins Press, Baltimore, 1931, p. 1.

6. Osler W. The reserves of life. St. Mary’s Hosp Gaz. 1907;13 (1):95-8.

7. Osler W. Aequanimitas. Chapter 7, P. Blakiston’s Son and Co., Philadelphia, 1925, p. 124

8. Osler W. Valedictory address to the graduates in medicine and surgery, McGill University. Can Med Surg J. 1874; 3:433-42.

9. Osler W. Remarks on organization in the profession. Brit Med J. 1911; 1(2614):237-9.

10. Jacobs. AM: PMNews, April, 2015.

ASSESSMENT: Your thoughts are appreciated.

ODER TEXTBOOK: https://www.routledge.com/Risk-Management-Liability-Insurance-and-Asset-Protection-Strategies-for/Marcinko-Hetico/p/book/9781498725989

INVITE DR. MARCINKO: https://medicalexecutivepost.com/dr-david-marcinkos-

THANK YOU

***

Filed under: Managed Care, Career Development, Risk Management, Insurance Matters, CMP Program, "Doctors Only", Ethics, Touring with Marcinko | Tagged: Risk Management, medical ethics, medical risk management, David Edward Marcinko, Professional Liability, william osler, osler | Leave a comment »

***

***

***

***

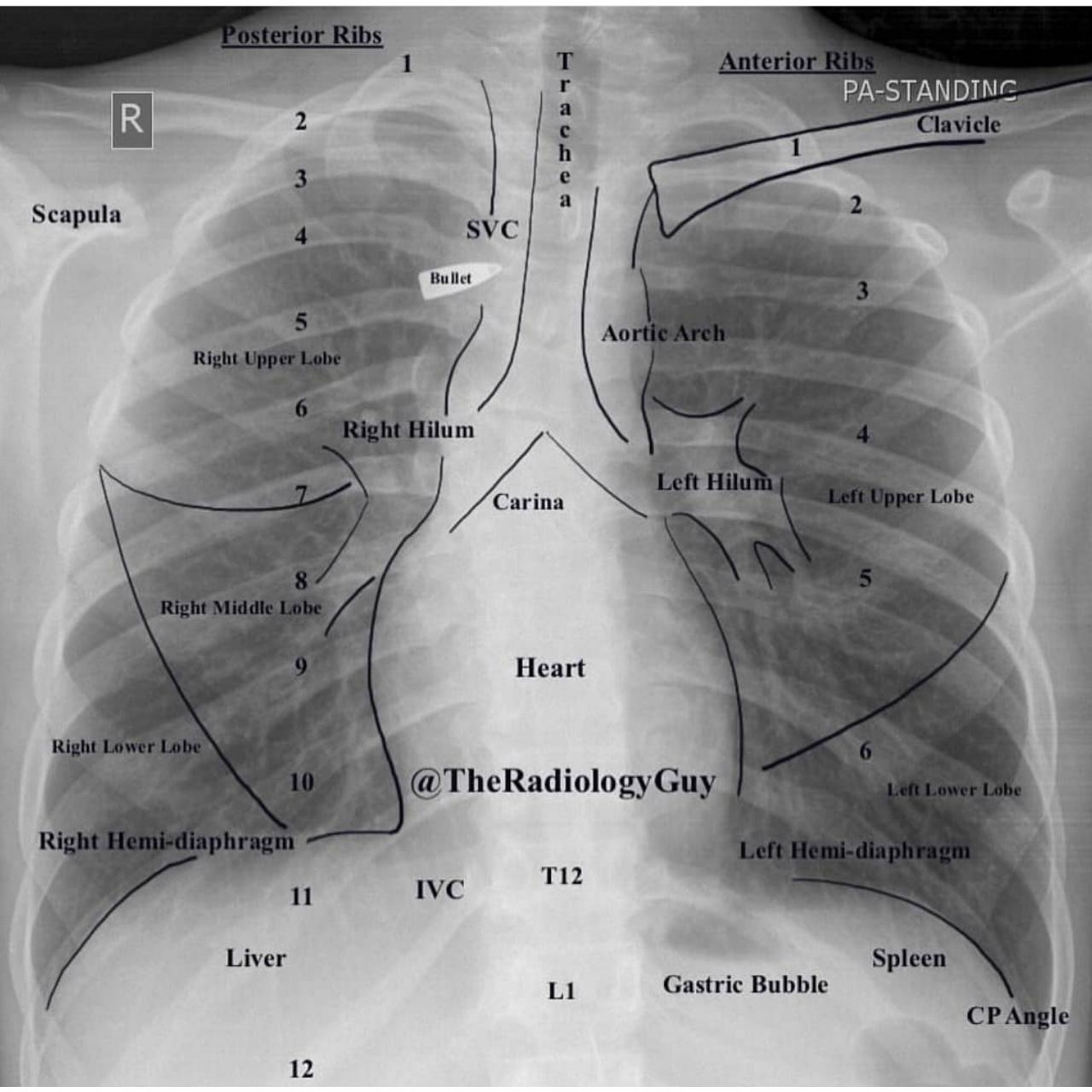

A chest radiograph showed that the mercury was distributed in the lungs in a vascular pattern that was more pronounced at the bases.

A chest radiograph showed that the mercury was distributed in the lungs in a vascular pattern that was more pronounced at the bases.