MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2024 |

REFER A COLLEAGUE: MarcinkoAdvisors@msn.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

Your Referral Count -0-

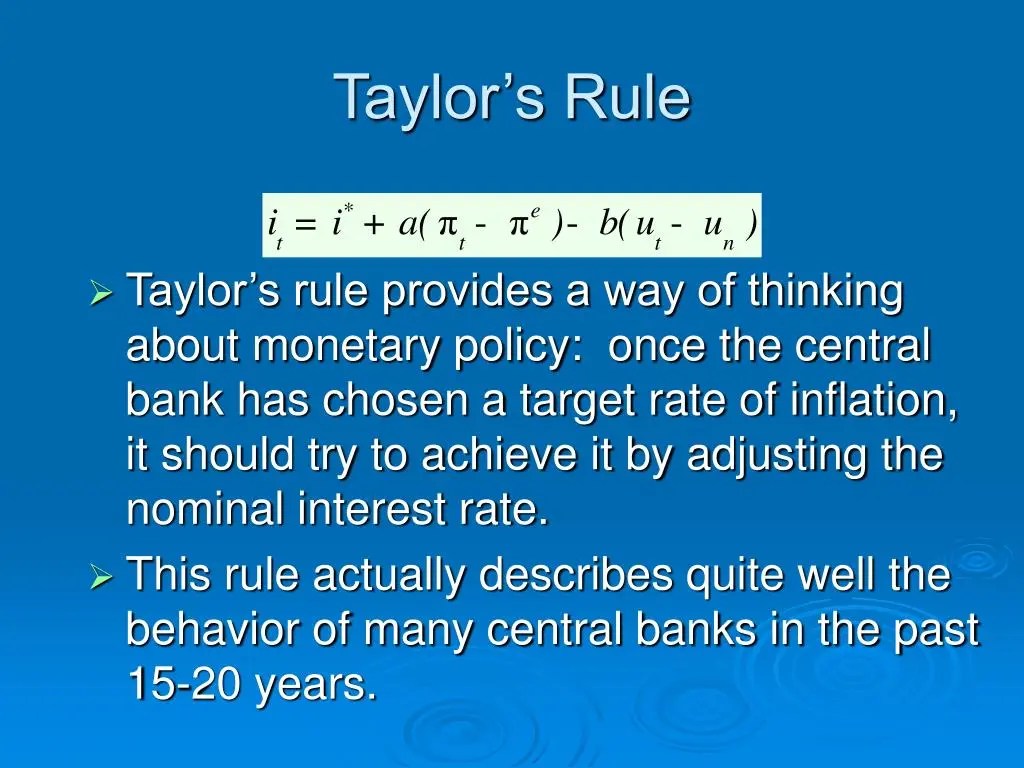

The Federal Reserve cut interest rates by 0.25 percentage points Thursday, the second consecutive cut after a two-year rate-hike run to curb post-pandemic inflation.

CITE: https://www.r2library.com/Resource

What’s up

- Lyft announced impressive earnings results thanks to more commuters using the ride-hailing service, as well as upbeat guidance for the future. Shares rose 22.92%.

- Shareholders worried about a housing market slowdown hurting Zillow had nothing to fear: The real estate website crushed earnings estimates, and shares popped 23.77%.

- Warner Bros. Discovery enjoyed its biggest single-quarter surge in subscribers ever thanks to streaming service Max, which sent shares soaring 11.81%.

- Under Armour rocketed 23.33% higher after its cost-savings plan paid off last quarter and management guided for a strong quarter ahead.

- Planet Fitness surprised shareholders with a solid quarter for the gym giant, as well as forecasts of more growth ahead. Shares climbed 11.26%.

- Prison operators GEO Group and CoreCivic both surged on Trump’s election, and their rally continued today—in-spite of very different paths forward for each stock. GEO Group gained 13.63%, while CoreCivic rose 25.60%.

What’s down

- Trump Media & Technology Group was one of the biggest winners on election night, and although the stock soared over the last few days, investors decided to take profits today. Shares sank 22.97%.

- Wolfspeed plummeted 39.24% after announcing larger-than-expected losses last quarter, poor forecasts for next quarter, and layoffs to cut costs.

- Match Group shareholders were heartbroken to hear that Tinder’s revenue fell last quarter, though strong revenue growth from Hinge helped ease the pain. Shares dropped 17.87%.

- Virgin Galactic isn’t just a mean nickname from your high school years—it’s also a space stock that can’t make money to save its life. Shares fell 11.87%.

CITE: https://tinyurl.com/2h47urt5

Here’s where the major benchmarks ended:

- The S&P 500® index (SPX) rose 44.06 points (0.74%) to 5,973.10; the Dow Jones Industrial Average® ($DJI) fell 0.59 points (0.00%) to 43,729.34; and the NASDAQ Composite® ($COMP) gained 285.99 points (1.51%) to 19,269.46.

- The 10-year Treasury note yield (TNX) fell nine basis points to 4.34%, with most of the drop coming long before the Fed decision.

- The CBOE Volatility Index® (VIX) continued its post-election plunge to 15.21.

CITE: https://tinyurl.com/tj8smmes

Visualize: How private equity tangled banks in a web of debt, from the Financial Times.

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@msn.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

Filed under: "Ask-an-Advisor", Funding Basics, Glossary Terms, Information Technology, Investing, Marcinko Associates, Recommended Books, Sponsors | Tagged: DJIA, DOW, economy, finance, FOMC, inflation, interest rates, Investing, Marcinko, NASA, NASDAQ, S&P 500, textbooks, TNX, VIX, WSJ | Leave a comment »