It’s never a source of pride stepping out of a dirty car or truck, especially for image conscious doctors. But, keeping your vehicle looking like new, for the doctor’s parking lot, is tough work. Sure, you may take it through the drive-thru car wash every now and then, but that isn’t the deep cleaning that your car deserves. All in the Details Detailing, on the other hand, is promised to give your beloved vehicle that ‘new-car’ feeling all over again. It isn’t easy work, but the results are amazing. While you could detail your car at home, is it really worth it? Let’s take a look at why letting the pros detail your vehicle is the way to go – or – not! Working at the Car Wash When you wash your vehicle at a drive-thru car wash, you may be doing more harm than good. If the car wash has brushes or pieces of cloth that scrub your vehicle as it goes through, these components can easily scratch your car’s finish. All of the bits of dirt from cars before can be trapped in the cloth and brushes, and as they scrub your vehicle, they act as sandpaper, permanently marring your paint. One step better is hand washing your car at home, but even then, you must be careful to not just become a humanized version of the car wash. Using two buckets is a good start, with one bucket being a rinse bucket to remove the dirt from your sponge, and the other containing the soap.

SOAP Suds – Not SOAP Notes Also, be careful of the type of soaps and car care products being used. The interior and exterior cleaners found at the local parts store are often of decent quality, but they aren’t always the best, and they must be used properly. Even then, for a normal car owner, detailing a car can become an all-day task, sometimes with less than perfect results. Don’t forget to use a clay bar or brick followed by your favorite Carnuba wax, too. The Pros So, why should you let the pros handle your detailing needs? They should know exactly what specialty products are right for your vehicle to get the perfect results every time. And, they know the techniques that will yield showroom-finish results while you don’t have to even touch your car. And, while you won’t want to clean out all the dried soda, coffee stains, or leftover cheeseburger wrappers from under your seat, they will gladly do it for you – for a price. Imagine Just picture getting into a blindingly shiny, clean vehicle with an interior that looks equally as pristine. No more purchasing all kinds of car care products that don’t deliver results. No more spending hours in the driveway getting soaked and frustrated. No more wasted time. Pros know what it takes to detail your vehicle to concourse standards. But then, it is just a job for them. It is a labor of love for me. Am I neurotic or compulsive? |

More:

Assessment

My near showroom and mint conditioned 2000 Jaguar XJ-V8-L is a full-size luxury sedan, offers sporting drive characteristics, mixed with a classic style and interior comfort. It was available in multiple trims which all came very well equipped with upscale amenities.

And, this extended wheelbase version offers much more rear seat leg room for long and winding Georgia road trips. The standard steel engine [not nikasil] in this XJ is a 4.0L V8 which produces 290 hp. The upper and lower timing chain tensioners are original, second generation metal, not plastic.

There is also a supercharged version of this vehicle which bumps output to an impressive 370 hp. Even with all of its power and weight, my XJ-8-L is still rated at over 20 mpg on the highway. Ammenities and upgrades include a mobile phone, Magellan GPS, LoJack theft recovery system, CD and MP-3 players, with internal and external cable antenna for satellite radio.

What a Cat? She is my third favorite female after my intelligent and beautiful wife, and smart and lovely daughter.

Conclusion

Are you a DIYer, like me? Nothing says you care more than doing it yourself.

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

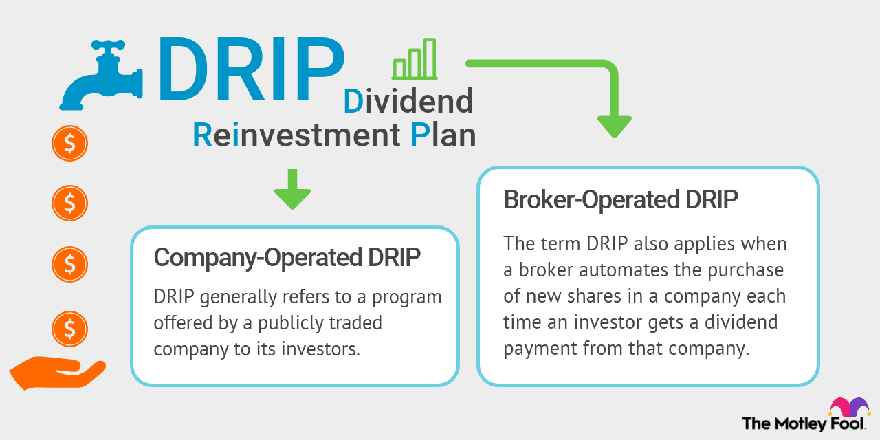

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: "Doctors Only", iMBA, Inc., LifeStyle, Touring with Marcinko | Tagged: Automobile Detailing, car wash, car wax, Marcinko | 9 Comments »