The Day the Dow Jones Industrial Average Lost 150 Points

By Lon Jefferies, MBA CFP™ http://www.NetWorthAdvice.com

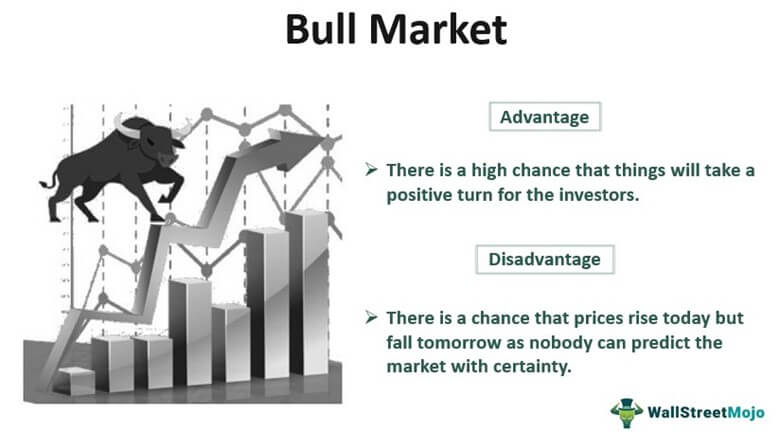

The stock market just reached an all time high, crossing 15,000 for the first time.

The stock market just reached an all time high, crossing 15,000 for the first time.

But, within three minutes during last April 23, 2013, the Dow Jones Industrial Average lost nearly 150 points, and approximately $136 billion of market value was wiped out. The recovery was just as fast, and markets returned to having a profitable session (both the Dow and the S&P 500 were up over 1% for the day). The crash and recovery both happened so fast that many Americans, and physician-investors, weren’t even aware of the events.

So what happened?

On Tweeting

Believe it or not, the crash was caused by a tweet – a 140 character message posted on Twitter. The Associated Press Twitter account — which has nearly 2 million followers — was hacked and a false tweet of “Breaking: Two Explosions in the White House and Barack Obama is Injured” was posted. The message was quickly debunked by the President’s staff and markets corrected themselves. Both the crash and recovery took place in less than five minutes.

Lessons Learned

Several lessons were learned that day.

First, the power of social media is now undeniable. This was caused by a simple twelve-word lie on the internet. Further, information about the market collapse and recovery were widespread via Twitter and Facebook instantaneously, while the whole episode was over before television networks had a chance to report the events.

Second, it’s amazing how fragile our world is these days. News regarding terrorism has the potential to dramatically affect the market as well as other important aspects of our lives. It’s concerning how the world might respond if the President really was injured. (Interestingly, however, the market didn’t suffer after the Boston Marathon tragedy.)

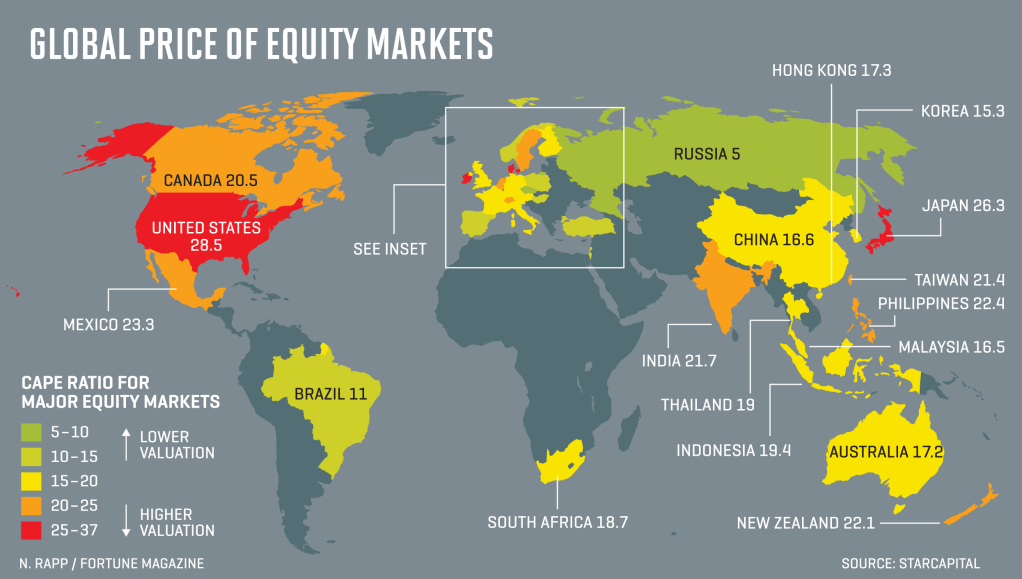

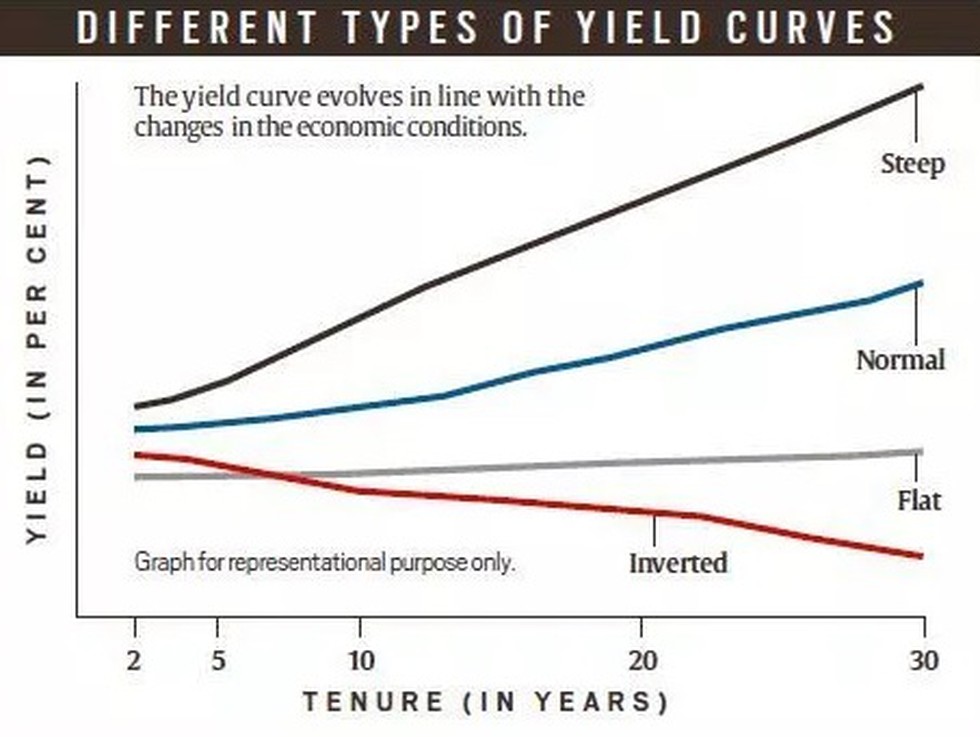

Third, it is fascinating to examine how different asset categories responded in a time of perceived crisis. Investors build diversified portfolios hoping that when one asset category collapses, another asset class will rally. Some investors swear that gold will be the asset to own when the world struggles. Yet, when the market experienced a flash crash, gold did not rally but treasury bonds and the Japanese Yen did. Gold investors shouldn’t be as confident in their investment after this experience.

Finally, automated trading platforms have become more prevalent in the stock market. These tools execute mandatory, instant sell orders in defined market environments. When the crash occurred, algorithms read headlines and saw the initial market reaction and computers created automatic sell orders at what turned out to be the worst possible time. Traders utilizing automatic trading mechanisms with stop-loss orders suffered exaggerated losses, as they sold right after the market dip and didn’t participate in the recovery. This is a potential weakness of automatic trading that many didn’t recognize.

Assessment

Why are many physician-investors unaware of this unusual market event? In reality, this drastic swing didn’t affect most investors hoping to improve their retirement. Individuals with a long-term investment strategy built around their risk tolerance don’t need to worry about these types of short-term market errors. At the end of the day, “buy-and-hold” investors had nothing to worry about and came out ahead. Perhaps we should be bragging via Twitter…

More:

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Health Dictionary Series: http://www.springerpub.com/Search/marcinko

Practice Management: http://www.springerpub.com/product/9780826105752

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Hospitals: http://www.crcpress.com/product/isbn/9781439879900

Physician Advisors: www.CertifiedMedicalPlanner.org

Filed under: Investing | Tagged: Boston Marathon tragedy, Dow Jones Industrial Average, Facebook, Flash Crash, Gold investors, http://www.NetWorthAdvice.com, Lon Jefferies, S&P, twitter | 1 Comment »