SPONSOR: http://www.CertifiedMedicalPlanner.org

Dr. David Edward Marcinko MBA MEd

***

***

A Turning Point in U.S. Drug Policy

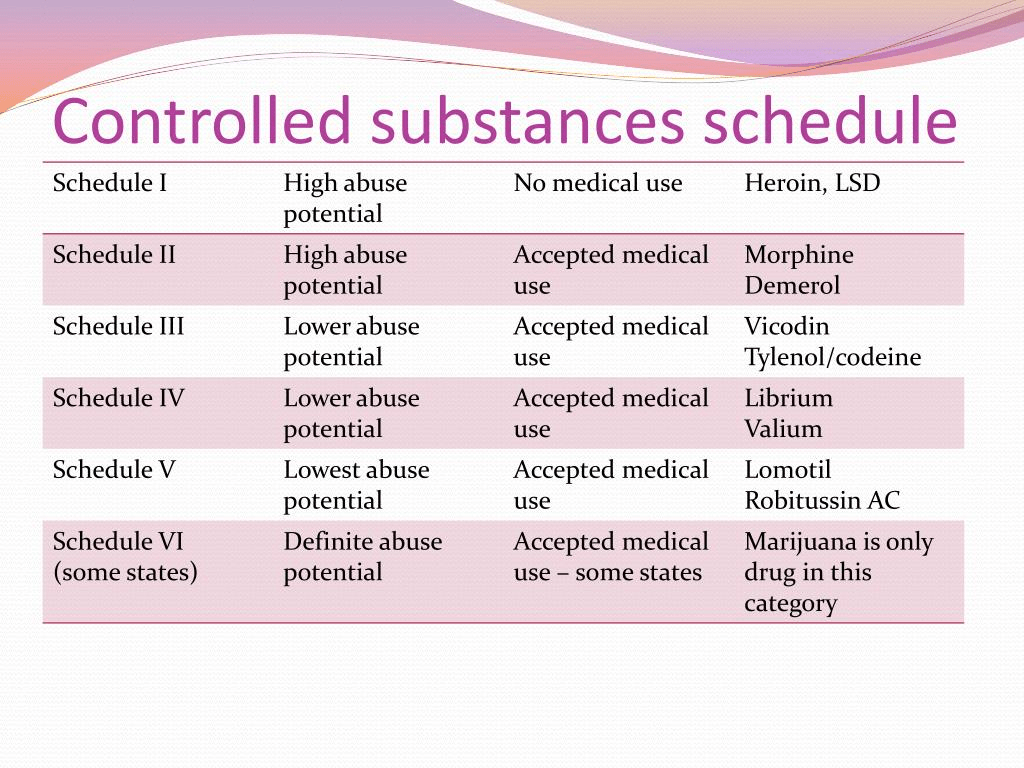

The recent decision by the Drug Enforcement Administration (DEA) to reschedule marijuana marks one of the most significant shifts in American drug policy in decades. For much of the twentieth century, marijuana was classified as a Schedule I substance under the Controlled Substances Act, a category reserved for drugs deemed to have no accepted medical use and a high potential for abuse. This classification placed marijuana alongside heroin and LSD, creating a legal framework that severely restricted research, medical application, and broader societal acceptance. The DEA’s move to reschedule marijuana represents not only a change in how the government views cannabis but also a reflection of evolving public attitudes, scientific evidence, and political realities.

At its core, rescheduling marijuana acknowledges its medical utility. Over the past several decades, a growing body of research has demonstrated that cannabis can provide relief for conditions such as chronic pain, epilepsy, multiple sclerosis, and chemotherapy-induced nausea. Patients across the country have long advocated for access to marijuana as a therapeutic option, often finding themselves caught between state-level legalization and federal prohibition. By rescheduling marijuana, the DEA effectively concedes that cannabis has legitimate medical applications, opening the door for more comprehensive research and standardized medical use. This shift is expected to encourage pharmaceutical development, clinical trials, and greater integration of cannabis into mainstream healthcare.

***

***

The rescheduling also carries profound implications for the criminal justice system. For decades, marijuana prohibition contributed to mass incarceration, disproportionately affecting communities of color. Even as many states legalized cannabis for medical or recreational use, federal law maintained its prohibition, creating inconsistencies and perpetuating penalties. By lowering marijuana’s classification, the DEA reduces the severity of federal penalties associated with its possession and distribution. While rescheduling does not equate to full legalization, it signals a move toward a more rational and less punitive approach. Advocates hope this change will pave the way for broader reforms, including expungement of past convictions and greater equity in the emerging cannabis industry.

Economically, the DEA’s decision is likely to accelerate the growth of the cannabis sector. Already, legal marijuana is a multibillion-dollar industry, generating tax revenue, creating jobs, and attracting investment. Federal rescheduling provides legitimacy that could encourage banks, insurers, and other institutions to engage with cannabis businesses more openly. This could reduce the financial barriers that have hampered the industry, particularly for small and minority-owned enterprises. Moreover, rescheduling may help align federal and state regulations, reducing the patchwork of conflicting laws that currently complicates commerce and enforcement.

Politically, the DEA’s move reflects the growing consensus among Americans that marijuana should no longer be treated as a dangerous, illicit substance. Polls consistently show strong support for legalization, both medical and recreational. Lawmakers across the political spectrum have responded to this shift, introducing legislation to reform cannabis policy at the federal level. The DEA’s rescheduling can be seen as a cautious step, balancing scientific evidence and public opinion while avoiding the more radical leap to full legalization. It demonstrates how federal agencies adapt to changing social norms, even when those changes challenge decades of entrenched policy.

***

***

Despite its significance, rescheduling marijuana is not without limitations. Cannabis remains subject to federal regulation, and its new classification still imposes restrictions on research, distribution, and use. The decision does not resolve the tension between state legalization and federal prohibition, nor does it automatically address issues such as interstate commerce or taxation. Critics argue that rescheduling is only a partial solution, and that full legalization or descheduling is necessary to truly modernize cannabis policy. Nonetheless, the DEA’s action represents a meaningful step forward, signaling that the federal government is willing to reconsider outdated assumptions about marijuana.

In conclusion, the DEA’s rescheduling of marijuana is a landmark moment in U.S. drug policy. It acknowledges the medical value of cannabis, reduces punitive measures, and legitimizes a rapidly growing industry. While challenges remain, the decision reflects a broader societal shift toward acceptance and rational regulation. For patients, entrepreneurs, and communities long affected by prohibition, rescheduling offers hope that the future of cannabis in America will be guided less by stigma and more by science, justice, and economic opportunity.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: iMBA, Inc. | Tagged: david marcinko | Leave a comment »