MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2025 |

REFER A COLLEAGUE: MarcinkoAdvisors@outlook.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

Your Referral Count -0-

***

CITE: https://www.r2library.com/Resource

A June 11th report from global professional services firm Alvarez & Marsal (A&M) predicts that more beneficiaries might soon ditch insurance coverage for options like short-term, limited duration plans or healthcare sharing ministries (HCSMs), which aren’t regulated like health insurance and aren’t required to comply with ACA protections like covering maternity care or pre-existing conditions.

CITE: https://tinyurl.com/2h47urt5

🟢 What’s up

- Nvidia extended its winning streak to five days, rising another 1.73% as the AI trade continues to recover.

- EchoStar climbed 13.16% after the parent company of Dish TV disclosed that President Trump did in fact prod the FCC to make a deal.

- Cyngn soared another 20.07% following a big day of gains after the company that makes self-driving tech for industrial vehicles announced a partnership with Nvidia.

- Strong earnings from Nike (more on that later) propelled sporting goods stocks higher today. ON Holdings rose 1.74%, while Dick’s Sporting Goods climbed 3.59%.

- Domestic power producers popped on reports that Trump is planning to issue an executive order increasing energy production to meet AI demand. Vistra gained 2.44%, GE Vernova climbed 2.54%, and Vertiv added 2.71%.

What’s down

What’s down

- Coinbase Global ended its winning streak, tumbling 5.77% after GENIUS Act hype propelled the crypto stock skyward all week long. Traders took profits in Circle as well, pushing the stablecoin stock down 15.54%.

- Chinese EV maker Li Auto fell 1.93% on its weaker-than-expected deliveries forecast for the second quarter.

- Fellow Chinese EV maker Xiaomi stunned markets with reports that it received 240,000 orders for its new SUV within 18 hours of its debut, but shares still sank 4%.

- Pony.ai lost 6.31% on a report that Uber is considering helping its founder Travis Kalanick fund his acquisition of the US subsidiary of the Chinese autonomous vehicle company.

- Gold miners tumbled while the price of the precious metal fell as investors took a risk-on stance. Newmont lost 4.11%, Barrick Mining fell 3.44%, and Kinross Gold shed 6.18%.

- Today’s trade deal reopens the door for Chinese rare earth imports, bad news for US producers like MP Materials (down 8.59%) and USA Rare Earth (down 12.14%).

CITE: https://tinyurl.com/tj8smmes

Visualize: How private equity tangled banks in a web of debt, from the Financial Times.

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@outlook.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

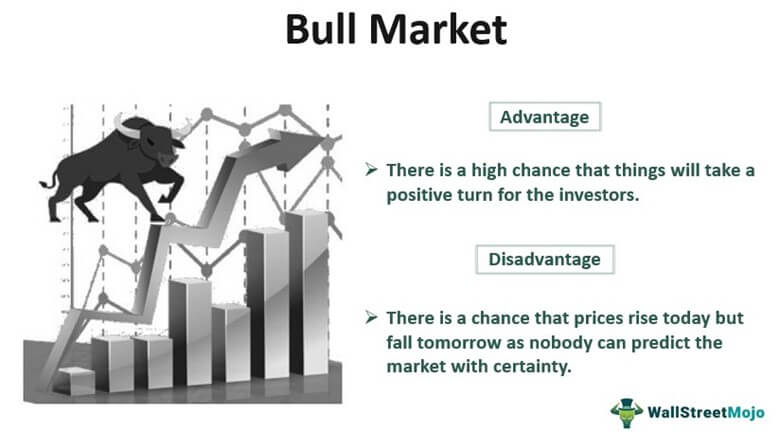

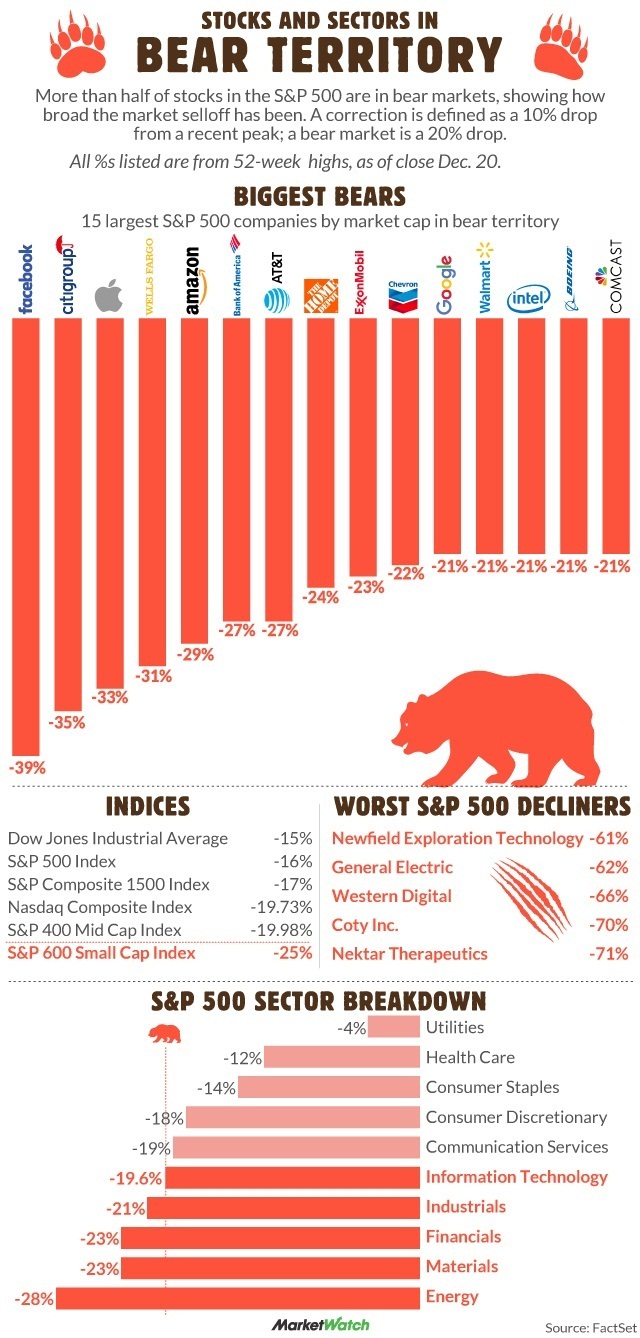

Filed under: "Ask-an-Advisor", Drugs and Pharma, Ethics, Experts Invited, finance, Glossary Terms, Health Economics, Health Insurance, Healthcare Finance, Information Technology, Insurance Matters, Investing, Marcinko Associates, Portfolio Management, Recommended Books, Sponsors | Tagged: ACA, Alvarez & Marsal, bull market, DJIA, DOW, HCSMs, Health Insurance, insurance, life insurance, Marcinko, NASDAQ, PBMs, personal-finance, S&P 500, textbooks, VIX | Leave a comment »