We don’t plan to fail – We fail to plan

[By Dr. David Edward Marcinko MBA CMP™]

http://www.CertifiedMedicalPlanner.org

Our newest textbook COMPREHENSIVE FINANCIAL PLANNING STRATEGIES FOR DOCTORS AND ADVISORS [Best Practices from Leading Consultants and Certified Medical Planners™] will shape the physician-focused financial planning landscape for the next-generation of Health 2.0 medical professionals and their financial advisors.

Why Now?

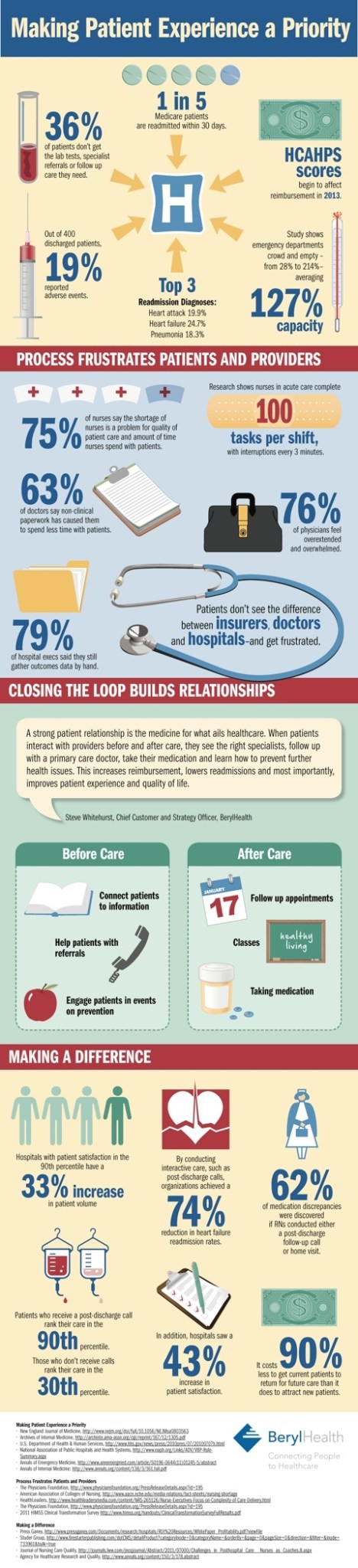

We created this innovative textbook because the healthcare industry is rapidly changing and the financial planning ecosystem has not kept pace. Traditional insurance-commission and sales-driven generic advice is yielding to a new breed of deeply informed fiduciary advisor, and educated consultant, or Certified Medical Planner (CMP™). Internet and social media of the last decade demonstrates that medical providers are becoming accustomed to the need for knowledgeable advice. And so, financial planning is set to be transformed by “market disruptors” that will soon make an impact on the $2.8 trillion healthcare marketplace for those financial advisers serving this sector.

We are at the leading edge of this positive disruption — also known as niche based Financial Planning 2.0 — that over time will see today’s command-controlled financial services industry becomes a wide open academic marketplace. And, a growing cadre of specialty entrants is poised to shake up the industry drawing billions of dollars in revenue from traditional broker-dealer organizations while building lucrative new markets.

For example, an iMBA Inc survey points to the growing need for financial advisors to serve current and future medical professionals thanks to their eagerness to seek premium financial planning solutions from non-traditional sources and providers; like the online Certified Medical Planner™ charter designation program. The industry is ripe for a shakeup and physician focused financial planning will soon have its own new brands. We aim to be among the first-movers and top tier names in the industry.

How We Are Different?

COMPREHENSIVE FINANCIAL PLANNING STRATEGIES FOR DOCTORS AND ADVISORS [Best Practices from Leading Consultants and Certified Medical Planners™] will change this niche industry sector by following eight important principles.

1. First, we have assembled a world-class editorial advisory board and independent team of contributors and reviewers and asked them to draw on their experiences in contemporaneous healthcare focused financial planning. Like many of their physician and nurse clients, each struggles mightily with the decreasing revenues, increasing costs, automation, SEC scrutiny and higher physician-client expectations in today’s competitive financial advisory and technological landscape. Yet, their practical experience and physician focused education, knowledge and vision is a source of objective information, informed opinion and crucial information to all consultants working with doctors and medical professionals in the financial services field.

2. Second, our writing style allows us to condense a great deal of information into one volume. We integrate bullet points and tables; pithy language, prose and specialty perspectives with real world examples and case models. The result is an oeuvre of integrated financial planning principles vital to all modern physicians and allied healthcare professionals.

3. Third, to the best of our knowledge, this is the first peer-reviewed book of its type, as we seek to follow traditional medical research and journal publishing guidelines for best practices. We present differing viewpoints, divergent and opposing stake-holder perspectives, and informed personal and professional opinions. Each chapter has been reviewed by one to three outside independent reviewers and critical thinkers. We include references and citations, and although we cannot rule out all biases, we do strive to make them transparent to the extent possible.

4. Fourth, our perspective is decidedly from the physician-client side of the equation. More specifically, as consultants to medical professionals, we champion the physician-investor over the financial advisor. And, to the extent that both sides ethically succeed; we hope all concerned “do well – by doing good”. This is unique in the fee and commission driven financial services industry. Much like the emerging patient-centered care initiative in medicine, we call it client-centered advice.

5. Fifth, it is important to note that deep specificity and niche knowledge is needed when advising physicians and healthcare providers. And so, we present information directly from that space, and not by indirect example from other industries, as is the unfortunate norm. Medical case models, healthcare industry examples, and anecdotal insights from the Over Heard in the Doctor’s Lounge, and Over Heard in the Advisor’s Lounge features, are also included. Finally, personalized financial planning for all medical professionals is our core, and only focus.

6. Sixth, this textbook represents an academic template for about 25 percent [125/500 credit hours] of the Certified Medical Planner™ chartered professional online certification program curriculum. It is useful for those studying, auditing, or considering matriculation for this prestigious designation mark.

7. Seventh, we include a glossary-of-terms specific to the text, a list of comprehensive advice sources, and three illustrative physician-specific financial plan examples additionally available by separate order.

8. Finally, as editor, we prefer engaged readers who demand compelling content. According to conventional wisdom, printed texts like this one should be a relic of the past; from an era before instant messaging and high-speed connectivity. Our experience shows just the opposite. Applied physician focused personal financial planning literature, from informed fiduciary sources, is woefully sparse; just as a plethora of generalized internet information makes that material less valuable to doctor clients.

***

***

A Seminal Work

And so, rest assured that COMPREHENSIVE FINANCIAL PLANNING STRATEGIES FOR DOCTORS AND ADVISORS [Best Practices from Leading Consultants and Certified Medical Planners™] will become a seminal book for the advancement of personal financial planning and related personal micro-economic principles in this niche ecosystem.

In the years ahead, we trust these principles will enhance utility and add value to your book. Most importantly, we hope to increase your return on investment by some small increment.

If you have any comments or would like to contribute material or suggest topics for future editions please contact me.

More:

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Comprehensive Financial Planning Strategies for Doctors and Advisors: Best Practices from Leading Consultants

Filed under: Book Reviews, CMP Program, Financial Planning, iMBA, Inc., Touring with Marcinko | Tagged: certified medical planner, CMP™ Course, david marcinko, Financial Planning | 2 Comments »

***

***