By Staff Reporters

***

***

April Fools’ Day—occurring on April 1 each year—has been celebrated for several centuries by different cultures, though its exact origins remain a mystery. April Fools’ Day traditions include playing hoaxes or practical jokes on others, often yelling “April Fools!” at the end to clue in the subject of the April Fools’ Day prank. While its exact history is shrouded in mystery, the embrace of April Fools’ Day jokes by the media and major brands has ensured the unofficial holiday’s long life.

CITE: https://www.r2library.com/Resource/Title/082610254

***

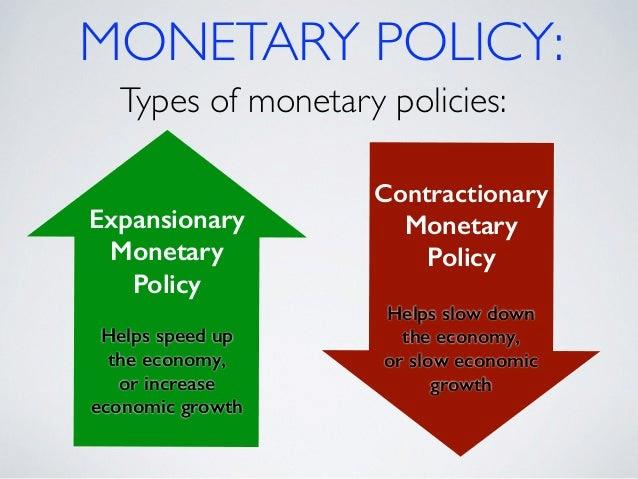

Investors celebrated a lower-than-expected reading on the Federal Reserve’s preferred inflation gauge by driving major U.S. stock indexes higher Friday, the last trading day of the first quarter. Sentiment got a boost after reports that the personal consumption expenditures (PCE) index rose 0.3% in February, a little below the 0.4% economists were expecting, and 5% from the same month a year ago. Core PCE inflation, which excludes volatile food and inflation prices, was also up 0.3% from the previous month and 4.6% from a year earlier. PCE and core PCE both rose 0.6% in January from the month before.

Despite wild fluctuation due to continuous rate hikes from the Fed and an unexpected bank panic, stocks and bonds managed to turn in a pretty, pretty, pretty good performance for the quarter. The S&P 500 gained 7%, and the Dow Jones Industrial Average gained 0.4%.

But, tech companies were indisputably the market leaders.

CITE: https://www.amazon.com/Comprehensive-Financial-Planning-Strategies-Advisors/dp/1482240289/ref=sr_1_1?ie=UTF8&qid=1418580820&sr=8-1&keywords=david+marcinko

LEADERS

Wall Street rewarded tech companies’ layoffs and other cost cutting measures, giving tech stocks a resurgence. And with ChatGPT becoming a household name, investors have their money on generative AI as the next big bet. As of last night:

- The tech-heavy NASDAQ Composite index rose a whopping 18% since January 1st, its largest quarterly gain in two years.

- Stocks of the tech giants leading the charge in AI-powered search, Microsoft and Alphabet, are up 20% and 16%, respectively.

Bitcoin surged 72%.

CITE: https://www.amazon.com/Dictionary-Health-Information-Technology-Security/dp/0826149952/ref=sr_1_5?ie=UTF8&s=books&qid=1254413315&sr=1-5

LAGGARDS

Bank stocks were a delight for short sellers, who made $2 billion betting against the sector in the past three months.

- Smaller institutions were most badly injured by the bank panic: The SPRD S&P Regional Banking ETF, which consists of non-behemoth banks, had more than a quarter of its value wiped out in Q1.

- Large banks are feeling the pinch of rising interest rates: Global merger and acquisition deals suffered the biggest first-quarter decline since 2001, according to data analyzed by the Financial Times.

“The 0.3% monthly increase in core PCE was a step in the right direction but suggests the path to 2% inflation will still likely be long and bumpy,” says Collin Martin, a fixed income strategist at the Schwab Center for Financial Research.

CITE: https://www.amazon.com/Comprehensive-Financial-Planning-Strategies-Advisors/dp/1482240289/ref=sr_1_1?ie=UTF8&qid=1418580820&sr=8-1&keywords=david+marcinko

Here’s how the major indexes performed Friday.

- The S&P 500 Index rose 58 points (1.44%) to 4109.05; the Dow Jones industrial average was up 415 points (1.26%) at 33274.15; the NASDAQ Composite was up 208 points (1.74%) at 12221.91.

- The 10-year Treasury yield slipped seven basis points to 3.482%.

- CBOEs Volatility Index was down 22 basis points (1.16%) at 18.78.

***

ORDER: https://www.routledge.com/Comprehensive-Financial-Planning-Strategies-for-Doctors-and-Advisors-Best/Marcinko-Hetico/p/book/9781482240283

***

COMMENTS APPRECIATED

Thank You

***

Filed under: "Ask-an-Advisor", Alerts Sign-Up, Experts Invited, Information Technology, Investing, LifeStyle | Tagged: April, April Fool's Day, CBOE, ChatGPT, Collin Martin, DJIA, DOW, fed, Financial Times, FOMC, fool, NASDAQ, PCE, S&P 500, Schwab, Volatility Index | Leave a comment »