Updating Competitive Strategy Theory in Healthcare

By Robert James Cimasi; MHA ASA FRICs MCBA AVA CM&AA

By Todd A. Zigrang; MBA MHA ASA FACHE

By Anne P. Sharamitaro; Esq.

Michael Porter[i] is considered by many to be one of the world’s leading authorities on competitive strategy and international competitiveness. In 1980, he published Competitive Strategy: Techniques for Analyzing Industries and Competitors,[ii] in which he argues that all businesses must respond to five competitive forces.

(1) The Threat of New Market Entrants

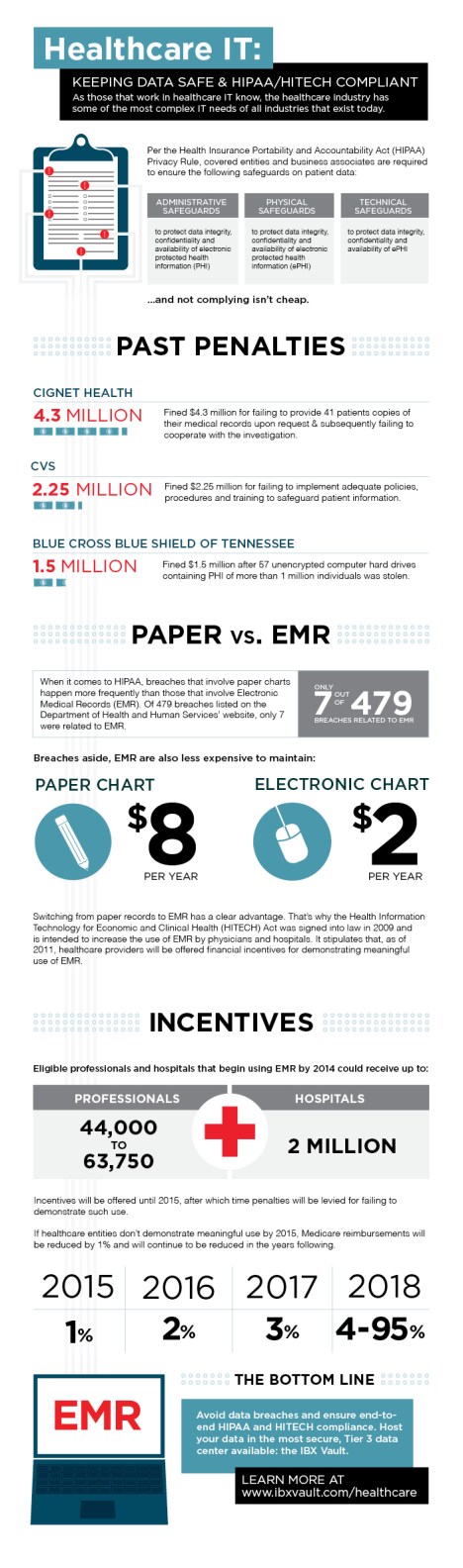

This force may be defined as the risk of a similar company entering the marketplace and winning business. There are many barriers to entry of new market entrants in healthcare including: the high cost of equipment, licensure, requirement for physicians and other highly trained technicians, development of physician referral networks and provider contracts, and other significant regulatory requirements.

Certificate of Need (CON) laws, which require governmental approval for new healthcare facilities, equipment, and services have been in place since they were federally mandated in 1974. State CON laws create a regulatory barrier to entry. New medical provider entrants commonly face substantial political opposition by established interests, which is manifested in the CON review process.

(2) The Bargaining Power of Suppliers

A supplier can be defined as any business relationship upon which a business relies to deliver a product, service, or outcome. Healthcare equipment is a highly technical product produced by a limited number of manufacturers. This reduces the range of choices for providers and can increase costs.

(3) Threats from Substitute Products or Services

Substitute products or services are those that are sufficiently equivalent in function or utility to offer consumers an alternate choice of product or service. An illustration of this in healthcare would be diagnostic imaging as a substitute for surgery, which is often a more costly and risky option for patients. The threat of less invasive or less expensive diagnostic tests other than diagnostic imaging is relatively small for the near term future.

(4) The Bargaining Power of Buyers

This force is the degree of negotiating leverage of an industry’s buyers or customers. The buyers of healthcare services are ultimately the patients. However, the competitive force of buyers is manifested through healthcare insurers including the U.S. and state governments through the Medicare, Medicaid, TRICARE, and other programs; managed care payors (e.g., Blue Cross/Blue Shield affiliates); workers’ compensation insurers; and, others. In addition to the government, many of these healthcare insurers are large, national companies, often publicly traded, commanding significant bargaining power over healthcare provider reimbursement.

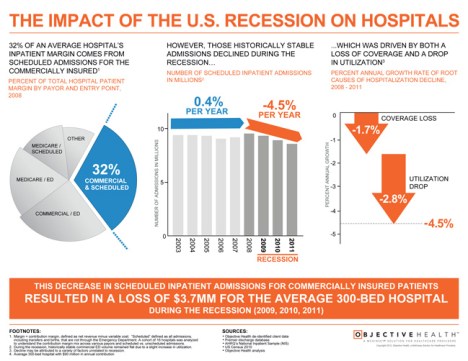

(5) Rivalry Amongst Existing Firms

This is ongoing competition between existing firms without consideration of the other competitive forces which define industries. Healthcare providers face pressure from other existing providers to obtain favorable provider contracts; maintain the latest technology; increase efficiencies; and, lower prices.

References:

[i] A professor of Business Administration at the Harvard Business School, Michael Porter serves as an advisor to heads of state, governors, mayors, and CEOs throughout the world. The recipient of the Wells Prize in Economics, the Adam Smith Award, three McKinsey Awards, and honorary doctorates from the Stockholm School of Economics and six other universities, Porter is the author of fourteen books, among them Competitive Advantage, The Competitive Advantage of Nations, and Cases in Competitive Strategy.

[ii] Porter, M.E. Competitive Strategy: Techniques for Analyzing Industries and Competitors. The Free Press, 1980.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

DICTIONARIES: http://www.springerpub.com/Search/marcinko

PHYSICIANS: www.MedicalBusinessAdvisors.com

PRACTICES: www.BusinessofMedicalPractice.com

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

ADVISORS: www.CertifiedMedicalPlanner.org

PODIATRISTS: www.PodiatryPrep.com

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Practice Management | Tagged: Certificate of Need, CON, Medicaid, medicare, michael porter, robert james cimasi, TRICARE, Understanding Healthcare Market Competition | 6 Comments »