Even When You Shouldn’t Ask

By Staff Writers

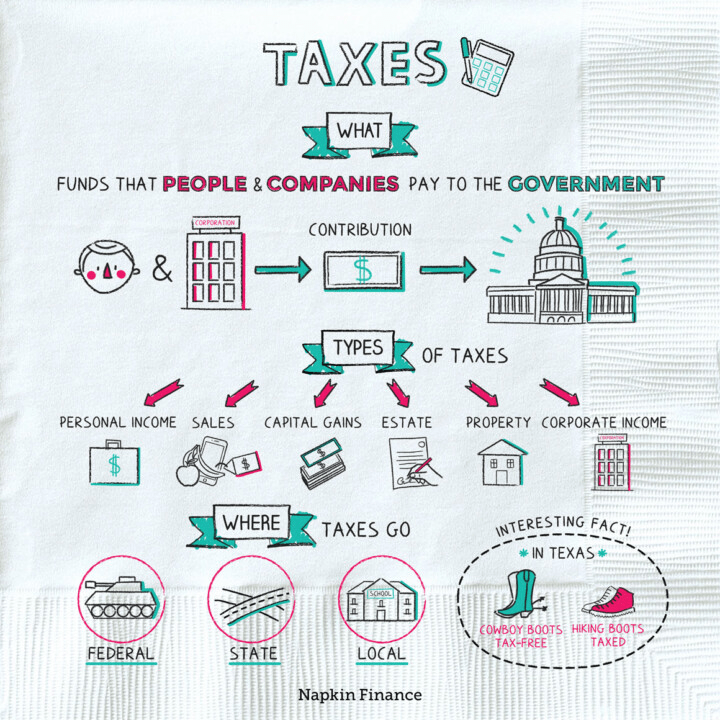

Our complex tax system has sparked moves toward a flat tax in 2008 and other efforts at simplification. But until such a change occurs—if it ever does—we are stuck with what we have. This means many doctors and all taxpayers will continue to be confused and uncertain about their tax situations, and they will have a lot of questions.

The IRS Source

According to many experts, the IRS, which should be the best source for doctor answers, does not come through nearly often enough. But, it does offer some options. Which one you choose depends on the complexity and nature of the problem. Some simple, straightforward questions may be readily answered by a phone call. But for questions that are more complicated, it might be better to do it in a letter—following IRS guidelines—and get a written answer. And, in some cases, you may be better off not asking the question in the first place.

Phoning the IRS

Getting through to the IRS can be difficult. Its lines are often busy, especially during tax season. According to a not-so-recent report by the General Accounting Office, only 20% of callers got through to the IRS on the first call during last year’s tax return season (50% eventually got through). The IRS itself says you should avoid calling during lunch hours or on Mondays. But more serious is the reliability of the information you get. And, as a rule, the IRS will not stand behind its oral advice.

Example:

—Emma and James Clarke called an IRS helpline and asked whether they would be taxed on funds they wanted to withdraw from an individual retirement account (IRA) to buy a home. The Clarkes believed that they were told the transactions would result in no tax. So they withdrew the funds. When the IRS taxed them on the withdrawals, the Clarkes went to the Tax Court. They argued that they should not be taxed because they had relied on the erroneous advice of an IRS representative.

The IRS said that the Clarkes had misunderstood. According to the IRS, its representative told them only that they would not face the 10% tax on early withdrawals since they were over age 59½.

The Tax Court had no way of knowing whether the Clarkes had misunderstood or had been given mistaken advice. But the court said it did not matter. The tax law calls for taxes on IRA withdrawals, and the IRS had to follow the law.

Note: The IRS is not legally bound by mistakes its agents may make.

Precautions

The risk of getting incorrect advice does not mean that you should never call the IRS. But you should do some things to protect yourself. In particular, after you get an answer to your question, ask the IRS representative if information on the subject appears in any IRS publication. Then order the publication from the IRS and check the answer you received.

For example, suppose you want to know whether you can claim your father as your dependent. Even if the IRS representative says you can, you would be smart to check the IRS’s Publication 17, Your Federal Income Tax, which sets forth all the requirements for claiming someone as a dependent. Even if the representative is knowledgeable, it’s easy in a conversation for one party to misunderstand the other.

The same basic principles apply if you visit a local IRS office and speak to an agent. You can then easily pick up the publications you need, too.

If you use your computer to surf the Internet, you now can get some forms and basic information from the IRS via the World Wide Web (www.irs.ustreas.gov). But you cannot yet ask questions and get tax help this way.

Writing for Help

You will get the most protection by writing to the IRS with your question, because it will have to send you the answer. Then, if you follow this written advice and it turns out to be wrong, penalties you would otherwise owe will be avoided.

Private letter rulings

—These are among the most common forms of IRS guidance. You would request a private letter ruling from the IRS National Office when you want to know the tax impact of some strategy or transaction you are considering. Such a ruling is like insurance. As long as you give full and accurate details of the proposed transaction, you can rely on the ruling. (You cannot rely on private letter rulings issued to other taxpayers, but you can study them for signs of how the IRS views particular transactions.)

A small medical business might seek a letter ruling to be sure, for instance, that fringe-benefit plans or corporate restructuring will be tax-free.

Example

—A company was engaged in two businesses, A and B. The company needed capital to finance B’s new technology product. It found a venture capitalist willing to invest in B, but not in A. So the company sought to spin off B to a new corporation. The IRS said that there would be no tax on the transaction.

If your transaction will achieve the desired results, the IRS may suggest ways you can fix it. If the IRS plans to issue a negative ruling, it may offer you a chance to withdraw your request.

Technical advice memos

—Similar to letter rulings, these also come from the IRS National Office but are most often requested when a technical question comes up during the course of an audit. IRS agents themselves regularly request them. But, as a taxpayer, you can request such advice yourself. Technical advice memos are usually retroactive, but you can request relief from retroactivity if it would hurt you.

Technical advice memos may be issued on some of the same matters as letter rulings. Typical memos deal with such issues as whether a medical office worker is an employee or an independent contractor, validity of pension plans, and use of accounting methods.

Example

—A repairman had worked in an auto body shop for several years. Originally, he was classified as an employee. Then the shop owner turned the business over to his son, who designated the worker as an independent contractor. But the worker’s job did not change. He worked eight to 10 hours a day at the shop, using some of his own tools—but also some of the shop’s tools and equipment. He was paid half of the total amount of the bill for the repairs he did. But receiving his pay did not hinge on whether the customer paid; he took no risk. The IRS ruled in a technical advice memo that the worker was an employee.

Example

—A company asked the IRS to rule on whether its pension plan was qualified for tax breaks. The IRS said yes. A year later, the IRS realized the plan violated the rules because it excluded some workers who put in more than 1,000 hours a year. In a technical advice memo, the IRS said that the company would have to amend the plan to comply with the tax law. But because the company had relied on the IRS ruling in good faith and had originally disclosed all of the facts, the change did not have to be made retroactively.

When Not to Ask

There is no reason not to call the IRS with a basic question so you can fill out your tax return correctly. You probably will not even have to give your name. But if you want a letter ruling, first weigh the pros and cons.

In some situations—for example, to change your accounting method—you must get an advance ruling. In other cases, an advance ruling may be desirable because you want to be sure of the tax consequences of a transaction. Moreover, as we said, the IRS may suggest ways to restructure the transaction to get the tax result you want.

However, sometimes it’s unwise to seek IRS advice. You may not have time for a ruling—they generally take two or three months. Or, if the transaction offers no chance for flexibility, you will be stuck if the IRS gives you a negative response. (You must attach the ruling—favorable or not—to your return.) The National Office will review all related issues and transactions when it examines your request. So you must also be sure such scrutiny will not create a problem for you.

Cost is another factor. Fees vary by type of ruling, but a typical one would be $500. Then you need professional assistance in preparing your request and responding to IRS questions.

Assessment

The IRS will not answer every question. It will not give you a “comfort ruling”—where the answer is clear or reasonably certain. And it will not rule in hypothetical situations.

Letter rulings are public information, but you don’t lose your privacy. The IRS will have you sign a deletion statement: You can tell it to block out items that would reveal your identity. Most all physicians and medical professionals should do this.

Conclusion

Your comments are appreciated. What has been your experience with IRS queries?

Related Information Sources:

Practice Management: http://www.springerpub.com/prod.aspx?prod_id=23759

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Physician Advisors: www.CertifiedMedicalPlanner.org

Subscribe Now:Did you like this Medical Executive-Post, or find it helpful, interesting and informative? Want to get the latest ME-Ps delivered to your email box each morning? Just subscribe using the link below. You can unsubscribe at any time. Security is assured.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Referrals: Thank you in advance for your electronic referrals to the Medical Executive-Post.

Filed under: Accounting, Taxation | Tagged: Accounting, private letter rulings, tax, technical advice memos | 1 Comment »