“I Still HATE Teams”

[By Dr. David Edward Marcinko CMP® MBA MBBS]

http://www.CertifiedMedicalPlanner.org

The Real Notion of Teams

I HATE teams. There I said it. Now; I repeat. I hate team sports, teams in medicine and especially teams in financial planning. I am NOT a team player; most doctors are independent minded and not team players.

On the other hand, my wife says that I am most assuredly a team player. But, that I just select my teams very carefully. She is much smarter than I; so perhaps she is correct!

Why I Rue the Hospital “Team-Based Medicine” Approach to In-Patient Care

Financial Planning

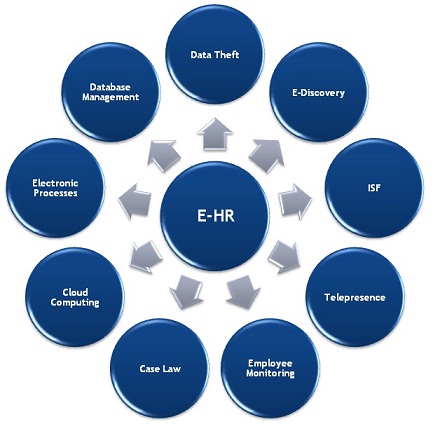

In financial planning, there seems to be a fixation … that a team is a financial planner [certified; or not] and an attorney; nice-but a couple and not really a team in the true sense of group development as first proposed by Bruce Tuckman PhD, in 1965.

In his model, Tucker maintained that four phases are all necessary and inevitable in order for the team to grow, to face challenges, to tackle problems, to find solutions, to plan work, and to deliver results [Forming – Storming – Norming – Performing].

Later, he added Adjourning to successfully complete the task and break up the team. Timothy Biggs PhD further added the Re-Norming stage to reflect a period where the team re-assembles, as needed. This put the emphasis back on the ME Inc or physician team leader – as too many ‘diplomats’ in a leadership role may prevent the team from reaching full potential.

Source: http://infed.org/mobi/bruce-w-tuckman-forming-storming-norming-and-performing-in-groups/

A Metaphor

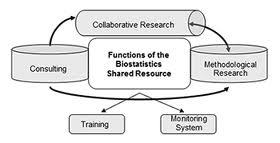

This is why “team” must be more than a metaphor. It deserves more than lip service. Delivering client-centered, coordinated financial planning services and products demands true collaboration–a fully integrated team engaged in practices that involve each member at the top, highest and best use of their licensure and education; optimizing their contributions and maximizing their impact on the well being of the client [Boyer Model of Education].

In this context, board Certified Medical Planners™ may play a lead role going forward; along with other like-minded and educated professionals.

Unfortunately, the ranks of CMPs™ while growing; are still painfully small. But, in addition to true expertise, they link physician clients with appropriate providers and resources throughout the holistic professional life/practice planning continuum. They focus on the doctor-client’s totality — emotional, financial, risk and business management and psyche. As fiduciaries at all times; They advocate for the doctor client to connect him/her to the necessary resources, professional advisors and consultants who need to have their voices heard. Such successful, high-functioning financial planning teams give each member a voice.

The medical professional must be an active participant; not a passive bystander. This is not the norm in financial planning today where doctors are urged to hire a team quarterback. But, the NFL-QB is not a generalist at all; his arm is special and unlike all other teams players. He/she is unique, skilled and exceptional. A franchise player!

Past not Prologue

Fortunately, past is not prologue in the era of transparency, information at your fingertips, tablet PCs, Skype® and smart phones. To succeed in the hyper competitive new era of health reform requires education, involvement and active participation.

In short, a new model of physician focused advisor. No longer is there a free lunch of passivity for medical professionals; either as doctors or advisory clients themselves.

For financial planning in the new era of healthcare reform, and robo-advisors, successful doctors will assume the mantle of self-quarterback themselves.

***

[Go Team Go]

***

ME Inc., or Going it Alone – but with a Team

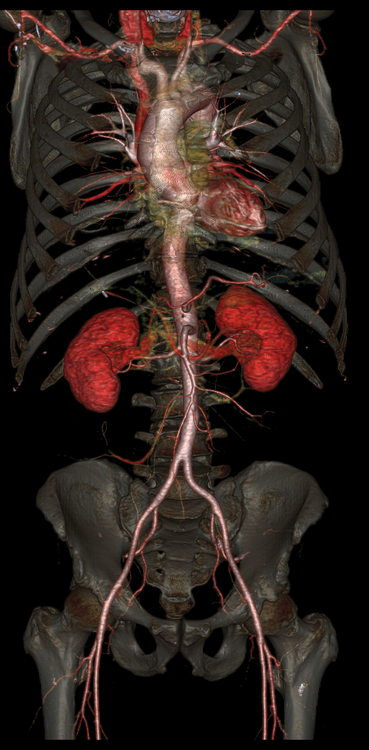

The physician, nurse, or other medical professional should easily recognize that there are a vast array of opportunities, obstacles, and pitfalls when it comes to managing one’s finances.

Still, with some modicum of effort, the basic aspects of insurance, investments, taxes, accounting, portfolio management, retirement and estate planning, debt reduction, asset protection and practice management can be largely self-taught. After all, it is NOT rocker science.

After all, anyone can purchase the exact same financial planning software that legions of FAs use, and there are many iterations on the market, as well. This concept is not unlike patients, using Dr. Google. No license required.

And TAMPs, relegate FAs to the role of “asset gather”; or should I say salesman/woman.

Why Physician-Investors Must Understand TAMPs

Informed Patient [Client]

So, an informed patient or client is ideal; is it not?

Yet, it is realized that nuances and subtleties can make a well-intentioned plan fall short. The devil truly is in the details. Moreover, none of these areas can be addressed in isolation. It is common for a solution in one area to cause a new set of problems in another.

Hourly Model

Accordingly, most health care practitioners would be well served to hire [independent, hourly compensated and prn] financial help.

Unlike some medical problems, financial issues may not cause any “pain” or other obvious symptoms. Medical professionals tend to have far more complex financial situations than most lay people. Despite the complexities of the new world of health reform, far too many either do nothing; or give up all control totally, to an external advisor. This either/or mistake can be costly in many ways, and should be avoided.

In reality, and at various time in their careers, the medical professional needs a team comprised of at least a financial analyst [CFA], lawyer, management consultant, risk manager [PhD actuary or insurance counselor] and accountant. At various points in time, each member of the team, or significant others, will properly assume a role of more or less importance, but the doctor must usually remain the “quarterback” or leader; in the absence of a truly informed other, or Certified Medical Planner™.

This is necessary because only the doctor [client] has the personal self-mandate with skin in the game, to take a big picture view. And, rightly or wrongly, investments dominate the information available regarding personal finance and the attention of most physicians. One is much more likely to need or want to discuss the financial markets with their financial advisor than private letter rulings by the IRS, or with their estate planning attorney or tax accountant.

So, while hiring for expertise is a good idea, there is sinister way advisors goad doctors into using all their retail services; all of the time. That artifice is – the value of time. Don’t fall for this out sourcing gambit!

How Doctors Pay for Wealth Management Services

***

[Not Going it Alone]

***

Assessment

True integrated physician focused and financial planning is at its core a service business, not a product or sales endeavor. And, increasingly money is more likely to be at the top of the list for providers as the healthcare environment is contracting.

So, eschewing the quarterback model of advice, and choosing to self-educate thru these new book and elsewhere, may be one of the best efforts a smart physician can make.

Enter the CMPs

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

[PHYSICIAN FOCUSED FINANCIAL PLANNING AND RISK MANAGEMENT COMPANION TEXTBOOK SET]

[Dr. Cappiello PhD MBA] *** [Foreword Dr. Krieger MD MBA]

***

Filed under: CMP Program, Ethics, Financial Planning, iMBA, Inc., Practice Management | Tagged: Dr. Marcinko, financial planning team, physician focused financial planning, team healthcare | 1 Comment »

***

***