By Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.MarcinkoAssociates.com

***

WARNING! WARNING! All DOCTORS

What Medical School Didn’t Teach Doctors About Money

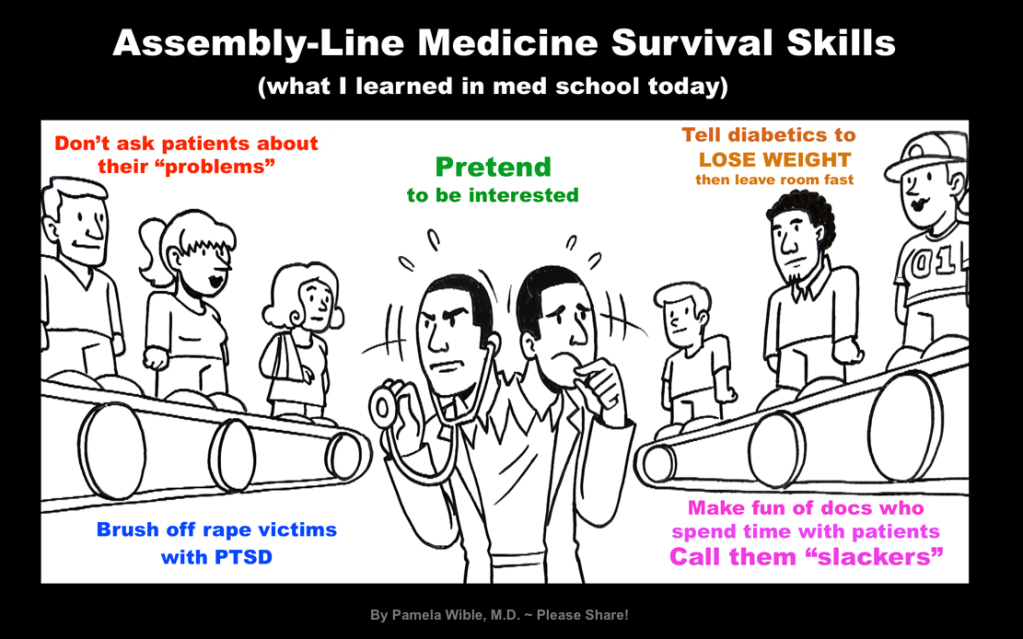

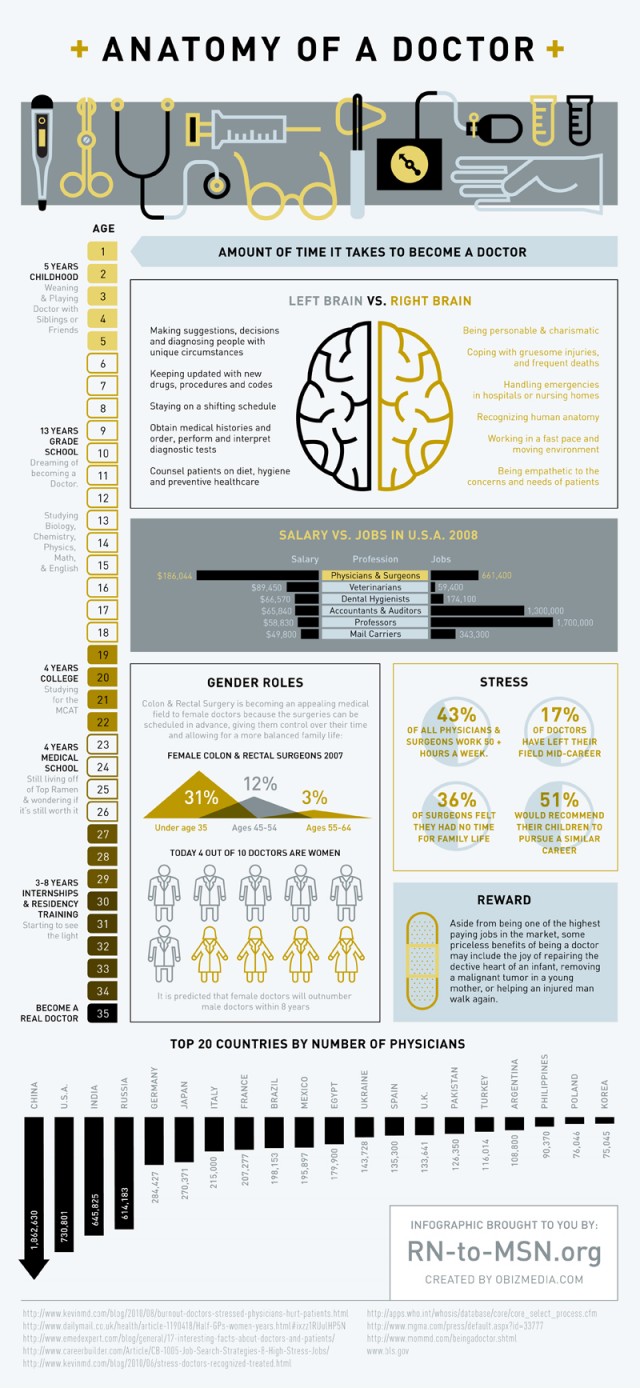

Medical school is designed to mold students into competent, compassionate physicians. It teaches anatomy, pathology, pharmacology, and clinical skills with precision and rigor. Yet, despite the depth of medical knowledge imparted, one critical area is often overlooked: financial literacy. For many doctors, the transition from student to professional comes with a steep learning curve—not in medicine, but in money. From managing debt to understanding taxes, investing, and retirement planning, medical school leaves a financial education gap that can have long-term consequences.

The Debt Dilemma

One of the most glaring omissions in medical education is how to manage student loan debt. The average medical student graduates with over $200,000 in debt, yet few are taught how to navigate repayment options, interest accrual, or loan forgiveness programs. Many doctors enter residency with little understanding of income-driven repayment plans or Public Service Loan Forgiveness (PSLF), missing opportunities to reduce their financial burden. Without guidance, some make costly mistakes—such as refinancing federal loans prematurely or choosing repayment plans that don’t align with their career trajectory.

Income ≠ Wealth

Medical students often assume that a high salary will automatically lead to financial security. While physicians do earn more than most professionals, income alone doesn’t guarantee wealth. Medical school rarely addresses the importance of budgeting, saving, and investing. As a result, many doctors fall into the “HENRY” trap—High Earner, Not Rich Yet. They spend lavishly, assuming their income will always cover expenses, only to find themselves living paycheck to paycheck. Without a solid financial foundation, even high earners can struggle to build net worth.

***

***

Taxes and Business Skills

Doctors are also unprepared for the complexities of taxes. Whether employed by a hospital or running a private practice, physicians face unique tax challenges. Medical school doesn’t teach how to track deductible expenses, optimize retirement contributions, or navigate self-employment taxes. For those who open their own clinics, the lack of business education is even more pronounced. Understanding profit margins, payroll, insurance billing, and compliance regulations is essential—but rarely covered in medical training.

Investing and Retirement Planning

Another blind spot is investing. Medical students are rarely taught the basics of compound interest, asset allocation, or retirement accounts. Many don’t know the difference between a Roth IRA and a traditional 401(k), or how to evaluate mutual funds and index funds. This lack of knowledge delays retirement planning and can lead to missed opportunities for long-term growth. Some doctors rely on financial advisors without understanding the fees or conflicts of interest involved, putting their wealth at risk.

Insurance and Risk Management

Medical school also fails to educate students on insurance—life, disability, malpractice, and health. Doctors need robust coverage to protect their income and assets, but many don’t know how to evaluate policies or understand terms like “own occupation” or “elimination period.” Inadequate coverage can leave physicians vulnerable to financial disaster in the event of illness, injury, or litigation.

Emotional and Behavioral Finance

Beyond technical knowledge, medical school overlooks the emotional side of money. Physicians often face pressure to maintain a certain lifestyle, especially after years of sacrifice. The desire to “catch up” can lead to impulsive spending, luxury purchases, and financial stress. Without tools to manage money mindset and behavioral habits, doctors may struggle with guilt, anxiety, or burnout related to finances.

The Case for Financial Education

Fortunately, awareness of this gap is growing. Organizations like Medics’ Money and podcasts such as “Docs Outside the Box” are working to fill the void by offering financial education tailored to physicians.

These resources cover everything from budgeting and debt management to investing and entrepreneurship. Some medical schools are beginning to incorporate financial literacy into their curricula, but progress is slow and inconsistent.

Conclusion

Medical school equips doctors to save lives, but it doesn’t prepare them to secure their own financial future. The lack of financial education leaves many physicians vulnerable to debt, poor investment decisions, and lifestyle inflation. To thrive both professionally and personally, doctors must seek out financial knowledge beyond the classroom. Whether through self-study, mentorship, or professional guidance, understanding money is as essential as understanding medicine. After all, financial health is a cornerstone of overall well-being—and every doctor deserves to master both.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", finance, Financial Planning, Funding Basics, Glossary Terms, Health Economics, Health Insurance, Healthcare Finance, Insurance Matters, Investing, Marcinko Associates, Portfolio Management, Retirement and Benefits, Risk Management | Tagged: Accounting, budgeting, business skills, david marcinko, DDS, debt, DMD, DO, doctors, DPM, finance, financial future, HENRY, Income, insurance, Investing, MD, medical school, money, personal-finance, physicians, Risk Management, taxes, Wealth, wealth management | Leave a comment »