By Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.MarcinkoAssociates.com

***

***

Turning 50 with little to no savings can be daunting, especially for a doctor who has spent decades in a demanding profession. Yet, all is not lost. With strategic planning, discipline, and a willingness to adapt, a broke 50-year-old physician can still build a solid retirement foundation by age 65.

First, it’s essential to confront the financial reality. This means calculating current income, expenses, debts, and any assets, however small. A clear picture allows for realistic goal-setting. The target should be to save aggressively—ideally 30–50% of income—over the next 15 years. While this may seem steep, doctors often have above-average earning potential, even in their later years, which can be leveraged.

Next, lifestyle adjustments are crucial. Downsizing housing, eliminating unnecessary expenses, and avoiding new debt can free up significant cash flow. If possible, relocating to a lower-cost area or refinancing existing loans can also help. Every dollar saved should be redirected into retirement accounts such as a 401(k), IRA, or a solo 401(k) if self-employed. Catch-up contributions for those over 50 allow for higher annual deposits, which can accelerate growth.

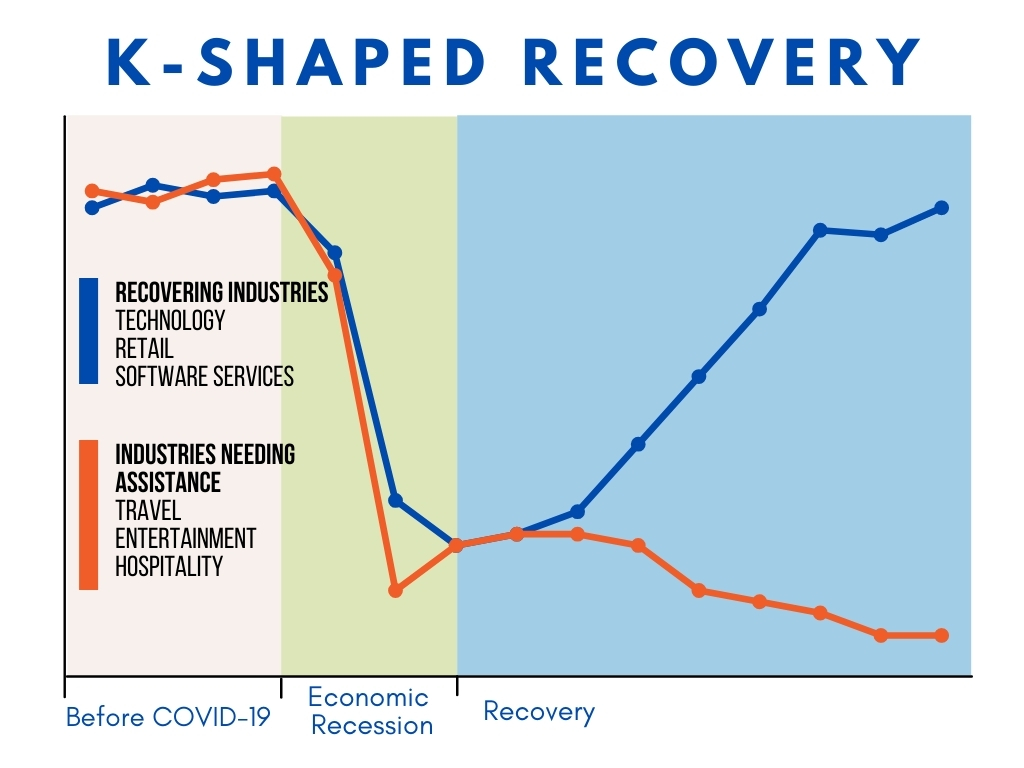

Investing wisely is non-negotiable. A diversified portfolio with a mix of stocks, bonds, and alternative assets can provide both growth and stability. Working with a fiduciary financial advisor ensures that investments align with retirement goals and risk tolerance. Time is limited, so the focus should be on maximizing returns without taking reckless risks.

Increasing income is another powerful lever. Many doctors can boost earnings through side gigs like telemedicine, consulting, teaching, or locum tenens work. These flexible options can add tens of thousands annually without requiring a full career shift. Additionally, monetizing expertise—writing, speaking, or creating online courses—can generate passive income streams.

Debt reduction must be prioritized. High-interest loans, especially credit card debt, can erode savings potential. Paying off these balances aggressively while avoiding new liabilities is key. For student loans, exploring forgiveness programs or refinancing options may offer relief.

Finally, mindset matters. Retirement at 65 doesn’t have to mean complete cessation of work. It can mean transitioning to part-time roles, passion projects, or advisory positions that provide income and fulfillment. The goal is financial independence, not necessarily total inactivity.

In conclusion, while starting late is challenging, a broke 50-year-old doctor can still retire comfortably at 65. It requires a blend of financial discipline, income optimization, smart investing, and lifestyle changes. With focus and determination, the next 15 years can be transformative—turning a precarious situation into a secure and dignified retirement.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Accounting, finance, Financial Planning, Funding Basics, Investing, Portfolio Management, Taxation, Touring with Marcinko | Tagged: broke DO, broke doctors, broke DPM, broke MD, broke physicians, budgeting, credit cards, david marcinko, debt, finance, Income, ivesting, money, personal-finance, rretirement | Leave a comment »