Physician Due Diligence is Important

[By Daniel B. Moisand; CFP®, and the ME-P Staff]

While the merits of hiring the right financial advisor [FA] may be clear, hiring the wrong one can be devastating. Medical professionals still tend to have higher incomes and are an attractive target for most financial institutions and scam artists. This fear is a poor excuse for not getting the assistance necessary. Advice about who to engage for financial assistance comes from a hodge-podge of disjointed sources. This leads to good intentions and bad results. Take caution when using the following as sources of advice.

Relying on Family and Friends

By far more people seek financial advice from trusted family members and friends than any other source. This is only natural. It is essential to trust that you are getting advice from a source that means well. It is also important that you get along well with your advisors. Hesitating to communicate with your advisor, even a great advisor, can cause problems even more problematic that getting bad advice from someone you like. While these sources have a good handle on the essential elements of trust and rapport, it is the competence of the advice that is most often the issue. The life and money experiences of those who are close to you certainly have value, but they are not necessarily relevant to your unique goals and circumstances. THINK: Bernie Madoff.

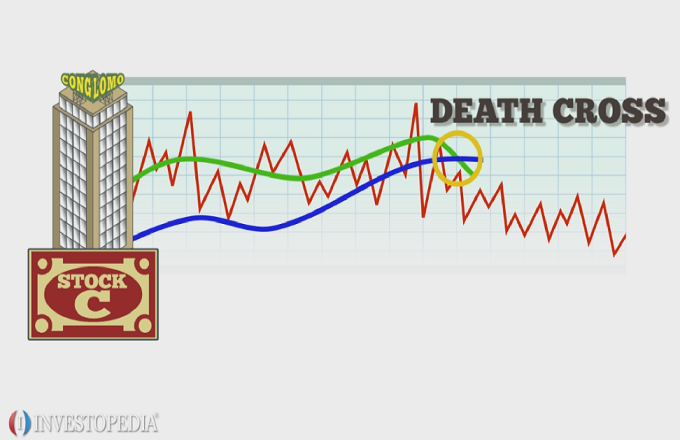

Media

A few years ago, the dominant media force in consumer oriented financial matters was the print media. Magazines and newsletters proliferated with the bull market. More recently however, television has supplanted print even in the bear market. For example, a study now estimates that 80 percent of what the average American knows about current events comes from TV. Why wait three weeks for the next issue when you can get a commentary instantly on the television? There is nothing wrong with watching shows that cover the markets or subscribing to a consumer finance magazine. It is certainly a good idea to be informed. However, be wary of the quality and applicability of information put out by the media.

The Internet

It is easy to run across an ad for prescriptions drugs on television. Images prance across the screen followed by a litany of potential side effects and the obligatory, “Ask your doctor about”. With the expansion of the information superhighway, more and more companies are going direct to the consumer in some manner or another.

Financially speaking this information can be of great benefit but should also generate more concern. It is very easy to project a particular image via the web. The webmaster controls the interaction from what you see to what you hear. One of the results of this is that the Internet has already garnered a reputation as a breeding ground for new scams. More prevalent, however, is the presentation of information meant to be useful that is simply wrong, misinterpreted, or misapplied. The most terrifying source of misinformation on the net is the chat rooms. Here the entire interaction is clouded by anonymity. Some people enter chat rooms because there is a comfort in anonymity when asking a question. There is also a danger in an anonymous answer. When it comes to something as important as your finances or your health, the prudent course should be to take all the advice with a grain of salt. A great deal of consideration to the quality of the source is in order. It is also essential that one understand the level of accountability a source may possess.

Assessment

Much has been written on financial advisor selection, here on the ME-P and elsewhere; but little on how not to select an advisor. We trust this information will be of assistance to the medical professional in some small increment. Send in your FA stories; both good and bad.

Channel Surfing the ME-P

Have you visited our other topic channels? Established to facilitate idea exchange and link our community together, the value of these topics is dependent upon your input. Please take a minute to visit. And, to prevent that annoying spam, we ask that you register. It is fast, free and secure.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security Dictionary of Health Insurance and Managed Care

***

Filed under: "Doctors Only", Book Reviews, Career Development, Financial Planning, Portfolio Management, Recommended Books, Research & Development, Risk Management | Tagged: bear market, bull market, certified financial planner, certified medical planner, CFP, CMP, Dan Moisand, david marcinko, financial advisors, Financial Planning, Wall Street, www.certifiedmedicalplanner.com | 5 Comments »