A Review for Doctors and Advisors

By Gary A. Cook; MSFS, CLU, ChFC, LUTC, RHU, CFP®, CMP™ (Hon)

Long-term care (LTC) insurance is considered one of the newest forms of personal coverage insurance. LTC insurance is designed to transfer the financial risk associated with the inability to care for oneself because of a prolonged illness, disability, or the effects of old age. In particular, it is designed to insure against the financial cost of an extended stay in a nursing home, assisted living facility, Adult Day Care Center, hospice or home health care. It has been estimated that two out of every five Americans now over the age of 65 will spend time in a nursing home. As life expectancy increases, so does the potential need for LTC. One unfortunate consequence of being the “new kid on the block” is the lack of actuarial data specifically collected for this style of policy. This results in policy premiums being underpriced to sustain the claims currently being experienced. During the first half of 2003, at least three insurance companies stopped writing these policies because of their losses. Those insurers remaining in this market are expected to increase premiums quickly. Unless these policies can be profitable for the company, their future will be an uncertain one.

Medicare

Any discussion of LTC must begin with an understanding of what Medicare is designed to cover. Currently, the only nursing home care that Medicare covers is skilled nursing care and it must be provided in a Medicare-certified skilled nursing facility. Custodial care is not covered. Most LTC policies have been designed with these types of coverage, or the lack thereof, in mind. To qualify for Medicare Skilled Nursing Care, an individual must meet the following conditions:

- Be hospitalized for at least three days within the 30 days preceding the nursing home admission;

- Be admitted for the same medical condition which required the hospitalization; and

- The skilled nursing home care must be deemed rehabilitative.

Once these requirements are met, Medicare will pay 100 percent of the costs for the first 20 days. Medicare covers days 21 to 100 along with a daily co-payment, which is indexed annually. After the initial 100 days, there is no additional Medicare coverage. Medicare Home Health Services cover part-time or intermittent skilled nursing care, physical therapy, medical supplies and some rehabilitative equipment. These are generally paid for in full and do not require a hospital stay prior to home health service coverage.

Critical LTC Policy Features

According to the U.S. Department of Health and Human Services and the Health Insurance Association of America, there are seven features that should always be included in a good long LTC policy:

- Guaranteed renewable (as long as premiums are paid, the policy cannot be canceled).

- Covers all levels of nursing care (skilled, intermediate and custodial care).

- Premiums remain level (individual premiums cannot be raised due to health or age, but can be raised only if all other LTC policies as a group are increased).

- Benefits never reduced.

- Offers inflation protection.

- Full coverage for Alzheimer’s Disease (earlier contracts tried to eliminate this coverage).

- Waiver of premium (during a claim period, further premium payments will not be required).

In addition, there are another seven features considered to be worthwhile and are included in the better LTC policies:

- Home health care benefits

- Adult day care and hospice care

- Assisted living facility care

- No prior hospital stay required

- Optional elimination periods

- Premium discounts when both spouses are covered

- Medicare approval not a prerequisite for coverage.

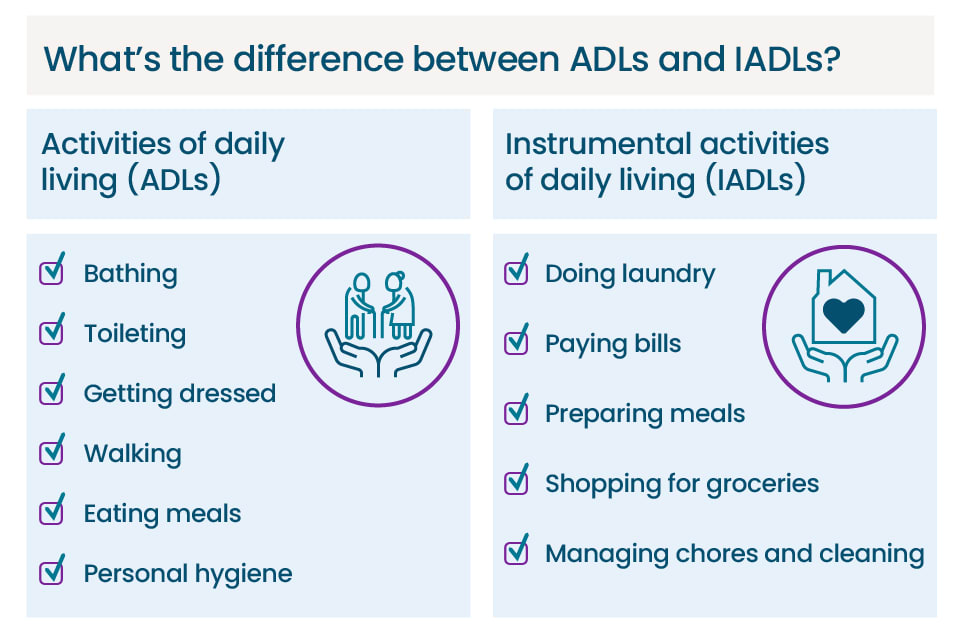

ADLs

Most LTC policies provide benefits for covered insured’s with a cognitive impairment or the inability to perform a specified number of Activities of Daily Living (ADLs). These ADLs generally include those listed below and the inability to perform two of six is generally sufficient to file a claim:

1. Bathing: Washing oneself in either a tub or shower, or by sponge bath, and includes the task the getting into and out of the tub or shower without hands-on assistance of another person.

2. Dressing: Putting on or taking off all necessary and appropriate items of clothing and/or any necessary braces or artificial limbs without hands-on assistance of another person.

3. Toileting: Getting to and from the toilet, getting on and off the toilet, and performing associated personal hygiene without hands-on assistance of another person.

4. Transferring: Moving in and out of a bed, chair or wheelchair without hands-on assistance of another person.

5. Eating: The ability to get nourishment into the body without hands-on assistance of another person once it has been prepared and made available.

6. Continence: The ability to voluntarily maintain control of bowel and/or bladder function, or in the event of incontinence, the ability to maintain a reasonable level of personal hygiene without hands-on assistance of another person.

Other Issues

Another issue concerning ADLs is whether the covered insured requires “hands-on” assistance or merely needs someone to “stand-by” in the event of difficulty. Obviously, LTC policies that read the latter are considered more liberal.

Long-Term Care Taxation

Some LTC policies have been designed to meet the required provisions of the Kassenbaum-Kennedy health reform bill, passed in 1996, and subsequently are “Tax Qualified Policies”. Insured’s who own policies meeting the requirements are permitted to tax deduct some of the policy’s premium, based on age, income and the amount of total itemized medical expenses. The major benefit of the tax-qualified LTC policy is that the benefit, when received, is not considered taxable income. There are several initiatives in Congress, however, which would expand and simplify these deductibility rules.

Assessment

Regardless, the medical professional or financial advisor [FA] should investigate the opportunity afforded them through their current form of business, or client use, for any purchase of a LTC policy. And, small businesses may be permitted to deduct LTC premiums on a discriminatory basis.

Conclusion

And so, your thoughts and comments on this Medical Executive-Post are appreciated. What have we missed, and who might wish to update this post?

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com or Bio: www.stpub.com/pubs/authors/MARCINKO.htm

Get our Widget: Get this widget!

Our Other Print Books and Related Information Sources:

Practice Management: http://www.springerpub.com/prod.aspx?prod_id=23759

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Healthcare Organizations: www.HealthcareFinancials.com

Health Administration Terms: www.HealthDictionarySeries.com

Physician Advisors: www.CertifiedMedicalPlanner.com

Subscribe Now: Did you like this Medical Executive-Post, or find it helpful, interesting and informative? Want to get the latest E-Ps delivered to your email box each morning? Just subscribe using the link below. You can unsubscribe at any time. Security is assured.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Filed under: "Advisors Only", "Doctors Only", Book Reviews, Career Development, Glossary Terms, iMBA, Inc., Insurance Matters, Practice Management, Recommended Books, Retirement and Benefits, Sponsors | Tagged: ADLs, Alzheimer's disease, david marcinko, elder care, elder law, gary cook, HIPAA, home health care, hope hetico, insurance, Kennedy-Kassenbaum, long term care insurance, LTC, LTCI, Medicaid, medicare, nursing home care | 9 Comments »