The fuel which fires the self-funded engine of employee health and welfare plans

[By William Rusteberg]

A SPECIAL ME-P REPORT

Introduction

The Affordable Care Act (ACA) has had a fundamental impact on health care financing in this country. It has effectively provided added incentives for plan sponsors to consider modified self-funding arrangements for their employee health and welfare plans in lieu of fully-insured plans. The advantages of doing so are clear.

Health care costs continue to rise despite passage of the ACA. While the ACA addresses many aspects surrounding the delivery of health care, it does little or nothing to identify and offer solutions to constantly rising costs. On the contrary, many ACA provisions are driving cost up.

Plan sponsors have a choice between assuming a passive strategy with little or no control through fully-insured funding arrangements or the alternative. The alternative affords more control and less cost. It rewards innovation and creativity. It utilizes all the tools a risk manager requires as part of his trade.

More plan sponsors are turning to self-funding in response to the ACA.

The Market Leading Up To the ACA

The financial and benefit advantages of self-funded health and welfare plans became evident with the passage of the Employee Retirement Income Security Act (ERISA) of 1974. Dramatic growth in self-funding occurred when ERISA preemption, clarified legal environment, rising health care costs, widespread use of risk management, the cost containment movement (Managed Care) and high interest rates were all being experienced.

Fully insured plans continued to be a large segment of the market, especially among smaller employer groups. However, a significant number larger groups remaining fully-insured moved towards minimum premium plans, or plans which were rated retrospectively on an administration cost plus basis. This approach among larger employers mirrored self-funding advantages to some degree, however the insurance companies ultimately bore the entire risk and maintained full control over plan expenses and claim costs. These types of fully-insured funding arrangements were the carrier’s response to the growing phenomenon and popularity of self-funding.

With the advent of managed care in the early 1980’s, the entire dynamics of health care delivery changed. Third party intermediaries became an important element in the health care equation. These intermediaries performed valuable services in cost containment which initially had a positive impact on health care benefits and costs to the advantage of both the consumer and payer.

Carefully selected health care givers were aggregated into exclusive networks of preferred providers. The theory behind the scheme was valid; selected health care providers would agree to discount their usual fees for service in return for more patients. Steerage was accomplished by rewarding consumers with improved benefits when seeking care through these “preferred” providers. All worked well, with health care costs temporarily softening.

Consumers no longer had to satisfy deductibles to receive most care. Instead, co-pays as low as $10 to see a doctor became the norm. Prescription drugs benefits, now accounting for as much as 25% of a plan’s total spend in today’s market, were easily accessed by paying a small co-pay. Access to care became easier and affordable. Utilization increased.

With increased utilization, consumers began to demand more doctors and hospitals to be added to networks. Over time, just about every doctor and hospital in a given geographic area were all on networks. Competition among insurance companies hinged upon who had the broadest network. The pressure to add medical providers became intense. A seller’s market for medical providers became an established trend that continues to this day. Preferred Provider Organizations (PPO) thus gained the advantage of a seller’s market they created while end users became subject to a weakened and impotent buyer’s market.

Over time PPO’s lost their core characteristic. There was no longer any steerage. The scheme that worked so well in the beginning began to unravel. Costs increased dramatically, year after year.

Plan sponsors failed to recognize the slow progression towards failure of managed care. They continued to subscribe to the theory behind managed care based upon reliance of advice and guidance from “trusted” insurance companies, third party administrators, agents, brokers and insurance experts posing as consultants. Unfortunately, and unknown to plan sponsors, these trusted advisors maintained a vested interest in continuing the scheme. A de facto conspiracy of third party intermediaries formed. The conspiracy continues to this day. It is one of the health care industry’s best kept secrets.

No one can dispute that managed care has failed. Health care costs have continued to increase at double digits year after year, becoming unaffordable for most Americans. Plan Sponsors, concerned and desperate for answers and solutions continue to rely on advice and guidance from third party intermediaries whose vested interests is in maintaining the status quo. To more and more employers health care costs can mean the difference between profit and loss.

The perception that private enterprise has failed in reining in costs is widespread. Private and public budgets can no longer sustain the current level of spending, let alone future health care inflation.

Pointing to failure of the market to keep medical costs affordable, many looked to government for solutions.

The Affordable Care Act & The Impact on Health Care Financing

With the passage of the ACA, we find ourselves in a dynamic and somewhat unpredictable market, particularly the political dimensions as the ACA continues to evolve. However, we do know to a large degree, how the market will be affected and what plan sponsors must do to maintain affordable health care for their employees.

The ACA’s most significant impact centers upon how group medical plans will be financially structured for years to come. The ACA effectively makes fully-insured plans less attractive while providing advantages to self-funded arrangements. Carriers have come to recognize this and are moving to increase their market share. Currently the BUCA’s (Blue Cross, United HealthCare, Cigna and Aetna) administer more self-funded business than fully-insured business on their respective large group blocks of business. They are now actively expanding this funding method to the small group market.

The ACA’s universal intent is to provide government mandated means for affordable health care for all Americans. However, the ACA as it is now written does not address cost of care nor does it mandate parameters around which cost of care is to be based. Instead, the ACA mandates rigid requirements that address what insurance companies can offer in the way of benefits, as well as profit and operating margins. There is nothing in the Act that addresses what medical providers charge and what they are paid.

These far reaching rules have dramatically impacted fully-insured plans. All ACA mandates apply to these plans, whereas self-funded plans are exempt from many of them. Fully-insured plans are effectively handcuffed affording little leeway to be proactive and innovative in plan design and cost basis. Unlike self-funded plans, little can be done to control costs under fully insured plans.

An example of a reverse outcome of good intentions pertains to the Minimum Loss Ratio mandate required of all fully insured plans but exempted under self-funded plans. Fully insured large groups are required to maintain a loss ratio wherein health care claims cannot be less than 85% of premium leaving insurance companies with15% of premium to cover their costs and earn profits. However this has had a reverse effect, the opposite of which is higher costs. The greater the cost (claims), the greater the profit to the insurance company. Fifteen percent of a larger number is larger than 15% of a smaller number.

Insurance companies remaining in the fully-insured market have little or no incentive to reduce health care costs except to remain competitive in the market. With only a handful of fully-insured carriers in any given market there is less competition. Shadow pricing between competitors can very often be an effective means of maximizing insurance company profits at the expense of the plan sponsor and plan participants. A 15% operating and profit margin becomes greater when insurance rates are higher.

A good example of a constricted market can be found in San Antonio, Texas, a market we know well. There are only four major players in the fully-insured market: Blue Cross, United Healthcare, Aetna and Humana. Employer groups who continue to fully-insure will contract with one of these four carriers.

The Lower Rio Grande Valley in deep South Texas, on the other hand, has only one major carrier in the fully-insured market. Blue Cross is the dominant carrier, with occasional, cyclical and short lived forays into the Valley by Aetna and Humana..

Fully insured health insurance carriers have developed proprietary provider networks as an integral part of their insurance plans. None to our knowledge market plans that do not utilize their PPO network as part of the offering. There is an economic reason for this and it has nothing to do with lowering health care costs.

To insure continuing higher profits, health claim costs must continue to escalate. Third party intermediaries negotiate provider agreements in secrecy with both parties agreeing to non-disclose of terms, conditions and pricing to the public. It is our opinion that if you are not allowed to see a contract you are probably paying more than you should. Plan sponsors have simply become third party beneficiaries, accessing provider agreements they cannot see, examine or audit.

Fully insured group medical insurance in today’s market requires accessing proprietary, secretive PPO contracts. These contracts drive costs up each year primarily due to automatic escalator clauses. Other contract provisions include provider re-pricing fees and shared savings provisions based on egregious charge master rates no one ever pays. There are other contract provisions that guarantee continued cost increases but we will save that discussion for another day.

Self-funding provides plan sponsors a means to comply with the ACA with less restrictive mandates and lower costs. In addition, plan sponsors have the ability to design benefits that are far more flexible. They gain the freedom to choose provider reimbursement methods based on transparency, benchmarked off costs instead of phony discounts based on inflated sticker prices no one ever pays. They have the ability to eliminate expensive third party intermediaries that bring no value, They have the ability to directly contract with willing providers based on transparent benchmarking, achieving savings of 20% or more.

The ACA’s adverse impact on fully insured plans include community rating and minimum essential benefit requirements, 3:1 age band rating, pre-existing condition inclusion, and benefit expansions. All of these mandates drive cost up.

A self-funded plan is not subject to community rating nor are they required to include all ten (10) essential benefits. In addition, self-funded plans are not subject to the 3:1 rating rule and can mitigate pre-existing inclusion through selective lasers. Lasers are an underwriting technique that increases exposure/costs only when a loss occurs. If no loss occurs, there is no effective additional load to plan costs unlike fully-insured plans that load the premium costs at the beginning of the plan year, effectively passing on a cost that may or may not be necessary.

Complementing the advantages of self-funding under the ACA, ERISA preempts the state’s ability to mandate health insurance contract terms and benefits, impose premium taxes, impose underwriting constraints and mandated premiums (varies by state) and limit employee benefit plan options.

The Future under the ACA

Health care costs continue to escalate. Both private and public sector budgets can no longer sustain the current level of spending, let alone future health care inflation.

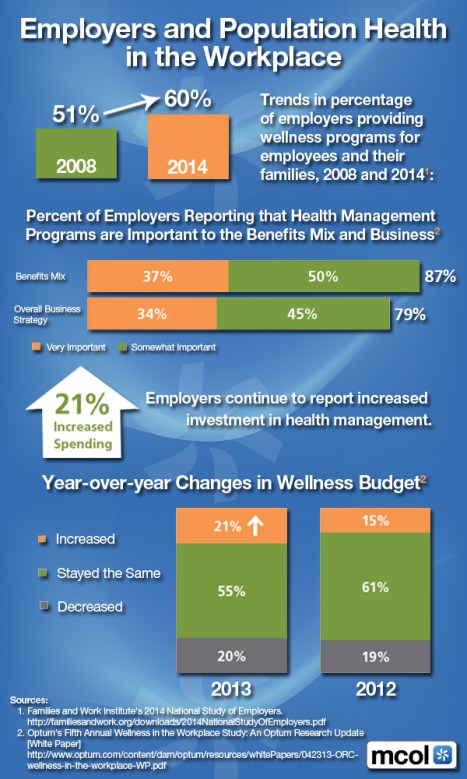

Over 170 million Americans are insured through employer sponsored health plans today. These employers, fearing the effects of the ACA on their bottom line, are concerned and desperate for answers and solutions to ever increasing health care costs. To more and more of them health care costs can mean the difference between profit and loss.

Acceptance to change, historically, has been slow among employers who have traditionally relied on third party intermediaries to guide them through the complicated maze of our health care system. The ACA has effectively changed that mindset among many plan sponsors.

We are seeing a movement away from managed care by some employers, and to a lesser degree, by health care providers, particularly health care professionals. Employers, for the first time, are questioning managed care contracts they cannot see but upon which their health care costs are based.

We are seeing a major shift to self-funded arrangements which enable plan sponsors to effectively manage costs through avoidance of certain ACA requirements, underwriting advantages, and pro-active risk management.

Assessment

Although ERISA was passed into law over 35 years ago, with the advent of the ACA more plan sponsors are accepting full fiduciary responsibility to assure that plan assets are expended prudently and in the best interests of plan participants.

Conclusion

As it stands today, the ACA is the fuel which fires the self-funded engine of employee health and welfare plans, providing flexibility, control and lower costs. It is the parking brakes of fully-insured plans.

About the Author

Bill Rusteberg is a fee based insurance consultant and principal of RiskManagers.us since 1998. He has been involved in the insurance industry for over 41 years specializing in self-funded employee welfare plans. Bill has spoken nationally on continuing changes affecting our health care delivery system, most recently at the Physician Hospital of America (PHA) annual forum in 2013 and the Health Care Administrators Association (HCAA) Executive Forum in 2014. Bill walks his audience through the complicated maze of the American health care delivery system. He exposes industry secrets that drive costs by outlining specific findings not generally known to Plan Sponsors. Bill offers common sense solutions to ever increasing health care costs. Armed with the knowledge industry insiders have kept hidden for years, Plan Sponsors are, for the first time, empowered to negotiate with insurance companies, managed care organizations and other third party intermediaries from a position of strength and can better achieve cost effective health care for their employees while often improving benefits at the same time. Bill is a licensed Risk Manager, Life & Health Counselor, Property & Casualty / Life & Health Insurance agent and Surplus Lines broker in Texas. He holds reciprocal licenses in several other states.

About RiskManagers.us

RiskMangers.us is a specialty company in the benefits market that, while not an insurance company, works directly with health entities, medical providers, and businesses to identify and develop cost effective benefits packages, emphasizing transparency and fairness in direct reimbursement compensation methods

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Comprehensive Financial Planning Strategies for Doctors and Advisors: Best Practices from Leading Consultants and Certified Medical Planners™

Filed under: Health Economics, Health Insurance, Healthcare Finance, Insurance Matters | Tagged: Affordable Care Act., Bill Rusteberg, PP-ACA, www.RiskManagers.Us | 9 Comments »