By Carol S. Miller RN CPM MHA

By Dr. David Edward Marcinko MBA CMP™

“Collectively the healthcare industry spends over $350 Billion to submit and process claims while still working with cumbersome workflows, inefficient processes, and a changing landscape marked by increasing out-of-pocket cost for patients as well as increasing operating costs.”

“Collectively the healthcare industry spends over $350 Billion to submit and process claims while still working with cumbersome workflows, inefficient processes, and a changing landscape marked by increasing out-of-pocket cost for patients as well as increasing operating costs.”

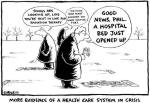

The Norm Continues Downhill

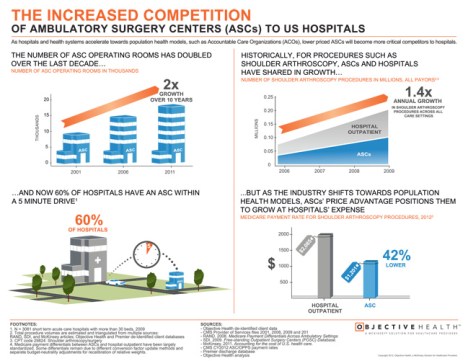

For many years hospitals and healthcare organizations have struggled to maintain and improve their operating margins. They continue to face a widening gap between their operating costs and the revenues required to cover not only current costs, but also to finance strategic growth initiatives and investments.

Faced with increased operational costs and associated declines in rates of reimbursement, many healthcare hospital executives and leaders are concerned that they will not achieve margin targets. To stabilize the internal financial issue, some hospital have focused on lowering expenses in order to save costs – an area they control and an area that will show an immediate impact; however, that is not the best solution.

Beware Cost Reductions

Hospital executives are concerned with the effect that these reductions may have on patient quality and service. Finding ways to maximize workflow to lower operating costs is vital. Every dollar not collected negatively impacts short- and long term capital projects, lowers patient satisfaction scores and possibly affects quality of patient care.

Status Today

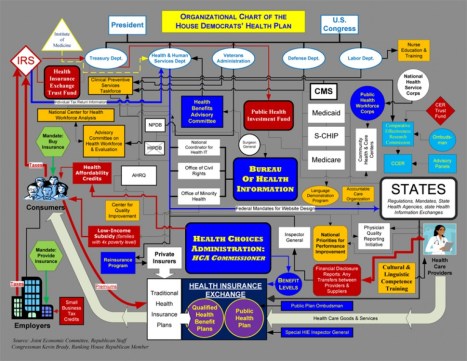

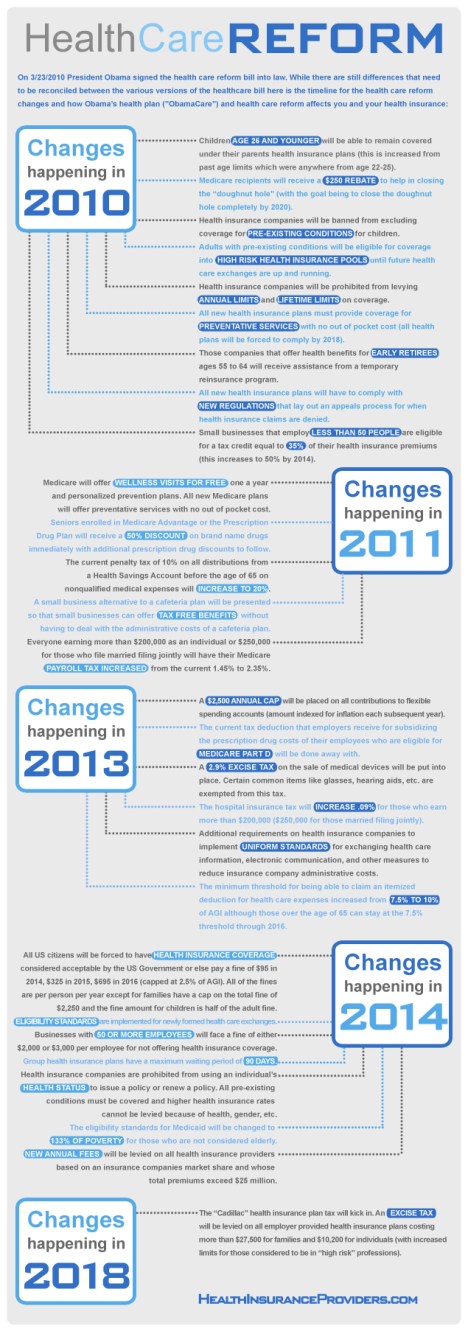

Hospitals, healthcare organizations and all medical providers are under great pressure to collect revenue in order to remain solvent. And so, here are some of the issues impacting the modern hospital revenue cycle as Obama-Care, or the PP-ACA of 2010, is launched next month?

Issues Impacting the Revenue Cycle

Several of the major leading issues facing the revenue cycle are:

- Impact of Consumer-driven Health – This process has emerged as a new approach to the traditional managed care system, shifting payment flows and introducing new “non-traditional” parties into the claims processing workflow. As market adoption enters the mainstream, consumer-driven health stands to alter the healthcare landscape more dramatically than anything we have seen since the advent of managed care. This process places more financial responsibility on the consumer to encourage value-drive healthcare spending decisions.

- Competing high-priority projects –Hospitals are feeling pressured to maximize collections primarily because they know changes are coming down the pike due to healthcare reform and they know they will need to juggle these major initiatives along with the day-to-day revenue cycle operations.

- Lack of skilled resources in several areas – Hospital have struggled to find the right personnel with sufficient knowledge of project management, clinical documentation improvement, coding and other revenue cycle functions, resulting in inefficient operations.

- Narrowing margins – Declines in reimbursement are forcing hospitals to look at their organization to determine if they can increase efficiencies and automate to save money. Hospitals are faced with the potential of increased cost to upgrade and adapt clinical software while not meeting budget projections. There are a number of factors contributing to the financial pressure including inefficient administrative processes such as redundant data collection, manual processes, and repetitive rework of claims submissions. Also included are organizations using outdated processes and legacy technologies.

- Significant market changes – Regardless of what happens with the Patient Protection and Affordable Care Act, hospitals will have to deal with fluctuating amounts of insured and uninsured patients and variable payments.

- Limited access to capital – With the trend towards more complex and expensive systems, industry may not have the internal resources and funding to build and manage these systems that keep pace with the trends.

- Need to optimize revenue – There are five core areas hospitals have to examine carefully and they are:

- ICD-10 – This is an entirely new coding and health information technology issue but is also a revenue issues

- System integration – Hospitals need to look at integrating software and hardware systems that can combine patient account billing, collections and electronic health records.

- Clinical documentation – Meaningful use will require detailed documentation in order for payment to be made and this is another revenue issue.

- Billing and claims management – Reducing denials and reject claims, training staff, improving point-of-service collections and decreasing delays in patient billing can improve the revenue cycle productivity,

- Contract analysis – Hospitals need to focus more on negotiating rates with insurers in order to increase revenue.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

***

Filed under: Health Economics, Practice Management, Recommended Books, Research & Development | Tagged: ACA, carol s. miller, Consumer-driven Health, Dr. David Marcinko, Hospital Revenue Cycle, ICD-10 | 6 Comments »