Filed under: Experts Invited | Leave a comment »

Click to access TELEMEDICINE.pdf

Filed under: Experts Invited | Tagged: teleHealth, Valuation of Telemedicine | Leave a comment »

By Years of experience

Via Michael Kitces

***

***

Filed under: Experts Invited, Investing | Tagged: financial advisor compensation, Michael Kitces | 1 Comment »

By Bertalan Mesk MD PhD

***

***

***

Filed under: "Doctors Only", Experts Invited | Tagged: Bertalan Meskó, covid, pandemic | 2 Comments »

Screwed-Up Decision Making

[By Staff reporters]

***

***

Filed under: Experts Invited, Glossary Terms, Quality Initiatives | Tagged: Biases investing, cognitve science, Decision Biases, decision-making | 1 Comment »

By Paul Thomas MD

There are perverse incentives in the healthcare system. As a part of my mission to provide affordable and accessible health care in Detroit and beyond, it needs to be said that the middlemen in healthcare inflate the cost of the care that you receive.Anthem Revenue $104 Billion (2019)

Cigna Revenue $154 Billion (2019)

United Revenue $242 Billion (2019)

Aetna Revenues $69.6 Billion (2019)

Cigna CEO salary $18.9 million (2018)

United CEO salary $21.5 million (2018)

Aetna CEO salary $18.7 million (2017)

The total annual healthcare spending in the US is over $3.6 trillion annually.

When your doctor can’t get you the tests/imaging/procedures/surgery/medication you NEED, remind yourself that the middle management, the CEOs, the lobbyists for health insurance company did NOT swear an oath to put your health above money.

Your doctor did.

Doctors are missing sleep, skipping vacation, answering calls on weekend and holidays, missing important family events, and otherwise working tirelessly to keep you healthy.

All of that’s to say that I firmly believe in the power of the doctor-patient relationship and removing the middlemen from this equation.

THANK YOU

Filed under: Experts Invited, Health Economics, Quality Initiatives | Tagged: Paul Thomas MD, Perverse Incentives in the Healthcare System | 3 Comments »

By staff reporters

***

***

Filed under: Experts Invited | Tagged: inventory management | Leave a comment »

Affiliates’ Research in Medical and Other Journals

By staff reporters

Many NBER-affiliated researchers publish some of their findings in medical and other journals that preclude pre-publication distribution. This makes it impossible to include these papers in the NBER Working Paper Series. This is a partial listing of recent papers in this category by NBER affiliates.

Health-Related Papers

|

“Medical Management and Health Economics Education for Financial Advisors”

CMP® CURRICULUM: https://lnkd.in/eDTRHex

CMP® WEB SITE: https://lnkd.in/guWSApq

Your thoughts and comments are appreciated.

BUSINESS, FINANCE, INVESTING AND INSURANCE TEXTS FOR DOCTORS:

THANK YOU

***

Filed under: Experts Invited | Leave a comment »

“The Path to Successful Utilization of Alternative Payment Models”

By Health Capital Consultants, LLC

An article authored by Todd Zigrang, Jessica Bailey-Wheaton, and Khaled Klele was featured in the most recent issue of The Health Lawyer published by the American Bar Association. Read the article entitled, “The Path to Successful Utilization of Alternative Payment Models,” here: https://lnkd.in/e78kXmE

***

ESSAY: The Path to Successful Utilization of Alternative Payment Models

ASSESSMENT: Your thoughts and comments are appreciated.

BUSINESS, FINANCE, INVESTING AND INSURANCE TEXTS FOR DOCTORS:

THANK YOU

***

Filed under: Experts Invited, Health Economics, Healthcare Finance | Tagged: Alternative Medical Payment Models, Health Capital Consultants LLC | 1 Comment »

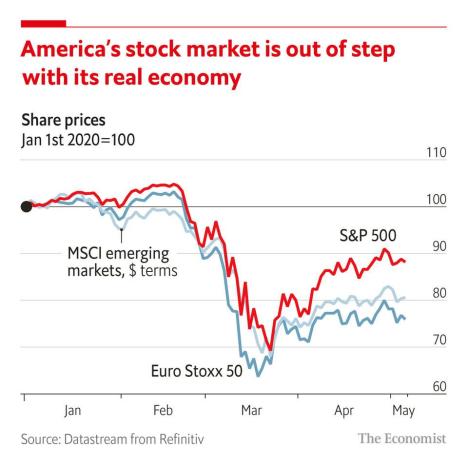

MID-YEAR ROUND-UP

STOCKS: A global stock market crash on March 12 set the worst single-day decline for stocks since 1987. But in Q2, major indexes clawed their way back on the promise of economic reopenings. Filled to the brim with tech companies, the Nasdaq has distanced itself from the Dow and the S&P.

FED: The Fed slashed interest rates in March to stem the economic bleeding, and in early June said it would hold rates near zero through 2022.

OIL: In late April, oil prices crashed below -$37 a barrel as plummeting demand from lockdowns left traders with nowhere to put their oil. Following an agreement by OPEC+ to reduce supply by 9.7 million barrels a day, prices are slowly rebounding back to March’s highs.

CMP® CURRICULUM: https://lnkd.in/eDTRHex

CMP® WEB SITE: https://lnkd.in/guWSApq

Your thoughts and comments are appreciated.

BUSINESS, FINANCE, INVESTING AND INSURANCE TEXTS FOR DOCTORS:

THANK YOU

***

Filed under: Experts Invited, Interviews, Investing | Tagged: STOCK MARKET ROUNDUP | Leave a comment »

Courtesy: www.CertifiedMedicalPlanner.org

On June 19, 2020 the Centers for Medicare & Medicaid Services (CMS) issued a proposed rule regarding Medicaid Drug Rebate Program (MDRP) regulations, with the aim of lowering drug prices, increasing patient access, and encouraging innovation in the insurance and pharmaceutical industries.

This proposal is consistent with the Trump Administration’s Blueprint to Lower Drug Prices (Blueprint) released in May 2018, in which the administration highlighted its goal to “avoid excessive pricing by relying more on value-based pricing by expanding outcome-based payments in Medicare and Medicaid” and to “speed access to and lower the cost of new drugs by clarifying policies for sharing information between insurers and drug makers.”

***

***

The proposed rule seeks to accomplish the Blueprint’s goals by reducing regulatory barriers that have previously prevented commercial plans and states from entering into value-based purchasing (VBP) arrangements with drug manufacturers.

Colleagues from Health Capital Consultants, LLC; explain.

ESSAY: DRUGS

Assessment: Your thoughts and comments are appreciated.

BUSINESS, FINANCE, INVESTING AND INSURANCE TEXTS FOR DOCTORS:

THANK YOU

***

Filed under: Drugs and Pharma, Experts Invited | Tagged: CMS, Drugs, Health Capital Consultants LLC, Value Based Purchasing for Drugs | Leave a comment »

By Health Capital Consultants, LLC

As the coronavirus (COVID-19) global pandemic has wreaked havoc on the U.S. economy generally, and the healthcare industry specifically, the previously-active healthcare transactional environment has been largely stunted.

Despite (or perhaps because of) this economic turbulence, stakeholders expect that merger and acquisition (M&A) activity will soon resume with a vengeance. This potential opportunity, however, is not without pitfalls, due in part to the concern from stakeholders and regulators that well-capitalized entities may use this economic and public health crisis to prey on debilitated physician practices. (Read more…)

ASSESSMENT: Your thoughts and comments are appreciated.

BUSINESS, FINANCE, INVESTING AND INSURANCE TEXTS FOR DOCTORS:

THANK YOU

***

Filed under: Experts Invited, Health Economics, Health Law & Policy, Healthcare Finance | Tagged: Health Capital Consultants LLC, Post-Coronavirus Physician Practice Acquisitions | Leave a comment »

COVID-19 Forces Value-Based Reimbursement Model Revision

***

ASSESSMENT: Your thoughts and comments are appreciated.

BUSINESS, FINANCE, INVESTING AND INSURANCE TEXTS FOR DOCTORS:

THANK YOU

***

Filed under: Experts Invited, Health Economics, Health Insurance, Health Law & Policy | Tagged: COVID-19 Forces Value-Based Reimbursement Model Revision, Health Capital Consultants LLC | Leave a comment »

Courtesy: www.CertifiedMedicalPlanner.org

[On Finding Physician-Focused Financial Advice]

“The financial planner is a like juggler, trying to keep a variety of balls simultaneously in the air. Each aspect of practice becomes critical, just as action is needed.

Some of the activities of operating a successful financial planning practice generally attract more attention than others, such as marketing and advertising, closing engagements, and office administration. Because product review, selection and implementation are often related to advisor compensation, they attract a great deal of the financial juggler’s concentration.

But, the heart of financial planning, niche advice, often receives little attention. Not because it is unimportant, it just doesn’t seem immediately and predictably urgent. Here, that ball does not seem to be dropping so rapidly.

However, retaining clients and receiving referrals from other professionals is very dependent on the quality of the advice delivered. And, the first line of protection from practitioner liability exposure is to not deliver incorrect or incomplete advice.

But, where does the financial advisor turn for ideas and organized research in the healthcare sector?”

Edwin P. Morrow; CFPTM, CLU, ChFC, RFC

[Middletown, Ohio, USA]

Your thoughts are appreciated.

BUSINESS, FINANCE, INVESTING AND INSURANCE TEXTS FOR DOCTORS:

THANK YOU

***

Filed under: Book Reviews, Experts Invited, iMBA, Inc., Investing | Tagged: Edwin P. Morrow; CFPT, Financial Planning | Leave a comment »

Filed under: "Doctors Only", Experts Invited | Tagged: Being a Doctor, Jain MD, prejudice | Leave a comment »

On “Balance Billing”

By Ryan Woody Ryan

Shareholder at Matthiesen, Wickert & Lehrer, S.C.

***

ASSESSMENT: Your thoughts are appreciated.

***

Filed under: Experts Invited, Health Insurance, Healthcare Finance | Tagged: balance-billing, Ryan Woody Ryan, Surprise billing | Leave a comment »

COVID-19 Financial Relief Available to Hospitals and Physicians

By Health Capital Consultants, LLC

The COVID-19 global pandemic has brought a time of grave uncertainty for U.S. healthcare and the greater economy.

While the focus of healthcare providers is, appropriately, on the access and delivery of care to those impacted by the COVID-19 outbreak, there are many providers who will require financial resources to persevere during a time when all sectors of the U.S economy are being significantly impacted.

The federal government has announced a myriad of programs in the form of grants and loans to reimburse hospitals and physicians for some expenses and loss of revenue. (Read more…)

Assessment: Your thoughts are appreciated.

***

***

Filed under: Experts Invited, Health Economics, Health Insurance, Healthcare Finance | Tagged: COVID-19 Financial Relief Available to Hospitals and Physicians, Health Capital Consultants | 2 Comments »

How Will COVID-19 Change Healthcare Delivery?

By Health Capital Consultants, LLC

Spurred by how unprepared the American healthcare system was for a pandemic, the current COVID-19 emergency may present the conditions necessary to commence a healthcare delivery model paradigm shift.

In response to the public health emergency, the federal government, which has a record of reducing regulatory “burdens” under the Trump Administration, has taken aggressive actions to create regulatory flexibilities for healthcare providers and suppliers.

At least some of the various actions taken to reduce provider burden as they treat COVID-19 patients are likely to stay intact following the end of this pandemic, potentially revising the fundamental tenets of U.S. healthcare delivery. (Read more…)

***

***

Assessment: Your thoughts are appreciated.

***

***

Filed under: Experts Invited, Health Economics, Health Insurance, Healthcare Finance | Tagged: Health Capital Consultants, How Will COVID-19 Change Healthcare Delivery?, LLC | Leave a comment »

Filed under: Experts Invited, Investing, Videos | Tagged: Dan Timotic CFA, Stock Market Insights for May 2020, stock markets | Leave a comment »

Filed under: Experts Invited, Investing, Videos | Tagged: Berkshire Hathaway Annual Meeting 2020, Vitaliy Katsenelson CFA | 1 Comment »

Does the Internet Promote the Same Dynamic as “Road Rage?”

Courtesy: https://lnkd.in/eBf-4vY

The best way to get an answer on the Internet is not to ask a question. It’s to post the wrong answer.

This “law” by Ward Cunningham is known to those with social media accounts. Once you’re arguing with a computer – social norms vanish! People like to fight online more than they like to help.

They’re quicker to point out flaws than to become a friendly resource.

In fact, psychologist Jonathan Haidt wrote that if you constantly express anger in your private conversations, your friends will likely find you tiresome. But, when there’s an audience, the payoffs are different and outrage can boost your status.

A study by William J. Brady at NYU measured half a million tweets and found that each moral or emotional word used in a tweet increased its virality by 20 percent.

***

***

Finally, another 2017 study, by the Pew Research Center, showed that posts exhibiting “indignant disagreement” received nearly twice as much engagement [likes and shares] as other types of content.

MORE: https://lnkd.in/emU7F5c

Assessment: Your thoughts are appreciated

TEXTS FOR PHYSICIAN-EXECUTIVES & MEDICAL CXOs:

1 – https://lnkd.in/eEf-xEH

2 – https://lnkd.in/e2ZmewQ

Thank You

Filed under: Experts Invited, Glossary Terms | Tagged: WARD CUNNINGHAM'S LAW OF INTERNET INQUIRIES!, William J. Brady | 1 Comment »

Opinion-Editorial

The ONLY way to protect dentists, staff, patients and their families from the risk of fatal COVID-19 infections is to keep the virus out of dental offices. (See graph from the New York Times).

Prediction: If quick and reliable testing is not available soon, within weeks after dental offices re-open for routine dental care – creating aerosols with high speed hand pieces, air/water syringes and ultrasonic scalers – dental offices will justifiably become known as reliable sources of COVID-19 infections, before being closed down again by the state.

Assessment: Your thoughts are appreciated.

***

Filed under: Experts Invited, LifeStyle, Op-Editorials, Pruitt's Platform | Tagged: corona, Darrell K. Pruitt, DDS, dentists | 3 Comments »

A NEW I.P.O

BY HEALTH CAPITAL CONSULTANTS, LLC

***

On January 30, 2020, 1Life Healthcare, Inc. (One Medical) went public, opening at $14 per share, and closing at $22.07 per share. The innovative San Francisco-based direct primary care organization more closely resembles a technology start-up than a traditional healthcare organization.

The membership model service provides “seamless access” to primary care services at “calming offices,” 24/7 virtual care, and 21st century technology (e.g., a mobile application that allows patients to schedule appointments and message their provider).

**

***

A new report from our colleagues over at Health Capital Consultants, LLC:

LINK: https://www.healthcapital.com/hcc/newsletter/02_20/HTML/IPO/convert_ipo_hc_topics.php#_edn4

ASSESSMENT: Your thoughts are appreciated.

***

***

Filed under: Experts Invited, Quality Initiatives, Research & Development | Tagged: Health Capital Consultants LLC, Health Care "DISRUPTORS" | 1 Comment »

Courtesy: www.CertifiedMedicalPlanner.org

Our message on Corona Virus so far has been “don’t panic.” For the vast majority of individuals, Corona Virus is not an existential threat.

However, the rapid rate of the virus’s spread has the potential to overwhelm our health system and cause a lot of problems.

And so, colleague Aaron E. Carroll MD MS explains the infection curve, right here.

***

***

PODCAST: https://theincidentaleconomist.com/wordpress/flattening-the-curve-of-coronavirus-infections/

Assessment: Your thoughts and comments are appreciated.

BUSINESS, FINANCE AND INSURANCE TEXTS FOR DOCTORS

THANK YOU

***

Filed under: Breaking News, Experts Invited, Health Economics, Quality Initiatives | Tagged: Aaron E. Carroll MD, corona virus, Covid-19 | 1 Comment »

FEBRUARY 2020 AJPHBy Alfredo Morabia, MD, PhD Editor-in-chief, AJPH Dear Dr. David Marcinko, |

***

| This month, AJPH has a collection of articles on ending the HIV epidemic, population health and telemedicine services.

New! Enjoy the current issue of AJPH on your mobile device. Download the e-Reader or Kindle version today. Here are a few of the many articles in the February 2020 issue: |

***

***

| Also, don’t miss our just released supplement on Documenting and Addressing the Health Impacts of Carceral Systems. It’s full of timely and insightful articles on mass incarceration and related topics.

The mission of AJPH is to advance public health research, policy, practice and education. Toward that goal, the journal also produces monthly podcasts available in English, Spanish and Chinese at ajph.org. The monthly podcasts also are on iTunes and Google Play. Be on the lookout for more timely research from AJPH, and consider subscribing or becoming an APHA member for full access. Thank you and Happy New Year 2020 |

| Alfredo Morabia, MD, PhD

Editor-in-chief, AJPH |

Filed under: Experts Invited, Health Law & Policy, iMBA, Inc. | Tagged: Alfredo Morabia, MD, PhD, Role of Pleasure in Public Health | Leave a comment »

Filed under: Experts Invited, Investing, Videos | Tagged: Market Risk & The All-Terrain Portfolio, Risk Adjusted Rate Return, Vitaliy Katsenelson CFA | Leave a comment »

By Vitaliy Katsenelson CFA

The stock market marched higher for the year even though US companies as a whole did not become more valuable, just more expensive, as earnings failed to grow from 2018 to 2019. Earnings are estimated to be up about 5% for 2020 (though these estimates are usually revised down as the year progresses).

If you look at the quality of this non-growth, then the rose-tinted glasses of the average stock market investor quickly prove inadequate. Corporate debt is up 5% in 2019, and a good chunk of the increase went into stock buybacks. As stocks become expensive their benefit from earnings per share growth diminishes.

Assessment: Your thoughts are appreciated.

BUSINESS, FINANCE, INVESTING AND INSURANCE TEXTS FOR DOCTORS:

THANK YOU

***

Filed under: Experts Invited, Investing | Tagged: finance, Investing, Vitaliy Katsenelson CFA | Leave a comment »

U.S.A BUSINESS CYCLE REPORT 2019

Courtesy: www.CertifiedMedicalPlanner.org

[Pictographic Presentation for December 2019]

Constructed and presented by Nick Reece CFA of MERK Investments LLC., and Research.

GRAPHIC CHART BOOK: MR

Your thoughts are appreciated.

BUSINESS, FINANCE, INVESTING AND INSURANCE TEXTS FOR DOCTORS:

THANK YOU

Filed under: Experts Invited, iMBA, Inc. | Tagged: U.S.A BUSINESS CYCLE REPORT 2019 | Leave a comment »

Responding to an ‘Objectivist’s’ Claim That Self-Ownership Doesn’t Exist

By Dr. David E. Marcink MBA

I was fascinated with this podcast.

It was recorded by my neighbor and Austrian economist Peter Raymond over at “The Free Man Beyond the Wall” website.

PODCAST: http://freemanbeyondthewall.libsyn.com/episode-335

Your thoughts are appreciated.

BUSINESS, FINANCE, INVESTING AND INSURANCE TEXTS FOR DOCTORS:

***

THANK YOU

Filed under: Experts Invited, Practice Management, Videos | Tagged: Peter Raymond, Self-Ownership Doesn't Exist?, The Free Man Beyond the Wall | Leave a comment »

Do your credit card reward points belong to you?

For frequent travelers, who often choose credit cards based on reward programs, accumulated points can be worth thousands of dollars. Whether points are an asset that can be transferred to an heir is another matter.

I recently received this question: “Our friend whose husband recently passed away lost over a million points with Capital One because her husband was the primary on the account and she was just an authorized user, not a joint owner. Capital One closed the credit card since he passed and all the points were forfeited. Do you have any ideas on how to get the points back?”

Unfortunately, not much can be done after the fact. Most credit cards offering points that can be redeemed for travel expense say that points have no cash value and are not actually the property of the account owner but rather belong to the reward’s program. Most card programs’ terms and conditions say that points outstanding upon the card holder’s death are permanently forfeited.

An appeal to the issuing bank would be worth trying. Surprisingly, some will show compassion and allow the points to transfer to another account or credit their value against any outstanding balances on the card, usually at one cent per point.

Considering this issue ahead of time, however, might allow surviving spouses to avoid losing all of a loved one’s hard-earned points.

First, try to find a rewards card that will allow you to own the account jointly with your spouse rather than being an authorized user. If one spouse passes away, the points will remain in the account and the other joint owner will have full access to them. An authorized user has no risk or obligation to pay any debt, and therefore has no claim on any points that remain in the account after the death of the primary cardholder.

The downside of a joint account is that each cardholder is equally liable for any amounts the other charges to the account. If your marriage is transparent and without any financial infidelity going on, this shouldn’t be a problem. If the card is a business card, joint ownership could be more problematic.

Banks that I found that will allow joint accounts are US Bank and PNC Bank. Specific rewards cards that allow joint ownership are Bank of America Cash Rewards, Wells Fargo Cash Wise Visa, and Discover it Cash Back. Obviously, with only three rewards cards allowing joint ownership, that option isn’t widely available.

The next best choice is to be sure both partners have the login information for the account. This would allow a survivor to log on and redeem or transfer points. Many cards will allow transferring points to an airline or hotel rewards programs for 1.5 to 2.3 cents per point. Of course, both partners need to have access to those accounts as well, which generally isn’t a problem with most programs.

This is also the recommended method of accessing points with a specific airline. According to a September 19, 2019, article by Richard Kerr at thepointsguy.com, giving your next of kin access to all your airline and hotel awards accounts gives them “all the information needed to continue using the points and miles without alerting the airline.”

Including airline reward points in a will may be worthwhile. It might not make a difference with every airline or bank, but some programs will transfer such designated points without a fee.

Assessment:

Travel reward points may be a relatively minor asset. Still, a little planning can make them readily available without adding stress for a surviving spouse during a difficult time.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

***

Filed under: Experts Invited, Investing | Tagged: credit cards, reward points, Rick Kahler CFP | Leave a comment »

An Important Money Skill

“Some days adulting is a pain.” What parent of college-age children hasn’t heard something similar from their kids? The transition from kid to adult is a necessary process toward living a fulfilled and meaningful life, but it isn’t easy or smooth.

This is especially true when it comes to money. Mastering money skills can be a challenge even for older adults.

One of the earliest opportunities to learn adult financial skills comes with renting an apartment. Before you sign that first lease—or any lease—it’s important to understand it. A lease is a legal document that sets out obligations and rights for both landlord and tenant.

One of the most important features of a lease is the length of the agreement. Your lease could be “month-to-month” or for a specific period like a few months or even several years. The most common residential lease terms are six months to one year.

There are pluses and minuses to both types. A month-to-month lease gives the renter the minimum commitment and maximum flexibility. Usually, if you want to move out for whatever reason, you just need to give the landlord a 30-day notice. Unlike a longer-term lease, there is no penalty for “breaking” the lease unless you fail to give even a 30-day notice.

So why wouldn’t a tenant always want a month-to-month lease? Many tenants don’t understand that the flexibility goes both ways. If a landlord chooses to stop leasing the property, finds a tenant willing to pay higher rent, or decides to sell the property, all the lease requires is a 30-day notice for the current tenant to move out. A tenant must accept that risk.

A recent local example concerned 11 house renters who lived on the campus of the Star Academy, a former state-owned property near Custer, SD. Some of the tenants had rented for 14 years with month-to-month leases. When the state foreclosed on the property it gave the tenants 30-day notices to move. This was not received well by the renters, who faced the prospect of immediately having to find new places to live in a town with a limited supply of housing. Fortunately, the governor reversed the decision and gave the renters six months to find new housing.

As shocking and heartless as this move might have seemed to the renters, it was completely within the rights of the landlord, just as it would have been completely within the rights of any of the tenants to do the same.

It’s easy to get lulled to sleep by a month-to-month lease, especially when a tenant has lived in the property for year after year. However, if the prospect of having to vacate your home in 30 days is not appealing, it would be a really good idea to ask the landlord for a longer lease.

Assessment:

Before signing a lease, consider how long you are willing to commit to living in the property. What will best serve your situation? For some, it may be a lease that expires at the end of a school year, or in a year, or even in three to five years if you see no reason that you will need to move anytime soon. Be aware that by signing the lease, you agree to stay and to pay rent until the time is up.

Also understand that, unless the lease specifically states otherwise, neither you nor the landlord are bound to renew when the lease expires. So it’s important to renegotiate a new lease well before the current lease expires.

Before signing any lease, read it carefully. Ask clarifying questions. Be sure you understand the legal commitment you are making.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

***

Filed under: Experts Invited, Financial Planning, LifeStyle | Tagged: apartment leases, leasing | Leave a comment »

FROM: The Ludwig Von Mises Institute

Courtesy: www.CertifiedMedicalPlanner.org

I was fascinated with this podcast as a rewind episode. Pete talks about a host of Liberty related topics with Ludwig Von Mises Institute President, Jeff Deist.

It was recorded by my neighbor and Austrian economist Peter Raymond over at “The Free Man Beyond the Wall” website.

PODCAST: http://freemanbeyondthewall.libsyn.com/episode-344

Your thoughts are appreciated.

BUSINESS, FINANCE, INVESTING AND INSURANCE TEXTS FOR DOCTORS:

***

THANK YOU

Filed under: Experts Invited, Videos | Tagged: Jeff Deist, Ludwig Von Mises Institute, Peter Raymond, The Free Man Beyond the Wall | Leave a comment »

Investing in Financial Counseling

Filed under: Experts Invited, Investing, Op-Editorials | Tagged: Financial Counseling | Leave a comment »

By RICK KAHLER, CFP

You have probably never seen an ad like this, because entrepreneurs are not hired. They hire themselves. Merriam-Webster defines an entrepreneur as “a person who starts a business and is willing to risk loss in order to make money” or “one who organizes, manages, and assumes the risks of a business or enterprise.”

God bless entrepreneurs. Without them our world would look much different. We would probably still be living in caves, hunting with clubs, and eating raw meat. They create companies from scratch. In so doing, they create jobs and take significant monetary risks of a business failure.

They also stand to gain substantial rewards for success, but that success is far from guaranteed. Few people realize that most entrepreneurs fail in their attempts in business. According to Investopedia, 50% of all new businesses fail in 5 years, 66% in 10 years, and 75% in 15 years.

Given those statistics, the entrepreneurs who succeed must be rich, right? A study by Career Explorer found that the average full-time salary of an entrepreneur is $43,240 a year. To put this into perspective, the average starting salary for a graduating four-year degree student at the South Dakota School of Mines and Technology is $63,354. Maybe there should be a song, “Mamas, don’t let your babies grow up to be entrepreneurs.”

My experience, however, is that it really doesn’t matter what Mama says. The entrepreneurial mindset is somewhat inextinguishable. While there have been some attempts at teaching entrepreneurial skills, it’s hard to teach grit, determination, and perseverance, coupled with a good dose of fantasy thinking and denial. It’s really hard to “tell” an entrepreneur anything.

Fittingly, entrepreneurs love to invest in their own companies. Investment advisors call such holdings “tangible” investments, ones you can see and touch. Tangible investments include start-up businesses, family-owned businesses, and all types of directly owned real estate. They are inherently non-diversified and illiquid. Typically, entrepreneurs have the vast portion of their net worth tied up in their businesses. It’s incredibly rare to find one with a stash of cash or any type of liquid portfolio or retirement plan.

Why? The entrepreneurial mindset. First, entrepreneurs don’t believe in traditional diversification. Why settle for earning an average of 5% a year when you can earn ten times that in your business? Never mind that the chance of losing it all is three to one. Most entrepreneurs firmly believe they are the one guaranteed to succeed even though the deck is stacked against them.

Second is that since 75% of businesses ultimately fail, most entrepreneurs are losing, not making, money. They are perennially cash-poor and need every dollar they can find to fund their negative cash flows. Even those who are making money rarely have any liquid investments because entrepreneurs are always looking for new ventures, which of course, need funding.

One of the most difficult tasks I face is persuading a successful entrepreneur to take some hard-earned “chips” off the table and sock away a low-risk, diversified nest egg to assure a comfortable retirement. The only ones I’ve convinced to do that were older entrepreneurs who had owned their companies for well over 15 years and were under five years from retirement. All the younger entrepreneurs to whom I have given that advice have refused the notion. All have eventually lost 75% to 90% of their net worth and, sadly, the opportunity to secure their future.

The entrepreneurial mindset of determination and perseverance can bring significant financial rewards. Expanding that mindset to include a broader, more diversified view of investing for the future can turn those rewards into long-term financial independence.

Assessment: Your thoughts are appreciated.

BUSINESS, FINANCE, INVESTING & INSURANCE TEXTS FOR DOCTORS:

THANK YOU

***

Filed under: Experts Invited, Financial Planning, iMBA, Inc. | Tagged: Entrepreneurs | Leave a comment »

A BLACK MARKET PODCAST VIEW OF THE OPIOID CRISIS

Courtesy: www.CertifiedMedicalPlanner,org

Opioid Overdose Crisis

Every day, more than 130 people in the United States die after overdosing on opioids.1 The misuse of and addiction to opioids—including prescription pain relievers, heroin, and synthetic opioids such as fentanyl used to help relieve severe ongoing pain —is a serious national crisis that affects public health as well as social and economic welfare.

***

***

The Podcast

And so, I was fascinated with this podcast because I often encountered narcotic seeking patients while in city center and urban practice. It was recorded by my neighbor and Austrian economist Peter Raymond over at “The Free Man Beyond the Wall” website.

Colleague Dr. Mark Thornton recently gave this talk at the Mises Institute Supporters Summit on the opioid crisis that is plaguing the US. Dr. Thornton lays out a short history of this tragic epidemic that is taking lives every day. He addresses how doctors prescribe these drugs, how government regulates them and explains what happens when people are forced into the “black market” to sustain their addiction.

PODCAST: http://freemanbeyondthewall.libsyn.com/episode-169-the-opioid-crisis

MORE: https://medicalexecutivepost.com/2019/08/22/the-opioid-crisis-rising-2000-2017/

MORE: https://medicalexecutivepost.com/2019/02/06/about-the-opioid-crisis/

Your thoughts are appreciated.

BUSINESS, FINANCE AND ECONOMICS TEXTBOOKS FOR DOCTORS:

THANK YOU

***

Filed under: Drugs and Pharma, Ethics, Experts Invited, Videos | Tagged: Dr. Mark Thornton, Free Man Beyond the Wall, Mises Institute Supporters Summit, Peter Raymond | Leave a comment »

Please – Do Not Do This!

By Francisco Gutiérrez, MD., Lucio Leon, M.D. at: nejm.org

***

Submitted for your consideration. Just In case you ever wondered what injecting 10 ml of elemental mercury would do to you?

Case report: A 21 yo woman attempted suicide by injecting 10 ml (135 g) of elemental mercury (quicksilver) intravenously.

Normal AP Chest X-Ray

***

***

Case: She presented to the emergency room with tachypnea, a dry cough, and bloody sputum. While breathing room air, she had a partial pressure of oxygen of 86 mm Hg.

***

Assessment

The patient was discharged after one week, with improvement in her pulmonary symptoms. Oral chelation therapy with dimercaprol was given for nine months. At follow-up at 10 months she was healthy, with no serious consequences. The abnormalities on the chest radiograph were still apparent.

Your thoughts are appreciated.

***

***

Filed under: Career Development, Experts Invited, Risk Management | Tagged: mercury poisoning | Leave a comment »

“Money is supposed to be spent!” “Money is supposed to be saved!”

We may not hear talk-show participants shouting these opposing views at each other with the same level of anger that characterizes some of our political rhetoric. Yet the core polarization that pervades so much of today’s society also shows up in people’s beliefs about money.

I saw this polarization recently in a conversation with a group of friends in Europe. The topic of money came up, as it usually does when people find out one of my specialties as a financial advisor is financial therapy. The thinking of my friends was that money is meant to be spent, not saved. They felt that people who saved money were faithless and greedy hoarders who by their saving threatened the economic system.

At the other extreme, I know other people who strongly believe a person’s first duty is to save and invest. According to them, those who don’t save as much as possible for emergencies and retirement are foolish, deluded, irresponsible, and destined to live out their last days in poverty.

My friends who embrace the money script that “money is to be spent, not saved” are likely to also hold a money script that “the universe will provide.” They tend to fall into a category we label Money Avoiders. Those who embrace the money scripts that “money is to be saved and not spent,” who also believe “one can never really have enough money,” are in the category of Money Worshipers.

Like most other forms of polarized thinking, neither of these extremes is right. Nor is either belief wrong.

Money does need to be spent. The health of our economic system depends on transactions. It’s important that money flows through the selling and buying of goods and services. When a significant number of consumers stop spending, economic activity grinds to a halt. We saw the effect of this in the financial crises of 2008. It’s also important to spend money to take care of ourselves and our families. Saving or investing money to a point that we go without adequate food, shelter, health care, or similar necessities is not healthy.

***

Money also needs to be saved to provide a cushion against emergencies and to provide for our needs in retirement. My European friends enjoy a higher certainty of adequate income in retirement. For them, this is the universe providing, a strong government security net. However, those that live in many Asian countries are assured very little, if anything, in the way of retirement income. For them, the universe comes up short and depends upon the generosity of family to provide. Saving in an Asian culture is therefore much more important than if you live in a Scandinavian country.

Saving and investing for retirement is important for those of us in the US, as well. Without it, we face two dubious prospects: we can depend on family to provide or we can eke out a meager living on a Social Security payment of around $2,000 a month in retirement.

Those who are not polarized around money understand that both spending and saving are important for financial health. They can balance their spending and saving, applying both when necessary in their own lives.

Assessment

Ideally, from this balanced middle ground, someone can also see past the limitations of others who are polarized. Those who believe “Money is meant to be spent” or “Money is meant to be saved” have a world view that results in such an extreme position. Labeling them as “wrong” is not a useful way to try to shift anyone’s polarized beliefs.

Conclusion: Your thoughts are appreciated.

***

***

Filed under: Experts Invited, Investing | Tagged: Prioriting Money Beliefs, Rick Kahler CFP | Leave a comment »

Taxes for All?

As the recent debates among the Democratic presidential candidates emphasized, the idea of government-managed health care is gaining popularity. “Medicare for all” or some form of “free” universal health care is certainly an appealing idea. Who among us wouldn’t appreciate someone else paying our medical bills?

I certainly would. My family’s personal health care costs, including premiums and out-of-pocket expenses, run just over $3,000 a month. If my health care were free, I could find a lot of uses for the savings.

But my skeptical side, and probably yours as well, knows that there is no such thing as a free medical procedure. Someone, by some means, has to pay for insurance coverage, doctor visits, hospitalizations, and other medical costs.

The tax tab for providing “Medicare for all,” as envisioned by Sen. Bernie Sanders, is $3 trillion a year, according to several analysts. Currently, the cost for Medicare is about one-sixth that amount, or $583 billion a year.

Sanders and other presidential candidates tell us the wealthy will pay this tab. The reality is that when we look at other countries that have similar universal health care plans, it isn’t just the wealthy that are paying for it.

Raising the more than $3 trillion needed annually to fund “Medicare for all” would require doubling all personal and corporate income taxes or tripling payroll taxes. This analysis comes from Marc Goldwein, a senior vice president at the non-partisan Committee for a Responsible Federal Budget. He was cited in a May 9, 2019, Bloomberg article by Laura Davison, “Tax hikes on wealthy alone can’t pay for Medicare for all plan.” “There is a lot of money out there, but there isn’t $30 trillion [over 10 years] sitting around from high earners,” Goldwein said. “It just doesn’t exist.”

I did a little investigating of the tax rates of European countries that have universal health care and found Goldwein’s statement to be true. For example, Denmark taxes income over $7,000, with rates starting at 40%. The US rate starts at 10%. This would indicate a doubling or tripling of income taxes or payroll taxes on the lowest earners is not a politically-skewed scare tactic, but an economic reality.

The top rate in Denmark is 56%, while the top rate in the US is 50% (37% federal and 13% state). This is just one of many examples I found in my searching that strongly indicate other countries that have universal health care haven’t found much room left to tax the wealthy. Based on their experience, the majority of the cost will need to come from lower income earners.

Sadly, this message is not being disseminated to voters by proponents of universal health care. While I am not advocating for or against universal health care here, I am advocating for full disclosure and transparency.

A topic as significant as this deserves a great deal of discussion based on clear, complete disclosure of facts and educated analysis. It requires the best available answers to questions like who will be covered, what will be covered, how much the program will cost, and who will pay for it.

***

***

Assessment

Raising six times what we are currently spending for Medicare would be a huge task. Transferring one-eighth of the US economy from the private sector pocket to the public sector one would not be easy or painless. Making the transition to some form of tax-funded universal health care would be a major shift in direction for this country that would have a significant impact on all Americans. It is not a decision to make based on inadequate information, political rhetoric, or unreasonably optimistic assumptions.

***

Foreword by Jason Dyken MD MBA

***

Filed under: Experts Invited, Health Insurance, Health Law & Policy | Tagged: medicare, Medicare for All, Rick Kahler CFP | 5 Comments »

Professor Marcinko Appointed to Medblob Advisory Board

By Richard S. Tannenbaum; MS

[Co-Founder and Chief Financial Officer]

At Medblob, we manage healthcare data for patients, providers, and research organizations. Our leadership team is from multi-disciplinary back grounds, including medicine, software and research. And, our advisors have broad experience and training in clinical medicine, insurance and healthcare information technology companies.

So, we are pleased to announce that Dr. David Edward Marcinko MBA CMP® has just been appointed to the Advisory Board of our company.

About Medblob™

The Challenge:

One of the biggest challenges for providers is having all of the patient’s medical information, at the point of care.

The Solution:

Medblob™ is an emerging and secure military encrypted and HIPAA compliant health information exchange and data warehouse, known as HealthFile™, that aims to have medical information available at the point-of-care so clinicians are able to make better decisions to improve their patients’ health.

The Outcome:

MedBlob™ solves a major cause of medical errors and preventable death: inaccurate or missing health information.

Assessment

Member of Medblob’s Advisory Board composed of medical, legal, and financial experts assisting the management team in the company’s mission of improving public health and outcomes for patients. Medblob Advisory Board was chartered to provide advice to the executive team regarding the company’s strategy, development, market positioning, and growth trajectory. LifeBook is Medblob’s military-grade secure patient electronic health record that acts as a single source of truth health record, medical data platform, and Network as a Service (NaaS).

Board of Advisors Link: http://www.medblob.com/board-of-advisors/

More: Please contact us to get involved in the future of healthcare information technology!

Filed under: Experts Invited, Information Technology | Tagged: david marcinko, HealthFile™, Medblob, Richard Tannenbaum | Leave a comment »

How can this possibly be fair?

By Rick Kahler MS CFP®

An April 29th headline in The New York Times got my attention: “Profitable Giants Like Amazon pay $0 in Corporate Taxes. Some Voters Are Sick of It.” My immediate reaction was outrage. Amazon had a 0% tax rate. My company’s overall tax rate was 24%, and its net profit was less than 0.000025% of Amazon’s. How can this possibly be fair?

The Times article, by Stephanie Saul and Patricia Cohen, gave few specifics but left the impression that Amazon simply gets out of paying taxes on its profits because of a legal, but unfair, manipulation of the tax code afforded only to wealthy corporations, leaving the heavy lifting to the rest of us poor saps.

I wanted to know how Amazon did it, so I did some research

First, let’s put the $11.1 billion profit into perspective. The past 18 months are the first time Amazon has shown any meaningful profit since 2011. Many of those years saw them losing billions of dollars.

The total value (market capitalization) that shareholders have invested in Amazon is $954 billion as of April 29, 2019. That means the 2018 profit of $11.1 billion represents an earnings yield of 1.16% return on investors’ money. The average earnings yield on a large US company is 4.5%, significantly higher than Amazon’s. While $11.1 billion sounds like a lot of money in dollar terms, when viewed in the amount of money it takes to generate those profits, Amazon’s financials are significantly subpar.

Amazon reduced their taxes to zero by primarily doing four things:

The article cited a carpet layer who had a profit of $18,000 and paid more in taxes than Amazon. He was so upset at this injustice that he joined the Socialist Party.

The article failed to mention that many of the same write-offs used by Amazon were available to him, too. If his business was incorporated, the tax bill on his profits was probably 21%, or $3,780. If he had reinvested his profit in a new carpet cleaning machine, had losses from previous years to carry forward, spent money on developing a new type of carpet cleaner, or paid his employees in stock, he would have paid nothing in taxes.

***

***

Assessment

Critics of big corporations might say such strategies would not be realistic for a one-person company. Yet I have seen many small business owners use them, particularly carrying forward losses that result from the essential start-up costs. The corporate tax code generally applies equally to all businesses and is meant to encourage small companies as well as large ones to take the risks necessary to create new jobs.

Conclusion

Your thoughts are appreciated.

***

***

Filed under: Experts Invited, Investing, Taxation | Tagged: Amazon, New York Times, Rick Kahler MS CFP® | Leave a comment »

Get Published – Get Known

By Ann Miller RN MHA [Executive Director] MarcinkoAdvisors@msn.com

The ME-P is one of the leading online and onground resources for medical professionals, financial advisors and medical management consultants.

Want to Contribute Your Thought Leadership?

By submitting a guest article, video, infographic, or case study/report related to our forum, you can:

Article/Guest Post Submission Guidelines

Submission Process

The ME-P also welcomes the submission of all white papers and case studies that will be posted in the appropriate channel section of the site.

Article/Guest Post Writing Tips

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

DICTIONARIES: http://www.springerpub.com/Search/marcinko

PHYSICIANS: www.MedicalBusinessAdvisors.com

PRACTICES: www.BusinessofMedicalPractice.com

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Experts Invited, Financial Planning, iMBA, Inc., Practice Management | Tagged: experts invited, Financial Planning, healthcare administration, medical practice management, www.MedicalExecutivePost.com | 2 Comments »

Random Drivel?

[By Vitaly Katsenelson CFA]

What I am about to share with you is somewhat random drivel about a topic that has been very important to me in 2018 – time.

I am anything but an expert on it; and in fact, as you’ll see, this is something I fail in and am trying to fail less.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements.

Book Marcinko: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

Subscribe: MEDICAL EXECUTIVE POST for curated news, essays, opinions and analysis from the public health, economics, finance, marketing, IT, business and policy management ecosystem.

DOCTORS:

“Insurance & Risk Management Strategies for Doctors” https://tinyurl.com/ydx9kd93

“Fiduciary Financial Planning for Physicians” https://tinyurl.com/y7f5pnox

“Business of Medical Practice 2.0” https://tinyurl.com/yb3x6wr8

HOSPITALS:

“Financial Management Strategies for Hospitals” https://tinyurl.com/yagu567d

“Operational Strategies for Clinics and Hospitals” https://tinyurl.com/y9avbrq5

***

Filed under: Experts Invited, Information Technology, Investing | Tagged: Resetting Defaults for 2019, Vitaliy Katsenelson CFA | Leave a comment »

By Alfredo Morabia, MD, PhD

Editor-in-chief, AJPH

| Dear Dr. David Marcinko,

This month, AJPH showcases articles on pain management and public health. Visit ajph.org to see all of this month’s articles and podcasts. A few are available to everyone, even if you aren’t an APHA member.

The mission of the journal is to advance public health research, policy, practice and education. Toward that goal, the journal also produces monthly podcasts in English, Spanish and Chinese. Be on the lookout for more timely research from AJPH, and consider subscribing or becoming an APHA member for full access. |

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements.

Book Marcinko: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

Subscribe: MEDICAL EXECUTIVE POST for curated news, essays, opinions and analysis from the public health, economics, finance, marketing, IT, business and policy management ecosystem.

DOCTORS:

“Insurance & Risk Management Strategies for Doctors” https://tinyurl.com/ydx9kd93

“Fiduciary Financial Planning for Physicians” https://tinyurl.com/y7f5pnox

“Business of Medical Practice 2.0” https://tinyurl.com/yb3x6wr8

HOSPITALS:

“Financial Management Strategies for Hospitals” https://tinyurl.com/yagu567d

“Operational Strategies for Clinics and Hospitals” https://tinyurl.com/y9avbrq5

***

Filed under: Experts Invited, Media Mentions and PR, Recommended Books | Tagged: AJPH, Alfredo Morabia, American Journal Public Health, pain-management | 1 Comment »

A Physician Focused Financial Advisior and Certified Medical Planner™

Financial Management Experience

Financial Management Experience

https://www.medicuswealthplanning.com/team/david-k-luke

David K. Luke focuses on helping physicians, medical professionals, and successful retirees with financial planning, investment and risk management.

In the past 24 years of industry experience, David has held licenses including general securities registered representative, registered investment advisor, Branch management supervision, and Life, Accident, and Health Producers.

David, a fee-only advisor, is able to help his clients to achieve peace of mind and greater assurance with their financial goals by giving advice and providing investment management that is in their best interest, untainted by commissions or sales objectives. Likewise, in a true fiduciary capacity, he is able to help investors determine the reliability and suitability of products and services that they have been sold by other advisors.

David began his career managing money in 1986 in the General Motors of Canada Banking and Investments department where he was engaged in cash management, foreign currency hedging, and the debt issuance of a $100 million Eurobond and a $300 million Note Issuance facility. In 1988 as Supervisor of Borrowings for GMAC Canada David was responsible for the daily average issuance of $125 million in short-term Commercial Paper. David worked as a stock broker and portfolio manager for 2 major national brokerage firms (A.G. Edwards and Wachovia Securities) from 1989 to 2008.

Additionally, at Wachovia Securities David was among an elite group of financial advisors approved as a PIM (Private Investment Management) Portfolio Manager. Prior to joining Net Worth Advisory Group in 2010, David managed his own independent firm, Luke Wealth Strategies, working as a registered representative and investment advisor.

Education and Designations

Assessment

David is our newest ME-P “thought-leader”. We look foward to his insider comments and posts. So, please welcome him and give his site a click: http://networthadvice.com/our-team/david-k-luke/

Filed under: CMP Program, Experts Invited, Financial Planning, iMBA | Tagged: •American Graduate School of International Management, CMP, david k. luke, Financial Planning, FPA, Medical Group Management Association, NAPFA, Net Worth Advice, www.certifiedmedicalplanner.com | 1 Comment »

By Austin Frakt PhD

And I’ve got an op-ed in the Washington Post about why the court is wrong. Here’s a taste:

Who cares if a zero-dollar mandate is constitutional or not? Why does it matter in the slightest? And what on earth does it have to do with the rest of ACA?

You might have thought that the right remedy would be to invalidate the penalty-free mandate. Doing so would align with Congress’s evident view that an ACA without an individual mandate was preferable to an ACA with it. That’s what I argued in an amicus brief with a bipartisan group of law professors.

Instead, the court held that the entire ACA was “inseverable” from the purportedly unconstitutional mandate. To reach that conclusion, the judge leaned heavily on Congress’s findings from 2010, where it said that the individual mandate was “essential” to the law.

But the mandate that the 2010 Congress said was essential had a penalty attached to it. The finding is irrelevant to a mandate that lacks any such penalty.

In any event, it doesn’t matter what Congress meant to do in 2010. It matters what Congress meant to do in 2017, when a different Congress made a different call about whether the mandate was essential. We know what Congress wanted to do in 2017: repeal the mandate and leave the rest of the act intact. Its judgment could not have been plainer. (I know. I was there! So were you. It wasn’t that long ago.)

***

***

You can read the whole thing here. My co-amici, Jonathan Adler and Abbe Gluck, have a New York Times op-ed sounding similar themes.

I’ll probably write them up more extensively in the coming days, but I’ve also got tentative thoughts about the immediate consequences of the decision (short answer: nothing right now) and the potential difficulties with getting a quick appeal of the decision.

***

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements.

Book Marcinko: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

Subscribe: MEDICAL EXECUTIVE POST for curated news, essays, opinions and analysis from the public health, economics, finance, marketing, IT, business and policy management ecosystem.

“Fiduciary Financial Planning for Physicians” https://tinyurl.com/y7f5pnox

“Business of Medical Practice 2.0” https://tinyurl.com/yb3x6wr8

HOSPITALS:

“Financial Management Strategies for Hospitals” https://tinyurl.com/yagu567d

“Operational Strategies for Clinics and Hospitals” https://tinyurl.com/y9avbrq5

***

Filed under: Experts Invited, Health Law & Policy | Tagged: ACA, ACA unconstitutional, Austin Frakt PhD | 11 Comments »

By Vitaliy Katsenelson CFA

***

I was interviewed by my friend Dan Ferris on the Stansberry Investor Hour show. My segment of the interview starts at the 22:22 mark (click here to listen).

If you’d like to dig deeper into some of the concepts I discussed, you can read the following articles:

1 – What quality means to us.

2 – Why we sold of ETFs and bought Treasuries

3 – How and why we are hedging our portfolios with options

4 – Why Amazon will not run McKesson out of business and why we like the stock and here is one more.

***

***

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements.

Book Marcinko: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

Subscribe: MEDICAL EXECUTIVE POST for curated news, essays, opinions and analysis from the public health, economics, finance, marketing, IT, business and policy management ecosystem.

DOCTORS:

“Insurance & Risk Management Strategies for Doctors” https://tinyurl.com/ydx9kd93

“Fiduciary Financial Planning for Physicians” https://tinyurl.com/y7f5pnox

“Business of Medical Practice 2.0” https://tinyurl.com/yb3x6wr8

HOSPITALS:

“Financial Management Strategies for Hospitals” https://tinyurl.com/yagu567d

“Operational Strategies for Clinics and Hospitals” https://tinyurl.com/y9avbrq5

Filed under: Experts Invited, Investing, Videos | Tagged: Stansberry Investor Hour Interview, Vitaliy Katsenelson CFA | Leave a comment »

|

Filed under: Experts Invited, Investing | Tagged: Vitaliy Katsenelson CFA | 1 Comment »

By Vitaliy Katsenelson CFA

***

Today I am going to share with you an article I wrote after the January 2018 stock market volatility index run-up. It’s as relevant today as it was then.

https://contrarianedge.com/how-a-volatile-stock-market-turns-investors-into-gamblers/

***

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements.

Book Marcinko: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

Subscribe: MEDICAL EXECUTIVE POST for curated news, essays, opinions and analysis from the public health, economics, finance, marketing, IT, business and policy management ecosystem.

DOCTORS:

“Insurance & Risk Management Strategies for Doctors” https://tinyurl.com/ydx9kd93

“Fiduciary Financial Planning for Physicians” https://tinyurl.com/y7f5pnox

“Business of Medical Practice 2.0” https://tinyurl.com/yb3x6wr8

HOSPITALS:

“Financial Management Strategies for Hospitals” https://tinyurl.com/yagu567d

“Operational Strategies for Clinics and Hospitals” https://tinyurl.com/y9avbrq5

***

Filed under: Experts Invited, Investing, Videos | Tagged: A Stock Market Top?, Optimal Living Daily, Vitaliy Katsenelson CFA | 1 Comment »

By Vitaliy Katsenelson CFA

***

|

Filed under: Experts Invited, Investing | Tagged: Vitaliy Katsenelson CFA | Leave a comment »