Deciding What Works?

[By Staff Reporters]

Another way of asking the above titled question might be, “Is it smart for a doctor’s household to build savings while they are getting out of debt?”

Financial Priorities

In the first instance, the doctor already has debt and would be increasing the terms of any loans by deferring some of the payments to savings, which is equivalent to borrowing the same amount.

In the second instance, the doctor would be taking on debt to save more money. The answer is that it makes sense to borrow money for investment purposes only if the financial gains derived from the investment are larger than the financial benefits of paying off the debt. But, who can know for sure?

www.MedicalBusinessAdvisors.com

Minimum Account Payments

Assuming that a medical professional has more debt than needed, and doesn’t make contributions to a retirement account, the concern becomes: [1] should he/she make minimum payments to the debt and contribute to a retirement account; or [2] should he/she make the maximum payments toward the debt or loans, etc?

Downside Risks

It is important to understand the downside risks of a lower payment strategy. Just as stocks return more than bonds due to their higher risk, the lower payment strategy returns more because of its’ higher risk. Taking on debt to finance an investment is riskier than paying off debt for a number of reasons.

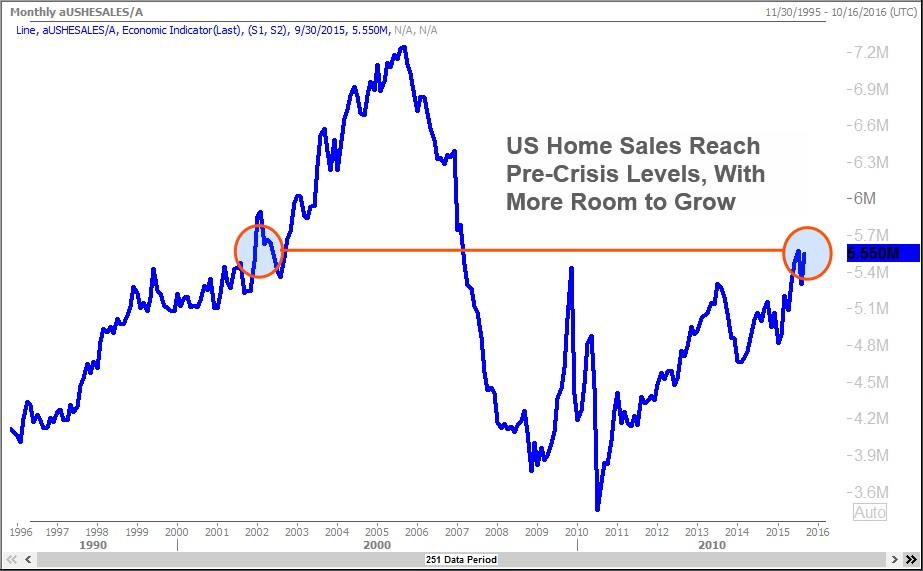

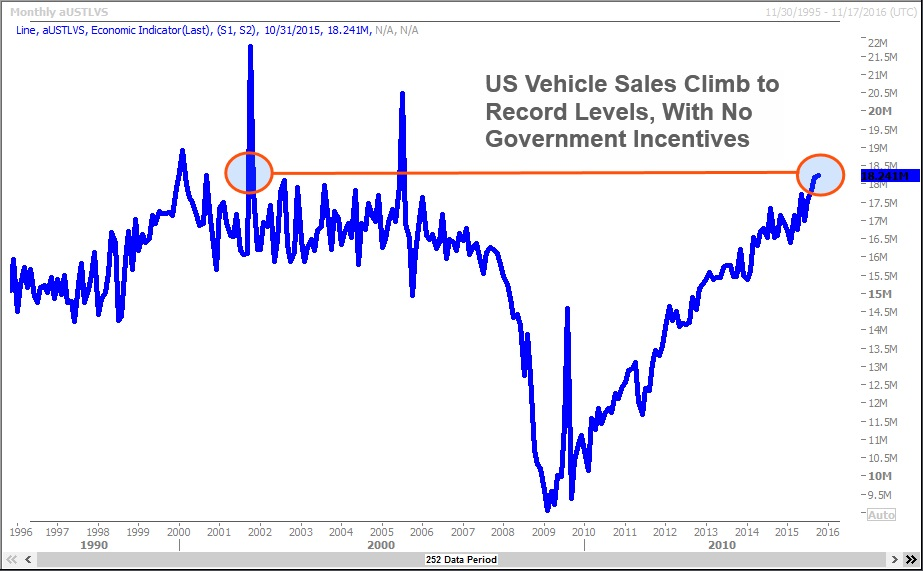

First, the US economy may continue its’ current depressionary spiral, and investments and savings could disappear as financial institutions fail. This would leave the doctor with debt that he or she could not service.

Second, the rate-of-return required to decide whether or not to borrow for investment purposes may not be achieved, leaving the doctor in worse financial shape than if he or she had just paid off the debt.

Assessment

Ultimately, the doctor must decide if the added risks are worth the possible gain. But, the services of a fiduciary financial advisor may also be required. However, some doctors may not be ready to receive the sort of “tough-love” required in this case.

Channel Surfing the ME-P

Have you visited our other topic channels? Established to facilitate idea exchange and link our community together, the value of these topics is dependent upon your input. Please take a minute to visit. And, to prevent that annoying spam, we ask that you register. It is fast, free and secure.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: Financial Planning, Funding Basics, Investing, Recommended Books | Tagged: cash management, certified financial planner, certified medical planner, CFP, CMP, david marcinko, debt, depression, financial planner, Financial Planning, Investing, physician debt, US economy | 1 Comment »