Environmental, Social and Governance Investing

SPONSOR: http://www.MarcinkoAssociates.com

***

***

An Informed Op-Ed Piece

By Dr. David Edward Marcinko; MBA MEd

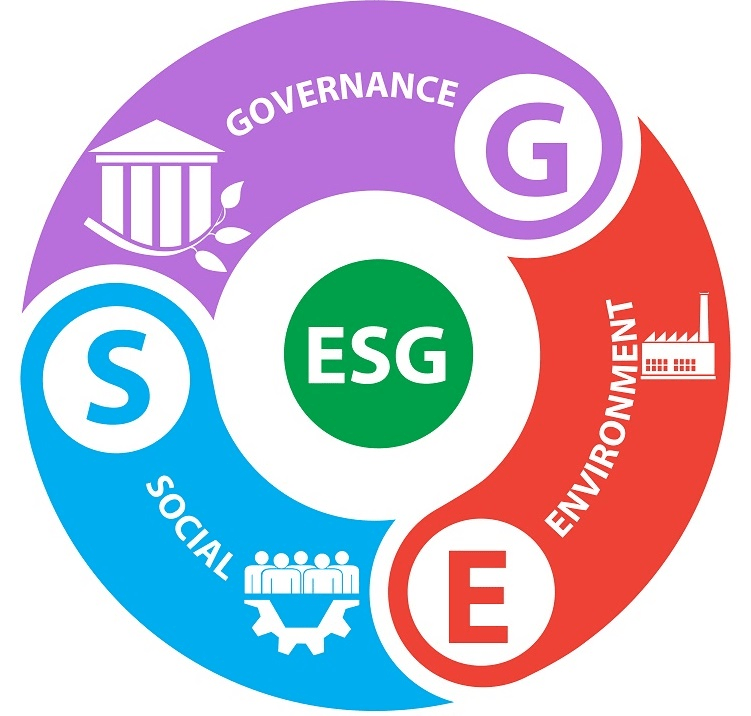

As many medical, dental and podiatric colleagues are aware, Environmental, Social and Governance (ESG) investing refers to a set of standards for a company’s behavior used by socially conscious investors to screen potential investments. Over the last decade, or so, I have seen many investors pursing this laudable aim.

Yet, more than 80% of private equity fund managers have now stepped away from at least one deal due to ESG concerns, according to the 2023 BDO Private Capital Survey. The reasons are complex, and point towards fund managers’ sentiment towards risk-reward in the current economic environment.

This retreat from ESG is due to backlash from conservatives who are critical of the idea that mutual fund managers should be considering any other factor but a company’s share holders in their investment decisions. Accusations of “Greenwashing” have also plagued many ESG funds, which is when an asset management firm charging higher fees or a specific thematic fund without actually delivering a unique investment strategic competitive advantage.

Greenwashing is the process of conveying a false impression or misleading information about how a company’s products are environmentally sound. Greenwashing involves making an unsubstantiated claim to deceive consumers and / or investors into believing that a company’s products are environmentally friendly or have a greater positive environmental impact than they actually do. Greenwashing may also occur when a company attempts to emphasize sustainable aspects of a product to overshadow the company’s involvement in environmentally damaging practices.

ESG: https://medicalexecutivepost.com/2023/09/23/mas-and-esg-profit/

***

***

According to internationally known linguistics and cognitive science Professor, Mackenzie Hope Marcinko PhD of the University of Delaware, greenwashing is performed through the use of environmental imagery, misleading labels, cognitive biases and tendencies hiding tradeoffs. Greenwashing is also a play on the term “Whitewashing,” which means using false information to intentionally hide wrongdoing, errors or an unpleasant situation in an attempt to make it seem less bad than it really is.

To be sure, uncertainty around ESG regulations in the USA is leading financial deal makers to tread carefully. For example, Jim Clayton MBA, a private equity advisor also from the University of Delaware recently stated:

- “We’re a year past when the SEC said they were going to issue ESG reporting standards for public filers which has created more noise in the system.”

- “People are nervous about what I would call ESG-intense exposed industries, in other words, those with “heavy carbon footprints”.

MORE ESG: https://medicalexecutivepost.com/2023/03/27/on-socially-responsible-investing-2/

And, a federal judge in Texas said that American Airlines violated federal law by basing investment decisions for its employee retirement plan on environmental, social, and other non-financial factors. The ruling in January 2025 by US District Judge Reed O’Connor appeared to be the first of its kind amid growing backlash by conservatives to an uptick in socially-conscious investing. O’Connor said American had breached its legal duty to make investment decisions based solely on the financial interests of 401(k) plan beneficiaries by allowing BlackRock, its asset manager and a major shareholder, to focus on environmental, social and corporate governance (ESG) factors.

Even the State of Florida pulled $2 billion from the investment management firm BlackRock in the largest divestment ever made. Florida Governor Ron DeSantis claimed that by taking ESG standards into account when making investment decisions, the firm isn’t prioritizing the financial bottom line for Floridians.

Assessment

But, for a few years at least, things were indeed good. In 2020 and 2021, ESG funds outperformed the market by ~4.3%.

Conclusion

So, always remember [caveat emptor]: let the buyer beware!

References and Readings:

1. 2023 BDO Private Capital Survey: https://insights.bdo.com/2023-BDO-Private-Capital-Survey.html

2. Marcinko, DE; Comprehensive Financial Planning Strategies for Doctors and Advisors [Best Practices from Leading Consultants and Certified Medical Planners™] Productivity Press, New York, 2017

3. Marcinko, DE: Dictionary of Health Economics and Finance. Springer Publishing Company, NY 2006.

4. Zymeri, Jeff: ‘Not Going to Fly Here’ [DeSantis Signs Far-Reaching Anti-ESG Bill into Law]. 2023: https://www.yahoo.com/news/not-going-fly-desantis-signs-121648679.html

COMMENTS APPRECIATED

Refer and Like

***

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit a RFP for speaking engagements: MarcinkoAdvisors@outlook.com

***

***

Filed under: "Ask-an-Advisor", Ethics, iMBA, Inc., Investing, Portfolio Management, Touring with Marcinko | Tagged: BDO, BlackRock, DeSantis, environment, environmental, ESG, finance, green washing, Investing, Jim Clayton, Marcinko, Portfolio Management, reed OConnor, SEC, Social and Governance, sustainability, white washing | Leave a comment »