MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2025 |

REFER A COLLEAGUE: MarcinkoAdvisors@outlook.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

Your Referral Count -0-

CITE: https://www.r2library.com/Resource

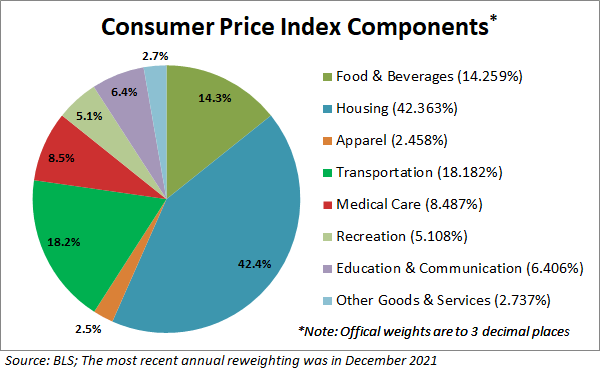

Americans are squirreling away a larger percentage of their earnings than ever before. In the first three months of the year, Americans stashed an average of 14.3% of their income in their 401(k)s, up from 13.5% in 2020, according to Fidelity Investments, which manages millions of accounts. That’s a record, and it also nearly approaches the 15% that’s recommended to be able to maintain your lifestyle after a 40-year career, as per the Wall Street Journal.

CITE: https://tinyurl.com/2h47urt5

🟢 What’s up

- Planet Labs exploded 49.37% thanks to the satellite imagery stock beating Wall Street forecasts, posting its first quarter of positive cash flow and record revenue.

- MongoDB soared 12.84% after the software company crushed analyst estimates last quarter and projected better-than-expected earnings next quarter.

- Five Below continued the trend of discount retailers beating expectations, rising 5.59% on an impressive beat-and-raise earnings report.

- Land’s End missed revenue forecasts but beat on profits last quarter. Shares climbed 13.02% after the clothing company promised tariffs won’t hurt its bottom line.

- Scott’s MiracleGro rose 11.04% after the fertilizer titan reiterated its healthy forward guidance.

What’s down

What’s down

- Tesla fell yet again today, down another 14.26% thanks to a growing rift between CEO Elon Musk and President Trump.

- Procter & Gamble fell 1.90% after the consumer goods giant announced it will slash 7,000 jobs over the next two years.

- Brown-Forman tumbled 17.92% on poor earnings for the alcohol maker and worse-than-expected forecasts for the coming year.

- Kimberly-Clark lost 2.27% due to an agreement to sell a majority stake in its international Kleenex tissue business.

- PVH plunged 17.96% after the parent company of brands like Calvin Klein beat earnings estimates last quarter but predicted a much worse quarter ahead.

- ChargePoint Holdings plummeted 22.49% thanks to a rough quarter for the EV charging company.

- Ciena sank 12.85% following a much-weaker-than-expected quarter for the communications equipment maker.

CITE: https://tinyurl.com/tj8smmes

Visualize: How private equity tangled banks in a web of debt, from the Financial Times.

D-DAY: Normandy Landing, 1944.

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@outlook.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

Filed under: Drugs and Pharma, Ethics, Information Technology, Investing, Marcinko Associates, Recommended Books, Sponsors | Tagged: D Day, DJIA, DOW, earnings, Fidelity, france, FTC, lifestyle, Marcinko, money, NASDAQ, Normandy, retirement, S&P 500, savings, textbooks, WSJ | Leave a comment »