A SPECIAL ME-P REPORT

BY ROBERT JAMES CIMASI; MHA, ASA, FRICS, MCBA, AVA, CM&AA, CMP™

HEALTH CAPITAL CONSULTANTS, LLC

www.HealthCapital.com

Aside from differences in insurer behavior, malpractice lawsuit rates, and political responses at the state level, the ACA may also have an impact on the medical liability insurance market. Following several months of partisan controversy and political debate during President Obama’s first term, Congress passed the ACA in March 2010.[1] While not achieving a universal coverage insurance program or a single payor system, the 2010 healthcare reform legislation marked the beginning of a new era in healthcare reform, resulting in a paradigm change in the way healthcare services are delivered and paid for in the U.S.

Some of the ACA’s initiatives have already had significant impact upon many aspects of the healthcare delivery system, including: (1) increased regulatory scrutiny aimed at combating fraud and abuse and antitrust violations; (2) health plan regulation; (3) addressing physician shortages; (4) access to and quality of care initiatives; and, (5) increased attention to public health and wellness activities, among others.[2]

In contrast, the ACA’s impact on the medical liability insurance market, and the medical malpractice system, is relatively unknown. The Medical Liability Monitor’s 2010 annual rate survey noted that 41% of medical liability insurers did not believe that the ACA would impact medical liability insurance markets;[3] however, by 2011, as stated above, this attitude had changed to reflect increasing concerns about provider consolidation and self-insurance for professional liability by providers.[4] These concerns continue to reflect the thinking of medical liability insurers, in part, because there have been few, if any, answers to alleviate their concerns and measure the ACA’s impact on the incidence and cost of medical malpractice.

Some of the medical liability insurer concerns regarding the ACA’s impact stems from the reality that the only one of two sections of the ACA directly relating to medical liability insurance and the current medical malpractice system have been implemented. Section 6801 of the ACA simply provides a policy statement regarding medical malpractice, stating that the U.S. Senate believes that “health care reform presents an opportunity to address issues related to medical malpractice and medical liability insurance,” and encourages Congress, as a whole, to develop demonstration programs with the goal of discovering alternatives to the current civil litigation system for medical malpractice.[5] Additionally, Section 10607 of the ACA authorizes HHS to award grants to states “for the development, implementation, and evaluation of alternatives to current tort litigation” for medical malpractice claims.[6] This section allows HHS to make $50 million available for these demonstration projects subject to Congressional approval.[7] To date, neither Congress nor the President has requested funding for these projects.[8]

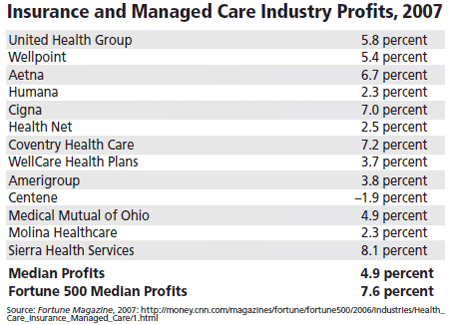

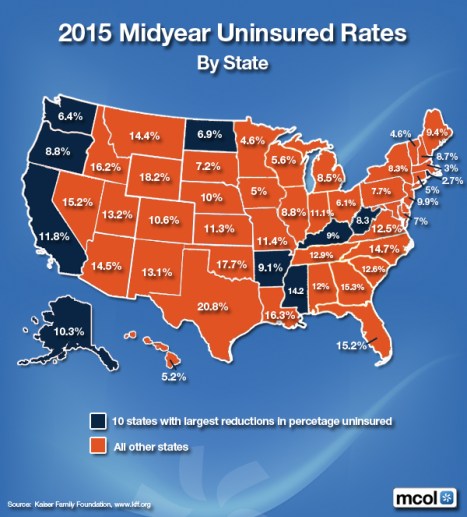

Even without these direct impacts, the medical malpractice system may still face changes as a result of the ACA. First, as providers consolidate with larger health systems, medical liability insurers fear the medical liability insurance market “will shrink as their former customers become their competitors.”[9] From 2011 to 2014, medical liability insurers consistently noted to the Medical Liability Monitor that hospital or ACO acquisitions of physician practices act as “the biggest threat to their market share” because of the entity’s ability to better absorb the risk related to malpractice liability.[10] In theory, this ability to absorb medical professional liability risk will allow higher rates of self-insurance, which can affect the rates of straight indemnity insurers. Second, the number of malpractice claims is expected to increase as more individuals gain health insurance coverage as a result of ACA enactments.

A 2007 Journal of the American Medical Association study concluded that insured persons who suffer a chronic condition receive higher quality and increased care compared to non-insured persons; reinforcing earlier studies suggesting insured persons receive more care than uninsured persons.[11] Building on this premise, a RAND report on the ACA and liability insurance relationships estimated that with the expected influx of newly-insured individuals, particularly in states expanding Medicaid, more physician-patient encounters will increase the volume of overall medical errors, leading to an increase in medical malpractice lawsuits.[12] Consequently, the RAND report estimates that the number of liability payments in medical malpractice actions will increase by 3.4% between pre-ACA insurance plan enrollment and enrollment post-ACA implementation.[13]

Additionally, the RAND report argues that, due to an increase in insurance plan enrollment, medical malpractice payments per claim will actually decrease in states adopting limitations to the collateral source rule. Under the collateral source rule, the damage awards for injured parties do not take into account payments previously received from other sources; consequently, the damage award includes the value of funds collected by another source (e.g., insurance) while allowing the injured party to keep the benefits of that previous value received.[14] In the medical malpractice context, plaintiffs in states adopting the collateral source rule can collect from the physician (or his medical liability insurer) as well as keep the benefits of healthcare reimbursed by their own health insurer. However, some states limit the application of the collateral source rule in medical malpractice cases where the plaintiff’s health insurance already paid for care resulting from the negligent actions of the physician, thereby preventing the plaintiff from receiving this double windfall. As insurance rates rise, RAND estimates that payouts per claim will decrease by 0.6% nationally.[15] Considering the three effects together, RAND projects that total liability claim costs will increase by 2.8% nationally by 2016 as a result of the ACA.[16]

Conversely, other healthcare industry commentators argue that the ACA’s expansion of coverage to previously uninsured individuals, as well as quality of care initiatives, will actually decrease malpractice costs by reducing the number of adverse events suffered by patients.[17] In a 2010 editorial in the Journal of Law, Medicine, and Ethics, Mark A. Rothstein, the Director of Institute for Bioethics, Health Policy, & Law at the University of Louisville – Louis D. Brandeis School of Law, argued that quality and infrastructure initiatives such as increased EHR usage, expansion of outcomes research and use of evidence-based medical standards, and better care coordination, will limit the number of adverse events that provide the basis for a medical malpractice claim.[18] Further, Rothstein posited that, by simply being insured, “significant numbers of injured patients are likely to forego medical malpractice claims.”[19]

Although President Obama signed the ACA in 2010, the effects of this landmark law on the medical malpractice market remain hazy. The current trend toward healthcare consolidation, accountable care, and self-insurance mirrors similar consolidation practices in the mid-1990s, which increased competition in the medical liability insurance market and eroded proper underwriting practices. Nevertheless, other critical ACA effects remain unknown. The impact of the expansion of health insurance coverage will likely remain unclear for the near future because new enrollees began receiving coverage through health insurance exchanges in 2014, limiting the amount of exposure to healthcare interactions that could give rise to an adverse event and result in a medical malpractice suit. Additionally, the average length of litigation surrounding preventable adverse events lasts 43.1 months from the date of the incident to the date of resolution,[20] which limits medical liability insurers from realizing the full costs of a claim and the aggregate of claims in its risk pool.

Assessment

Now, assuming that increased enrollment does not affect the average length of medical malpractice litigation,[21] the average newly insured person who suffered a preventable adverse event in July 2014 will not resolve his or her claim until March 2018. With this lag time of almost four years between adverse events and claims, it is likely that the full impact of the ACA on the medical malpractice market and medical liability insurance premiums will not be fully known until the next decade.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

References

[1] “Patient Protection and Affordable Care Act,” Public Law 111-148, 124 Stat. 119 (March 23, 2010); “Health Care and Education Reconciliation Act” Public Law 111-152, 124 Stat. 1029 (March 25, 2010).

[2] “Restructuring, Consolidation in Health Care Make Reform Top Health Law Issue for 2010,” By Susan Carhart et al., BNA Health Law Reporter, Vol. 19, No. 5 (January 8, 2010).

[3] “Now Hard & Crunchy on the Outside: Could Strong Financials be Hiding a Market That’s Growing Soft Within?” By Chad C. Karls, FCAS, MAAA, Medical Liability Monitor, Vol. 35, No. 10, October 2010, p. 4.

[4] “From Crunchy Candy to Simmering Frogs: Waiting and Hoping for a Hardening Market as the Market Trends Slowly, Steadily Softer,” By Chad C. Karls, FCAS, MAAA, Medical Liability Monitor, Vol. 36, No. 10 (October 2011), p. 5.

[5] “Patient Protection and Affordable Care Act,” Public Law 111-148, 124 Stat. 804 (March 23, 2010).

[6] “Patient Protection and Affordable Care Act,” Public Law 111-148, 124 Stat. 1009 (March 23, 2010).

[7] “Patient Protection and Affordable Care Act,” Public Law 111-148, 124 Stat. 1014 (March 23, 2010).

[8] “Medical Liability Reform – Demonstration Grants,” American College of Physicians, 2013, http://www.acponline.org/advocacy/where_we_stand/assets/iii12-medical-liability-reform-demo.pdf (Accessed 12/23/14).

[9] “From Crunchy Candy to Simmering Frogs: Waiting and Hoping for a Hardening Market as the Market Trends Slowly, Steadily Softer,” By Chad C. Karls, FCAS, MAAA, Medical Liability Monitor, Vol. 36, No. 10 (October 2011), p. 5.

[10] “The Slinky Effect: With Medical Professional Liability Insurance Rates Continuing to – Slowly and Steadily – Decline During the Most Recent Soft Market, It Appears It will Take Several More Years Before the Market Hardens and Rates Accelerate Upward,” By Chad C. Karls, FCAS, MAAA, Medical Liability Monitor, Vol. 39, No. 10 (October 2014), p. 6; “Casualty Actuarial Society Session Debates Potential Medical Professional Liability Implications of PPACA,” Medical Liability Monitor, Vol. 39, No. 7 (July 2014), p. 4.

[11] “Insurance Coverage, Medical Care Use, and Short-Term Health Changes Following an Unintentional Injury or the Onset of a Chronic Condition,” By Jack Hadley, Ph.D., Journal of the American Medical Association, Vol. 297, No. 10 (March 14, 2007), p. 1080.

[12] “How Will the Patient Protection and Affordable Care Act Affect Liability Insurance Costs?” By David I. Auerbach et al., RAND Corporation, 2014, p. 30.

[13] “How Will the Patient Protection and Affordable Care Act Affect Liability Insurance Costs?” By David I. Auerbach et al., RAND Corporation, 2014, p. 30.

[14] “How Will the Patient Protection and Affordable Care Act Affect Liability Insurance Costs?” By David I. Auerbach et al., RAND Corporation, 2014, p. 18.

[15] “How Will the Patient Protection and Affordable Care Act Affect Liability Insurance Costs?” By David I. Auerbach et al., RAND Corporation, 2014, p. 18.

[16] “How Will the Patient Protection and Affordable Care Act Affect Liability Insurance Costs?” By David I. Auerbach et al., RAND Corporation, 2014, p. 37.

[17] “How Will the Patient Protection and Affordable Care Act Affect Liability Insurance Costs?” By David I. Auerbach et al., RAND Corporation, 2014, p. 40-41

[18] “Currents in Contemporary Bioethics: Health Care Reform and Medical Malpractice Claims,” By Mark A. Rothstein, Journal of Law, Medicine, and Ethics, Winter 2010, p. 871.

[19] “Currents in Contemporary Bioethics: Health Care Reform and Medical Malpractice Claims,” By Mark A. Rothstein, Journal of Law, Medicine, and Ethics, Winter 2010, p. 872.

[20] “On Average, Physicians Spend Nearly 11 Percent of their 40-Year Careers with an Open, Unresolved Malpractice Claim,” By Seth A. Seabury et al., Health Affairs, Vol. 32, No. 1 (January 2013), p. 114.

[21] This assumption is faulty, as it is unknown at this point whether or not claims will increase, whether insurers will or will not enter the market, and whether malpractice caseloads will increase due to the ACA.

Risk Management, Liability Insurance and Asset Protection Strategies for Doctors and Advisors

[Best Practices from Leading Consultants and Certified Medical Planners™]

Harvard Medical School

Boston Children’s Hospital – Psychiatrist

Yale University

***

Filed under: Health Insurance, Professional Liability, Risk Management | Tagged: ACA, Medical Liability Insurance, PP-ACA’s Impact on Medical Liability Insurance, Robert Cimasi | 3 Comments »